Regarding the legitimacy of Sun Long Bullion forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is Sun Long Bullion safe?

Software Index

Risk Control

Is Sun Long Bullion markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

旭隆金業(香港)有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.slgold88.comExpiration Time:

--Address of Licensed Institution:

九龍海濱道133號萬兆豐中心17樓A室Phone Number of Licensed Institution:

39779288Licensed Institution Certified Documents:

Is Sun Long Bullion Safe or a Scam?

Introduction

Sun Long Bullion is a Hong Kong-based forex broker that specializes in precious metals trading, particularly gold. Established around 2013, the broker positions itself as a provider of a secure trading environment for clients interested in gold investments. Given the increasing prevalence of scams in the forex market, it is crucial for traders to conduct thorough due diligence before engaging with any broker. This article aims to critically evaluate the safety and legitimacy of Sun Long Bullion by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

To conduct this investigation, we utilized a combination of primary data from regulatory bodies, customer reviews, and expert analyses from reputable financial sources. Our assessment framework includes key indicators of broker safety, such as regulatory compliance, customer experiences, and financial transparency.

Regulation and Legitimacy

The regulatory status of a forex broker is a significant factor in determining its safety. Sun Long Bullion is regulated by the Chinese Gold & Silver Exchange Society (CGSE), holding a Type AA license, which is a requirement for conducting trading activities in Hong Kong. This regulatory framework is designed to protect investors and ensure that brokers adhere to industry standards.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Chinese Gold & Silver Exchange Society | 157 | Hong Kong | Regulated |

The CGSE is recognized for its oversight in the precious metals market, adding a layer of credibility to Sun Long Bullion's operations. However, it is important to note that while the CGSE provides some level of protection, it may not be as stringent as top-tier regulators like the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US.

Historically, Sun Long Bullion has faced scrutiny regarding its compliance with regulatory standards. Although the broker claims to operate within the legal framework, there are reports of customer complaints and issues related to fund withdrawals, which raises questions about its adherence to regulatory requirements. Therefore, while Sun Long Bullion is regulated, potential clients should remain vigilant and consider the implications of engaging with a broker under a less stringent regulatory environment.

Company Background Investigation

Sun Long Bullion was founded approximately 5 to 10 years ago, establishing itself in the competitive landscape of forex and precious metals trading. The company is headquartered in Kwun Tong, Hong Kong, and primarily focuses on gold trading. The ownership structure is not extensively detailed in public records, which could be a point of concern regarding transparency.

The management team of Sun Long Bullion comprises individuals with varying degrees of experience in the financial services industry. However, specific details about their professional backgrounds and qualifications are limited, making it difficult to assess their capability in managing client funds effectively. Transparency in leadership and operational practices is essential for building trust with clients, and the lack of detailed information may deter potential investors.

In terms of information disclosure, Sun Long Bullion provides basic details about its services and regulatory compliance on its website. However, the absence of comprehensive educational resources or detailed explanations of trading conditions could lead to confusion among clients. A transparent broker typically offers extensive information about its operations, which is crucial for fostering a safe trading environment.

Trading Conditions Analysis

The trading conditions offered by Sun Long Bullion are an important aspect of its overall safety profile. The broker primarily focuses on gold trading, with a minimum deposit requirement of $100. However, the absence of detailed information regarding account types, leverage, and spreads can create uncertainty for potential clients.

| Fee Type | Sun Long Bullion | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While Sun Long Bullion does provide access to the popular MT4 trading platform, the lack of clarity on trading costs and conditions is concerning. This ambiguity can lead to unexpected fees or unfavorable trading conditions, which may not align with clients' expectations.

Moreover, the absence of a clear commission structure and information on spreads can be perceived as a red flag. Traders should be cautious when dealing with brokers that do not transparently disclose their fee structures, as this could indicate potential hidden costs that may erode profits.

Customer Funds Security

The security of customer funds is a critical consideration when evaluating a forex broker. Sun Long Bullion claims to implement various measures to protect client funds, including segregated accounts and investor protection policies. However, detailed information regarding these measures is not readily available, which raises concerns about the actual level of security provided.

The broker operates under the regulatory framework of the CGSE, which mandates certain protections for clients. However, the effectiveness of these protections may not be as robust as those offered by brokers regulated by top-tier authorities. Additionally, there have been reports of clients experiencing difficulties in withdrawing their funds, which is a significant concern for any trader.

