Regarding the legitimacy of MB Group forex brokers, it provides ASIC, VFSC and WikiBit, .

Is MB Group safe?

Pros

Cons

Is MB Group markets regulated?

The regulatory license is the strongest proof.

ASIC Derivatives Trading License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (STP)

Licensed Entity:

DLS MARKETS (AUST) PTY LTD

Effective Date: Change Record

2006-02-07Email Address of Licensed Institution:

compliance@dlsm.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 21 207 KENT ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0452639886Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

DLS Markets Limited

Effective Date:

2023-06-13Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is MB Group Safe or a Scam?

Introduction

MB Group is a broker operating in the foreign exchange (Forex) market, positioning itself as a platform that offers a wide range of trading instruments, including CFDs on forex, commodities, and indices. As the Forex market continues to grow, traders must exercise caution when selecting a broker, as the landscape is rife with both legitimate firms and potential scams. This article aims to provide an objective analysis of MB Group's legitimacy by examining its regulatory status, company background, trading conditions, client fund security, user experiences, and overall risk assessment. The evaluation is based on a comprehensive review of the available online resources and user feedback.

Regulatory and Legality

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. A well-regulated broker is typically seen as safer because it adheres to strict guidelines set by financial authorities. In the case of MB Group, there are concerns regarding its regulatory compliance and oversight. Below is a table summarizing the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 676418 | United Kingdom | Suspicious Clone |

The Financial Conduct Authority (FCA) is one of the most reputable regulatory bodies globally, and brokers under its jurisdiction are expected to meet stringent requirements. However, MB Group has been flagged as a "suspicious clone," which raises significant concerns about its regulatory legitimacy. The lack of a clear regulatory framework and the presence of negative indicators suggest that potential clients should approach MB Group with caution.

Company Background Investigation

Understanding the history and structure of a brokerage is essential for assessing its reliability. MB Group was established in 2017, and although it claims to have a solid foundation in the Forex market, the absence of detailed information regarding its ownership and management team is concerning. Transparency is vital in the financial sector, and companies that do not provide adequate information about their leadership may have something to hide.

The management teams background and expertise are crucial in determining a broker's operational integrity. Unfortunately, there is limited information available regarding the qualifications and experience of MB Group's leadership. This lack of transparency can lead to increased skepticism among potential traders, making it essential to consider the implications of such obscurity when evaluating whether "Is MB Group safe?"

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. In the case of MB Group, the broker promotes competitive trading conditions, including low spreads and high leverage. However, it is essential to scrutinize the overall fee structure and any unusual or problematic fee policies. The following table summarizes the core trading costs associated with MB Group:

| Fee Type | MB Group | Industry Average |

|---|---|---|

| Spread for Major Pairs | 0.0 pips | 1-2 pips |

| Commission Structure | $0.00 | Varies |

| Overnight Interest Range | Varies | Varies |

While the advertised spreads are attractive, traders should be wary of hidden fees or unfavorable terms that may not be immediately apparent. This kind of transparency is crucial for determining if "Is MB Group safe?" for potential investors.

Client Fund Security

The safety of client funds is paramount in the Forex industry. MB Group claims to implement several measures to protect client funds, including segregation of client accounts and custodianship with major financial service providers. However, it is essential to evaluate these claims critically.

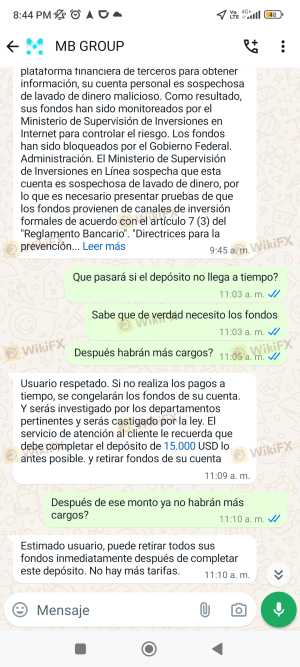

Investment protection mechanisms, such as negative balance protection and participation in compensation schemes, further enhance client safety. Unfortunately, detailed information regarding MB Group's specific policies in these areas is lacking. Moreover, any historical issues related to fund security or disputes should be closely examined to understand the broker's track record better.

