Is Midasama safe?

Pros

Cons

Is Midasama Safe or Scam?

Introduction

Midasama is a forex broker that has positioned itself as a platform for trading various financial instruments, including forex, commodities, and precious metals. However, the legitimacy of Midasama has come under scrutiny, prompting many traders to question whether their funds would be safe with this broker. In the volatile world of forex trading, it is crucial for traders to conduct thorough evaluations of brokers before committing their capital. The potential for scams and fraudulent activities is high, making due diligence essential. This article aims to investigate Midasama's regulatory status, company background, trading conditions, customer experiences, and overall safety. Our evaluation will be based on a comprehensive analysis of available online resources, user reviews, and regulatory disclosures.

Regulation and Legitimacy

Regulatory oversight is a critical aspect of any financial service provider, particularly in the forex market. A regulated broker is typically subject to strict standards that protect investors and ensure transparency. Midasama, however, lacks regulation from any recognized financial authority, raising significant red flags regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulatory oversight means that traders using Midasama do not have the same protections afforded by regulated brokers. Without a license, there is no formal mechanism for resolving disputes or holding the broker accountable for any malpractices. This lack of regulation is a significant factor contributing to the perception that Midasama may not be a safe option for traders. Historical compliance and regulatory quality are also critical; Midasama has no track record of compliance, as it has never been regulated. This raises concerns about the broker's operational integrity and the safety of traders' funds.

Company Background Investigation

Midasama claims to have been established in 2012, but further investigation reveals that its domain was first registered in 2016, with updates made in 2019. This discrepancy in the company's claimed history raises questions about its transparency and credibility.

The ownership structure of Midasama is also obscure. The company does not disclose the identities of its owners or key personnel, which is a common practice among legitimate brokers. The only name that appears in association with Midasama is Morgan Matthews, who is described as a business director. However, there is a lack of verifiable information regarding his professional background or experience in the forex industry.

The overall transparency of Midasama is concerning. The absence of clear information about the company's management and ownership indicates a lack of accountability, which is essential for building trust with potential clients. This opacity is a common characteristic of brokers that may not be safe for traders.

Trading Conditions Analysis

The trading conditions offered by Midasama are another critical factor for consideration. The broker claims to offer various account types, with a minimum deposit requirement of $1,000, which is significantly higher than the industry average. This high barrier to entry may deter many potential traders.

| Fee Type | Midasama | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Midasama does not provide detailed information about its spreads, commissions, or overnight interest rates, leaving traders in the dark about potential costs. The lack of transparency regarding fees is a significant concern, as it can lead to unexpected charges that eat into traders' profits. Additionally, the absence of a demo account means that traders cannot test the platform or its trading conditions before committing their funds, which is another indicator that Midasama may not be a safe broker.

Client Fund Security

When evaluating a broker's safety, the security of client funds is paramount. Midasama's website does not provide any information about the measures it has in place to protect client funds. There is no mention of segregated accounts, which are essential for ensuring that client funds are kept separate from the broker's operational funds.

Furthermore, Midasama does not appear to offer any investor protection schemes or negative balance protection policies. This lack of safety measures means that traders could potentially lose more than their initial investment without any recourse. Historical complaints from users indicate that there have been issues with fund withdrawals, further highlighting the risks associated with trading with Midasama.

Customer Experience and Complaints

Customer feedback is an invaluable resource for evaluating a broker's reliability. Numerous online reviews and complaints about Midasama suggest a troubling trend. Many users report difficulties in withdrawing their funds, with some claiming that their accounts were liquidated without warning.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Liquidation | High | Poor |

For example, one user reported that they were unable to access their funds for several months, leading to significant financial distress. Another complaint highlighted the lack of communication from Midasama regarding these issues, indicating a failure to provide adequate customer support. The overall sentiment from users suggests that Midasama may not be a safe option for traders, as the company appears unresponsive to serious concerns.

Platform and Trade Execution

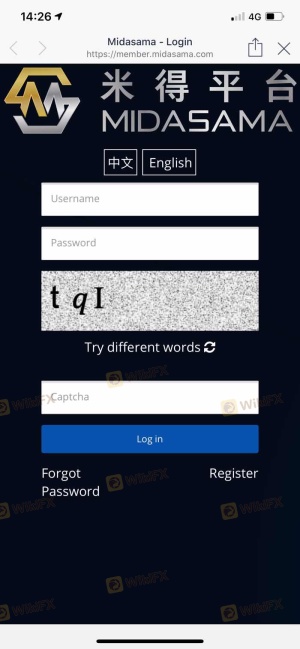

The trading platform offered by Midasama is based on MetaTrader 4 (MT4), a widely used trading platform known for its user-friendly interface and robust features. However, users have reported issues with the platform's stability and execution quality. Problems such as slippage and order rejections have been noted, which can severely impact trading performance.

Additionally, the lack of advanced security features, such as two-factor authentication, raises concerns about the safety of user accounts. The overall user experience appears to be below industry standards, further questioning the broker's reliability.

Risk Assessment

Using Midasama poses several risks that traders should consider before engaging with the platform.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | No segregation of client funds. |

| Withdrawal Risk | High | Numerous complaints regarding fund access. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, traders should consider using regulated brokers with established reputations and strong customer support. It is essential to conduct thorough research and avoid brokers with significant red flags, such as Midasama.

Conclusion and Recommendations

In conclusion, the evidence suggests that Midasama may not be a safe broker for forex trading. The lack of regulation, transparency, and customer support, combined with numerous complaints about fund access and trading conditions, raises serious concerns about the broker's legitimacy.

Traders should exercise extreme caution when considering Midasama for their trading needs. It is advisable to explore alternative, regulated brokers that offer better security and customer service. Brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback should be prioritized to ensure a safer trading experience.

In summary, Midasama appears to exhibit multiple characteristics of a potentially fraudulent operation, and traders are strongly advised to seek safer alternatives.

Is Midasama a scam, or is it legit?

The latest exposure and evaluation content of Midasama brokers.

Midasama Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Midasama latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.