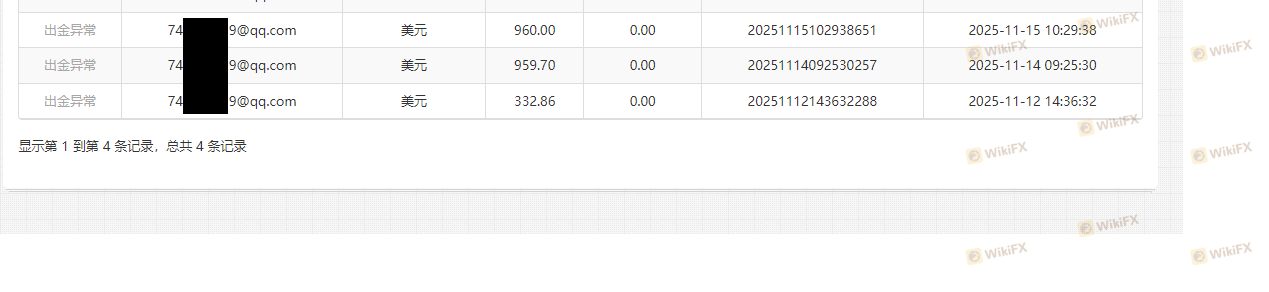

Historically, there have been instances where clients reported losing substantial amounts of money without recourse. These accounts of financial loss contribute to a perception of risk associated with Sun Long Bullion, highlighting the importance of thorough research and caution when dealing with this broker.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing the reliability of a forex broker. Reviews of Sun Long Bullion reveal a mixed bag of experiences from clients. While some traders report satisfactory experiences, others have voiced serious concerns regarding their interactions with the broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Management | Medium | Average |

| Lack of Transparency | High | Poor |

Common complaints include difficulties in withdrawing funds, lack of transparency regarding fees, and inadequate customer support. These issues suggest a pattern of dissatisfaction among clients, which can significantly impact the broker's reputation.

For instance, one user reported being unable to withdraw funds after multiple requests, leading to frustration and distrust. Such experiences raise alarms about the broker's operational integrity and its commitment to customer service.

Platform and Trade Execution

The trading platform is a critical component of a trader's experience, and Sun Long Bullion offers the widely-used MT4 platform. While MT4 is known for its user-friendly interface and advanced trading features, the overall performance and stability of the platform are crucial for effective trading.

Traders have reported varying experiences with order execution, with some noting instances of slippage and rejected orders. These issues can significantly affect trading outcomes, especially in volatile market conditions.

Moreover, any signs of platform manipulation or unfair trading practices can lead to significant financial losses for traders. Therefore, it is essential for potential clients to assess the platform's reliability and execution quality before committing their funds.

Risk Assessment

Using Sun Long Bullion comes with inherent risks that traders should carefully evaluate. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Regulated by CGSE, but not a top-tier regulator. |

| Customer Service Risk | High | Numerous complaints regarding withdrawal issues and poor support. |

| Financial Risk | High | Reports of substantial financial losses reported by clients. |

To mitigate these risks, traders should consider starting with a small investment and conduct regular monitoring of their trading activities. Additionally, researching alternative brokers with stronger regulatory oversight and better customer feedback may be beneficial.

Conclusion and Recommendations

In conclusion, Sun Long Bullion presents a mixed picture regarding its safety and legitimacy. While it is regulated by the Chinese Gold & Silver Exchange Society, the overall quality of regulation and the broker's operational transparency raise concerns. Reports of withdrawal issues and customer dissatisfaction suggest that traders should exercise caution when considering this broker.

For those contemplating trading with Sun Long Bullion, it is advisable to conduct thorough research, start with a minimal investment, and be prepared for potential challenges. If you are looking for more reliable alternatives, consider brokers that are regulated by top-tier authorities, such as the FCA or ASIC, which offer better investor protection and transparency.

In summary, is Sun Long Bullion safe? The answer is not straightforward; while it operates under a regulatory framework, the risks associated with customer service and financial transparency warrant a cautious approach.

Is Sun Long Bullion a scam, or is it legit?

The latest exposure and evaluation content of Sun Long Bullion brokers.

Sun Long Bullion Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Sun Long Bullion latest industry rating score is 6.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.