Is Huigu Limited safe?

Business

License

Is Huigu Limited Safe or Scam?

Introduction

Huigu Limited is a relatively new player in the forex trading market, having been established in late 2022. It positions itself as a broker offering a wide range of financial instruments, including forex, commodities, cryptocurrencies, and indices. However, with the influx of new brokers, traders must exercise caution and conduct thorough evaluations before committing their funds. This article seeks to analyze the legitimacy and safety of Huigu Limited by investigating its regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and overall risk profile. The assessment is based on a review of multiple sources and data points to provide a comprehensive picture of whether Huigu Limited is safe for traders.

Regulation and Legitimacy

When evaluating any forex broker, regulatory status is a crucial factor to consider. A regulated broker typically adheres to strict guidelines that protect investors and ensure fair trading practices. In the case of Huigu Limited, it claims to hold a registration with the National Futures Association (NFA) in the United States, but further investigation reveals that it is not a member of the NFA, thus lacking regulatory oversight. The following table summarizes the key regulatory information regarding Huigu Limited:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0558557 | United States | Not a member |

| FinCEN | N/A | United States | Registered |

The absence of a legitimate regulatory framework raises significant concerns about the safety of funds deposited with Huigu Limited. Unregulated brokers are not required to adhere to the same standards as regulated ones, which can lead to issues related to transparency and accountability. Moreover, the lack of historical compliance records further exacerbates the risks associated with trading through Huigu Limited. Therefore, it is essential for traders to be cautious when considering whether Huigu Limited is safe.

Company Background Investigation

Huigu Limited's company history and ownership structure provide further insights into its legitimacy. Established in December 2022, the broker operates from an address in Lakewood, Colorado. However, reports suggest that the physical office may not exist, raising questions about the broker's transparency and reliability. The management team's background is also unclear, with no publicly available information regarding their experience or expertise in the financial industry. This lack of transparency can be concerning for potential investors.

Moreover, the company's information disclosure practices appear to be inadequate, as crucial details regarding operational procedures, risk management protocols, and team qualifications are not readily available. This lack of information makes it challenging for potential clients to assess whether Huigu Limited is safe to trade with. Traders are advised to consider these factors carefully before engaging with the broker.

Trading Conditions Analysis

When assessing a broker, it is vital to understand the trading conditions they offer, including fees, spreads, and commissions. Huigu Limited presents itself as a competitive broker with low spreads and high leverage. However, the overall fee structure lacks transparency, making it difficult for traders to gauge the true cost of trading. The following table outlines the core trading costs associated with Huigu Limited:

| Fee Type | Huigu Limited | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | From 0 pips | 1-2 pips |

| Commission Model | Not disclosed | $5 - $10 per lot |

| Overnight Interest Range | Not disclosed | Varies |

The promise of low spreads can be enticing, but the absence of clear information about commissions and overnight fees raises red flags. Traders should be cautious and inquire about any hidden costs that may apply. Additionally, the lack of a demo account or trial period makes it challenging for traders to test the platform without risking real money. Hence, potential clients should carefully evaluate if Huigu Limited is safe for their trading activities.

Customer Fund Security

The security of customer funds is paramount when assessing a broker's credibility. Huigu Limited claims to implement measures to safeguard client funds, including segregation of accounts and partnerships with major financial institutions. However, the lack of regulatory oversight means that there are no legal protections in place to ensure the safety of these funds. Furthermore, there are no details available regarding investor protection schemes or negative balance protection policies.

The absence of historical incidents related to fund security is a positive sign, but it does not eliminate the inherent risks associated with trading through an unregulated broker. Traders must consider the potential for fund mismanagement or fraud, which is a common concern with unregulated entities. Therefore, it is crucial to weigh these factors when determining whether Huigu Limited is safe for trading.

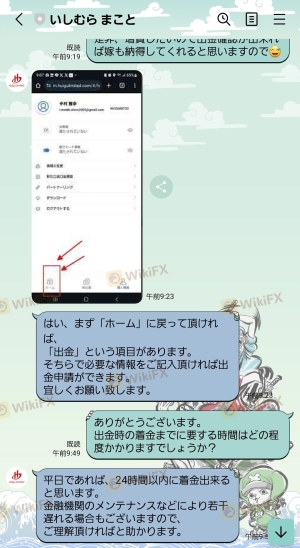

Customer Experience and Complaints

Analyzing customer feedback can provide valuable insights into the overall experience of trading with a broker. Reports suggest that Huigu Limited has received mixed reviews from clients, with complaints primarily focusing on withdrawal issues and poor customer service. The following table summarizes the major types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Lack of Communication | Medium | Inconsistent support |

| Account Freezing | High | No resolution offered |

Typical cases highlight traders experiencing difficulties in withdrawing their funds, with some reporting that their requests went unanswered for extended periods. These issues can be alarming and indicate potential operational problems within the brokerage. Therefore, potential clients should carefully consider these experiences when deciding if Huigu Limited is safe for their trading needs.

Platform and Execution

The trading platform offered by Huigu Limited is another critical aspect to evaluate. The broker claims to provide a user-friendly web-based platform, but there are concerns regarding its stability and execution quality. Traders have reported instances of slippage and order rejections, which can significantly impact trading performance. The lack of established trading platforms like MetaTrader 4 or 5 raises further concerns about the robustness of Huigu's technology.

Moreover, there are no indications of any manipulative practices on the platform, but the opacity of its rules and procedures can lead to potential exploitation of traders. Given these factors, it is essential for traders to assess the platform's reliability before determining if Huigu Limited is safe for trading.

Risk Assessment

Engaging with any broker involves inherent risks, particularly when dealing with unregulated entities. The following risk assessment summarizes the key risk areas associated with Huigu Limited:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Issues with withdrawals and support |

| Technology Risk | Medium | Unverified platform stability |

To mitigate these risks, traders should consider using smaller amounts for initial trades, conducting extensive research, and potentially seeking regulated alternatives. Understanding these risks is crucial for anyone considering whether Huigu Limited is safe for their trading activities.

Conclusion and Recommendations

In conclusion, the analysis of Huigu Limited reveals several concerning factors that may indicate it is not a safe trading option for investors. The lack of regulatory oversight, transparency issues, and negative customer feedback suggest that traders should approach this broker with caution. While it may offer competitive trading conditions, the potential risks outweigh the benefits.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are regulated and have a proven track record of customer satisfaction. Brokers like IG, OANDA, or Forex.com are examples of reputable firms that provide a safer trading environment. Ultimately, potential clients must thoroughly evaluate their options before deciding whether Huigu Limited is safe for their trading needs.

Is Huigu Limited a scam, or is it legit?

The latest exposure and evaluation content of Huigu Limited brokers.

Huigu Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Huigu Limited latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.