Mind Stone 2025 Review: Everything You Need to Know

Executive Summary

This mind stone review presents a comprehensive analysis of Mind Stone as a trading platform in 2025. Mind Stone appears to be associated with financial education and trading services, though specific operational details remain limited in publicly accessible sources. The platform seems to target forex traders and individuals seeking stock market education. Mind Stone Fintech offers educational programs covering stock market basics and fundamental analysis.

However, our investigation reveals significant gaps in transparency regarding core trading conditions, regulatory status, and user feedback. The lack of detailed information about spreads, commissions, platform features, and regulatory compliance raises concerns for potential users. While educational offerings appear to be a strength, the absence of comprehensive trading specifications and user testimonials suggests traders should exercise caution and conduct thorough due diligence before engaging with this platform.

Important Notice

This review is based on limited publicly available information about Mind Stone. Different regional entities may operate under similar names, and trading conditions may vary significantly across jurisdictions. Our evaluation methodology relies on accessible data sources, regulatory databases, and user feedback where available. Potential users should verify all information directly with the broker and ensure compliance with local regulations before opening any trading account.

Rating Overview

Broker Overview

Mind Stone appears to operate in the financial services sector with a focus on trading and financial education. According to available sources, Mind Stone Fintech offers structured educational programs, including a two-week course covering stock market basics, fundamental analysis, and primary market insights. The company provides both weekday and weekend training batches, suggesting an emphasis on accessibility for different user schedules.

The platform's educational approach indicates a focus on developing trader knowledge and skills. This could appeal to beginner and intermediate traders seeking to enhance their market understanding. However, the specific establishment date, company registration details, and operational history remain unclear from available public information.

Regarding the trading infrastructure, mind stone review sources indicate limited transparency about the core business model. The platform's relationship with traditional forex and CFD trading, execution methods, and market maker versus ECN models are not clearly defined in accessible documentation. This lack of clarity extends to fundamental aspects such as asset coverage, platform technology, and regulatory oversight. These are typically essential considerations for serious traders.

Regulatory Status: Available information does not clearly specify the regulatory authorities overseeing Mind Stone's operations. This represents a significant concern for traders prioritizing regulatory protection and fund safety.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not readily available in public sources.

Minimum Deposit Requirements: The minimum account funding requirements have not been disclosed in accessible materials. This makes it difficult for potential users to plan their initial investment.

Bonuses and Promotions: No specific information about welcome bonuses, trading incentives, or promotional offers has been identified in available sources.

Tradeable Assets: While the platform appears connected to stock market education, the specific range of tradeable instruments including forex pairs, commodities, indices, and cryptocurrencies remains unspecified.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs is not detailed in publicly available materials. This makes cost comparison challenging.

Leverage Options: Maximum leverage ratios and margin requirements across different asset classes are not specified in current mind stone review materials.

Platform Options: Information about trading platform availability, including web-based, desktop, and mobile applications, is not comprehensively documented.

Geographic Restrictions: Specific countries or regions where services are restricted or unavailable are not clearly outlined.

Customer Support Languages: Supported languages for customer service communication are not specified in available documentation.

Account Conditions Analysis

The account conditions evaluation for Mind Stone reveals significant information gaps that impact our ability to provide a comprehensive assessment. Available sources do not detail the variety of account types offered. We don't know whether the platform provides standard, premium, or VIP account tiers with different features and benefits. This lack of transparency makes it difficult for potential traders to understand what options are available and which might best suit their trading style and capital requirements.

Minimum deposit requirements are not specified in publicly available materials. These requirements are fundamental to account accessibility. Without this information, traders cannot determine if the platform caters to retail clients with smaller initial investments or primarily targets institutional and high-net-worth individuals. The absence of clear deposit thresholds also complicates financial planning for prospective users.

Account opening procedures and verification requirements remain unclear from current sources. Modern traders expect streamlined onboarding processes with clear documentation requirements and reasonable verification timeframes. The lack of detailed information about KYC procedures, required documents, and account activation timelines represents a transparency deficit that may concern potential users.

