Is IFF-TRADING safe?

Business

License

Is IFF-Trading A Scam?

Introduction

IFF-Trading is an online forex broker that positions itself as a platform for trading various financial instruments, including forex, commodities, and cryptocurrencies. In an increasingly crowded market, it is crucial for traders to carefully evaluate brokers to ensure they are not falling victim to scams. The forex market is notorious for its lack of regulation, which can expose traders to significant risks, especially when dealing with unregulated brokers. This article aims to provide a comprehensive analysis of IFF-Trading's legitimacy by investigating its regulatory status, company background, trading conditions, customer experience, and overall risk profile. Our evaluation is based on a thorough review of online resources, customer feedback, and expert analyses.

Regulation and Legitimacy

One of the primary factors in determining whether a broker is a scam is its regulatory status. IFF-Trading claims to be registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory framework. This raises significant concerns regarding the safety of traders' funds and the broker's operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unregulated |

The absence of a valid regulatory license is a red flag, as it means that IFF-Trading is not subject to oversight by any major financial authority. This lack of regulation implies that traders have limited recourse in the event of disputes or financial losses. Furthermore, the local financial authority in Saint Vincent and the Grenadines does not supervise forex brokerage activities, which adds to the risk associated with trading through IFF-Trading.

Company Background Investigation

IFF-Trading is operated by IFF-Trading LLC, but detailed information about the company's history, ownership structure, and management team is scarce. The lack of transparency raises concerns about the broker's credibility. A reputable broker typically provides information about its founding, ownership, and the experience of its management team, which helps build trust with potential clients.

Unfortunately, IFF-Trading does not disclose such information, making it difficult for traders to assess the broker's reliability. The absence of a clear company profile and the anonymity surrounding its management team are significant warning signs. Traders should be cautious when dealing with brokers that lack transparency, as this may indicate an attempt to obscure potential risks or fraudulent practices.

Trading Conditions Analysis

The trading conditions offered by IFF-Trading are another critical aspect to consider when assessing its legitimacy. The broker claims to offer competitive spreads and high leverage, which can be enticing for traders. However, the overall fee structure and any unusual charges should be scrutinized.

| Fee Type | IFF-Trading | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.5 pips | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While IFF-Trading advertises a spread of 1.5 pips for major currency pairs, the lack of transparency regarding additional fees, such as commissions or overnight interest, raises concerns. Many brokers provide detailed information about their fee structures, which allows traders to make informed decisions. The absence of such information on IFF-Trading's website could suggest hidden costs that may negatively impact traders' profitability.

Customer Fund Safety

The safety of customer funds is a paramount concern when evaluating any broker. IFF-Trading does not provide clear information regarding its fund security measures, such as whether it offers segregated accounts or negative balance protection.

Segregated accounts are essential as they ensure that clients' funds are kept separate from the broker's operating funds, providing an added layer of security. The absence of this feature raises significant concerns about the safety of traders' investments. Furthermore, the lack of investor protection measures means that traders may not have any recourse in the event of financial difficulties faced by the broker.

Customer Experience and Complaints

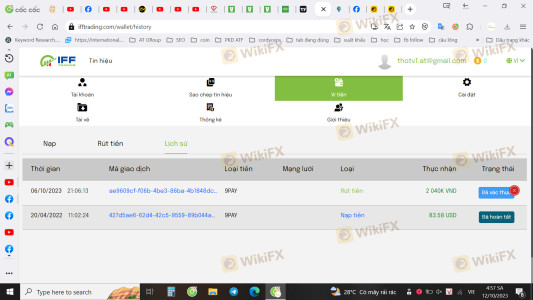

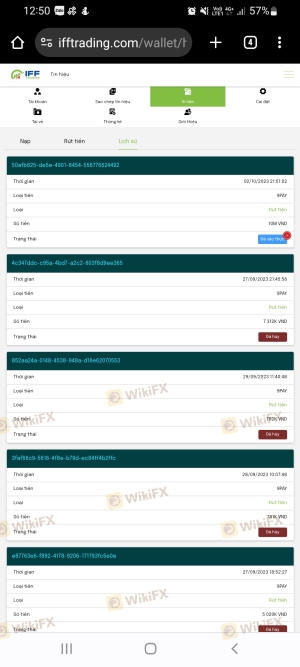

Customer feedback is a valuable source of information when assessing a broker's reliability. Reviews of IFF-Trading reveal a mix of experiences, with several users expressing dissatisfaction with the broker's services. Common complaints include difficulties in withdrawing funds and poor customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

Many traders have reported challenges in accessing their funds, which is a significant red flag. Effective withdrawal processes are a hallmark of reputable brokers, and the inability to withdraw funds can indicate potential fraudulent activity. The poor response quality from customer support further exacerbates these concerns, as it suggests a lack of commitment to resolving client issues.

Platform and Trade Execution

The trading platform provided by IFF-Trading is an important factor in the overall user experience. The broker claims to offer the widely used MetaTrader 5 platform, which is known for its robust features and user-friendly interface. However, the platform's performance, stability, and order execution quality must be evaluated to determine if it meets traders' expectations.

Unfortunately, reports indicate that traders have experienced issues with order execution, including slippage and rejected orders. Such problems can significantly impact trading outcomes and raise questions about the broker's reliability. Moreover, any signs of platform manipulation should be taken seriously, as they can indicate unethical practices.

Risk Assessment

Trading with IFF-Trading presents several risks that potential clients should be aware of. The lack of regulation, transparency issues, and negative customer feedback contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | No segregation of funds or investor protection. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with any broker. It is crucial to consider alternative options that are regulated and have a proven track record of reliability.

Conclusion and Recommendations

In conclusion, the evidence strongly indicates that IFF-Trading poses significant risks for potential traders. The lack of regulation, transparency, and poor customer feedback all suggest that this broker may not be trustworthy. Traders should exercise caution and consider alternative, regulated brokers that prioritize client safety and provide clear, transparent services.

For those who are still considering trading with IFF-Trading, it is advisable to start with a small investment or explore other options altogether. Reputable brokers with strong regulatory oversight, such as those regulated by the FCA or ASIC, offer a safer trading environment and are recommended for traders seeking to minimize risk.

In summary, is IFF-Trading safe? The consensus is that it is not, and traders should be wary of engaging with this broker.

Is IFF-TRADING a scam, or is it legit?

The latest exposure and evaluation content of IFF-TRADING brokers.

IFF-TRADING Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IFF-TRADING latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.