Is MRG Premiere safe?

Business

License

Is MRG Premiere A Scam?

Introduction

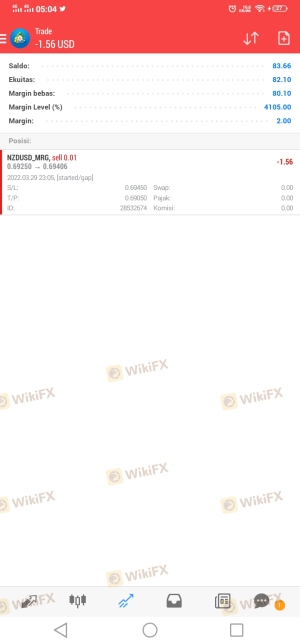

MRG Premiere is a forex broker that has positioned itself within the competitive landscape of the foreign exchange market. It offers a range of trading services, including access to various currency pairs, commodities, and indices. However, with the increasing number of fraudulent schemes in the trading industry, it is crucial for traders to conduct thorough evaluations of their brokers before committing funds. The importance of regulatory compliance and transparency cannot be overstated, as these factors significantly impact the safety and security of traders' investments. In this article, we will investigate the legitimacy of MRG Premiere by analyzing its regulatory status, company background, trading conditions, client fund security measures, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety for traders. MRG Premiere claims to operate under the auspices of regulatory bodies in New Zealand; however, there are significant concerns regarding the validity of these claims. The absence of a recognized regulatory framework raises red flags, prompting potential clients to approach this broker with caution.

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| Financial Markets Authority (FMA) | N/A | New Zealand | Unverified |

The lack of a valid license from a reputable authority, such as the FCA (UK) or ASIC (Australia), suggests that MRG Premiere does not meet the necessary standards for regulatory compliance. Furthermore, the absence of historical compliance records adds to the skepticism surrounding this broker. Traders must be aware that engaging with unregulated brokers exposes them to higher risks, including potential fund misappropriation and a lack of recourse in case of disputes.

Company Background Investigation

MRG Premiere operates under the ownership of Maxrich Group Ltd, which has been in the market for several years. However, the company's history is shrouded in ambiguity, with limited information available regarding its founding and operational track record. The lack of transparency in the company's ownership structure raises questions about accountability and trustworthiness.

The management team behind MRG Premiere has not been prominently featured in available resources, making it difficult for potential clients to assess their qualifications and experience. A strong management team with a solid background in trading and finance is essential for building trust with clients. The overall opacity regarding the company's operations and the absence of clear disclosures further exacerbate concerns about MRG Premiere's reliability.

Trading Conditions Analysis

When evaluating a broker, it is crucial to consider their trading conditions, including fees and spreads. MRG Premiere offers a variety of account types, each with its own fee structure. However, the overall cost of trading with MRG Premiere appears to be on the higher side, particularly for the basic account, which features elevated spreads.

| Fee Type | MRG Premiere | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 2.5 pips | From 1.0 pips |

| Commission Model | Varies by account type | Typically lower |

| Overnight Interest Range | Not specified | Varies by broker |

The basic account, while having a low minimum deposit requirement, imposes high spreads that could significantly impact profitability, especially for active traders. Moreover, the premium account, which offers lower spreads, still charges a commission, making it less competitive compared to other brokers in the market. These factors suggest that traders should carefully evaluate the cost implications of trading with MRG Premiere.

Client Fund Security

The safety of client funds is a paramount concern for any trader. MRG Premiere claims to implement certain measures to protect client deposits; however, the lack of clear information regarding fund segregation, investor protection, and negative balance protection policies raises concerns.

Traders should be cautious when dealing with brokers that do not provide comprehensive details about their fund security measures. Historical issues related to fund safety, if any, should also be investigated. Without robust security measures, traders risk losing their investments without any recourse.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews and testimonials about MRG Premiere reveal a mixed bag of experiences. Some users report difficulties in communication and support, leading to frustrations when trying to resolve issues.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| High Spreads | Medium | Limited explanation |

| Customer Support Issues | High | Unresolved inquiries |

Common complaints include slow withdrawal processes and a lack of effective customer support. The absence of live chat options and the reliance on email communication can lead to delays in addressing urgent matters. These issues highlight the importance of responsive customer service in ensuring a positive trading experience.

Platform and Execution

The trading platform is a critical component of any broker's offering. MRG Premiere utilizes the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading tools. However, concerns have been raised regarding the platform's performance, stability, and execution quality.

Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes. Any signs of platform manipulation or irregularities in order execution must be carefully scrutinized to ensure a fair trading environment.

Risk Assessment

Engaging with MRG Premiere carries inherent risks that traders must consider. The absence of regulatory oversight, coupled with high trading costs and questionable customer support, contributes to a precarious trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases potential for fraud. |

| Financial Risk | Medium | High spreads and commissions can erode profits. |

| Operational Risk | High | Poor customer service and platform reliability issues. |

Traders should exercise caution and implement effective risk management strategies when dealing with MRG Premiere. Diversifying investments and avoiding overexposure to any single broker can help mitigate potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that MRG Premiere exhibits several characteristics that warrant caution. The lack of regulatory oversight, high trading costs, and mixed customer experiences raise significant concerns about the broker's legitimacy. While MRG Premiere may offer certain trading opportunities, potential clients should be wary of the risks involved.

For traders seeking reliable alternatives, it is advisable to consider brokers that are regulated by reputable authorities and offer transparent trading conditions. Brokers such as FXPro, IC Markets, or OANDA may provide safer and more trustworthy trading environments. Ultimately, thorough research and careful consideration are essential to ensure a secure trading experience.

Is MRG Premiere a scam, or is it legit?

The latest exposure and evaluation content of MRG Premiere brokers.

MRG Premiere Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MRG Premiere latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.