Regarding the legitimacy of MTF forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is MTF safe?

Pros

Cons

Is MTF markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

明德國際盈富有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.mingtakfn.comExpiration Time:

--Address of Licensed Institution:

九龍尖沙咀海港城海洋中心8樓822室Phone Number of Licensed Institution:

28869795Licensed Institution Certified Documents:

Is MTF A Scam?

Introduction

MTF, or Ming Tak Financial, is a forex broker operating out of Hong Kong, specializing in trading precious metals and crude oil. In the rapidly evolving landscape of forex trading, it is essential for traders to exercise caution when selecting a broker. This is due to the prevalence of scams and fraudulent activities that can lead to significant financial losses. Consequently, a thorough evaluation of MTF's credibility, regulatory compliance, and overall trading conditions is crucial for any potential trader.

To conduct this investigation, we will analyze MTF's regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and associated risks. This structured evaluation will provide a comprehensive overview of whether MTF can be considered a trustworthy broker or if there are red flags that potential clients should be aware of.

Regulation and Legitimacy

One of the primary factors in determining a broker's credibility is its regulatory status. Regulatory bodies oversee broker operations to ensure compliance with laws and protect traders' interests. MTF claims to be regulated by the Chinese Gold & Silver Exchange Society (CGSE) under a Type AA license. This regulatory framework is crucial as it adds a layer of accountability and trustworthiness to the broker's operations.

Regulatory Information Table

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Chinese Gold & Silver Exchange Society | 194 | Hong Kong | Verified |

While MTF holds a license from CGSE, it is important to note that this regulatory body may not be as stringent as other global regulators like the FCA or ASIC. The quality of regulation can significantly impact traders' safety, and a lack of comprehensive oversight may expose clients to higher risks. Historical compliance records indicate that while MTF has not faced major regulatory sanctions, the overall regulatory environment in Hong Kong may not offer the same level of investor protection as more established jurisdictions.

Company Background Investigation

MTF was established within the past five years and operates out of Hong Kong. The company is owned by Ming Tak Financial, and the management team comprises individuals with varying degrees of experience in the financial services sector. However, specific details about the teams qualifications and backgrounds remain limited, raising concerns about the overall transparency of the organization.

A lack of transparency can be a significant red flag for potential investors. It is essential for brokers to provide clear information regarding their ownership structure and management team to foster trust among clients. MTF appears to have room for improvement in this area, as the absence of detailed disclosures may lead to skepticism about its operations.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is vital. MTF provides fixed spreads starting from 0.15 pips, which is competitive within the industry. However, the absence of clear information regarding commission structures and overnight interest rates raises questions about potential hidden costs that traders may encounter.

Trading Cost Comparison Table

| Cost Type | MTF | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.15 pips | 1.0-1.5 pips |

| Commission Model | Not Specified | Varies (0-10 USD) |

| Overnight Interest Range | Not Specified | 2-5% |

The lack of clarity surrounding commission models and overnight interest rates could lead to unexpected expenses for traders, making it essential for potential clients to inquire directly with MTF for detailed fee structures before committing any funds.

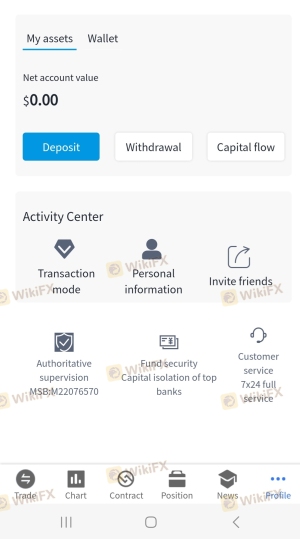

Customer Fund Security

The safety of client funds is paramount in the forex trading industry. MTF claims to implement several measures to secure customer funds, including the use of segregated accounts. However, specific details about these measures, such as the banks used for fund segregation and the existence of any investor protection schemes, are not readily available.

A thorough examination of MTF's fund security policies reveals a lack of comprehensive investor protection. Unlike brokers regulated by more stringent authorities, MTF does not appear to offer a robust safety net for client funds, which could expose traders to significant risks in the event of financial instability or mismanagement.

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing a broker's reliability. Reviews for MTF are mixed, with some users praising the competitive spreads and user-friendly platforms, while others report issues related to customer service responsiveness and withdrawal delays.

Complaint Severity Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Slow response |

| Customer Service Issues | High | Unresolved |

| Platform Stability Problems | Moderate | Acknowledged |

A few case studies highlight these issues. For example, one user reported significant delays in fund withdrawals, which took longer than the promised timeframe, leading to frustration. Another user experienced difficulties in reaching customer support, further exacerbating their concerns about the broker's reliability.

Platform and Trade Execution

MTF offers trading through popular platforms such as MT4 and MT5, which are known for their reliability and range of features. However, user experiences indicate that the execution quality can be inconsistent, with reports of slippage and occasional order rejections.

The performance of MTF's trading platform is crucial for traders, as any delays or issues can significantly impact their trading results. Users have expressed concerns about the execution speed, particularly during high volatility periods, which raises questions about the broker's overall reliability.

Risk Assessment

Using MTF presents several risks that potential traders should consider. The lack of comprehensive regulation, combined with mixed customer feedback and potential hidden costs, creates a landscape of uncertainty.

Risk Assessment Table

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Limited oversight and potential gaps |

| Fund Security | High | Lack of robust investor protection |

| Trading Costs | Medium | Unclear fee structures |

| Customer Service | High | Inconsistent responsiveness |

To mitigate these risks, potential clients should conduct thorough due diligence, seek clarity on all fees, and consider starting with a small investment to gauge the broker's reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, while MTF offers competitive trading conditions and a variety of market instruments, the overall assessment raises several concerns regarding its legitimacy and safety. The lack of comprehensive regulatory oversight, combined with mixed customer feedback and potential hidden costs, suggests that traders should exercise caution when considering this broker.

For traders seeking a more secure trading environment, it may be prudent to explore alternatives that are regulated by more reputable authorities, such as FCA or ASIC. Brokers like IG, OANDA, or Forex.com offer robust regulatory frameworks, transparent fee structures, and strong customer support, making them safer options for forex trading.

Ultimately, potential traders must weigh the pros and cons of MTF carefully and consider their risk tolerance before making any commitments.

Is MTF a scam, or is it legit?

The latest exposure and evaluation content of MTF brokers.

MTF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MTF latest industry rating score is 7.76, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.76 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.