Is Lockwood safe?

Pros

Cons

Is Lockwood Safe or Scam?

Introduction

Lockwood Investments has emerged as a player in the Forex market, positioning itself as a broker that offers a wide array of trading instruments, including forex pairs and CFDs. However, with the increasing number of online trading platforms, traders must exercise caution and conduct thorough evaluations before committing their funds. The potential for scams in the forex trading space is significant, and many traders have fallen victim to unregulated brokers that promise high returns but deliver little to no actual trading success. This article aims to analyze whether Lockwood Investments is a safe trading option or if it raises red flags that could indicate a scam. Our investigation is based on a comprehensive review of regulatory status, company background, trading conditions, customer feedback, and risk assessments.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its legitimacy and safety. Lockwood Investments operates under an offshore license, specifically registered in the Marshall Islands. This raises concerns, as the Marshall Islands is known for its lenient regulatory environment, which often leads to a lack of investor protection. Below is a table summarizing key regulatory information:

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | Marshall Islands | Unregulated |

The absence of a reputable regulatory body overseeing Lockwood Investments is alarming. Brokers regulated by authorities such as the FCA in the UK or ASIC in Australia are generally considered safer options due to their stringent compliance requirements. Lockwood's lack of regulation means that traders have limited recourse in the event of disputes or issues with fund withdrawals, making it essential to question is Lockwood safe for trading.

Company Background Investigation

Lockwood Investments has a somewhat murky history, with ownership changes that have raised eyebrows. Initially owned by Solutions CM Ltd, which is associated with several other unregulated brokers, Lockwood Investments has been linked to a network of questionable trading platforms. The management team behind Lockwood has not been thoroughly disclosed, further contributing to concerns about transparency and accountability. The company's history of ownership changes and its connection to other unregulated entities suggest a lack of stability and reliability in its operations.

Moreover, the company's website lacks comprehensive information about its operations, which raises questions about its transparency. A broker that is open about its operations and ownership is typically viewed more favorably in the trading community. Therefore, potential investors should be wary of Lockwood Investments and consider the implications of its ambiguous background when assessing whether is Lockwood safe for their trading needs.

Trading Conditions Analysis

Lockwood Investments offers a variety of account types with different minimum deposit requirements, ranging from $500 for a micro account to $50,000 for a diamond account. The broker claims to provide competitive spreads and leverage of up to 200:1. However, the actual trading conditions may not align with industry standards. Below is a comparison of core trading costs:

| Fee Type | Lockwood Investments | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 70 pips (EUR/USD) | 1.5 pips |

| Commission Model | None specified | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The significant disparity in spreads indicates that Lockwood may not offer competitive trading conditions, which can erode traders' profits over time. Additionally, the broker's lack of transparency regarding commission structures and overnight interest rates raises further concerns. Traders should carefully consider these factors when evaluating whether is Lockwood safe for their trading activities.

Customer Funds Security

The safety of customer funds is a paramount concern when assessing any broker. Lockwood Investments does not appear to have robust measures in place for fund security. The lack of segregation of client funds, investor protection schemes, and negative balance protection policies could expose traders to significant risks. In the event of financial difficulties or insolvency, traders may find it challenging to recover their funds.

Moreover, historical complaints regarding fund withdrawals and issues with account management further highlight potential risks associated with Lockwood Investments. Traders should always prioritize brokers that demonstrate a commitment to fund security and transparency. Given the current information, it is reasonable to question is Lockwood safe for managing your trading capital.

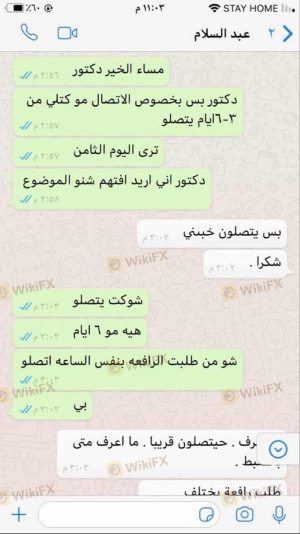

Customer Experience and Complaints

Customer feedback is an invaluable source of information when evaluating a broker's reliability. Reviews of Lockwood Investments reveal a concerning pattern of complaints, primarily regarding withdrawal issues, account management, and overall customer service. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor response |

| Account Management Problems | Medium | Slow response |

| Customer Service Complaints | High | Unresponsive |

Many users have reported difficulties in withdrawing their funds, with some claiming that their accounts were frozen without explanation. This lack of responsiveness and the severity of complaints suggest that Lockwood Investments may not prioritize customer satisfaction or support. As a result, traders should be cautious and consider whether is Lockwood safe based on the experiences of others.

Platform and Trade Execution

The trading platform provided by Lockwood Investments is reportedly unstable, with issues related to order execution quality, slippage, and an overall poor user experience. Traders have expressed dissatisfaction with the platform's performance, citing instances of delayed orders and technical glitches that hinder trading activities. These issues raise concerns about the broker's ability to provide a reliable trading environment.

Moreover, any signs of platform manipulation or unfair trading practices can significantly impact traders' outcomes. A broker that fails to deliver a stable and efficient trading platform cannot be considered safe. Therefore, it is crucial to assess whether is Lockwood safe based on the platform's performance and reliability.

Risk Assessment

Engaging with Lockwood Investments carries several risks that potential traders should be aware of. Below is a concise risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk of fraud. |

| Fund Security Risk | High | Lack of segregation and protection policies. |

| Customer Service Risk | Medium | Poor response to complaints and issues. |

| Platform Performance Risk | High | Unstable trading platform may lead to losses. |

To mitigate these risks, traders should consider diversifying their investments and exploring more reputable brokers with robust regulatory oversight and proven track records. Evaluating whether is Lockwood safe should include a thorough analysis of these risk factors.

Conclusion and Recommendations

In light of the evidence presented, it is clear that Lockwood Investments raises several red flags that warrant caution. The lack of regulation, questionable ownership history, poor customer feedback, and significant trading risks suggest that potential investors should think twice before engaging with this broker. While Lockwood may offer a range of trading instruments, the potential for loss and issues with fund withdrawals make it a risky option.

For traders seeking safer alternatives, it is advisable to consider brokers that are well-regulated and have a proven track record of customer satisfaction, such as those regulated by the FCA or ASIC. Ultimately, the question of is Lockwood safe can be answered with a resounding no, and traders should prioritize their safety and security by choosing more reputable trading platforms.

Is Lockwood a scam, or is it legit?

The latest exposure and evaluation content of Lockwood brokers.

Lockwood Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Lockwood latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.