Iron Bits 2025 Review: Everything You Need to Know

Iron Bits has garnered significant attention in the forex trading community, yet the reviews surrounding this broker paint a largely negative picture. Many users have reported experiences that suggest a lack of transparency and regulatory oversight, leading to serious concerns about its legitimacy. Key features highlighted include unregulated status and high leverage offerings, which may attract traders but also pose substantial risks.

Note: It is crucial to acknowledge that Iron Bits operates under different entities across regions, which can complicate the regulatory landscape. This review aims to provide a fair and comprehensive assessment based on multiple sources to ensure accuracy.

Rating Overview

We score brokers based on user feedback, expert analysis, and factual data.

Broker Overview

Iron Bits was established in 2020 and is marketed as a forward-thinking brokerage firm that provides trading services across various asset classes, including forex, stocks, commodities, and cryptocurrencies. Users can access the platform via a web-based interface, but it does not support popular trading platforms like MT4 or MT5. The broker claims to offer over 200 tradable assets and provides a range of account types, but it is essential to highlight that it operates without any regulatory oversight, which raises significant red flags.

Detailed Section

Regulatory Status:

Iron Bits is not regulated by any recognized financial authority, which is a major concern for potential investors. According to multiple sources, including WikiFX, the absence of a regulatory framework means that user funds are not protected, and there is no recourse in case of disputes.

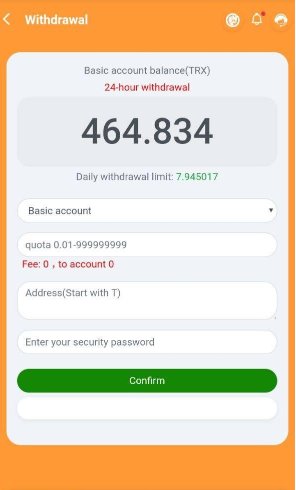

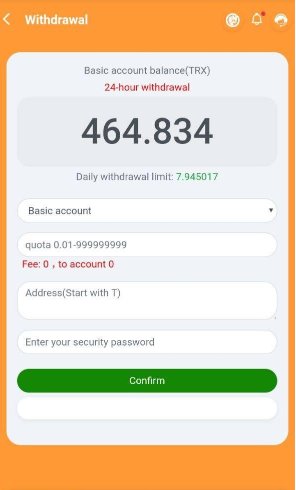

Deposit/Withdrawal Currencies:

The broker accepts deposits in major currencies like USD, EUR, and GBP. However, users have reported difficulties with withdrawals, often facing delays and high withdrawal fees (up to 1% with a minimum of €30).

Minimum Deposit:

To open a trading account with Iron Bits, the minimum deposit requirement is €250 for a Silver account, which is the most basic account type. Higher tiers, such as Gold and Platinum, require deposits of €10,000 and €50,000 respectively.

Bonuses/Promotions:

While Iron Bits advertises various promotional offers, many reviews suggest that these may be misleading or tied to stringent conditions that make it difficult for users to access their funds.

Asset Classes Available:

Iron Bits claims to offer a diverse range of trading assets, including forex pairs, cryptocurrencies, commodities, and indices. However, the lack of regulatory oversight raises concerns about the legitimacy of these offerings.

Cost Structure:

The cost of trading with Iron Bits includes spreads that are reportedly higher than the industry average, with some sources indicating spreads as high as 7.8 pips. This could significantly impact profitability for traders, particularly those employing high-frequency strategies.

Leverage:

Iron Bits offers leverage up to 400:1 on certain accounts, which can amplify both profits and losses. While high leverage may attract experienced traders, it poses substantial risks, particularly for those who are less familiar with the forex market.

Trading Platforms Allowed:

The broker only provides a web-based trading platform, which lacks the advanced features and user-friendly interface found in established platforms like MT4 or MT5. This limitation may deter more experienced traders seeking robust trading tools.

Restricted Regions:

Iron Bits does not clearly specify any restricted regions, but the unregulated nature of the broker suggests that it may not be a safe choice for traders in heavily regulated markets.

Available Customer Service Languages:

Customer service is limited, with support primarily available in English and German. Users have reported slow response times and a lack of effective support when issues arise, leading to frustration and dissatisfaction.

Rating Recap

Detailed Breakdown

-

Account Conditions:

Iron Bits offers a variety of account types, but the high minimum deposit requirements and lack of transparency regarding account management fees raise concerns. The limited features associated with the Silver account may not appeal to more experienced traders.

Tools and Resources:

While the broker claims to provide educational resources, the lack of a comprehensive trading platform hinders user experience. The absence of advanced charting tools and trading indicators can be detrimental for traders seeking to analyze market trends effectively.

Customer Service and Support:

Multiple sources have highlighted severe shortcomings in customer support. Users often report long wait times and unhelpful responses, which can exacerbate issues when trying to withdraw funds or resolve account-related problems.

Trading Experience:

The trading experience with Iron Bits is marred by reports of delayed withdrawals and high fees, which can significantly impact traders' profitability. The lack of a robust trading platform further complicates the user experience.

Trustworthiness:

Iron Bits has received a low trust score across various platforms, primarily due to its unregulated status and numerous complaints about withdrawal issues. Experts strongly advise against engaging with this broker.

User Experience:

Overall, user experiences with Iron Bits are overwhelmingly negative. Many users have reported feeling misled by the broker's marketing tactics and have expressed frustration regarding the challenges faced in withdrawing their funds.

In conclusion, the Iron Bits review suggests that potential traders should exercise extreme caution before engaging with this broker. The lack of regulation, coupled with numerous negative user experiences, indicates that Iron Bits may not be a reliable choice for forex trading.