Is MR AGE safe?

Business

License

Is MR AGE Safe or Scam?

Introduction

MR AGE is a forex brokerage based in Egypt, offering a range of trading services to clients worldwide. Established in 2006, it aims to provide traders with access to various financial instruments, including forex, commodities, and indices. However, the lack of proper regulation raises concerns about its credibility and safety. Traders must exercise caution when evaluating forex brokers, as the industry is rife with unregulated entities that may engage in fraudulent activities. This article investigates MR AGE's legitimacy, focusing on its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The evaluation is based on a thorough review of various sources, including broker reviews and regulatory databases.

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its safety and reliability. MR AGE is currently unregulated, meaning it operates without oversight from a recognized financial authority. This absence of regulation can expose traders to significant risks, as there are no guarantees of fair trading practices or protection of client funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Egypt | Unverified |

The lack of a valid regulatory framework raises red flags regarding MR AGE's operational integrity. Without stringent oversight, the broker may not adhere to best practices, making it challenging for traders to seek recourse in the event of disputes. Additionally, the absence of regulatory history indicates potential vulnerabilities in compliance and risk management. Therefore, it is essential for traders to approach MR AGE with caution, as the unregulated status significantly diminishes its credibility.

Company Background Investigation

MR AGE was founded in 2006 and is headquartered in Egypt. Despite its years of operation, the broker has not established a robust reputation in the forex market. The ownership structure remains somewhat opaque, with limited information available about its stakeholders. This lack of transparency can be concerning for potential clients, as it raises questions about the accountability of the management team.

The management team at MR AGE appears to have a mixed background, with limited public profiles available to assess their expertise in the financial sector. A strong management team with relevant experience is crucial for ensuring effective operations and client trust. However, the absence of detailed information about its executives may lead to skepticism regarding the broker's reliability.

Moreover, MR AGE's commitment to transparency in information disclosure is questionable. A reputable broker should provide clear information about its services, fees, and policies to facilitate informed decision-making by clients. The lack of transparency can hinder traders' ability to understand the broker's operations, further amplifying the risks associated with engaging with MR AGE.

Trading Conditions Analysis

The trading conditions offered by MR AGE are a vital aspect of its overall service. However, the broker's fee structure raises concerns, particularly regarding unusual or hidden fees. While MR AGE provides access to various trading instruments, the absence of detailed information on spreads and commissions makes it difficult for traders to evaluate the potential costs associated with trading.

| Fee Type | MR AGE | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 2% - 5% |

The lack of clarity surrounding MR AGE's trading costs can be a significant drawback for traders. Unexplained or excessive fees can erode profits and create an unfavorable trading environment. Additionally, without a transparent commission structure, traders may find it challenging to assess the broker's competitiveness compared to industry standards. This lack of transparency in trading conditions raises concerns about the broker's overall trustworthiness.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. MR AGE's approach to safeguarding client funds is not well-documented, leading to uncertainty about its security measures. A reliable broker should implement robust measures to protect client funds, including segregating accounts and offering investor protection schemes.

Unfortunately, MR AGE does not provide adequate information regarding its fund safety protocols. Without clear policies on fund segregation or negative balance protection, traders may face significant risks in the event of financial distress or operational failures. Furthermore, the absence of any historical incidents regarding fund safety issues raises questions about the broker's overall reliability.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into a broker's performance and reliability. Reviews of MR AGE indicate a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and receiving adequate customer support. The recurring theme of withdrawal issues raises concerns about the broker's operational integrity and responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Fair |

| Unclear Fee Structure | High | Poor |

Typical complaints revolve around the inability to withdraw funds, lack of timely responses from customer support, and confusion regarding fees. These issues can significantly impact traders' experiences, leading to frustration and financial losses. A broker's ability to address customer concerns effectively is essential for building trust, and MR AGE's performance in this area appears lacking.

Platform and Trade Execution

The trading platform's performance is a crucial factor in determining the overall trading experience. MR AGE offers a trading platform that is reportedly user-friendly, but there are concerns regarding its stability and execution quality. Traders have expressed dissatisfaction with order execution speeds and instances of slippage, which can adversely affect trading outcomes.

Moreover, any signs of potential platform manipulation or unfair practices should be scrutinized. A reliable broker must ensure that its trading platform operates fairly and transparently, providing traders with the tools they need to succeed.

Risk Assessment

Engaging with MR AGE carries inherent risks due to its unregulated status and questionable operational practices. Traders must carefully consider the potential pitfalls before deciding to open an account.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Financial Risk | Medium | Lack of transparency in fees. |

| Customer Support Risk | High | Poor responsiveness to complaints. |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with established regulatory frameworks and proven track records. It is advisable to prioritize brokers that offer transparency, robust fund safety measures, and reliable customer support.

Conclusion and Recommendations

In conclusion, the investigation into MR AGE raises several concerns regarding its safety and legitimacy. The lack of regulation, transparency issues, and negative customer experiences suggest that traders should approach this broker with caution. While MR AGE may offer access to various trading instruments, the risks associated with engaging in trading activities with an unregulated broker are significant.

For traders seeking reliable alternatives, it is recommended to consider brokers with established regulatory oversight and positive customer feedback. By prioritizing safety and transparency, traders can enhance their chances of a successful trading experience. Ultimately, it is crucial to remain vigilant and informed when selecting a forex broker to ensure the protection of investments and trading capital.

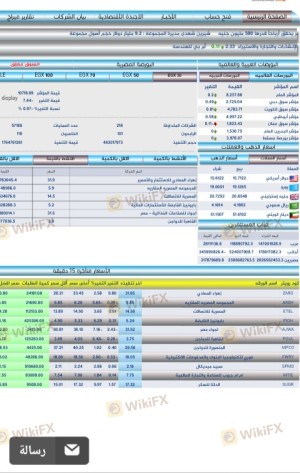

Is MR AGE a scam, or is it legit?

The latest exposure and evaluation content of MR AGE brokers.

MR AGE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MR AGE latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.