Is Njafx safe?

Business

License

Is NJAFX Safe or Scam?

Introduction

NJAFX is a forex broker that has garnered attention in the trading community for its diverse offerings and competitive trading conditions. As the forex market continues to expand, traders are increasingly faced with the challenge of selecting a reliable broker. The importance of conducting thorough due diligence cannot be overstated, as the market is rife with potential scams and unregulated entities. Evaluating a broker's legitimacy involves scrutinizing its regulatory status, company background, trading conditions, and customer experiences. This article aims to provide an objective analysis of NJAFX, assessing whether it is a safe choice for traders or if there are red flags that warrant caution.

Regulation and Legitimacy

A broker's regulatory status is a crucial factor in determining its legitimacy. NJAFX claims to operate under the oversight of regulatory authorities, which is essential for ensuring that it adheres to industry standards and practices. Regulatory oversight provides a layer of protection for traders, as it enforces compliance with financial laws and practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | N/A | USA | Suspicious Clone |

The above table highlights that NJAFX is associated with the National Futures Association (NFA), but there are concerns regarding its verification status, as it has been labeled a "suspicious clone." This raises significant questions about its regulatory compliance and operational legitimacy. A broker's history of compliance is also vital; any past infractions or regulatory actions can be indicative of its reliability.

Company Background Investigation

Understanding the company behind a broker is essential for assessing its trustworthiness. NJAFX, operating under the name Noja Global Co., Ltd, has a relatively short history in the forex market. Established in China, the broker's ownership structure and management team are not well-documented, which can be a red flag for potential investors. Transparency in company operations is a hallmark of reputable brokers, and the lack of available information about NJAFX may deter cautious traders.

Furthermore, the management teams background is critical in evaluating the broker's operational integrity. A strong, experienced leadership team can instill confidence in traders. However, without detailed information about the team behind NJAFX, traders may find it challenging to assess the broker's reliability. The opacity surrounding its operations further complicates the evaluation process.

Trading Conditions Analysis

When considering whether NJAFX is safe, it is crucial to analyze its trading conditions, including fees and costs. A broker's fee structure can significantly impact a trader's profitability. NJAFX offers competitive spreads and commissions, but it is essential to scrutinize any unusual fees that may apply.

| Fee Type | NJAFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% | 0.3% |

The table above indicates that NJAFX's spreads on major currency pairs are slightly higher than the industry average, which could affect trading costs. Additionally, the commission model appears to be variable, potentially leading to unexpected costs for traders. Understanding the full fee structure is vital for evaluating the overall trading conditions and their impact on profitability.

Customer Funds Security

The safety of customer funds is paramount when assessing a broker's reliability. NJAFX claims to implement several security measures to protect traders' investments. These measures typically include segregating client funds from company operating capital, ensuring that client deposits are not used for operational expenses. Furthermore, investor protection schemes are essential for safeguarding traders' capital in the event of broker insolvency.

However, the effectiveness of these measures is contingent upon the broker's regulatory status. Given NJAFX's questionable regulatory standing, traders must exercise caution regarding the safety of their funds. Historical issues related to fund security can also provide insights into a broker's reliability; thus, any past controversies or disputes should be thoroughly investigated.

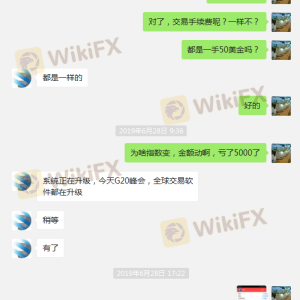

Customer Experience and Complaints

Analyzing customer feedback is an essential component in determining whether NJAFX is safe. Reviews from current and former clients can reveal common issues and the broker's responsiveness to complaints. A pattern of negative feedback, particularly concerning withdrawals or account management, can be a significant warning sign.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Inconsistent |

| Platform Performance | High | Unresolved |

The table above summarizes common complaints associated with NJAFX. The high severity level of withdrawal issues indicates a critical area of concern for potential traders. Slow response times from customer support can exacerbate these issues, leading to frustration among clients. Furthermore, unresolved platform performance issues can hinder trading experiences, raising additional red flags.

Platform and Trade Execution

A broker's trading platform is the primary interface through which traders engage with the market. Evaluating the platform's performance, stability, and user experience is crucial. NJAFX utilizes well-known trading platforms, such as MetaTrader 4, which is favored for its user-friendly interface and robust features.

However, concerns about order execution quality, slippage, and rejection rates must be addressed. Any signs of platform manipulation, such as consistent slippage in one direction, can indicate unethical practices. Traders should remain vigilant for any anomalies that could compromise their trading experience.

Risk Assessment

Using NJAFX entails certain risks that traders must be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Suspicious clone status raises concerns. |

| Fund Security | High | Lack of transparency around fund protection. |

| Customer Support | Medium | Slow response times to complaints. |

Traders should consider these risks when deciding whether to engage with NJAFX. To mitigate potential issues, it is advisable to start with a small investment and monitor the broker's performance closely.

Conclusion and Recommendations

In conclusion, while NJAFX offers various trading opportunities, there are significant concerns regarding its legitimacy and safety. The broker's suspicious regulatory status, lack of transparency, and history of customer complaints suggest that traders should proceed with caution. It is essential to evaluate whether the potential risks outweigh the benefits of trading with this broker.

For traders seeking alternatives, consider reputable brokers with strong regulatory oversight and a proven track record of customer satisfaction. Options such as brokers regulated by the FCA or ASIC may provide a safer trading environment. Ultimately, thorough research and careful consideration are crucial for making informed trading decisions in the forex market. Is NJAFX safe? The evidence suggests that potential traders should tread carefully.

Is Njafx a scam, or is it legit?

The latest exposure and evaluation content of Njafx brokers.

Njafx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Njafx latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.