Customer Experience and Complaints

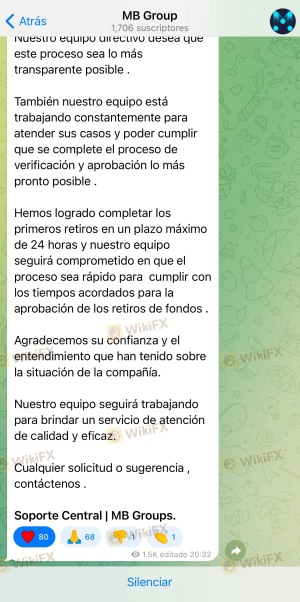

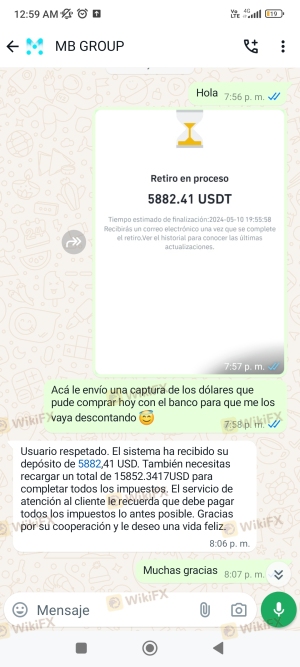

Analyzing customer feedback is vital in assessing a broker's reputation and reliability. Reviews of MB Group reveal a mixed bag of experiences. While some users praise the platform for its execution speed and customer support, others have raised concerns about withdrawal difficulties and lack of responsiveness to complaints.

The following table summarizes the primary types of complaints received about MB Group:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Generally responsive |

| Platform Stability | Medium | Mixed feedback |

Two notable case studies illustrate the concerns raised by users. One trader reported significant delays in fund withdrawals, leading to frustration and distrust towards the broker. Another user highlighted issues with platform stability during high volatility periods, raising questions about the broker's reliability.

Platform and Trade Execution

The performance and reliability of a trading platform can greatly influence a trader's success. MB Group utilizes the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust features. However, it is essential to evaluate the platform's performance concerning execution quality, slippage, and order rejection rates.

User feedback indicates that while the execution speed is generally fast, there have been instances of slippage during volatile market conditions, which can adversely affect trading outcomes. Traders should remain vigilant regarding any signs of platform manipulation or discrepancies in execution.

Risk Assessment

Engaging with any broker carries inherent risks, and MB Group is no exception. An overall risk assessment reveals several areas of concern, summarized in the table below:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lacks solid regulatory oversight |

| Fund Security | Medium | Claims of fund segregation but lacks transparency |

| Customer Experience | Medium | Mixed user reviews with significant complaints |

To mitigate risks, potential traders should conduct thorough due diligence, utilize small initial deposits, and be cautious of high leverage.

Conclusion and Recommendations

In conclusion, while MB Group presents itself as a competitive player in the Forex market, numerous red flags suggest that traders should approach with caution. The lack of robust regulatory oversight, transparency regarding company operations, and mixed customer feedback raises significant concerns about its safety and reliability.

For traders seeking a secure trading environment, it may be prudent to consider alternative brokers that are well-regulated and have a proven track record of positive client experiences. Some reputable alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which offer a more transparent and secure trading environment.

Ultimately, the question remains: Is MB Group safe? The evidence suggests that potential traders should exercise caution and conduct thorough research before committing their funds.

Is MB Group a scam, or is it legit?

The latest exposure and evaluation content of MB Group brokers.

MB Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MB Group latest industry rating score is 1.30, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.30 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.