Special account features such as Islamic accounts for Muslim traders, demo accounts for practice trading, or managed account options are not mentioned in available mind stone review materials. These specialized offerings often distinguish brokers in competitive markets. Their absence from public information suggests either limited product diversity or insufficient marketing communication.

The tools and resources evaluation reveals a mixed picture with some educational strengths but significant gaps in trading infrastructure information. Mind Stone Fintech's educational offerings represent a notable positive aspect, with structured programs covering stock market basics, fundamental analysis, and primary market insights. The availability of both weekday and weekend batches demonstrates flexibility in accommodating different learning schedules. This could benefit working professionals seeking to develop trading skills.

However, critical information about trading tools remains absent from available sources. Modern traders expect comprehensive charting packages, technical analysis indicators, economic calendars, and market research resources. The lack of specific details about analytical tools, real-time data feeds, and research capabilities makes it difficult to assess whether the platform meets contemporary trading requirements.

Automated trading support is not addressed in current documentation. This includes Expert Advisor compatibility, algorithmic trading capabilities, and API access for advanced users. These features are increasingly important for traders seeking to implement systematic strategies or connect third-party tools and services.

Educational resources beyond the basic stock market course are not detailed. This leaves questions about ongoing learning support, webinars, market analysis publications, and advanced training modules. While the foundational educational program shows promise, the absence of comprehensive learning resources may limit long-term user development and engagement.

Customer Service and Support Analysis

Customer service evaluation is significantly hampered by the lack of specific information about support infrastructure and service quality. Available sources do not detail the customer support channels offered. We don't know whether the platform provides telephone support, live chat, email assistance, or comprehensive help desk services. This information gap makes it impossible to assess accessibility and convenience for users requiring assistance.

Response time commitments and service level agreements are not specified in publicly available materials. Professional traders often require rapid support resolution, particularly during volatile market conditions or when technical issues affect trading activities. The absence of clear service standards raises concerns about support reliability and effectiveness.

Multilingual support capabilities remain unclear. This could impact international users seeking assistance in their native languages. Global trading platforms typically offer support in major languages to serve diverse client bases effectively. The lack of language support information may indicate limited international focus or insufficient service infrastructure.

Operating hours for customer support are not documented in available sources. Forex markets operate 24/5, and traders expect support availability during major trading sessions. Without clear information about support schedules, users cannot determine if assistance will be available when needed most.

Trading Experience Analysis

Trading experience assessment is severely limited by the absence of specific platform performance data and user feedback. Available sources do not provide information about execution speeds, order processing efficiency, or platform stability during high-volume trading periods. These technical performance metrics are crucial for evaluating whether the platform can support serious trading activities effectively.

Platform functionality details are not comprehensively documented. This leaves questions about order types supported, charting capabilities, and advanced trading features. Modern traders expect sophisticated order management, including stop losses, take profits, trailing stops, and conditional orders. The lack of specific feature information makes it difficult to assess platform sophistication.

Mobile trading capabilities are not detailed in current sources. Mobile access is essential for contemporary trading. Traders require reliable mobile platforms for monitoring positions, executing trades, and receiving market alerts while away from desktop computers. The absence of mobile platform information represents a significant documentation gap.

Market execution quality is not addressed in available materials. This includes slippage rates, requote frequency, and order rejection statistics. These performance indicators directly impact trading profitability and user satisfaction. Professional traders typically seek platforms with transparent execution statistics and competitive performance metrics.

Mind stone review sources do not provide specific user testimonials or trading experience reports. This makes it challenging to assess real-world platform performance from actual user perspectives.

Trust and Reliability Analysis

Trust and reliability assessment reveals significant concerns due to limited regulatory transparency and unclear operational oversight. Available sources do not clearly specify the regulatory authorities supervising Mind Stone's operations. This represents a fundamental issue for traders prioritizing regulatory protection and fund safety. Regulated brokers typically prominently display their license numbers and regulatory affiliations, and the absence of this information raises questions about compliance status.

