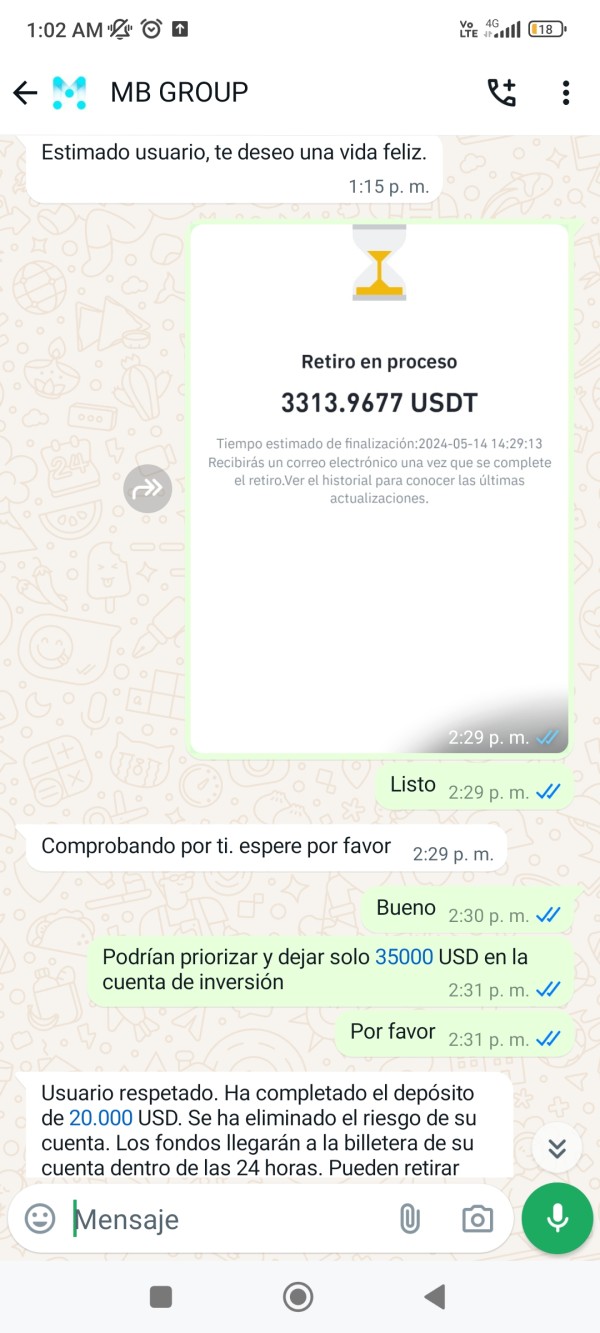

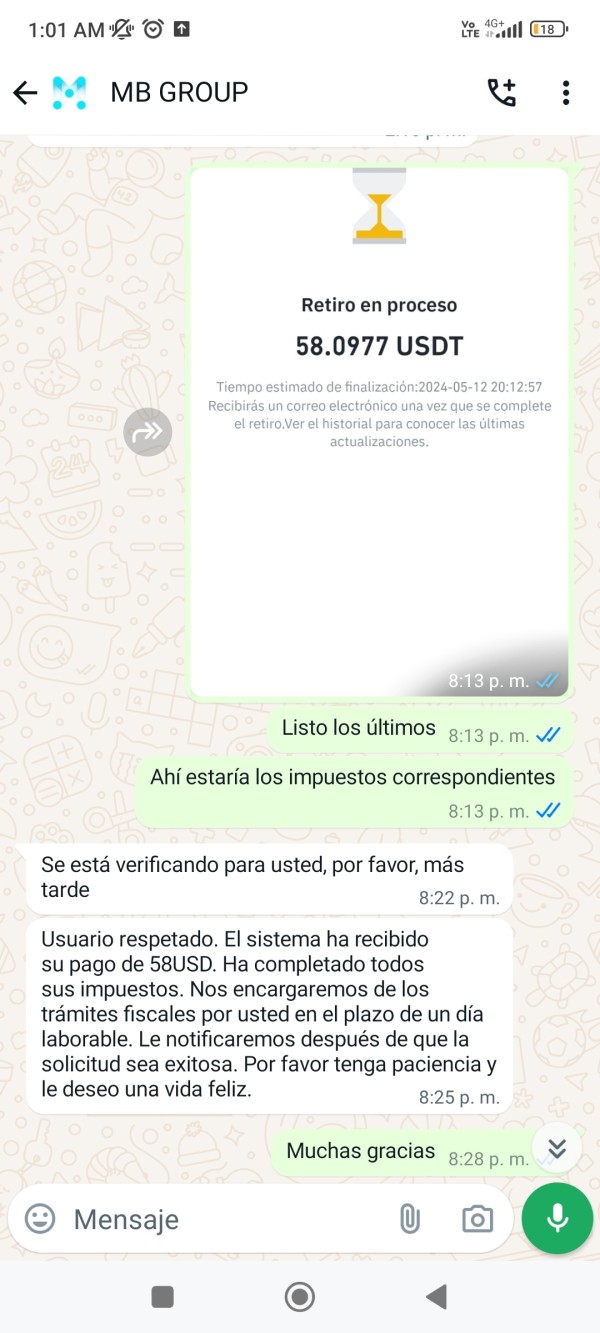

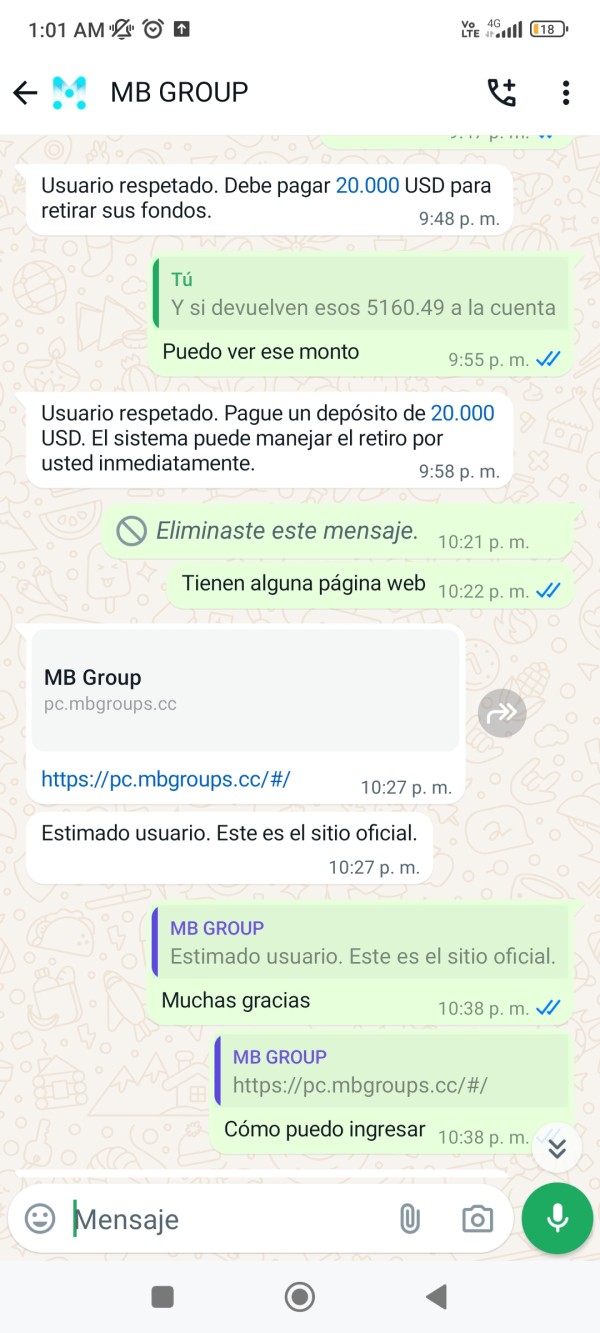

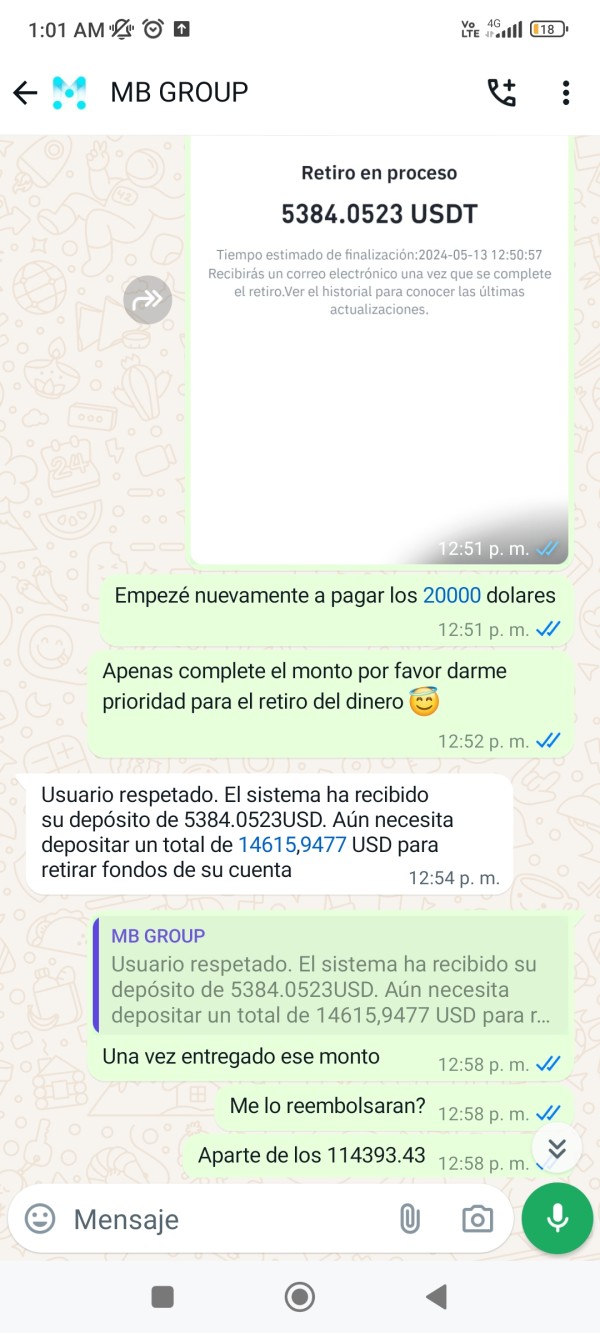

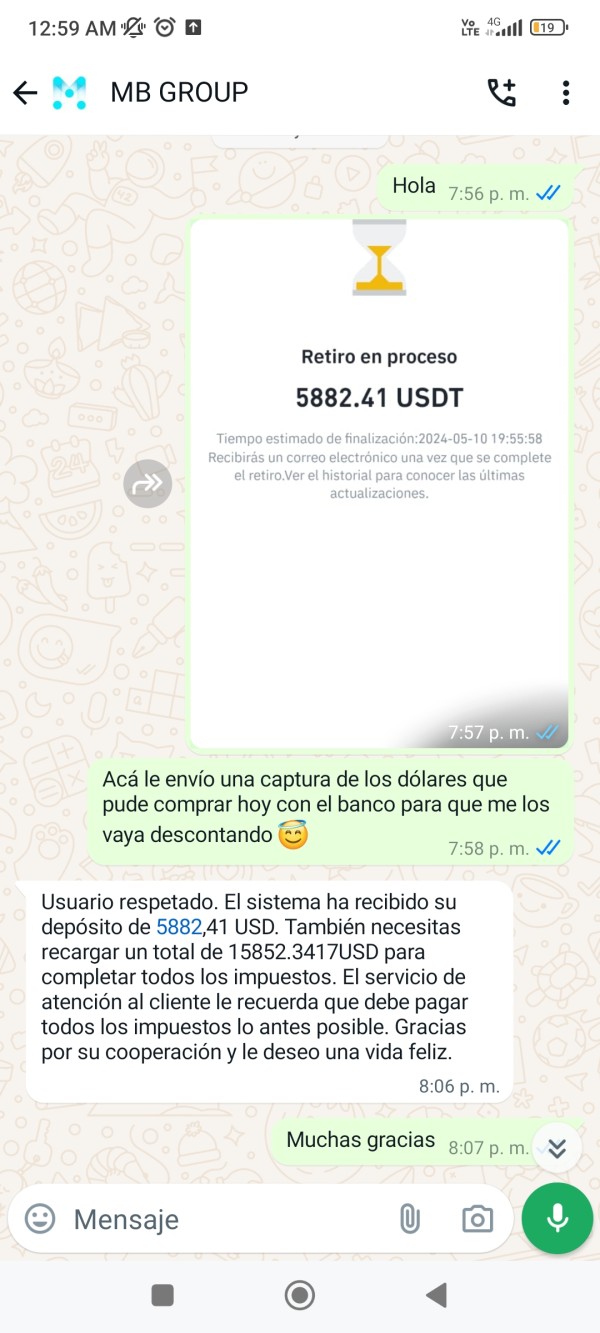

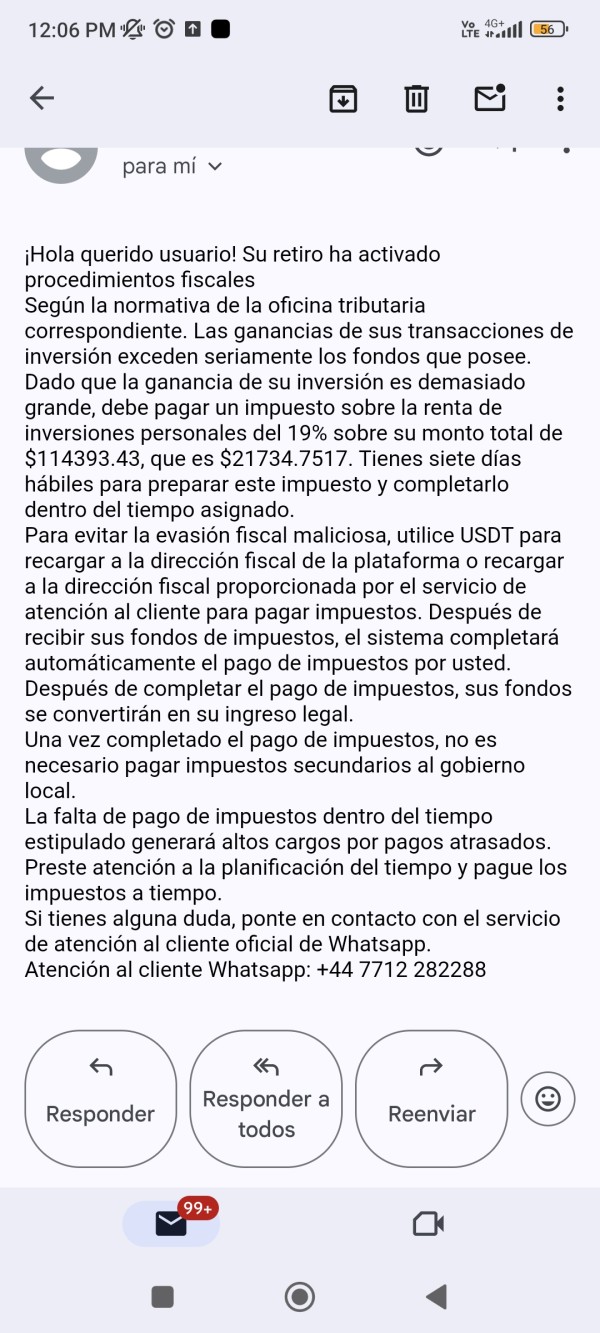

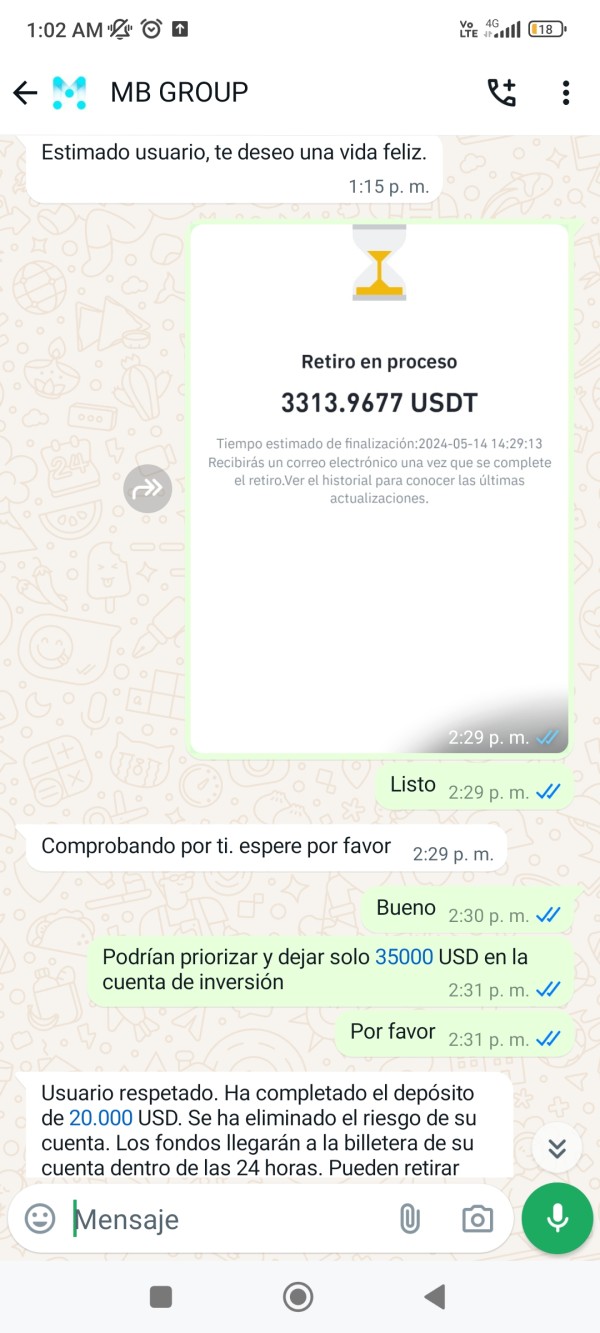

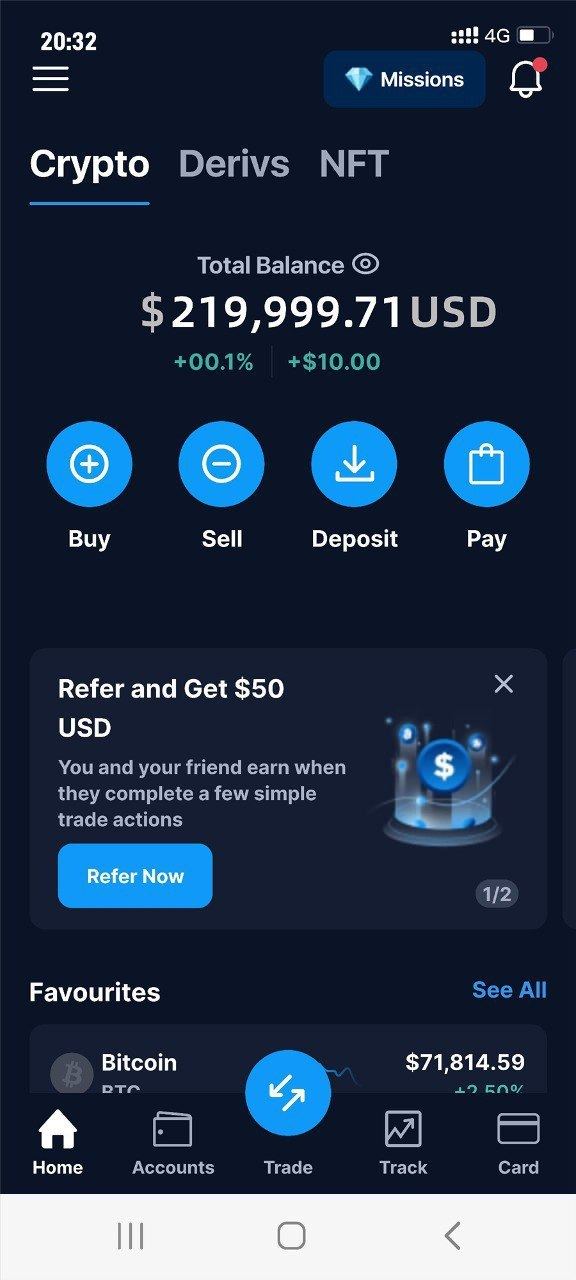

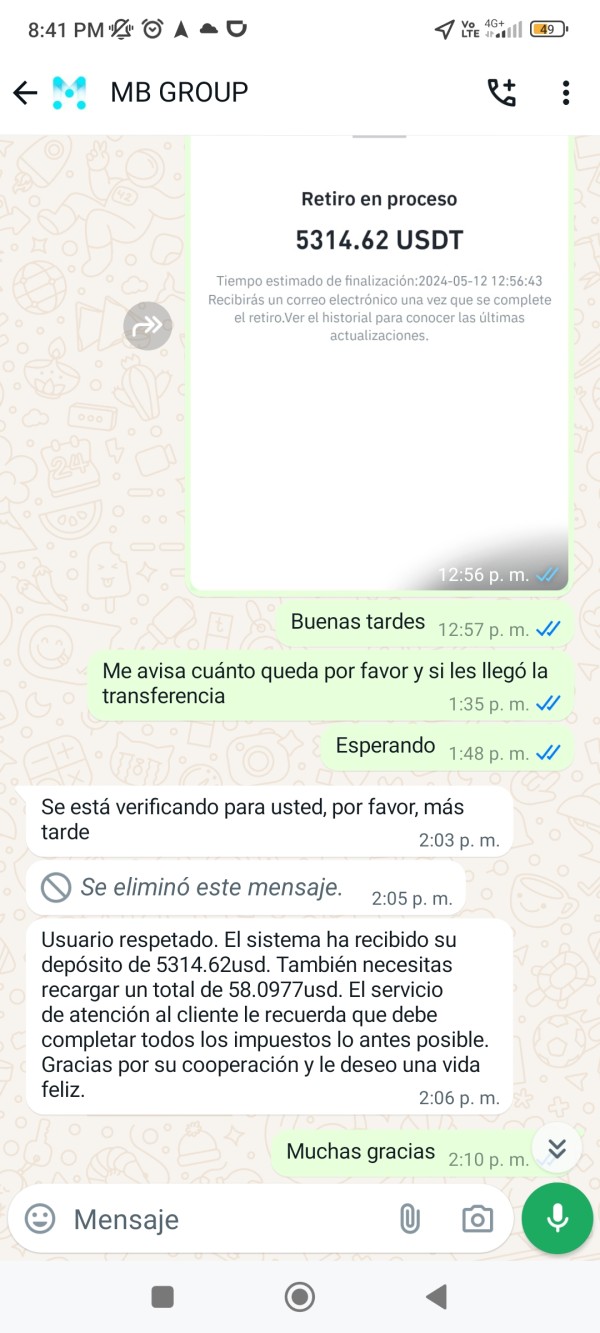

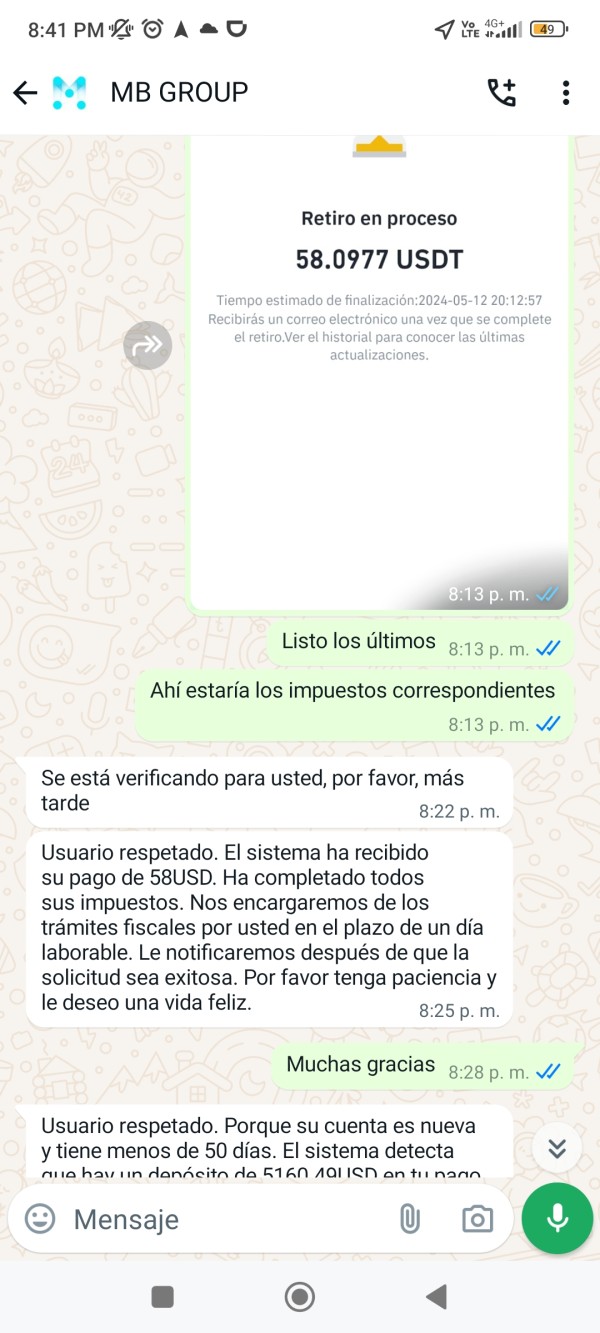

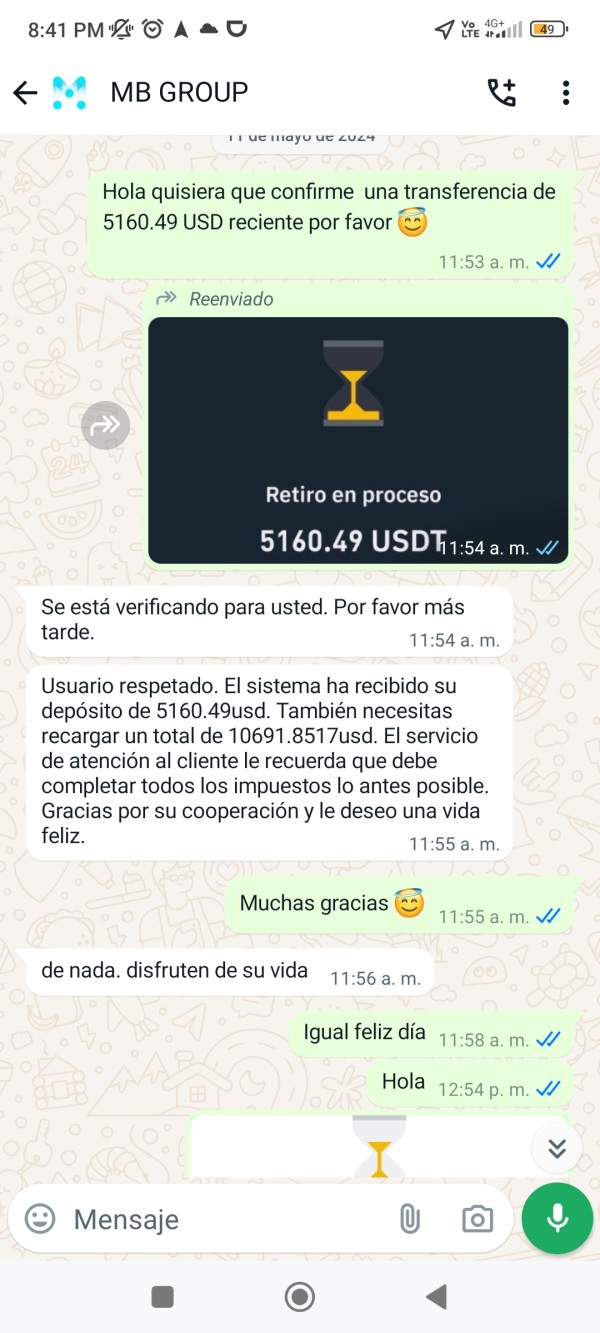

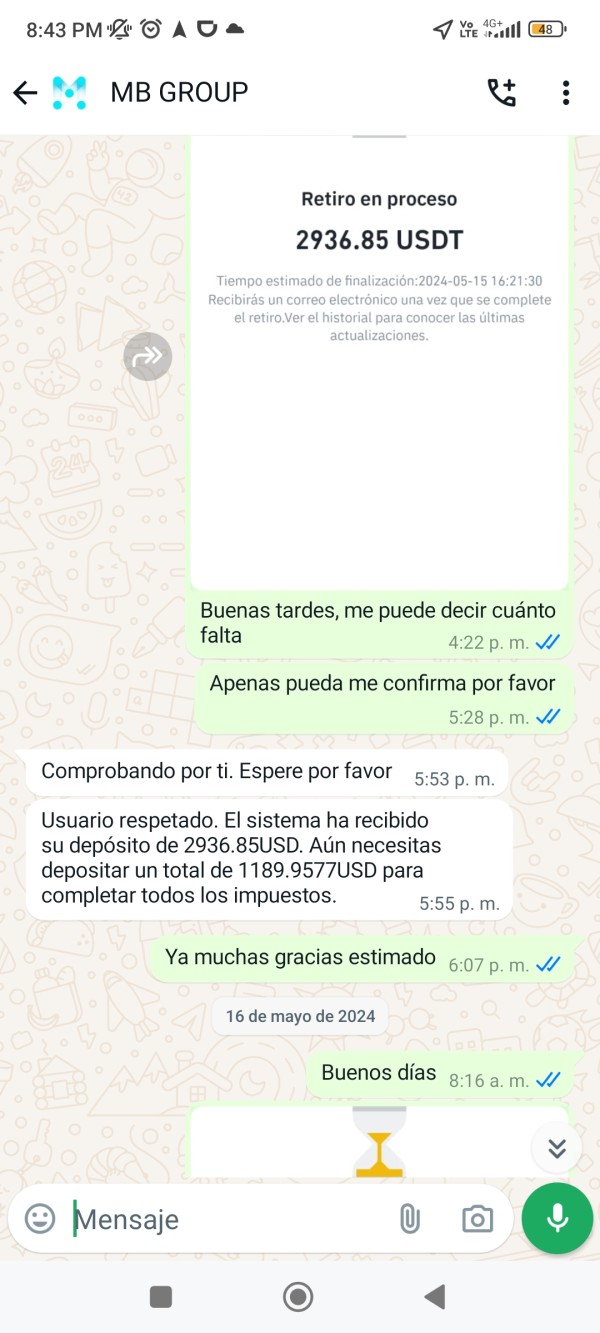

MB Group 2025 Review: Everything You Need to Know

