Is OTC Global Holdings safe?

Pros

Cons

Is Otc Global Holdings Safe or Scam?

Introduction

Otc Global Holdings, a prominent name in the forex and commodity brokerage market, has garnered attention for its extensive range of services and market reach. Established in 2007, the firm claims to be a leading independent inter-dealer broker, particularly in energy commodities, with a significant market share in natural gas and crude oil. However, potential traders must exercise caution when selecting a brokerage, as the forex market is rife with both legitimate and fraudulent entities. The importance of due diligence cannot be overstated, as traders risk losing substantial amounts of capital. This article aims to provide a comprehensive evaluation of Otc Global Holdings, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety. The analysis draws on multiple sources, including user reviews, regulatory databases, and financial reports, to assess the legitimacy and safety of Otc Global Holdings.

Regulation and Legitimacy

Regulation is a critical factor in determining the trustworthiness of any brokerage. Otc Global Holdings currently operates without valid regulatory oversight, a situation that raises significant concerns among potential clients. The absence of a regulatory license means that the firm is not held accountable to any financial authority, which could expose traders to increased risk.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | No License |

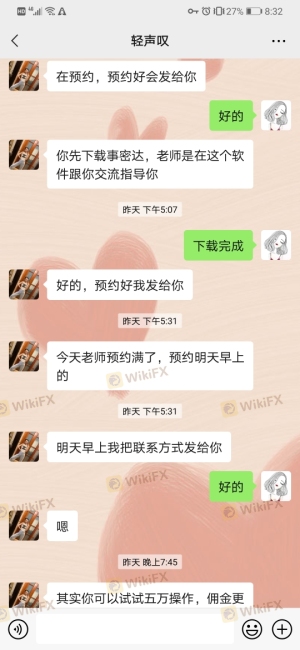

The lack of regulation is compounded by a low score on platforms like WikiFX, where Otc Global Holdings has been rated only 1.32 out of 10. Such a rating indicates a high potential risk associated with trading through this broker. Furthermore, user complaints have surfaced, detailing issues such as difficulty in fund withdrawals and a lack of transparency regarding trading conditions. The absence of regulatory oversight not only undermines the credibility of Otc Global Holdings but also highlights the importance of choosing a broker that operates under the scrutiny of a recognized financial authority.

Company Background Investigation

Otc Global Holdings was founded in 2007 and has since positioned itself as a significant player in the commodities brokerage sector. The company operates from multiple locations, including Houston and New York, and claims to serve over 450 institutional clients, including many Fortune 500 companies. However, the company's ownership structure and management team have raised questions regarding transparency.

The co-founders, Javier Loya and Joseph Kelly, have extensive backgrounds in the energy sector, which adds a layer of credibility to the firm. However, the lack of comprehensive information about the company's operational practices and financial health is concerning. Transparency is crucial for building trust, and Otc Global Holdings has not provided sufficient data regarding its financial performance or internal governance. This lack of disclosure could be a red flag for potential traders evaluating whether Otc Global Holdings is safe.

Trading Conditions Analysis

When assessing whether Otc Global Holdings is safe, it's essential to examine its trading conditions. The firm claims to offer a wide range of financial instruments, including forex, commodities, and indices. However, the specifics regarding spreads, commissions, and other fees are not well-documented, which can lead to confusion and mistrust among traders.

| Fee Type | Otc Global Holdings | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies widely |

| Overnight Interest Range | N/A | 1.5% - 3.0% |

The lack of clear information about trading costs is troubling. Traders may find themselves subjected to unexpected fees or unfavorable trading conditions, which could significantly impact their trading performance. Such opacity in fee structures can be a warning sign, suggesting that Otc Global Holdings may not prioritize the interests of its clients. Therefore, potential traders should be cautious and consider the implications of these trading conditions before proceeding.

Client Funds Security

The safety of client funds is paramount when evaluating any forex broker. Otc Global Holdings has not provided specific information regarding its fund security measures. The absence of details about segregated accounts, investor protection mechanisms, or negative balance protection policies raises concerns about the safety of traders' capital.

Traders should be particularly wary of brokers that do not clearly outline their policies for safeguarding client funds. The lack of transparency in this area could indicate that Otc Global Holdings is not taking the necessary precautions to protect its clients' investments. Historical complaints about fund withdrawal difficulties further exacerbate these concerns, making it imperative for potential clients to thoroughly investigate the safety measures in place at Otc Global Holdings.

Customer Experience and Complaints

Customer feedback is a vital component of assessing whether Otc Global Holdings is safe. Reviews from current and former clients reveal a mixed bag of experiences. While some users report satisfactory trading experiences, many others have highlighted issues such as difficulty in withdrawing funds and poor customer service response times.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Lack of Transparency | Medium | Inadequate |

| Poor Customer Support | High | Delayed Replies |

The prevalence of complaints regarding withdrawal issues is particularly alarming. Traders have reported being unable to access their funds, which is a significant red flag for any brokerage. The company's slow response to these complaints suggests a lack of commitment to customer service, further eroding trust in Otc Global Holdings. These patterns of feedback should be carefully considered by anyone contemplating trading with this broker.

Platform and Trade Execution

Evaluating the trading platform's performance is essential when assessing whether Otc Global Holdings is safe. Users have reported mixed experiences with the platform's stability and execution quality. While some traders appreciate the technology and tools available, others have experienced issues such as slippage and order rejections.

A reliable trading platform should offer seamless execution, minimal slippage, and a user-friendly interface. Any signs of manipulation or technical glitches could indicate a lack of professionalism and reliability. Traders must weigh these factors carefully when considering Otc Global Holdings as their broker, as poor execution can lead to significant losses.

Risk Assessment

Using Otc Global Holdings presents several risks that potential traders should be aware of. The absence of regulation, unclear trading conditions, and numerous customer complaints contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Transparency | Medium | Lack of clear financial information |

| Customer Service Risk | High | Poor response to complaints |

To mitigate these risks, traders should consider using a demo account to test the platform before committing significant funds. Additionally, researching alternative brokers with solid regulatory frameworks and positive user experiences can help ensure a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Otc Global Holdings presents several concerns that potential traders should carefully consider. The lack of regulatory oversight, unclear trading conditions, and a history of customer complaints raise significant red flags. While the firm has established itself as a player in the commodities market, the risks associated with trading through Otc Global Holdings cannot be ignored.

For those looking to engage in forex trading, it may be prudent to seek out brokers with established reputations, strong regulatory frameworks, and positive customer feedback. Alternatives such as brokers that are regulated by reputable authorities like the FCA or ASIC may provide a more secure trading environment. Ultimately, traders must weigh their options and proceed with caution when considering whether Otc Global Holdings is safe.

Is OTC Global Holdings a scam, or is it legit?

The latest exposure and evaluation content of OTC Global Holdings brokers.

OTC Global Holdings Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OTC Global Holdings latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.