Fund security measures are not detailed in publicly available materials. This includes client money segregation, deposit protection schemes, and insurance coverage. These protections are essential for trader confidence and represent standard industry practices among reputable brokers. The lack of specific security information may indicate either inadequate protections or insufficient transparency about existing safeguards.

Company transparency regarding ownership structure, management team, and operational history is limited in current sources. Established brokers typically provide comprehensive company information, including leadership profiles, business history, and corporate governance details. This transparency helps traders assess the stability and credibility of their chosen platform.

Industry reputation and third-party evaluations are not readily available for Mind Stone. This makes it difficult to assess peer recognition and professional standing. Established brokers often receive industry awards, regulatory commendations, and positive reviews from independent evaluation services. The absence of such recognition may indicate either limited market presence or insufficient track record.

User Experience Analysis

User experience evaluation is constrained by limited feedback and interface information available in public sources. Overall user satisfaction metrics are not documented in accessible materials. This includes retention rates, user growth statistics, and satisfaction surveys. These indicators typically provide valuable insights into platform quality and user acceptance levels.

Interface design and usability assessments are not available through current sources. This makes it difficult to evaluate navigation efficiency, feature accessibility, and overall user-friendliness. Modern trading platforms require intuitive designs that enable efficient trade execution and portfolio management without unnecessary complexity.

Registration and verification processes are not detailed in available documentation. This leaves questions about onboarding efficiency and user experience quality. Streamlined account opening procedures with clear requirements and reasonable processing times are essential for positive initial user experiences.