Summary: The MB Group has garnered mixed reviews from users and experts alike, with commendations for its low spreads and fast execution times, but concerns regarding customer service and limited deposit options. Overall, it presents itself as a competitive option in the forex market, particularly for those seeking low-cost trading solutions.

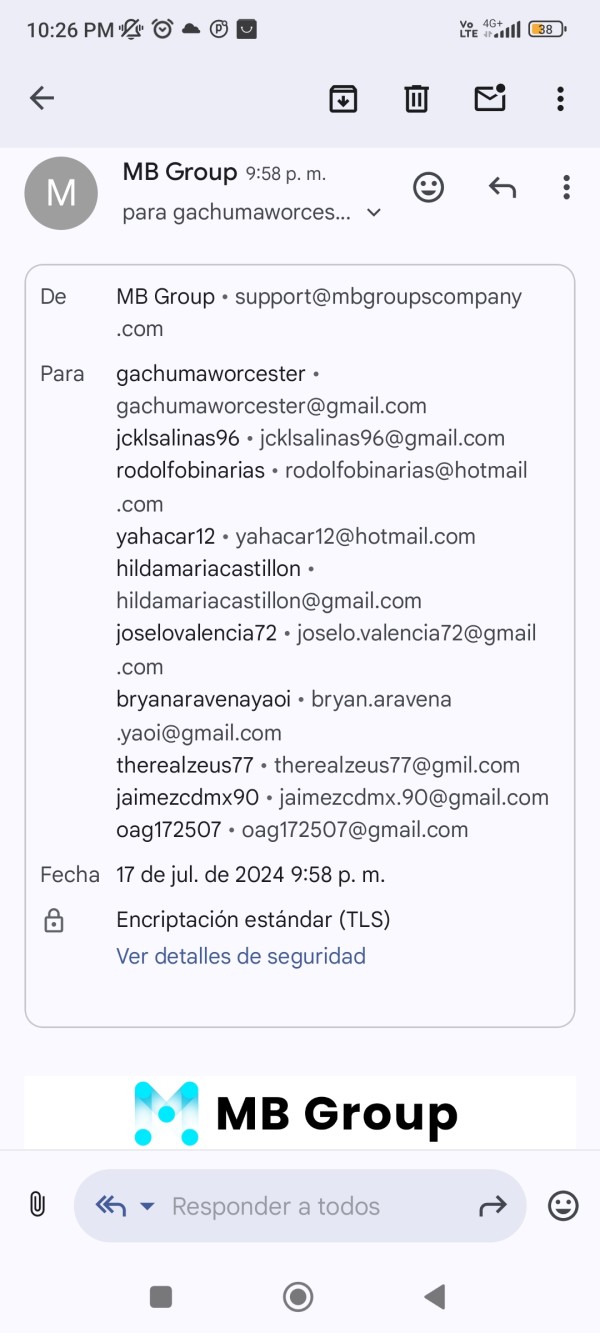

Note: It's important to recognize that MB Group operates under different entities in various regions, which can influence the trading experience and regulatory oversight. This review aims for fairness and accuracy by synthesizing diverse sources.

Rating Overview

How We Rated the Broker: Ratings are derived from user experiences, expert opinions, and factual data collected from multiple sources.

Broker Overview

Founded in 1999, MB Group is based in El Segundo, California, and is recognized as a reliable broker in the forex market. It specializes in electronic communications network (ECN) trading, providing access to a variety of asset classes including forex, commodities, stocks, and futures. The platform supports popular trading software such as MetaTrader 4 (MT4) and NinjaTrader, catering to both novice and experienced traders. Its operations are regulated by notable authorities, including the CFTC, FINRA, and SIPC, which enhances its credibility in the industry.

Detailed Section

Regulated Geographic Areas

MB Group primarily operates in the United States, with regulatory oversight from the CFTC, FINRA, and SIPC. However, users should be aware that the regulations may differ based on the specific entity they are trading under, which can affect the overall trading experience.

