Is VISN safe?

Pros

Cons

Is VISN Safe or a Scam?

Introduction

VISN, a forex broker operating under the name VISN Markets, has attracted attention in the trading community for its offerings in the foreign exchange market. With the proliferation of online trading platforms, it is crucial for traders to carefully evaluate the trustworthiness of brokers before committing their funds. The forex market is rife with both legitimate opportunities and potential scams, making it essential for traders to conduct thorough research. This article aims to provide an objective assessment of whether VISN is a safe trading platform or a potential scam. The evaluation is based on various factors, including regulatory status, company background, trading conditions, customer feedback, and risk assessment.

Regulation and Legitimacy

One of the most critical aspects of evaluating any forex broker is its regulatory status. Regulatory bodies ensure that brokers adhere to certain standards, providing a level of protection for traders. Unfortunately, our investigation revealed that VISN operates without a valid regulatory license. This lack of oversight raises significant concerns regarding the safety of traders' funds and the overall legitimacy of the broker.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of regulation means that VISN is not subject to the stringent requirements imposed by recognized financial authorities. This lack of oversight can lead to questionable practices, including the mishandling of client funds and inadequate dispute resolution mechanisms. Furthermore, without regulatory oversight, traders have limited recourse in the event of disputes or fund mismanagement. The importance of regulation cannot be overstated, as it serves as a safeguard against potential fraud and malpractice.

Company Background Investigation

To fully understand the risks associated with trading on the VISN platform, it is essential to investigate the company's background. VISN Markets, registered as VISN Markets (SV) Ltd, claims to be based in Saint Vincent and the Grenadines. However, the details surrounding its ownership structure and operational history remain vague. The lack of transparency regarding the company's origins and management raises red flags for potential clients.

The management team behind VISN has not been extensively documented, and there is limited information available regarding their professional backgrounds and qualifications. This opacity can be indicative of a lack of accountability, which is concerning for potential traders. A reputable broker typically provides comprehensive information about its team, including their credentials and experience in the financial sector. In contrast, VISN's limited disclosure does not inspire confidence in its operations.

Trading Conditions Analysis

An essential factor for traders to consider is the trading conditions offered by a broker, including fees and spreads. VISN's fee structure has been described as opaque, with several complaints from users regarding unexpected charges and withdrawal issues. This lack of clarity can lead to frustration and financial losses for traders.

| Fee Type | VISN | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | Unknown | $0 - $10 per trade |

| Overnight Interest Range | High | Low to Moderate |

The absence of a clear commission model and the high overnight interest rates reported by users could indicate a less favorable trading environment compared to industry standards. Traders should be wary of brokers that do not transparently disclose their fee structures, as hidden costs can significantly impact overall profitability.

Client Fund Safety

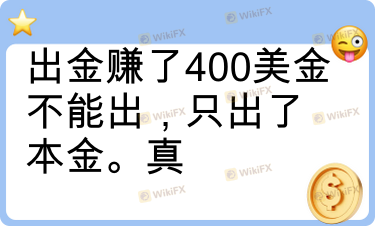

Client fund safety is paramount when assessing a broker's reliability. Unfortunately, VISN has received multiple complaints regarding fund withdrawals, with users reporting difficulties in accessing their profits. Such issues are a significant concern, suggesting that VISN may not have adequate measures in place to protect client funds.

The lack of information regarding fund segregation and investor protection mechanisms further exacerbates these concerns. Reputable brokers typically implement strict policies to ensure that client funds are kept separate from their operational funds, providing an additional layer of security. In contrast, VISN's failure to provide such assurances raises questions about the safety of traders' investments.

Customer Experience and Complaints

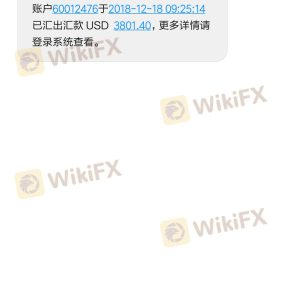

Analyzing customer feedback is crucial in determining the reliability of any broker. A review of user experiences with VISN reveals a pattern of dissatisfaction, particularly concerning withdrawal issues and customer service responsiveness. Many users have reported being unable to withdraw their funds, with some claiming that their requests for withdrawals were met with delays or outright denials.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Lack of Transparency | High | Minimal |

The severity of complaints related to withdrawal issues cannot be overlooked. When traders are unable to access their funds, it raises serious concerns about the broker's integrity and operational practices. Furthermore, the company's inadequate response to customer inquiries exacerbates the situation, leaving users feeling frustrated and helpless.

Platform and Trade Execution

The trading platform's performance and execution quality are critical factors for successful trading. VISN claims to offer a user-friendly trading experience; however, user reviews suggest that the platform may not be as reliable as advertised. Reports of slippage and order rejections have emerged, indicating that traders may not receive the best execution on their trades.

Traders should be cautious of platforms that exhibit signs of manipulation or poor execution practices. A reliable broker should provide a stable trading environment with minimal slippage and a high fill rate. The issues reported by VISN users raise concerns about the platform's reliability and its ability to facilitate smooth trading experiences.

Risk Assessment

Using VISN as a trading platform entails several risks that potential traders should be aware of. The lack of regulation, withdrawal issues, and negative customer feedback contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No valid regulation |

| Fund Security | High | Withdrawal issues reported |

| Customer Support | Medium | Poor response quality |

Given the high-risk levels associated with VISN, traders should exercise extreme caution. It is advisable to explore alternative brokers with established regulatory oversight and positive customer feedback to mitigate potential risks.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about the safety and legitimacy of VISN as a forex broker. The absence of regulation, troubling customer feedback, and withdrawal issues suggest that VISN may not be a safe choice for traders.

Traders should be particularly cautious if they are considering using VISN for their trading activities. It is recommended to seek out brokers with strong regulatory oversight, transparent fee structures, and positive customer experiences. Some reputable alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC. By prioritizing safety and transparency, traders can protect their investments and enhance their trading experience.

In summary, IS VISN safe? The overwhelming evidence points to a high level of risk, and potential users are advised to proceed with caution or consider more reliable alternatives.

Is VISN a scam, or is it legit?

The latest exposure and evaluation content of VISN brokers.

VISN Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VISN latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.