Regarding the legitimacy of BLACKWELL GLOBAL forex brokers, it provides SFC, SERC, SCB and WikiBit, (also has a graphic survey regarding security).

Is BLACKWELL GLOBAL safe?

Software Index

Risk Control

Is BLACKWELL GLOBAL markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Solo Futures Limited

Effective Date:

2016-11-07Email Address of Licensed Institution:

cs@solo.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.solo.com.hkExpiration Time:

--Address of Licensed Institution:

香港灣仔告士打道151號資本中心9樓901室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

SERC Derivatives Trading License (EP)

Securities and Exchange Regulator of Cambodia

Securities and Exchange Regulator of Cambodia

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Blackwell Global Investment (Cambodia) Co., Ltd

Effective Date:

--Email Address of Licensed Institution:

info@blackwellglobalkh.comSharing Status:

No SharingWebsite of Licensed Institution:

www.blackwellglobal.com.khExpiration Time:

--Address of Licensed Institution:

# 48, Mao Tse Toung Boulevard, Phum 1, Sangkat Bueong Trabek, Khan Chamkarmon, Phnom Penh.Phone Number of Licensed Institution:

023 998 866Licensed Institution Certified Documents:

SCB Derivatives Trading License (MM)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

Blackwell Global Investments Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

4 North Buckner Square Sandyport, Nassau, BahamasPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

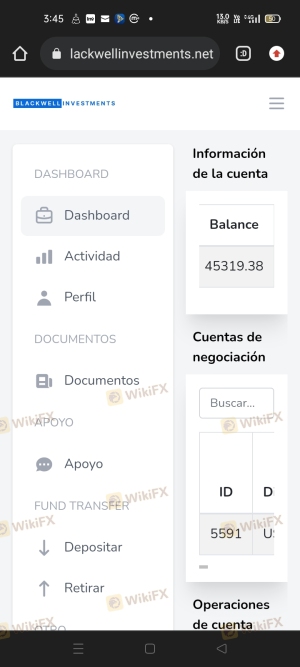

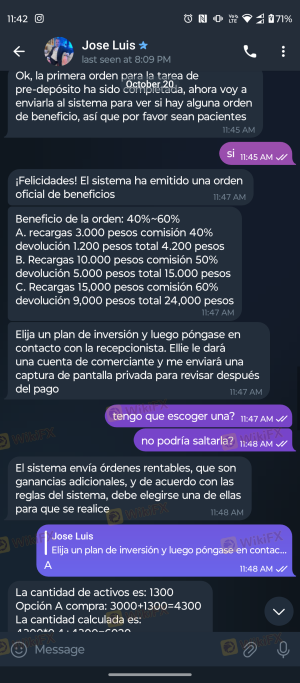

Is Blackwell Global A Scam?

Introduction

Blackwell Global, established in 2010, has positioned itself as a notable player in the forex market, offering a range of trading services across various financial instruments. With its headquarters in the UK and a presence in over 90 countries, the broker aims to cater to both retail and institutional clients. However, as the forex market continues to evolve, traders must exercise caution when selecting a broker. The need for due diligence arises from the potential risks associated with trading, including fraud, regulatory non-compliance, and inadequate customer support. This article aims to provide a comprehensive evaluation of Blackwell Global, examining its regulatory status, company background, trading conditions, client safety measures, customer experiences, platform performance, and overall risk assessment. The analysis draws on multiple credible sources, including user reviews, regulatory information, and expert assessments.

Regulation and Legitimacy

A broker's regulatory status is a crucial factor in determining its legitimacy and reliability. Blackwell Global operates under several regulatory authorities, which adds a layer of security for traders. Below is a summary of its core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 687576 | United Kingdom | Verified |

| SFC | BGX 296 | Hong Kong | Verified |

| SCB | SIA-F 215 | Bahamas | Verified |

| SECC | 005 | Cambodia | Verified |

The FCA (Financial Conduct Authority) is one of the most stringent regulatory bodies globally, ensuring that brokers adhere to strict financial standards, including client fund segregation and negative balance protection. Blackwell Global's compliance with the FCA's regulations enhances its credibility. Additionally, the broker holds licenses from the SFC in Hong Kong and the SCB in the Bahamas, further affirming its commitment to regulatory compliance.

Historically, Blackwell Global has maintained a clean regulatory record, with no significant compliance issues reported. This regulatory framework is essential, as it provides a safety net for traders, ensuring that their funds are protected in the event of broker insolvency. Overall, Blackwell Global's regulatory status suggests that it operates within a legal and secure framework, minimizing the risk of fraudulent activities.

Company Background Investigation

Blackwell Global has a rich history, having commenced operations in New Zealand before expanding its reach to the UK and other significant financial markets. The company has evolved over the years, adapting to market changes and regulatory requirements. It operates under the ownership of Blackwell Global Investments (UK) Limited and has established offices in various countries, including Hong Kong, Cambodia, and the Bahamas.

The management team at Blackwell Global comprises seasoned professionals with extensive experience in the financial services industry. Their expertise ranges from trading and risk management to compliance and customer service, ensuring that the broker is well-equipped to meet the needs of its clients. The company's transparency regarding its ownership structure and management team is commendable, as it reflects a commitment to building trust with its clients.