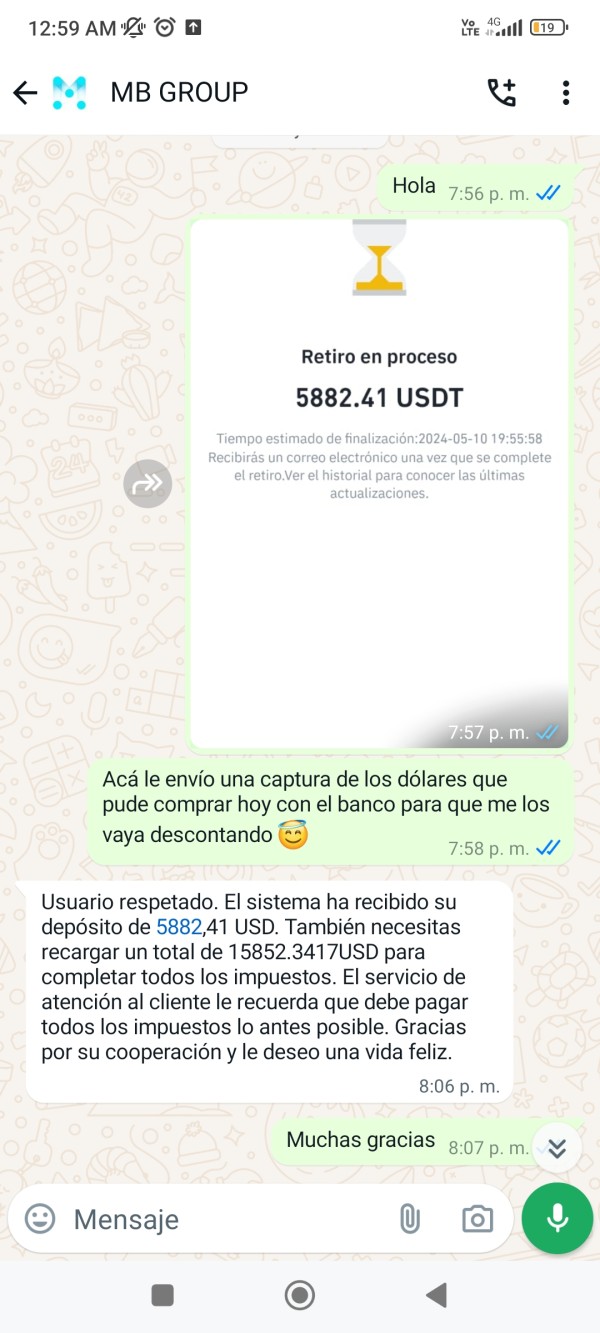

Deposit/Withdrawal Currencies

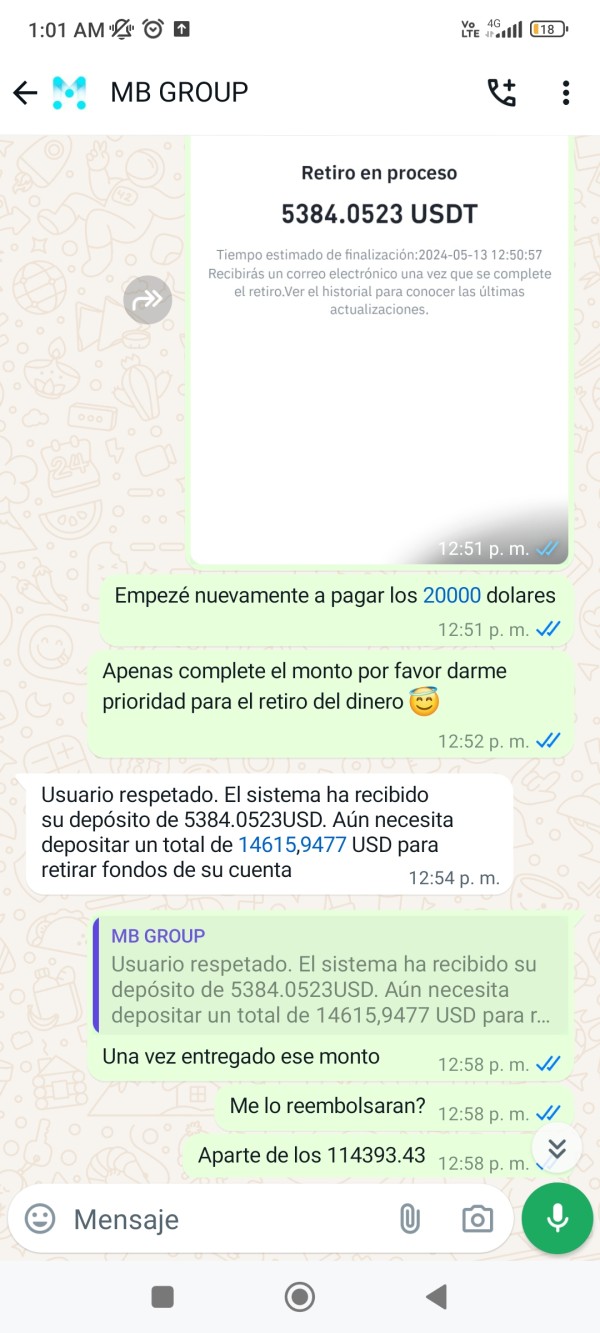

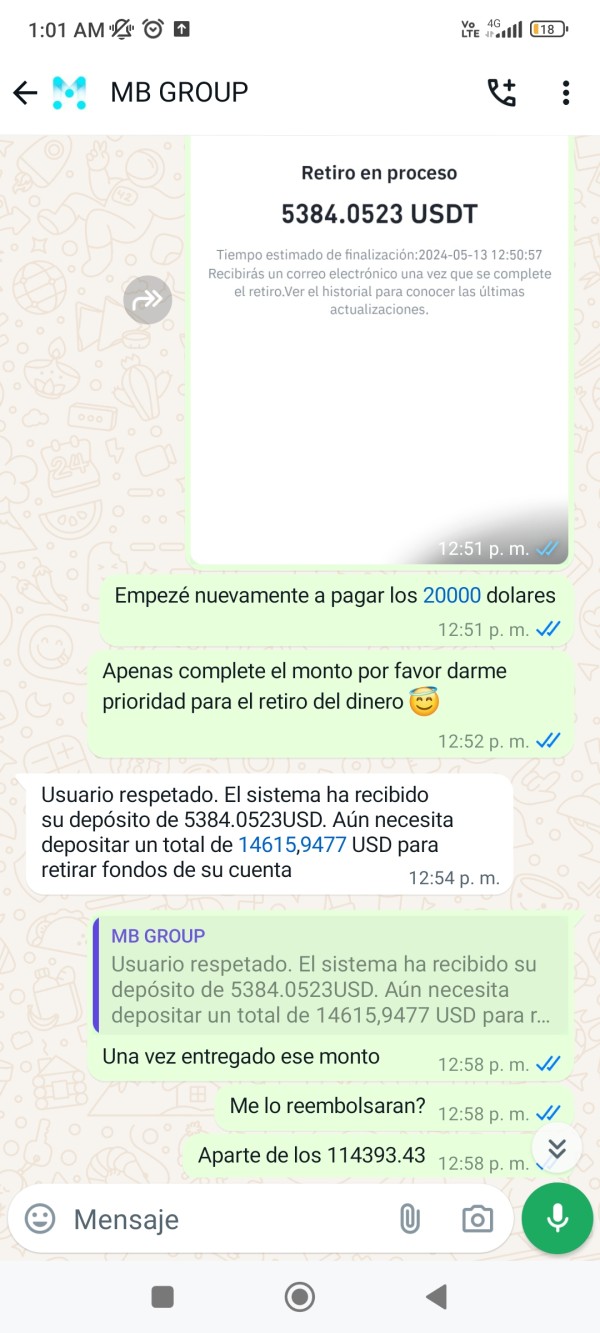

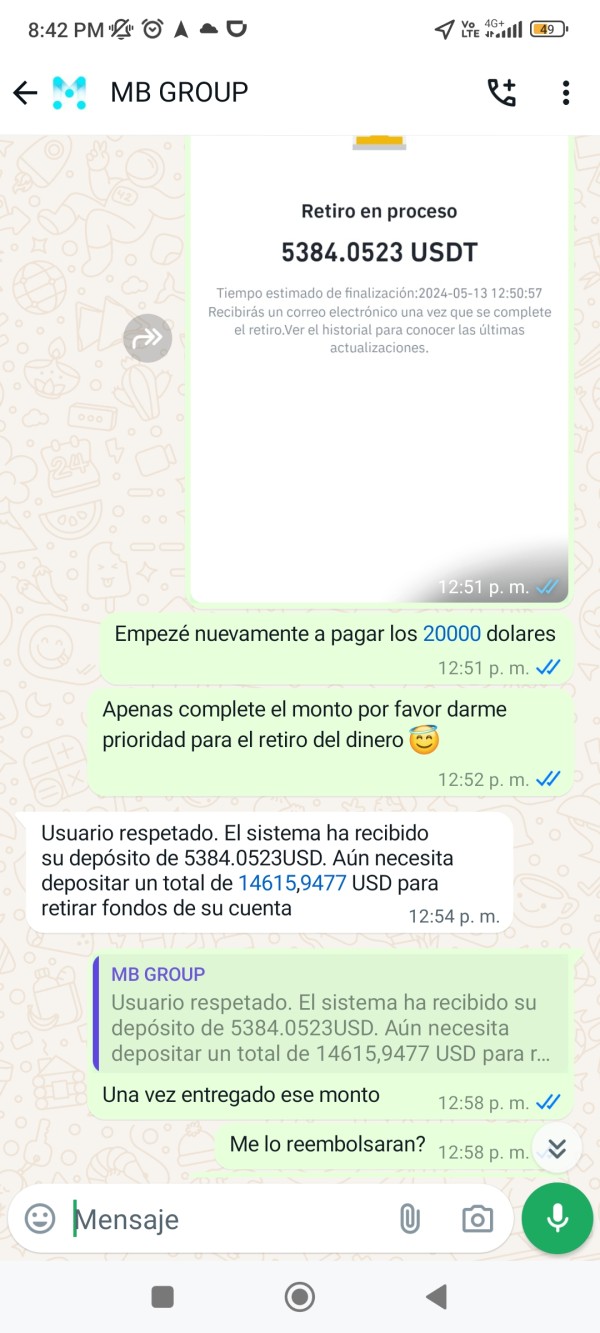

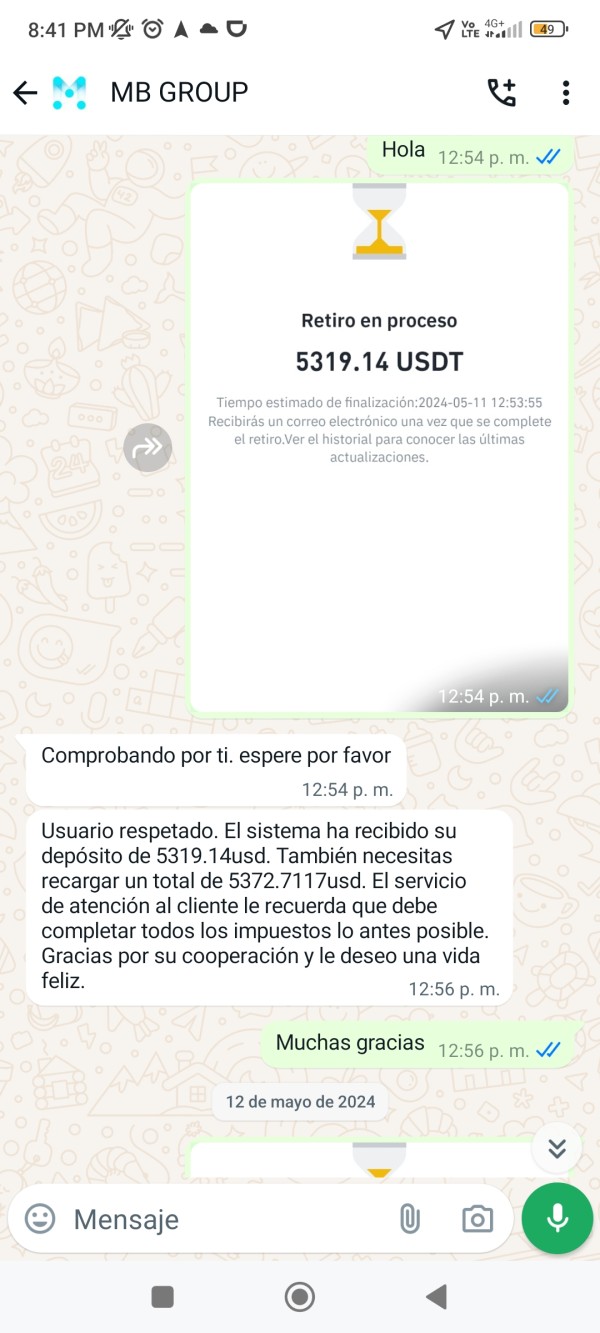

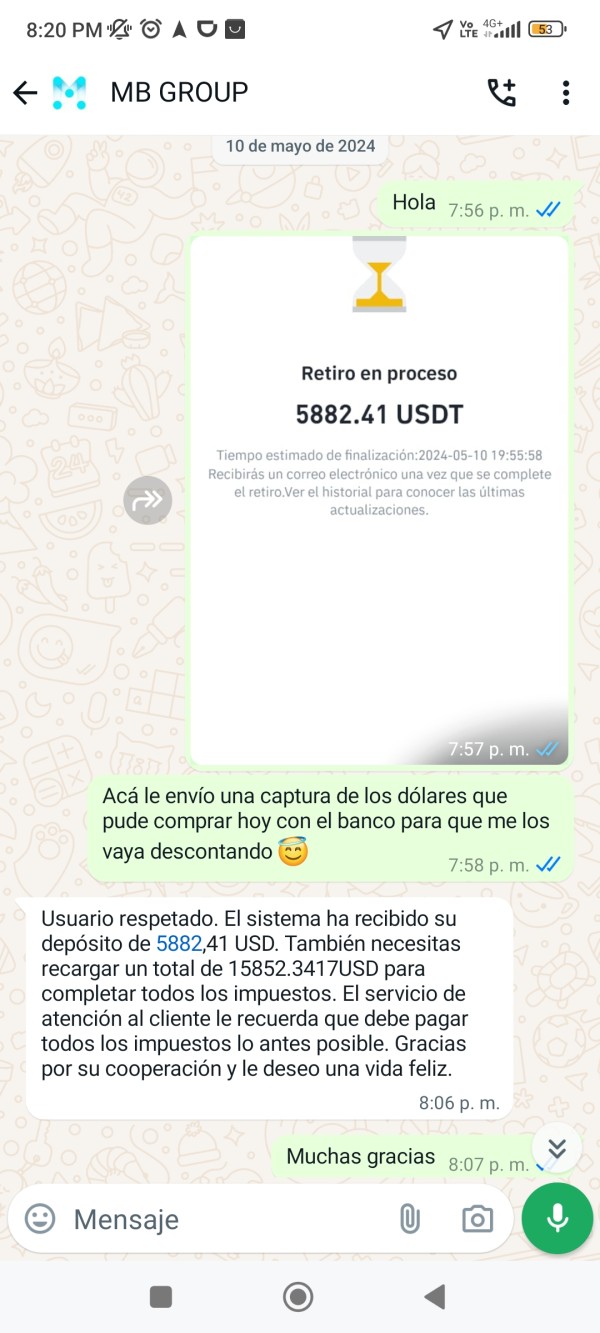

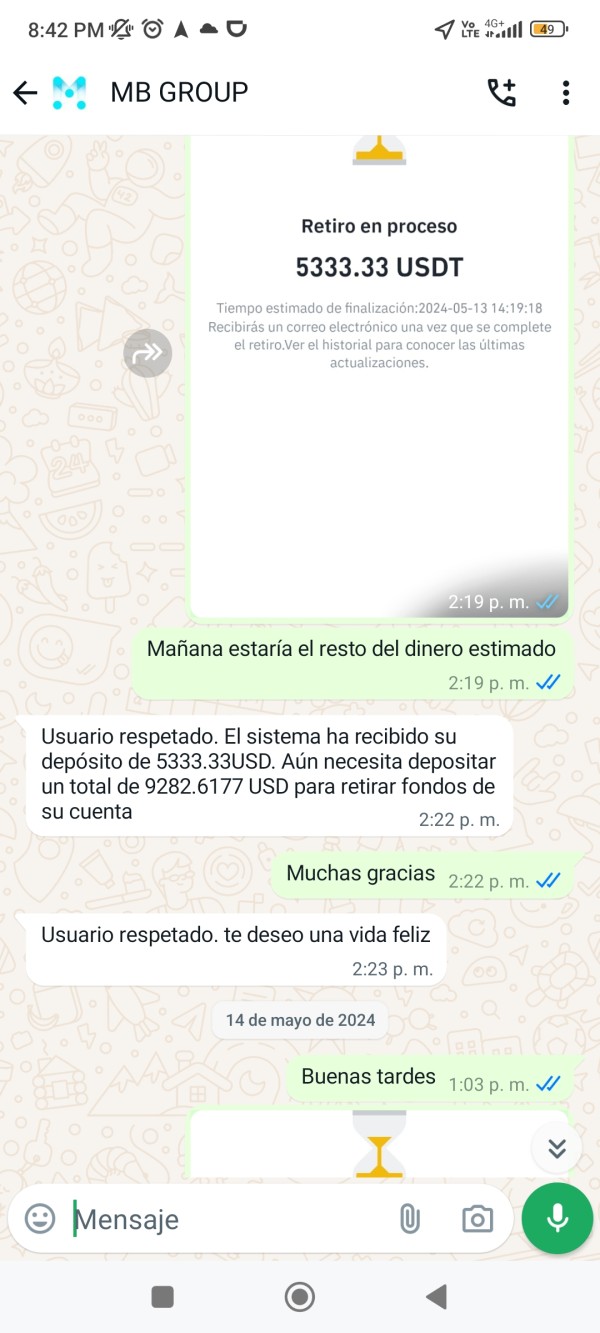

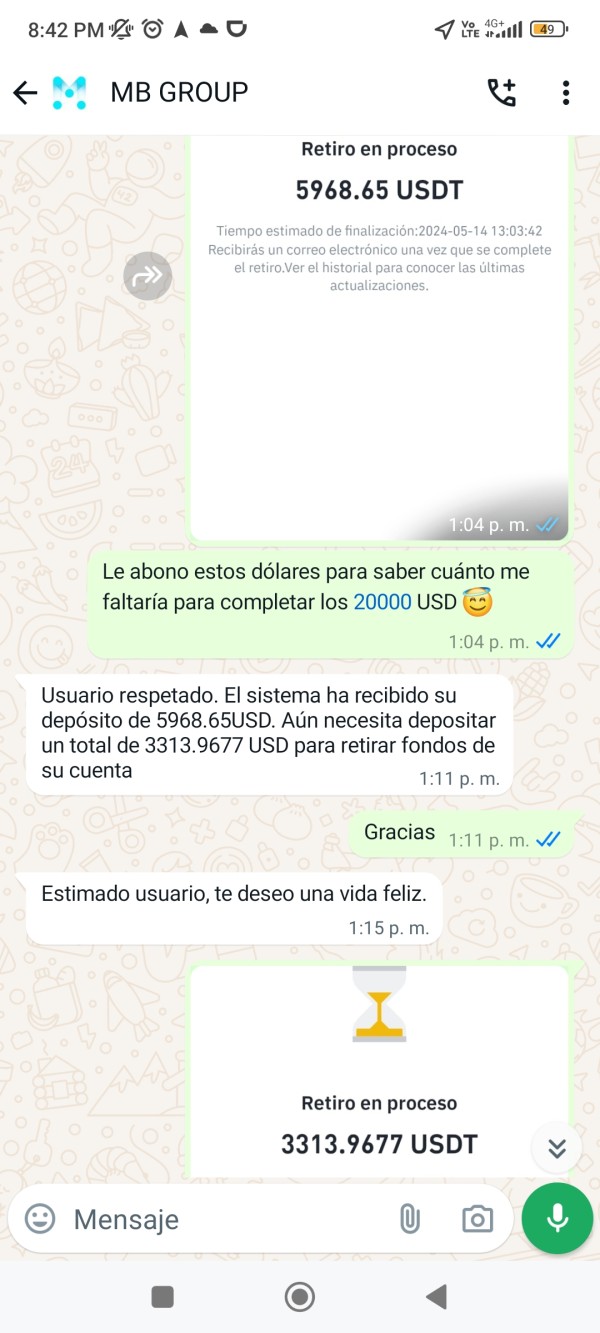

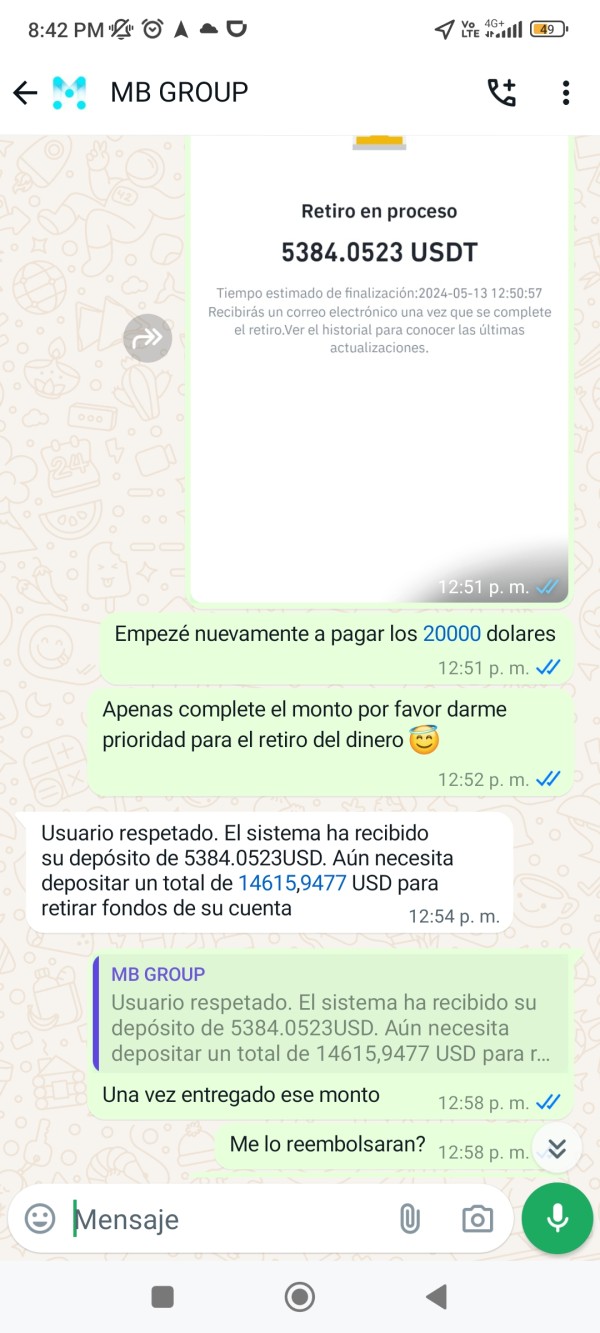

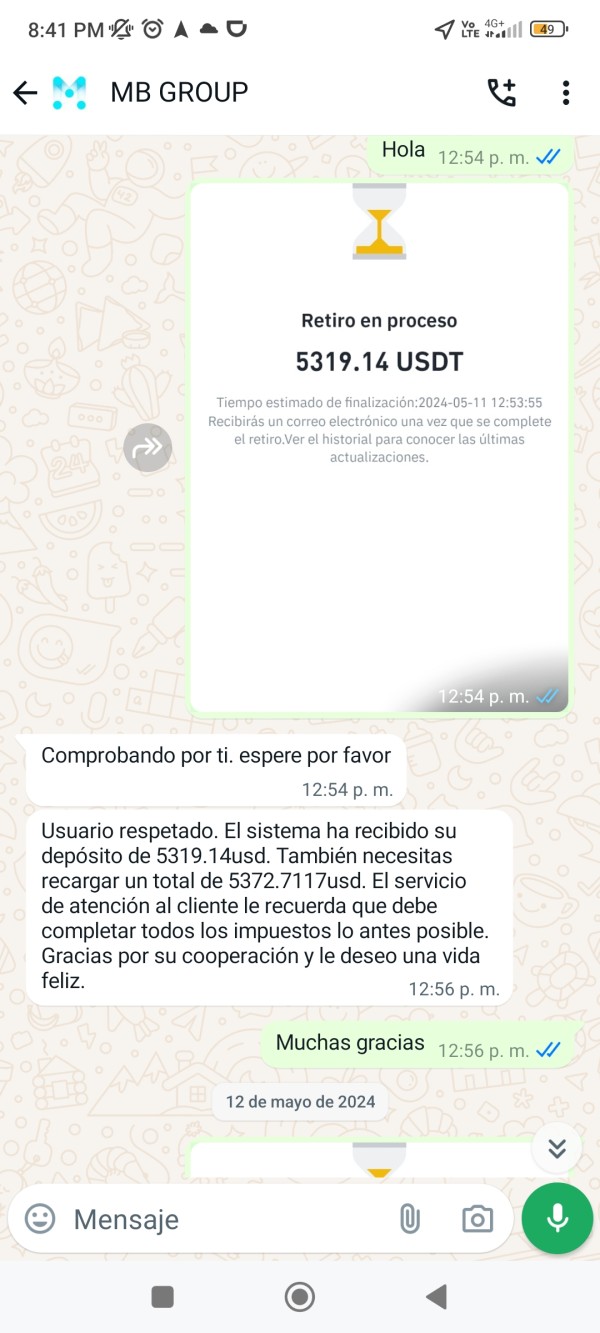

Deposits can be made in USD and through various methods, including ACH transfers, wire