Regarding the legitimacy of GTM forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is GTM safe?

Pros

Cons

Is GTM markets regulated?

The regulatory license is the strongest proof.

FCA Inst Forex Execution (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

Astral Financial Ltd

Effective Date:

2018-04-18Email Address of Licensed Institution:

compliance@astral-financial.comSharing Status:

No SharingWebsite of Licensed Institution:

www.astral-financial.comExpiration Time:

--Address of Licensed Institution:

3 Shortlands London W6 8DA UNITED KINGDOMPhone Number of Licensed Institution:

+442031437480Licensed Institution Certified Documents:

Is GTM Safe or Scam?

Introduction

GTM, or Global Transaction Market, is a brokerage firm that positions itself as a player in the forex market, offering traders access to a variety of financial instruments, including currencies, precious metals, and indices. In an industry rife with both legitimate and fraudulent entities, it is crucial for traders to conduct thorough due diligence before engaging with any broker. The potential for significant financial loss makes it imperative for investors to assess the credibility and safety of trading platforms. This article aims to provide a comprehensive evaluation of GTM's legitimacy, focusing on its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk profile. Our investigation is based on various online reviews, regulatory databases, and user feedback, ensuring a balanced and objective analysis.

Regulation and Legitimacy

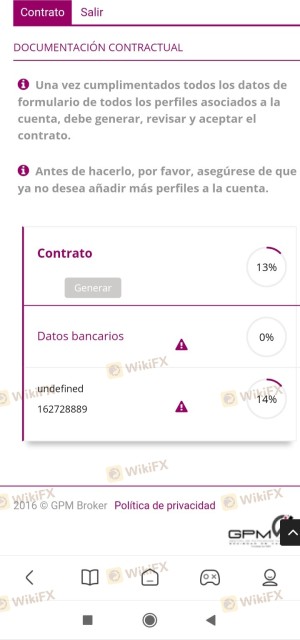

Understanding a broker's regulatory status is vital for determining its trustworthiness. GTM claims to be regulated by the Financial Conduct Authority (FCA) in the United Kingdom; however, it is categorized as a "suspicious clone," which raises significant concerns regarding its legitimacy. The following table summarizes the core regulatory information for GTM:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | Unverified | United Kingdom | Suspicious Clone |

The importance of regulation cannot be overstated; it serves as a safeguard for traders, ensuring that brokers adhere to ethical standards and comply with legal requirements. A broker's regulatory history can provide insight into its operational integrity. In GTM's case, the lack of a valid regulatory license and its identification as a clone of a legitimate entity raise red flags about its operational practices. Traders should be cautious when considering GTM, as the absence of stringent oversight can lead to potential malpractice.

Company Background Investigation

GTM operates as a brokerage firm based in Hong Kong, with a history spanning approximately 5 to 10 years. However, the limited information available about its ownership structure and management team adds to the ambiguity surrounding its operations. Transparency is a critical factor in assessing a broker's reliability, and GTM's lack of detailed disclosures about its corporate governance and management experience can hinder potential investors from making informed decisions.

The company appears to have minimal public presence, which is concerning in an industry where reputation and accountability are paramount. A credible broker typically provides information about its founders, management team, and operational history, allowing traders to gauge their expertise and reliability. Unfortunately, GTM falls short in this regard, further complicating the assessment of its trustworthiness.

Trading Conditions Analysis

Assessing the trading conditions offered by a broker is essential for understanding the overall cost of trading. GTM presents a competitive fee structure, featuring leverage up to 1:400 and tight spreads on popular currency pairs. However, the minimum deposit requirement of $100 for a standard account and $2,000 for an ECN account may deter some traders.

The following table compares GTM's core trading costs with industry averages:

| Fee Type | GTM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 - 2.0 pips |

| Commission Model | $6 per lot | $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

While GTM's trading conditions may seem attractive at first glance, the potential for hidden fees or unfavorable trading practices should not be overlooked. Traders must remain vigilant for any unexpected costs that could impact their overall profitability, especially given the broker's dubious regulatory standing.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. GTM claims to implement various measures to protect client funds, including segregated accounts and investor protection policies. However, the lack of a solid regulatory framework raises concerns about the effectiveness and enforcement of these measures.

Traders should be aware of the following aspects regarding GTM's fund safety:

- Segregated Accounts: While GTM claims to maintain segregated accounts, the absence of a verified regulatory authority raises questions about the actual implementation of this practice.

- Investor Protection: Without proper regulation, the level of investor protection is significantly diminished. Traders may have limited recourse in the event of financial disputes or broker insolvency.

- Negative Balance Protection: GTM does not explicitly state whether it offers negative balance protection, which is a crucial feature for safeguarding traders from incurring debts beyond their initial investments.

Historically, reports of difficulties in withdrawing funds from GTM have surfaced, adding to the skepticism surrounding its operations. Traders should approach this broker with caution, given the potential risks associated with fund safety.

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing a broker's reliability. Reviews of GTM reveal a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and receiving timely support. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Access | Medium | Unresponsive |

| Account Management | High | Limited assistance |

One notable case involves a trader who reported being unable to withdraw their funds for an extended period, citing vague responses from the customer support team. Such experiences highlight the importance of reliable customer service and prompt issue resolution in building trust with clients.

Platform and Trade Execution

The trading platform offered by GTM is a significant factor in the overall trading experience. GTM utilizes the popular MetaTrader 4 (MT4) platform, known for its stability and user-friendly interface. However, concerns have been raised regarding order execution quality, including instances of slippage and rejected orders.

Traders should be aware of the following aspects related to GTM's platform performance:

- Execution Quality: Reports of delayed order execution and slippage can adversely affect trading outcomes, particularly for those employing scalping or high-frequency trading strategies.

- Platform Manipulation: While there is no direct evidence of platform manipulation, the lack of transparency surrounding GTM's operational practices raises concerns about potential unethical behavior.

Risk Assessment

Using GTM for trading comes with inherent risks that traders should carefully consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of valid regulation raises concerns. |

| Fund Safety | High | Unverified protection measures and withdrawal issues. |

| Trading Conditions | Medium | Competitive fees but potential hidden costs. |

To mitigate these risks, traders should conduct thorough research, maintain a diversified portfolio, and consider using risk management strategies such as stop-loss orders.

Conclusion and Recommendations

In conclusion, while GTM presents itself as a viable option for forex trading, significant concerns regarding its regulatory status, fund safety, and customer experiences warrant caution. The classification of GTM as a "suspicious clone" by regulatory authorities raises serious questions about its legitimacy.

Traders should remain vigilant and consider the potential risks associated with engaging with GTM. For those seeking safer alternatives, it is advisable to explore brokers that are regulated by reputable authorities, offer transparent fee structures, and have a proven track record of customer satisfaction.

Ultimately, the question of "Is GTM safe?" leans towards skepticism, and potential investors should prioritize their financial security by opting for more established and regulated trading platforms.

Is GTM a scam, or is it legit?

The latest exposure and evaluation content of GTM brokers.

GTM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GTM latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.