Is Iron-Bits safe?

Pros

Cons

Is Iron Bits Safe or Scam?

Introduction

Iron Bits is a forex broker that has emerged in the competitive landscape of online trading, aiming to provide a platform for both retail and institutional investors. Established in 2020, it claims to offer a variety of trading instruments, including forex, commodities, and cryptocurrencies. However, as the forex market is rife with scams and unregulated brokers, it is crucial for traders to exercise caution and thoroughly evaluate the credibility of any broker they consider. This article investigates whether Iron Bits is a safe broker or a potential scam, utilizing a comprehensive approach that includes regulatory status, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory environment is a key indicator of a broker's legitimacy. Regulation provides a level of oversight that can protect traders from fraud and malpractice. In the case of Iron Bits, it is important to note that the broker is not regulated by any recognized financial authority, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that Iron Bits does not have to adhere to the stringent rules and standards that protect investors. Unregulated brokers often operate with higher risks, as they are not accountable to any regulatory body. This lack of oversight is a major red flag, as it leaves traders vulnerable to potential fraud and malpractice, making the question of "Is Iron Bits safe?" even more pressing.

Furthermore, the lack of a regulatory history means that there are no past compliance records to evaluate. Licensed brokers are typically required to maintain transparency and provide financial disclosures, which can help build trust with their clients. Without such oversight, Iron Bits poses a significant risk to potential investors.

Company Background Investigation

Iron Bits claims to be based in the United Kingdom, but its actual ownership and operational transparency are questionable. The broker's website lacks detailed information regarding its management team and corporate structure, which is essential for assessing its credibility.

The company's history is relatively short, having been established only in 2020. A brief history may not provide enough evidence of stability and reliability in the financial markets. The absence of detailed information about the management team raises concerns about their qualifications and experience. A well-established broker typically has a management team with a proven track record in finance and trading, which can instill confidence in potential clients.

Moreover, the lack of transparency in Iron Bits operations makes it difficult for traders to ascertain the broker's reliability. Investors should be wary of brokers that do not disclose their ownership structure or provide clear information about their management team, as this can often indicate a lack of accountability.

Trading Conditions Analysis

When evaluating whether Iron Bits is safe, it is essential to consider the trading conditions and fee structures it offers. Iron Bits provides various account types, including silver, gold, platinum, and VIP, each with differing minimum deposit requirements and leverage options. However, the overall fee structure is a critical aspect that potential clients must scrutinize.

| Fee Type | Iron Bits | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | No commission | Varies |

| Overnight Interest Range | 2% | 1-2% |

While the spread for major currency pairs is slightly above the industry average, Iron Bits does not charge commissions, which might seem attractive. However, traders should be cautious of any hidden fees or unfavorable terms that could affect their overall profitability.

Additionally, the overnight interest rates are on the higher end of the spectrum, which can significantly impact traders who hold positions overnight. High overnight rates can erode profits and must be taken into account when assessing the overall cost of trading with Iron Bits.

In conclusion, while Iron Bits may present competitive trading conditions, the lack of transparency regarding any additional fees or charges makes it difficult to determine if the broker is genuinely offering favorable terms. This raises further questions about the safety of trading with them.

Client Fund Security

The security of client funds is paramount in determining if Iron Bits is safe. A trustworthy broker should implement stringent measures to protect clients' deposits, including segregating client funds from operational funds and offering investor protection schemes. However, Iron Bits has not provided clear information regarding its security measures.

There is no indication that Iron Bits employs segregated accounts, which are crucial for protecting client funds in the event of financial difficulties. Additionally, without any regulatory oversight, there is no legal requirement for Iron Bits to implement such protective measures, leaving clients at risk.

Moreover, the absence of negative balance protection policies is concerning. This means that traders could potentially lose more than their initial investment, which is a significant risk in the volatile forex market. Historical issues related to fund security or disputes have not been disclosed by the broker, which further complicates the evaluation of its safety.

In summary, the lack of clear information about client fund security measures raises significant concerns about whether Iron Bits is a safe trading option.

Customer Experience and Complaints

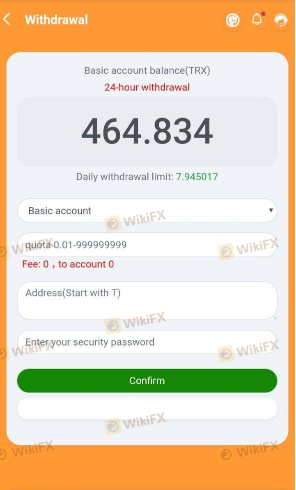

Analyzing customer feedback is essential to understanding the overall reliability of a broker. Unfortunately, reviews of Iron Bits reveal a pattern of negative experiences among clients. Many users have reported difficulties in withdrawing funds, with complaints about delayed processing times and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Misleading Promotions | High | Poor |

Common complaints include claims that the broker employs tactics to delay withdrawals, making it challenging for clients to access their funds. Users have reported waiting months for their withdrawal requests to be processed, leading to frustration and distrust.

In one case, a client reported that after making a deposit, they were contacted by a supposed account manager who promised high returns but subsequently became unresponsive when the client attempted to withdraw their funds. Such experiences raise serious questions about the integrity of Iron Bits and whether it is safe to trade with them.

Platform and Trade Execution

The performance of a trading platform is critical for a successful trading experience. Iron Bits offers a web-based trading platform that is designed to be user-friendly. However, the quality of order execution, including slippage and rejection rates, is an essential factor to consider.

Users have reported mixed experiences regarding order execution, with some indicating that they experienced slippage during high volatility periods. This can lead to significant losses, especially for traders employing scalping strategies. Additionally, there have been complaints about orders being rejected without clear explanations, which can be frustrating for traders looking to capitalize on market movements.

The overall stability of the platform has also been questioned, with reports of downtime during critical trading hours. Such issues can severely impact a trader's ability to execute orders, further complicating the question of whether Iron Bits is a safe broker to use.

Risk Assessment

When contemplating whether Iron Bits is safe, it is essential to assess the overall risk involved in trading with them. The lack of regulation, combined with a history of customer complaints and withdrawal issues, presents a considerable risk for potential investors.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of transparency on fund protection |

| Withdrawal Risk | High | Delays and issues reported by clients |

| Platform Execution Risk | Medium | Reports of slippage and order rejections |

To mitigate these risks, potential traders should conduct thorough research before engaging with Iron Bits. It may be advisable to start with a small investment or to consider using a demo account to assess the platform's functionality before committing significant funds.

Conclusion and Recommendations

In conclusion, while Iron Bits presents itself as a forex trading platform, the evidence suggests that it may not be a safe option for traders. The lack of regulatory oversight, coupled with a history of negative customer experiences, raises significant red flags.

For traders seeking a reliable broker, it is recommended to consider alternatives that are regulated and have established a positive reputation in the industry. Brokers such as IG, OANDA, or Forex.com are known for their regulatory compliance and commitment to customer service.

In summary, potential investors should approach Iron Bits with caution and consider the risks involved. The question of "Is Iron Bits safe?" leans towards a negative response based on the available evidence, and traders are encouraged to prioritize safety and regulatory compliance in their trading decisions.

Is Iron-Bits a scam, or is it legit?

The latest exposure and evaluation content of Iron-Bits brokers.

Iron-Bits Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Iron-Bits latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.