transfers, and checks. However, credit or debit card payments are not accepted, which may limit options for some traders. Withdrawals are processed via similar methods, ensuring a degree of consistency in transaction processes.

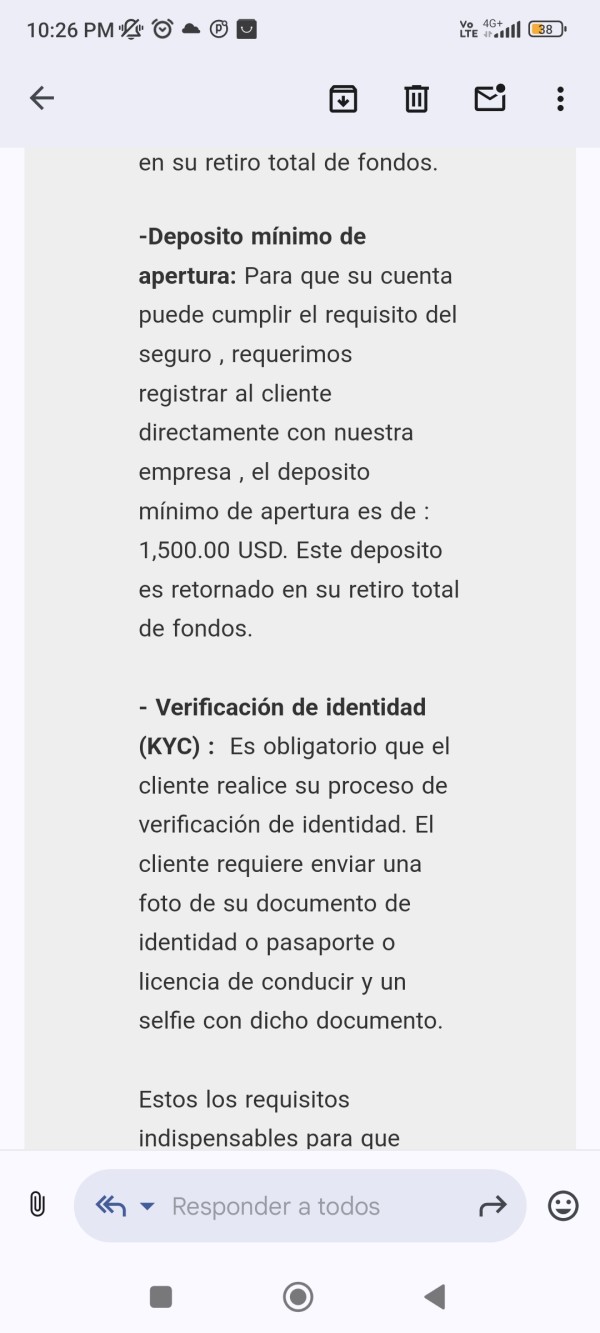

Minimum Deposit

The minimum deposit requirement is set at $200, making it accessible for new traders looking to enter the forex market without a substantial initial investment.

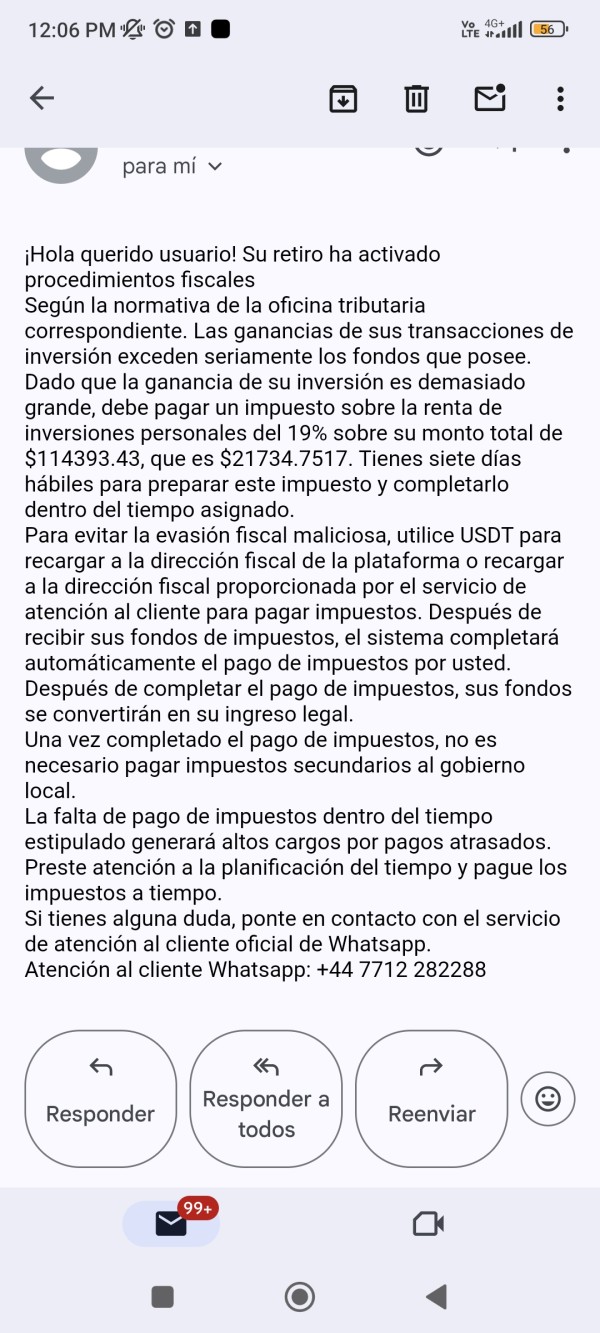

