Is FX MAGNUS safe?

Business

License

Is FX Magnus Safe or a Scam?

Introduction

FX Magnus is a relatively new player in the forex market, having launched in 2022. As a broker, it positions itself as an accessible platform for traders looking to engage in various financial instruments, including forex, commodities, indices, and cryptocurrencies. However, the rapid growth of online trading has also led to an increase in fraudulent activities, making it essential for traders to conduct thorough due diligence before committing their funds. In this article, we will explore whether FX Magnus is a reliable trading platform or a potential scam. We will utilize multiple sources, including regulatory databases, customer reviews, and expert analyses, to provide a comprehensive evaluation of the broker's legitimacy and safety.

Regulation and Legitimacy

Regulation is a critical aspect to consider when evaluating a broker's safety. A regulated broker is subject to oversight by financial authorities, which helps ensure that they adhere to strict operational standards. Unfortunately, FX Magnus does not hold any licenses from recognized regulatory bodies. Below is a summary of the broker's regulatory status:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation raises significant concerns regarding the safety of funds and the broker's operational practices. Regulatory authorities, such as the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC), impose strict guidelines on brokers to protect investors. FX Magnus has not been subject to such scrutiny, which is a red flag for potential investors. Furthermore, the fact that it has been blacklisted by the FCA indicates that it is operating without proper authorization, further solidifying the argument that FX Magnus is not safe.

Company Background Investigation

FX Magnus operates under the ownership of Cloudview OÜ, a company registered in Estonia. However, the legitimacy of this registration raises questions, as the company does not appear to have a solid operational history or a background in financial services. The lack of transparency regarding the management team and their qualifications further compounds the concerns surrounding FX Magnus.

The company claims to provide a range of trading services, but the absence of detailed information about its founders, management, and operational history makes it difficult to assess its credibility. Furthermore, the limited disclosure raises questions about the broker's commitment to transparency, which is crucial in building trust with clients. Given these factors, it is reasonable to conclude that FX Magnus is likely not a safe option for traders.

Trading Conditions Analysis

Understanding a broker's trading conditions is essential for evaluating its overall value and reliability. FX Magnus offers a minimum deposit requirement of $250, which is relatively low compared to many other brokers. However, the overall cost structure and fee policies are concerning. While specific fees are not clearly outlined, reports suggest that FX Magnus employs various hidden charges that could significantly impact traders' profitability.

Here is a comparison of core trading costs:

| Fee Type | FX Magnus | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unspecified | 1-2 pips |

| Commission Model | Unspecified | Varies |

| Overnight Interest Range | Unspecified | Varies |

The lack of transparency regarding spreads, commissions, and other fees raises questions about the broker's integrity. Traders could find themselves facing unexpected costs, which is a common tactic employed by scam brokers to exploit their clients. Therefore, it is crucial for potential investors to be aware of these potential pitfalls, as they indicate that FX Magnus might not be a safe trading environment.

Client Fund Security

The safety of client funds is paramount when choosing a broker. FX Magnus claims to implement measures like segregated accounts to protect client funds; however, the lack of regulatory oversight means that these claims cannot be independently verified. Segregated accounts are designed to separate client funds from the broker's operational funds, thereby providing a layer of security in the event of financial difficulties.

Unfortunately, without a regulatory body overseeing these practices, clients have no recourse should issues arise. Reports of fund withdrawal difficulties and other financial disputes have surfaced, which further complicates the situation. Given these factors, it is essential for traders to consider that FX Magnus may not prioritize the safety of client funds.

Customer Experience and Complaints

Customer feedback is an invaluable resource when assessing a broker's reputation. Unfortunately, reviews of FX Magnus are predominantly negative. Many users have reported challenges in withdrawing their funds, which is a common complaint among scam brokers. The following table summarizes the most common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Hidden Fees | Medium | Poor |

| Customer Support Quality | High | Poor |

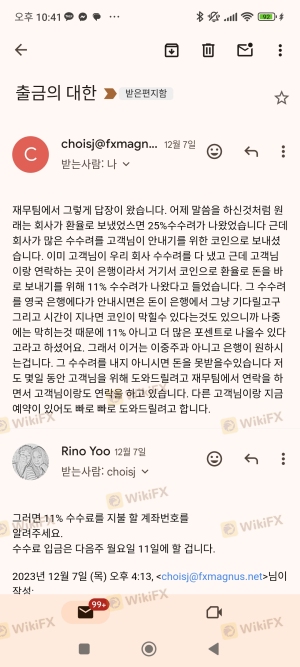

One notable case involved a trader who reported being pressured to deposit additional funds under the pretense of unlocking their existing balance. Such aggressive tactics are characteristic of fraudulent schemes, and they contribute to the growing concern regarding the broker's trustworthiness. Given the overwhelming evidence of negative experiences, it is evident that FX Magnus does not provide a reliable customer experience.

Platform and Trade Execution

The trading platform offered by FX Magnus is a proprietary web-based platform. While it claims to provide a user-friendly interface, many reviews indicate that it lacks the advanced features and stability found in established platforms like MetaTrader 4 or 5. Issues such as slippage and order rejections have been reported, which are detrimental to a trader's performance.

Traders have also expressed concerns about potential platform manipulation, a serious allegation that could further tarnish the broker's reputation. Given these performance issues, it is crucial for traders to approach FX Magnus with caution, as the trading environment may not be conducive to successful trading.

Risk Assessment

Using FX Magnus comes with several risks that potential investors should be aware of. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Possible hidden fees and withdrawal issues |

| Operational Risk | Medium | Platform stability concerns |

To mitigate these risks, traders should consider using regulated brokers with established reputations. It is advisable to avoid investing large sums until more information is available about FX Magnus's operations and regulatory status.

Conclusion and Recommendations

In conclusion, the evidence suggests that FX Magnus is not a safe trading platform. The lack of regulation, poor customer feedback, and questionable business practices raise significant red flags. For traders looking to invest their money, it is advisable to seek alternatives that offer better protection and transparency.

Some reputable alternatives include regulated brokers like IG, OANDA, or Forex.com, which have established track records and robust regulatory oversight. By choosing a well-regulated broker, traders can ensure that their investments are better protected and that they are engaging in a legitimate trading environment.

Is FX MAGNUS a scam, or is it legit?

The latest exposure and evaluation content of FX MAGNUS brokers.

FX MAGNUS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FX MAGNUS latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.