Is Isports Trader safe?

Business

License

Is Isports Trader A Scam?

Introduction

Isports Trader is a relatively new player in the forex market, positioning itself as a platform for trading sports-related contracts for difference (CFDs). With the rise of online trading platforms, it has become increasingly important for traders to carefully evaluate the legitimacy and safety of their chosen broker. The potential for scams in this space is significant, with many unregulated brokers operating without adequate oversight. This article aims to provide a comprehensive analysis of Isports Trader, exploring its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a review of multiple sources, including user feedback, regulatory databases, and industry reports.

Regulation and Legitimacy

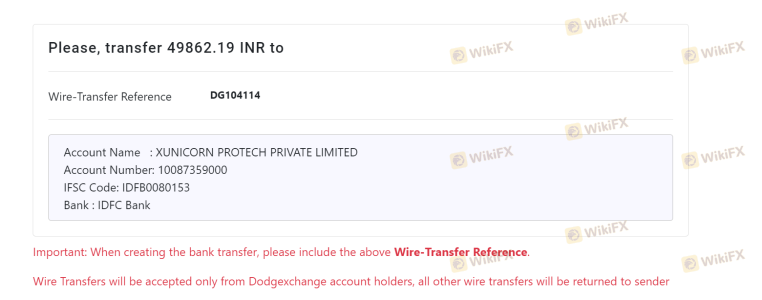

The regulatory status of a forex broker is crucial for determining its safety and legitimacy. Isports Trader claims to be registered in Saint Vincent and the Grenadines, but it lacks regulation from any notable financial authority. This absence of oversight raises significant concerns regarding the protection of client funds and the overall integrity of the trading platform.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

Operating without regulation means that Isports Trader does not adhere to the strict compliance requirements that regulated brokers must follow. For instance, regulated firms are typically required to maintain a minimum capital reserve and provide client fund protection. The lack of such oversight not only puts traders at risk but also suggests that the broker may not be held accountable for any misconduct. Historical compliance issues are also a red flag, as unregulated brokers can often disappear without notice, leaving clients with little recourse to recover lost funds.

Company Background Investigation

Isports Trader is operated by El Toro Pvt Ltd, a company that has not provided transparency regarding its ownership structure or management team. This lack of information can be alarming for potential investors, as knowing who is behind the platform is vital for assessing its credibility. A thorough investigation into the company's history reveals that it is relatively new, having been established within the last two years. However, the absence of a clear and experienced management team further complicates the evaluation of its legitimacy.

The company's transparency is lacking, as there is no publicly available information about its executives or their professional backgrounds. This obscurity can lead to increased skepticism among traders, who may feel uncertain about the safety of their investments. Without a clear understanding of the company's operational practices and governance, potential clients are left in the dark regarding the integrity of Isports Trader.

Trading Conditions Analysis

The trading conditions offered by Isports Trader raise further concerns about its legitimacy. The overall fee structure appears to be less competitive than industry standards, and the presence of hidden fees could lead to unexpected costs for traders.

| Fee Type | Isports Trader | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable | 1.0-1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Moderate |

The spread on major currency pairs is variable, which can significantly affect trading costs. Additionally, the commission model is unclear, leaving traders uncertain about how much they will be charged for executing trades. The overnight interest rates are reported to be high, which could deter traders who plan to hold positions for extended periods. Such conditions may indicate a lack of commitment to providing a fair trading environment, raising questions about Isports Trader's overall motives.

Customer Funds Safety

When it comes to customer funds, Isports Trader's safety measures are questionable. The broker does not provide any clear information regarding the segregation of client funds, which is a standard practice among regulated brokers. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, providing an additional layer of security.

Furthermore, there is no mention of investor protection schemes or negative balance protection policies, which are crucial for safeguarding traders from excessive losses. The absence of these measures can lead to significant risks for traders, especially in volatile market conditions. Historical incidents of funds being inaccessible or lost due to broker mismanagement further exacerbate these concerns.

Customer Experience and Complaints

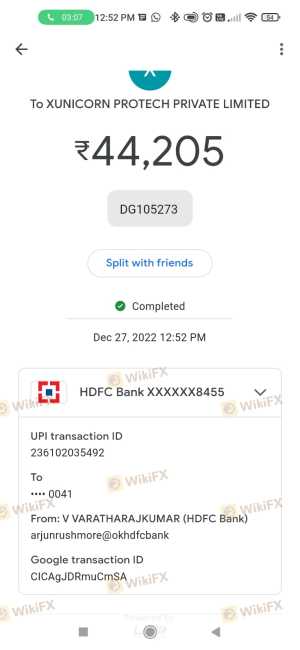

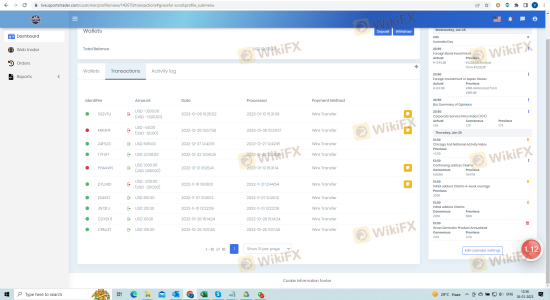

Customer feedback regarding Isports Trader has been largely negative, with numerous complaints highlighting serious issues with the platform. Common patterns include difficulties in withdrawing funds, unresponsive customer service, and aggressive sales tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | High | Poor |

| Misleading Promotions | Medium | Poor |

Several users have reported that after initially being able to withdraw small amounts, they faced significant hurdles when attempting to access larger sums. In some cases, clients have claimed that their account managers became unresponsive after they deposited funds, leaving them unable to retrieve their investments. This pattern of behavior is characteristic of many scam brokers, further supporting the notion that Isports Trader may not be a safe option for traders.

Platform and Trade Execution

The trading platform offered by Isports Trader has been described as unstable, with users reporting frequent outages and execution delays. Such issues can significantly impact a trader's ability to capitalize on market movements, leading to missed opportunities and potential losses.

Additionally, there have been claims of slippage and order rejections, which can be detrimental to a trader's performance. The presence of these issues raises concerns about the broker's reliability and may indicate potential manipulation of trades. Traders should be wary of platforms that do not demonstrate consistent performance and reliability.

Risk Assessment

Using Isports Trader comes with several inherent risks that potential clients should consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases the risk of loss. |

| Fund Safety Risk | High | Lack of segregation and protection for client funds. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

| Customer Support Risk | High | Poor response to complaints and withdrawal issues. |

Given these risks, it is advisable for traders to approach Isports Trader with caution. It is essential to conduct thorough research and consider alternative platforms that offer better regulatory oversight and customer protection.

Conclusion and Recommendations

In conclusion, the evidence suggests that Isports Trader presents numerous red flags that indicate it may be a scam. The lack of regulation, poor customer feedback, and questionable trading conditions all point to a platform that may not be safe for traders.

For those considering entering the forex market, it is crucial to choose brokers that are regulated and have a solid reputation for customer service and fund safety. Alternatives to Isports Trader could include well-established brokers with transparent operations and positive user experiences. Always prioritize safety and due diligence when selecting a trading platform to avoid potential scams.

Is Isports Trader a scam, or is it legit?

The latest exposure and evaluation content of Isports Trader brokers.

Isports Trader Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Isports Trader latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.