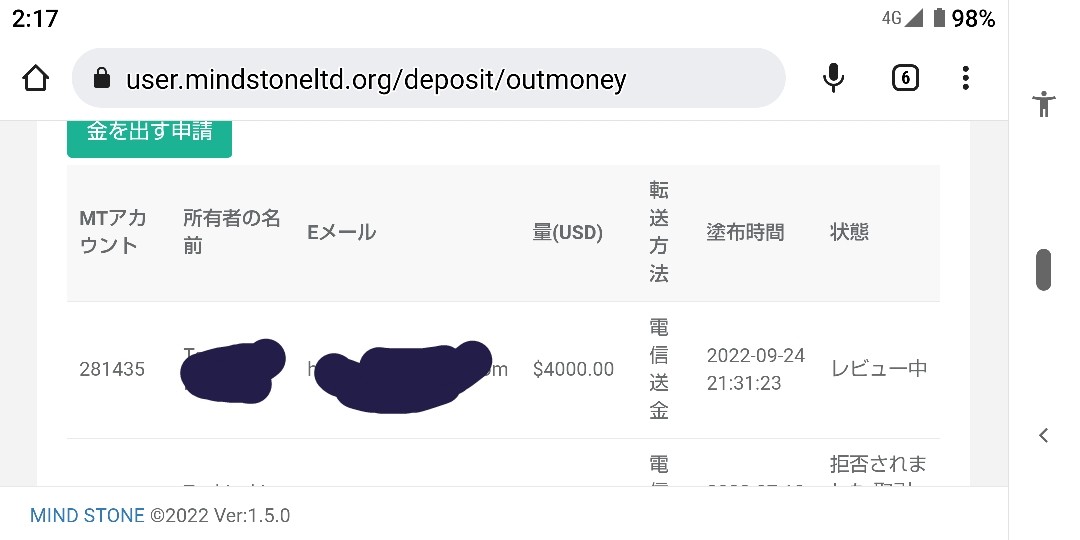

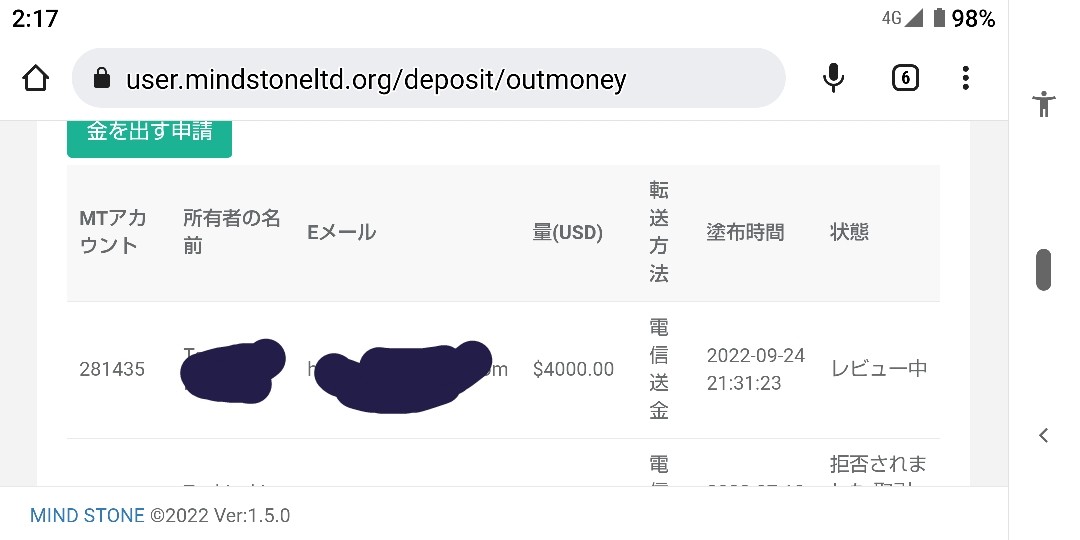

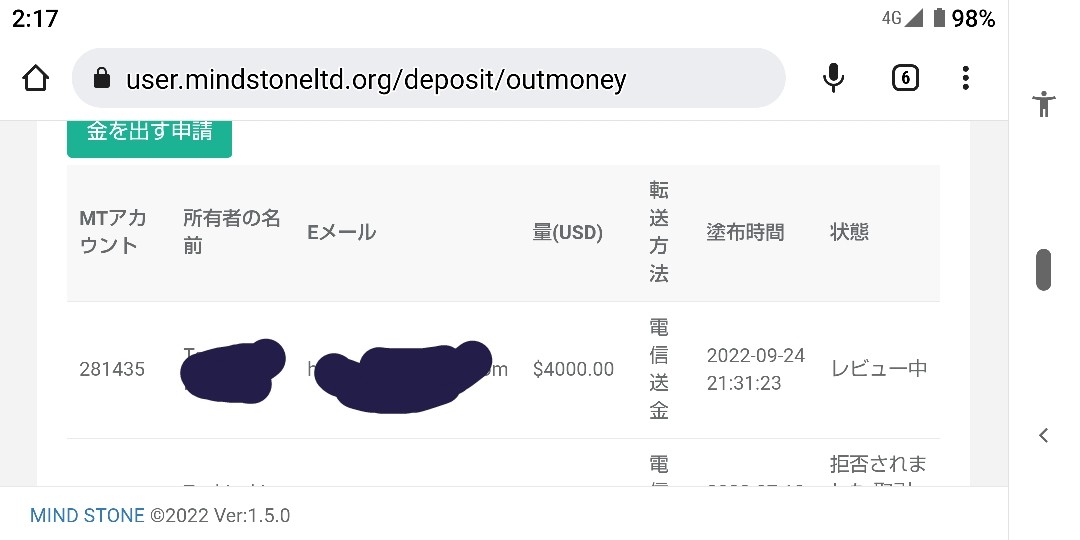

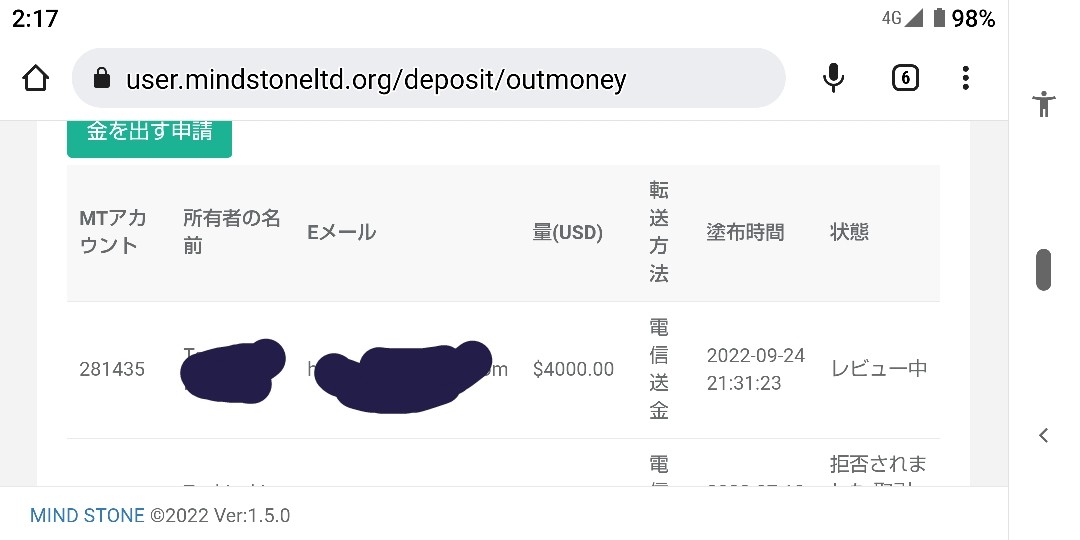

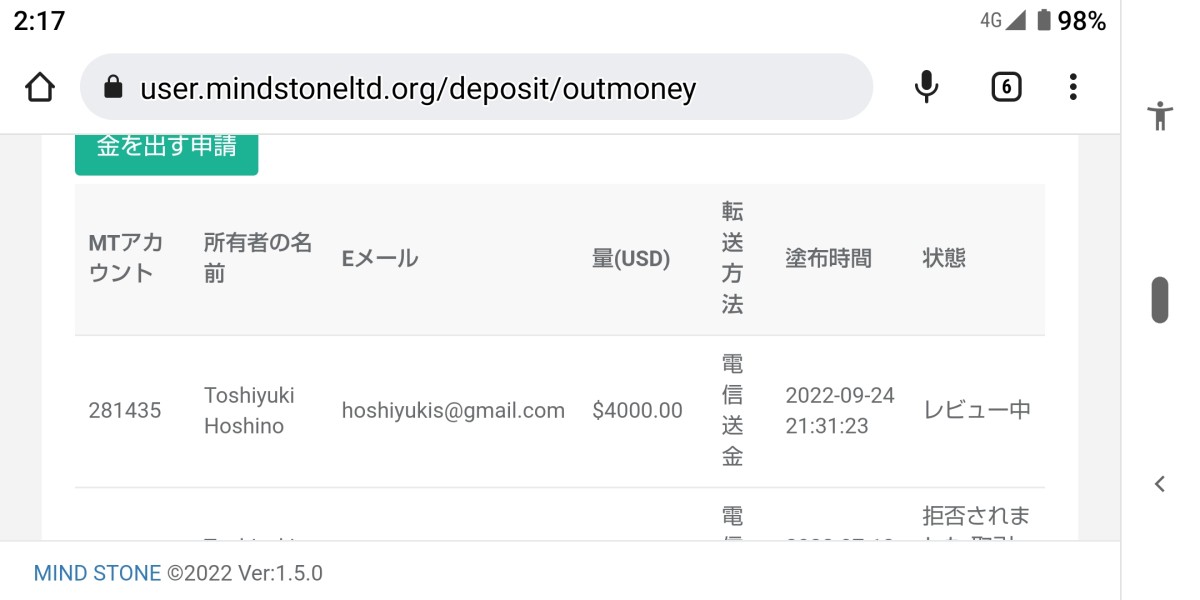

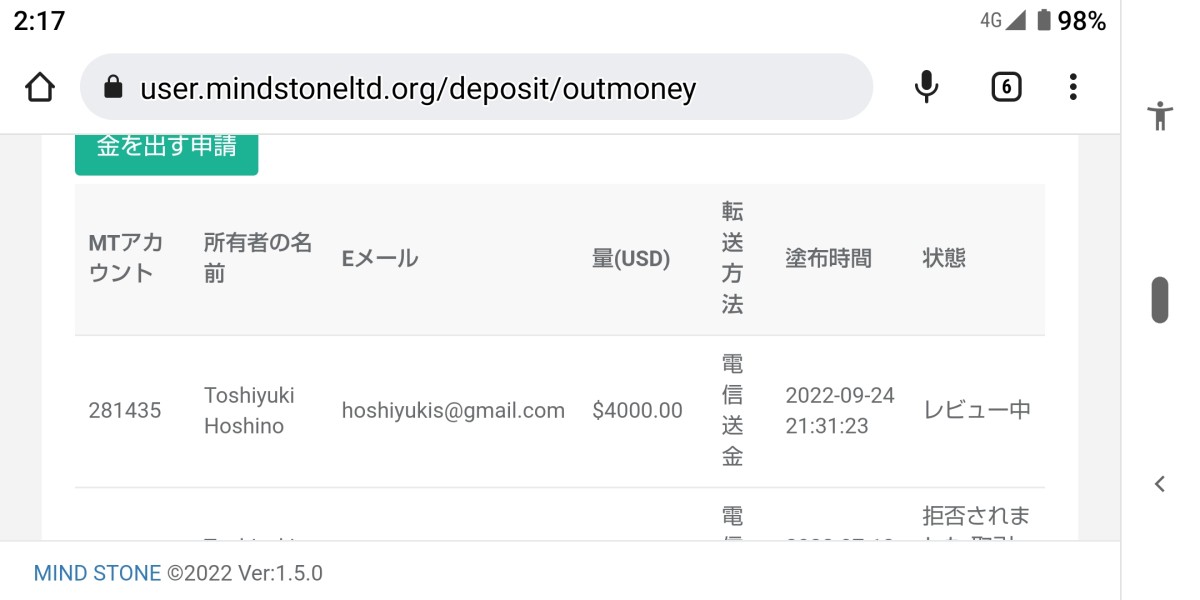

Funding and withdrawal experiences are not addressed in current materials. This includes processing speeds, fee transparency, and transaction reliability. These operational aspects significantly impact user satisfaction and platform usability for regular trading activities.

Common user complaints and resolution patterns are not documented in available sources. This prevents assessment of typical issues and platform responsiveness to user concerns. Understanding frequent problems and their resolution helps potential users anticipate challenges and evaluate platform reliability.

Conclusion

This comprehensive mind stone review reveals significant information gaps that limit our ability to provide a definitive recommendation. Mind Stone Fintech's educational programs demonstrate some commitment to trader development. However, the lack of transparency regarding core trading operations, regulatory status, and user feedback raises substantial concerns for potential users.

The platform may suit individuals primarily seeking basic financial education. This is particularly true for those interested in stock market fundamentals and flexible learning schedules. However, serious traders requiring comprehensive trading infrastructure, regulatory protection, and transparent operational conditions should exercise extreme caution and seek additional information before committing funds.

The absence of clear regulatory oversight, detailed trading conditions, and user testimonials suggests that Mind Stone may not meet the standards expected by experienced traders. Potential users should thoroughly investigate regulatory status, verify company credentials, and consider alternative platforms with more transparent operations and established track records in the competitive forex and CFD trading market.