Currently, MB Group does not offer any sign-up bonuses or promotional incentives, which is a notable difference compared to many other brokers in the industry. However, they do provide commission-free trading on certain stocks and options as part of their promotional strategy.

Tradable Asset Classes

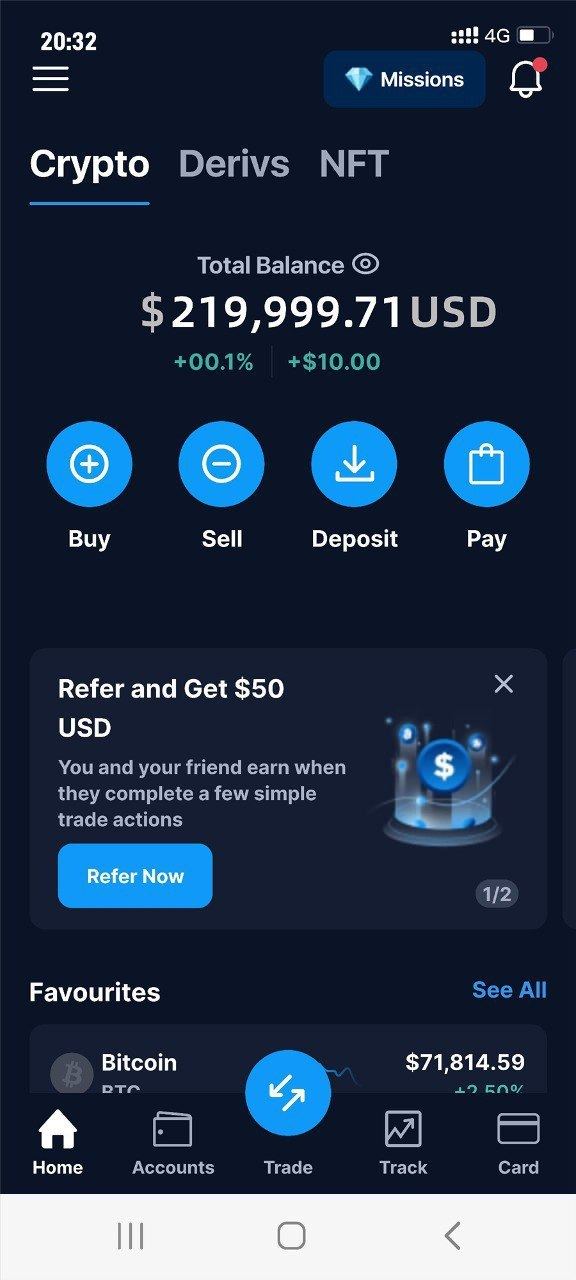

MB Group offers a diverse range of tradable instruments, including forex pairs, commodities, stocks, ETFs, and binary options. This variety allows traders to build a comprehensive portfolio tailored to their investment strategies.

