Is MIND STONE safe?

Pros

Cons

Is Mind Stone Safe or Scam?

Introduction

Mind Stone is a relatively new player in the foreign exchange market, positioning itself as an online trading platform that offers a variety of financial instruments, including forex, cryptocurrencies, and CFDs. As the popularity of online trading continues to grow, so does the number of unregulated brokers, making it essential for traders to carefully assess the legitimacy and reliability of any trading platform before investing their hard-earned money. In this article, we will investigate whether Mind Stone is a safe trading option or if it raises red flags that suggest otherwise. Our investigation will be based on a comprehensive analysis of regulatory status, company background, trading conditions, customer safety measures, and user experiences.

Regulation and Legitimacy

One of the most critical factors in determining the safety of a trading platform is its regulatory status. Regulation serves as a safeguard for traders, ensuring that the broker adheres to specific standards and practices that protect clients' funds and interests. Mind Stone has been flagged as an unregulated offshore broker, which raises significant concerns about the safety of its operations.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of any regulatory oversight is a major concern for potential investors. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC) are known for their stringent requirements for licensing brokers. Without such regulation, there is a higher risk of fraud and mismanagement. Furthermore, the lack of transparency regarding Mind Stone's operational details and ownership adds to the skepticism surrounding its legitimacy. Given these factors, it is prudent to question is Mind Stone safe for trading.

Company Background Investigation

Understanding the company behind a trading platform is crucial for evaluating its reliability. Mind Stone claims to operate from Hong Kong, but there is limited information available regarding its history and ownership structure. The website lacks comprehensive details about the management team and their professional backgrounds, which is a significant transparency issue.

Additionally, the company has not provided any legal documents, such as terms and conditions or a privacy policy, which are typically available on legitimate trading platforms. This lack of information raises questions about the company's accountability and commitment to ethical trading practices.

Moreover, the absence of identifiable contact information, aside from a single phone number, further complicates the situation. If a broker is legitimate, it should be easy for clients to verify its credentials and reach out for support. In this case, the opacity surrounding Mind Stone's operations leads to increased skepticism about whether is Mind Stone safe for traders.

Trading Conditions Analysis

When evaluating a trading platform, it's essential to consider the trading conditions it offers. Mind Stone's website presents various financial instruments, but it lacks clarity regarding its fee structure. Traders are often deterred by hidden fees or unfavorable trading conditions that can erode their profits.

| Fee Type | Mind Stone | Industry Average |

|---|---|---|

| Spread (Major Pairs) | Not Specified | 1.0 - 2.0 pips |

| Commission Structure | Not Specified | Varies (typically $0 - $10) |

| Overnight Interest Rates | Not Specified | Varies (typically 2% - 5%) |

The failure to provide explicit details about spreads, commissions, and overnight interest rates is alarming. Legitimate brokers usually disclose this information to ensure transparency. Moreover, the lack of specified minimum deposits and withdrawal fees can lead to unexpected costs for traders. This uncertainty contributes to the overall risk associated with trading on this platform, raising the question of is Mind Stone safe for potential investors.

Customer Fund Safety

The security of customer funds is paramount when it comes to online trading. Mind Stone has not presented any clear information regarding its safety measures for safeguarding client deposits. In regulated environments, brokers are often required to maintain segregated accounts for client funds, which helps protect them in the event of the broker's insolvency.

However, Mind Stone does not offer any such assurances. The absence of segregated accounts, investor protection schemes, and negative balance protection policies raises significant concerns about the safety of traders' funds. Historical issues related to fund security within unregulated brokers further exacerbate these concerns. Given the lack of transparency and security measures, potential clients must seriously consider whether is Mind Stone safe for their investments.

Customer Experience and Complaints

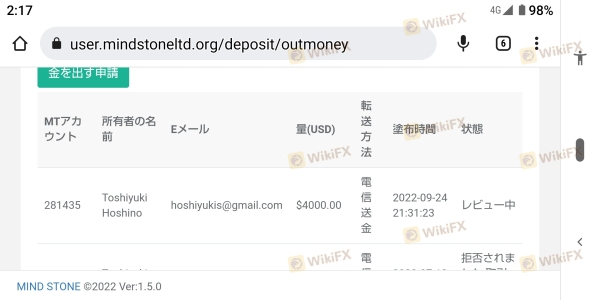

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews and complaints about Mind Stone reveal a pattern of negative experiences. Many users have reported difficulties with withdrawals, citing that their requests remained unaddressed for extended periods.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Inadequate |

| Misleading Information | High | Unresponsive |

Typical complaints include the inability to withdraw funds, unresponsive customer service, and misleading information on the website. These complaints suggest a troubling trend that potential investors should be aware of. If a broker consistently fails to address customer issues, it can be a strong indicator of operational problems. Therefore, it is crucial to question is Mind Stone safe given the negative customer experiences reported.

Platform and Execution

The trading platform's performance and execution quality are vital for a seamless trading experience. Mind Stone claims to offer advanced trading tools and a user-friendly interface. However, many users have reported issues with platform stability, including frequent downtime and execution slippage.

Furthermore, the inability to access the registration page raises concerns about the platform's reliability. A legitimate broker should provide a stable and efficient trading environment, allowing traders to execute orders without significant delays. The presence of such issues leads to skepticism about whether is Mind Stone safe for trading activities.

Risk Assessment

When considering any trading platform, an overall risk assessment is essential. Mind Stone presents several risks that potential investors should be aware of:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Fund Security Risk | High | No segregation of client funds |

| Customer Service Risk | Medium | Poor response to complaints |

| Execution Risk | High | Issues with platform stability and order execution |

Given these risk factors, it is crucial for traders to approach Mind Stone with extreme caution. The lack of regulatory oversight combined with negative customer experiences creates a hazardous environment for potential investors. To mitigate these risks, traders should consider using established, regulated brokers with proven track records.

Conclusion and Recommendations

In conclusion, the investigation into Mind Stone raises several red flags regarding its legitimacy and safety. The absence of regulatory oversight, lack of transparency, and negative customer experiences strongly suggest that is Mind Stone safe is a question that remains unanswered in a reassuring manner.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are well-regulated and have positive reviews from users. Brokers such as FXTM, XM, and FP Markets are known for their transparency, customer service, and regulatory compliance, making them safer options for trading.

In light of the findings, it is clear that potential investors should exercise extreme caution and consider the risks associated with Mind Stone before making any financial commitments.

Is MIND STONE a scam, or is it legit?

The latest exposure and evaluation content of MIND STONE brokers.

MIND STONE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MIND STONE latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.