Is LARIOX safe?

Business

License

Is Lariox A Scam?

Introduction

Lariox is a relatively new player in the forex trading market, claiming to offer a wide range of trading instruments, including forex, commodities, and indices. As with any broker, it is essential for traders to conduct thorough due diligence before committing their funds. The forex market is rife with both legitimate brokers and scams, making it crucial for traders to assess the credibility and safety of their chosen platforms. This article aims to evaluate whether Lariox is a scam or a safe broker by examining its regulatory status, company background, trading conditions, customer experience, and risk factors. The investigation is based on a thorough review of multiple online sources and user feedback.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. Lariox operates as an offshore broker, registered in Saint Vincent and the Grenadines, which is known for having lax regulatory standards. This lack of oversight raises significant concerns about the safety and security of traders' funds.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unregulated |

The absence of a reputable regulatory body overseeing Lariox means that traders have limited recourse in case of disputes or fraudulent activities. Established regulatory bodies like the FCA (UK), ASIC (Australia), and CySEC (Cyprus) are known for enforcing strict compliance standards, thus providing a safety net for traders. Lariox's lack of regulation places it in a precarious position, making it vulnerable to potential scams and unethical practices.

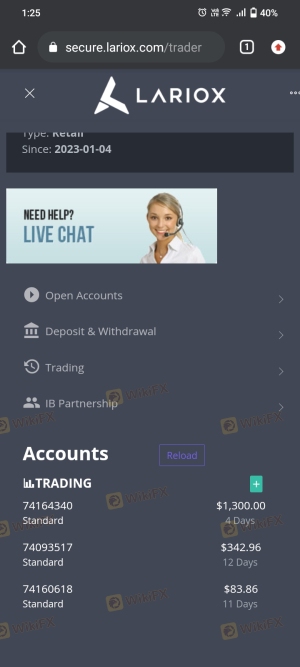

Moreover, the broker has received numerous negative reviews and complaints, further indicating that it may not be a safe trading environment. Many users have reported difficulties in withdrawing funds, which is a common red flag for unregulated brokers. Therefore, the question remains: Is Lariox safe? The evidence suggests otherwise.

Company Background Investigation

Lariox was established in 2022, making it a relatively new entrant in the forex market. The company claims to offer a variety of trading services, but information about its ownership structure and management team is sparse. The lack of transparency regarding its operational history raises concerns about its credibility.

The company operates from an address in Saint Vincent and the Grenadines, a location often associated with offshore brokers that seek to evade stringent regulatory scrutiny. Furthermore, the absence of detailed information about the management team and their professional backgrounds raises additional questions about the broker's legitimacy.

A credible broker typically provides comprehensive information about its management, including their qualifications and experience in the financial industry. Lariox's failure to disclose such information contributes to the perception that it may not be a trustworthy platform. Thus, the lack of transparency in its operations further complicates the question: Is Lariox safe? The evidence points to a broker that may not be fully above board.

Trading Conditions Analysis

When evaluating a broker's trading conditions, it is essential to consider the overall fee structure and any potentially unusual policies. Lariox offers a variety of account types with different minimum deposit requirements, which may seem attractive to new traders. However, the specifics of its fee structure raise concerns.

| Fee Type | Lariox | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by Lariox are slightly higher than the industry average, which could eat into traders' profits. Additionally, the lack of a clear commission structure may lead to hidden fees that are not disclosed upfront, a common tactic among less reputable brokers.

Moreover, the broker offers leverage of up to 1:500, which is significantly higher than what is permitted in many regulated jurisdictions. While high leverage can amplify profits, it also increases the risk of significant losses, particularly for inexperienced traders. The combination of high spreads, unclear fees, and excessive leverage raises serious questions about the safety of trading with Lariox. Therefore, one must ask again: Is Lariox safe? The trading conditions do not inspire confidence.

Customer Funds Safety

The safety of customer funds is paramount when assessing any broker. Lariox claims to implement various security measures, but the lack of regulation makes it difficult to verify these claims. The broker does not provide clear information regarding the segregation of client funds or any investor protection schemes that might be in place.

In regulated environments, brokers are often required to keep client funds in separate accounts to protect them in case of insolvency. However, Lariox's operational framework does not guarantee such protections, leaving traders vulnerable to potential financial loss.

Additionally, the absence of negative balance protection policies further exacerbates the risks associated with trading on this platform. Traders could lose more than their initial investment, which is a significant concern, especially in the volatile forex market. The lack of transparency regarding these critical aspects leads to the conclusion that Lariox may not be safe for traders looking to protect their capital.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. A review of user experiences with Lariox reveals a concerning pattern of complaints related to withdrawal issues and inadequate customer support. Many users have reported difficulties in accessing their funds, with some claiming that their withdrawal requests were ignored or delayed indefinitely.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Quality | Medium | Poor |

These complaints highlight a significant gap in the company's customer service, which is often a vital component of a trustworthy trading experience. The lack of responsive support can exacerbate traders' frustrations, especially when they encounter issues that require immediate attention.

In some cases, users have reported being pressured to increase their deposits or continue trading despite their concerns, which raises ethical questions about the broker's practices. Given the severity of these complaints, it is reasonable to conclude that Lariox may not be safe for traders who value responsive and effective customer service.

Platform and Trade Execution

The trading platform's performance is crucial for a seamless trading experience. Lariox claims to offer the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading tools. However, users have reported issues with platform stability, including frequent disconnections and slow execution speeds.

Furthermore, there have been allegations of slippage and order rejections, which can severely impact trading outcomes. Traders expect their orders to be executed at the specified prices, but if a broker manipulates these conditions, it can lead to significant financial losses. This raises the question of whether Lariox is safe from potential platform manipulation.

Risk Assessment

When considering the overall risk of trading with Lariox, several factors come into play. The combination of unregulated status, high leverage, and poor customer feedback paints a concerning picture.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated offshore broker |

| Withdrawal Risk | High | Numerous complaints about withdrawals |

| Trading Conditions Risk | Medium | High spreads and unclear fees |

To mitigate these risks, traders are advised to approach Lariox with extreme caution. It may be prudent to start with a small deposit, if at all, and to be prepared for potential challenges regarding fund withdrawals and customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that Lariox is not a safe broker for forex trading. The absence of regulation, coupled with numerous complaints regarding withdrawals and customer support, raises significant red flags. Traders should exercise caution and consider alternative brokers with a solid regulatory framework and positive user reviews.

For those seeking reliable trading platforms, consider brokers that are regulated by reputable authorities, such as the FCA, ASIC, or CySEC. These brokers typically offer better protection for customer funds and more transparent trading conditions. Always prioritize safety and due diligence when selecting a trading partner in the forex market.

Is LARIOX a scam, or is it legit?

The latest exposure and evaluation content of LARIOX brokers.

LARIOX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LARIOX latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.