Costs (Spreads, Fees, Commissions)

MB Group is known for its competitive pricing structure, with fixed spreads ranging from 1 to 3 pips on major currency pairs. The costs associated with trading can vary based on the trading volume and account type, which may benefit active traders through lower fees.

Leverage

The maximum leverage offered by MB Group is 1:100, which is relatively standard in the industry. This allows traders to amplify their market exposure, but it also increases the potential for losses.

Traders can utilize a range of platforms, including MetaTrader 4 and NinjaTrader, which offer robust tools for analysis and automated trading. These platforms are widely recognized for their user-friendly interfaces and comprehensive features.

Restricted Areas

While MB Group accepts U.S. traders, it is essential to note that certain geographical restrictions may apply based on the entity under which a trader operates. Therefore, potential users should verify their eligibility before opening an account.

Available Customer Support Languages

Customer support is available in multiple languages, including English, Chinese, and Spanish. However, user reviews indicate that the quality of customer service can be inconsistent, with some traders reporting delays in response times.

Repeated Rating Overview

Detailed Breakdown

-

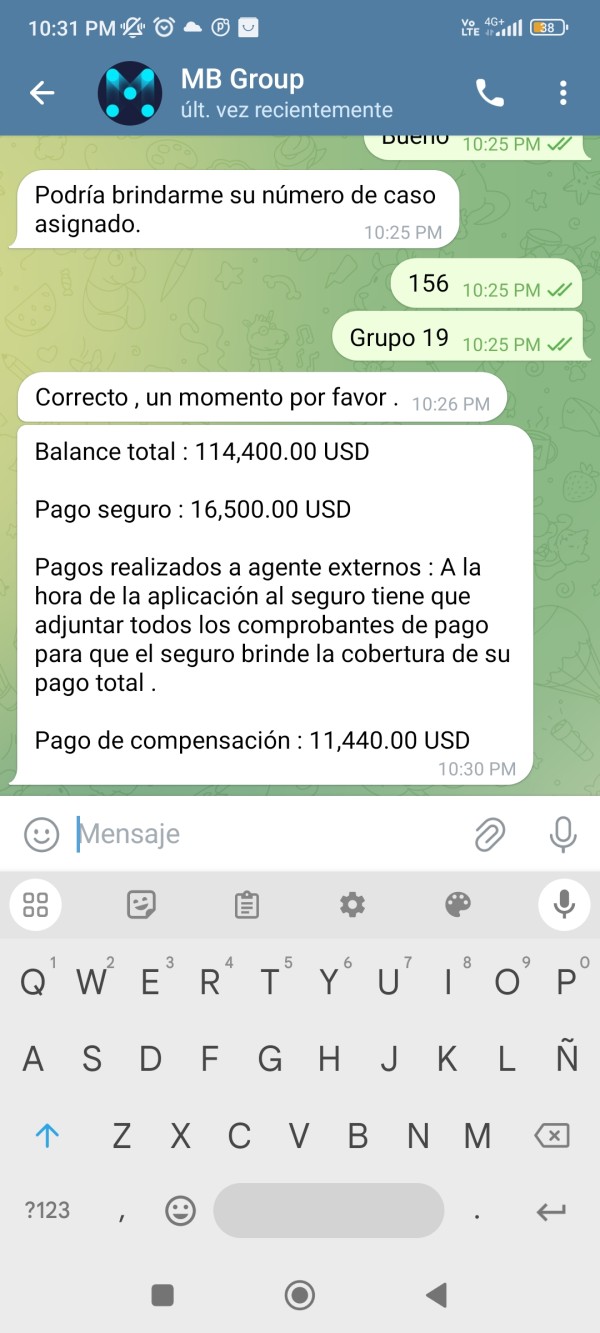

Account Conditions (7/10): The minimum deposit is low, making it accessible for new traders. However, the lack of multiple account types may limit options for experienced traders seeking tailored solutions.

Tools and Resources (6/10): While MB Group provides access to popular trading platforms like MT4, the educational resources and research tools are somewhat limited compared to competitors.

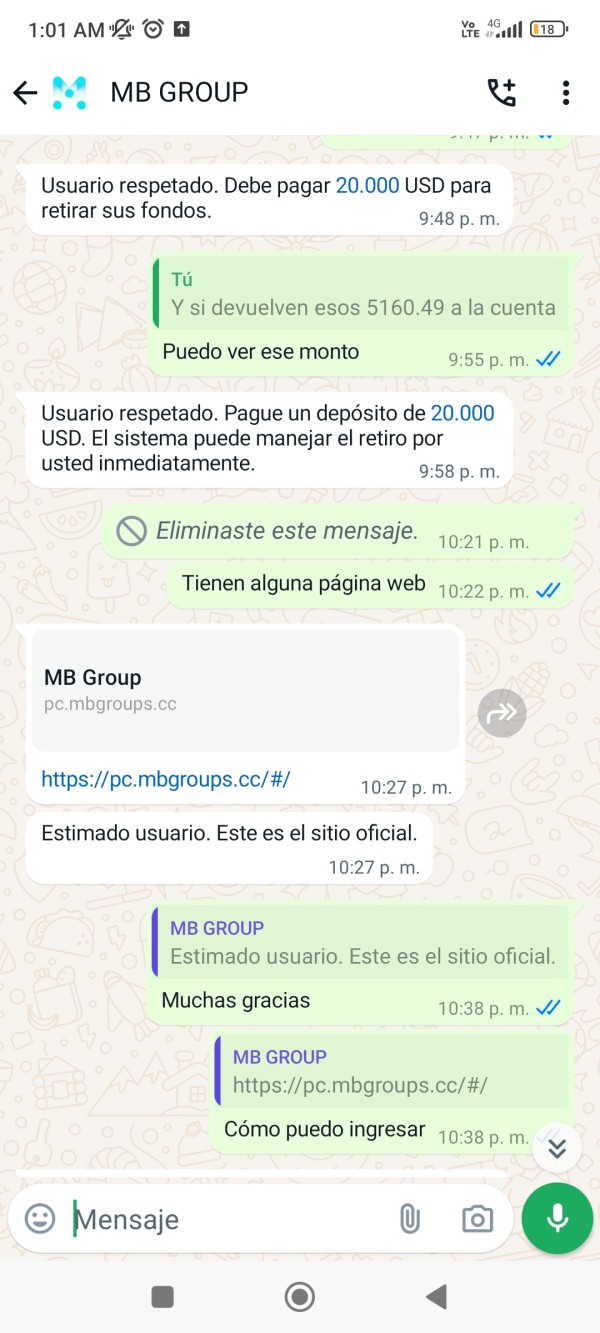

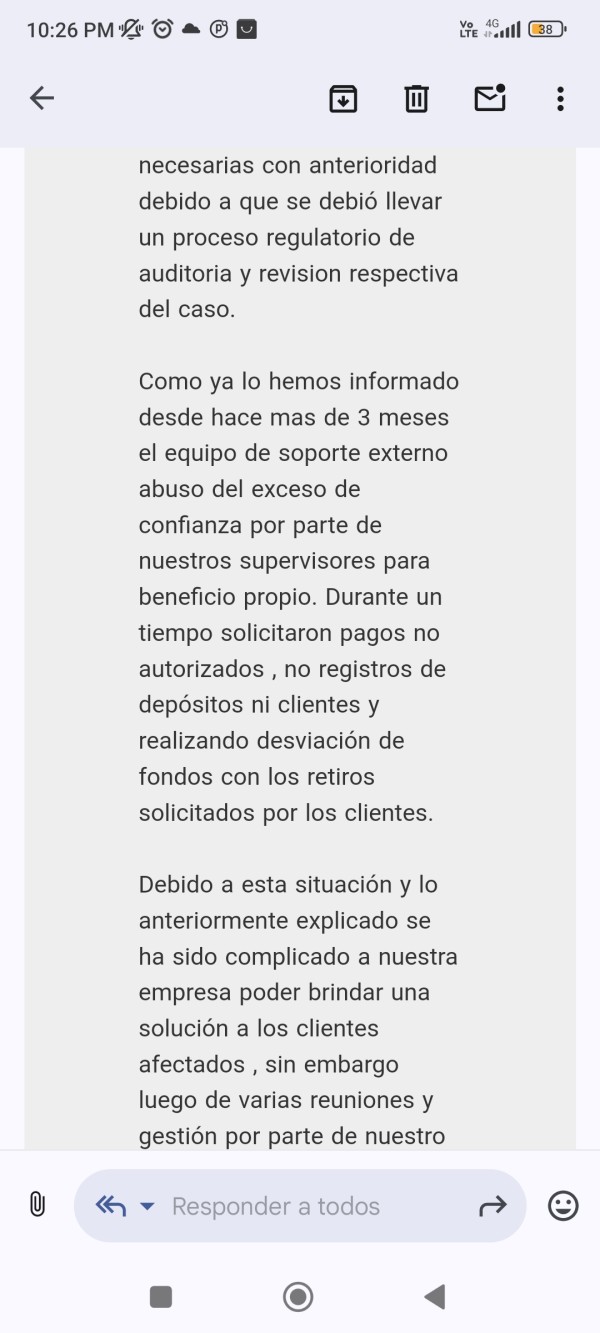

Customer Service and Support (5/10): Users have reported mixed experiences with customer service, with some praising responsiveness while others highlight delays and unhelpful interactions.

Trading Setup (7/10): The trading experience is generally smooth, with fast execution times reported. However, the platform's interface could be improved for better usability.

Trustworthiness (6/10): MB Group is regulated by reputable authorities, which adds a layer of security for traders. However, the absence of promotional bonuses may deter some potential users.

User Experience (5/10): Overall user experience is average, with some traders reporting issues with platform stability and customer support, while others appreciate the low-cost trading options.

In conclusion, the MB Group presents a viable option for traders looking for low-cost trading solutions in the forex market. However, potential users should weigh the pros and cons based on their individual trading needs and preferences.