Moreover, Blackwell Global provides a wealth of information on its website, including details about its services, trading conditions, and educational resources. This level of transparency is crucial for traders seeking to understand the broker's operations and make informed decisions.

Trading Conditions Analysis

Blackwell Global offers a variety of trading accounts, catering to different types of traders. The broker's fee structure is competitive, but it's essential to understand the specifics. Below is a comparison of core trading costs:

| Fee Type | Blackwell Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.8 pips | 1.0 pips |

| Commission Model | $4.5 per lot | $7 per lot |

| Overnight Interest Range | Varies | Varies |

The spread for major currency pairs is relatively competitive, with Blackwell Global offering spreads from 0.8 pips on standard accounts. The commission model on ECN accounts is $4.5 per lot, which is lower than the industry average of $7. However, traders should be aware of any additional fees that may apply, such as overnight interest rates and inactivity fees, which could impact overall trading costs.

While the trading conditions appear favorable, traders should carefully review the terms associated with each account type to ensure they align with their trading strategies and risk tolerance. The availability of various account types, including standard, ECN, and Islamic accounts, allows traders to select options that best suit their needs.

Client Fund Safety

The safety of client funds is paramount in the forex industry, and Blackwell Global implements several measures to ensure this. The broker adheres to strict regulations that require the segregation of client funds from its operational funds. This means that in the event of financial difficulties, client funds remain protected.

Blackwell Global utilizes reputable banking institutions, such as Barclays, for holding client funds, which adds an extra layer of security. Additionally, the broker offers negative balance protection, ensuring that clients cannot lose more than their invested capital. This policy is particularly beneficial for traders using high leverage, as it mitigates the risk of significant financial losses.

Historically, Blackwell Global has not faced any major controversies regarding fund safety. The broker's commitment to transparency and regulatory compliance reflects its dedication to maintaining a secure trading environment for its clients.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability, and Blackwell Global has received a mix of reviews from its users. Common complaints include issues related to slow customer support response times and difficulties in withdrawing funds. Below is a summary of the primary complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Slow response |

| Customer Support Issues | High | Mixed responses |

| Platform Performance | Medium | Generally positive |

One typical case involved a trader who reported challenges in withdrawing funds, citing delays that extended beyond the promised processing times. While the broker eventually resolved the issue, the trader expressed dissatisfaction with the lack of timely communication during the process. Such experiences highlight the importance of responsive customer service in maintaining client trust.

Overall, while many traders report positive experiences with Blackwell Global, the recurring themes of customer support issues warrant attention. The broker must enhance its responsiveness to improve overall client satisfaction.

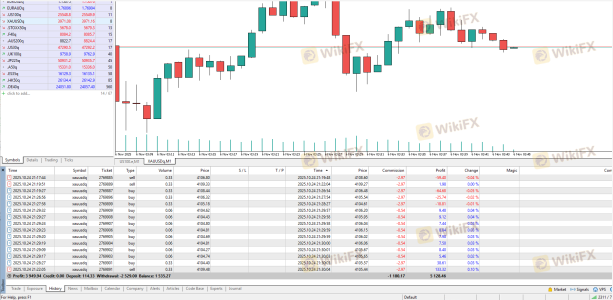

Platform and Trade Execution

Blackwell Global provides access to popular trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are known for their robust performance, user-friendly interfaces, and extensive analytical tools. Traders generally report positive experiences with the platforms, noting their stability and range of features.

However, some users have reported instances of slippage during high volatility periods, which can impact trade execution quality. While slippage is a common occurrence in the forex market, the broker's ability to minimize it is crucial for maintaining a competitive edge. The absence of any significant complaints regarding order rejections suggests that Blackwell Global maintains a reliable execution environment.

Risk Assessment

Using Blackwell Global comes with certain risks, as with any trading platform. Below is a summary of key risk areas associated with the broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Low | Well-regulated by FCA and other authorities. |

| Customer Support | Medium | Mixed reviews on responsiveness. |

| Fund Safety | Low | Strong measures in place for fund protection. |

| Trading Conditions | Medium | Competitive fees, but watch for hidden costs. |

To mitigate risks, traders are advised to conduct thorough research before trading, utilize demo accounts to familiarize themselves with the platform, and maintain effective communication with customer support for any concerns.

Conclusion and Recommendations

In conclusion, Blackwell Global is not a scam; it is a regulated broker with a solid reputation in the forex market. The broker's adherence to regulatory standards, strong fund safety measures, and competitive trading conditions position it as a reliable choice for traders. However, potential clients should remain vigilant regarding customer support responsiveness and be aware of any fees that may impact their trading experience.

For traders seeking a trustworthy broker, Blackwell Global is a viable option, particularly for those who value regulation and fund safety. However, beginners may wish to explore other brokers that offer more robust educational resources and support. Alternatives to consider include brokers with strong customer service ratings and comprehensive educational offerings, such as IG and OANDA. Ultimately, traders should assess their individual needs and preferences before making a decision.

Is BLACKWELL GLOBAL a scam, or is it legit?

The latest exposure and evaluation content of BLACKWELL GLOBAL brokers.

BLACKWELL GLOBAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BLACKWELL GLOBAL latest industry rating score is 6.10, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.10 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.