GTM Broker, operating under the name Global Transaction Market LLC, is primarily based in Hong Kong and has been in the online trading sector for over a decade. Established ostensibly to offer comprehensive financial services, GTM claims to have garnered customers from more than 50 countries. The firm's public persona suggests a focus on providing potential investors with market access across a broad array of instruments.

While GTM touts its low cost of entry and high leverage as attractive features, it is essential to note that its claims of FCA regulation have not been substantiated and are relatively overshadowed by the serious red flags surrounding its operational integrity. These aspects paint a concerning picture for potential traders considering engagement with legal and ethical trading practices.

GTM Broker specializes in providing a diverse set of financial services, including forex trading, commodities, indices, and other financial instruments. Traders can employ the popular MT4 platform for execution and management of trades. Over 400 financial instruments are reportedly available for trading, aimed at attracting a wide audience from novice traders to seasoned professionals.

Although GTM presents a competitive range of trading conditions—including leverage as high as 1:500 and minimum deposits starting at $10—potential users must exercise heightened discernment due to the ambiguous regulatory environment and negative user feedback. The broker claims to operate under the auspices of the FCA through a licensed entity, Astral Financial Ltd. However, the validity of this license remains uncertain, marking a significant concern for fund safety.

The information available around GTMs regulatory status is profoundly contradictory. The broker presents claims of FCA regulation, yet it has been flagged as a "suspicious clone," indicating deceptive practices and a lack of regulatory compliance. This dissonance in the operational narrative heightens the risk for traders who may mistakenly trust the legitimacy of GTM without sufficient scrutiny.

- Visit FCA's Official Website: Verify if GTM is listed as a regulated entity.

- Search NFAs BASIC database: This will confirm the license and regulatory compliance status.

- Consult Independent Review Platforms: Use sites like WikiFX and Forexpeacearmy for authentic user feedback.

Industry Reputation and Summary

Feedback from users about GTM predominantly leans towards negativity, with many expressing concerns regarding fund security. As indicated by a users experience reflected on review sites:

“This broker has made a disaster with my investment. They practically handled it as they wanted and they did not warn me at all.”

Given this context, self-verification and diligent research are paramount before engaging financially with this broker.

Trading Costs Analysis

Advantages in Commissions

GTM offers a seemingly competitive pricing structure, particularly with low-cost trading conditions. The absence of commissions on specific accounts makes it an appealing choice for cost-sensitive traders.

The "Traps" of Non-Trading Fees

Despite the attractive commission structure, GTM reportedly imposes withdrawal fees that can be considered excessive. For instance, some users have noted fees up to $30 for withdrawing smaller amounts, which can erode profits quickly, especially for novice traders just starting.

"GTM is a nasty platform that asks to pay a risk contribution equivalent to own assets before it can be allocated in order to withdraw money completely."

Cost Structure Summary

Overall, the expense structure presents a double-edged sword. While trading fees may seem favorable, hidden non-trading charges can inhibit overall cost-effectiveness, mandating careful consideration by traders looking to optimize their strategies.

GTM supports several popular trading platforms, primarily MT4, which is renowned for its robustness and automation capabilities. It facilitates a comprehensive trading experience with real-time market analyses and charting functionalities.

The overall suite of tools and resources available on GTM includes advanced charting features, analytic tools, and educational content aimed at improving users' understanding of the market. While MT4 provides a solid base, the lack of additional proprietary tools could deter users seeking highly specialized analytical resources.

General sentiment surrounding the usability of GTM's platform is mixed. User feedback highlights good experiences with the MT4 interface; however, some have reported difficulties and inefficiencies when navigating the platform, particularly under high-volume trading scenarios.

User Experience Analysis

Onboarding Process

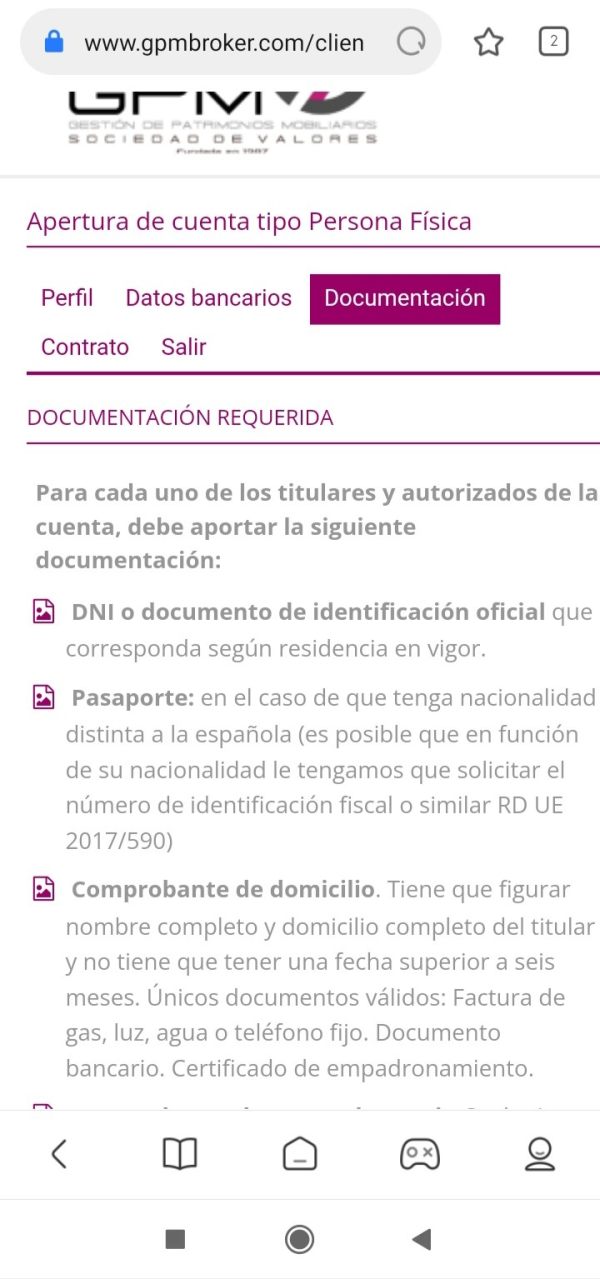

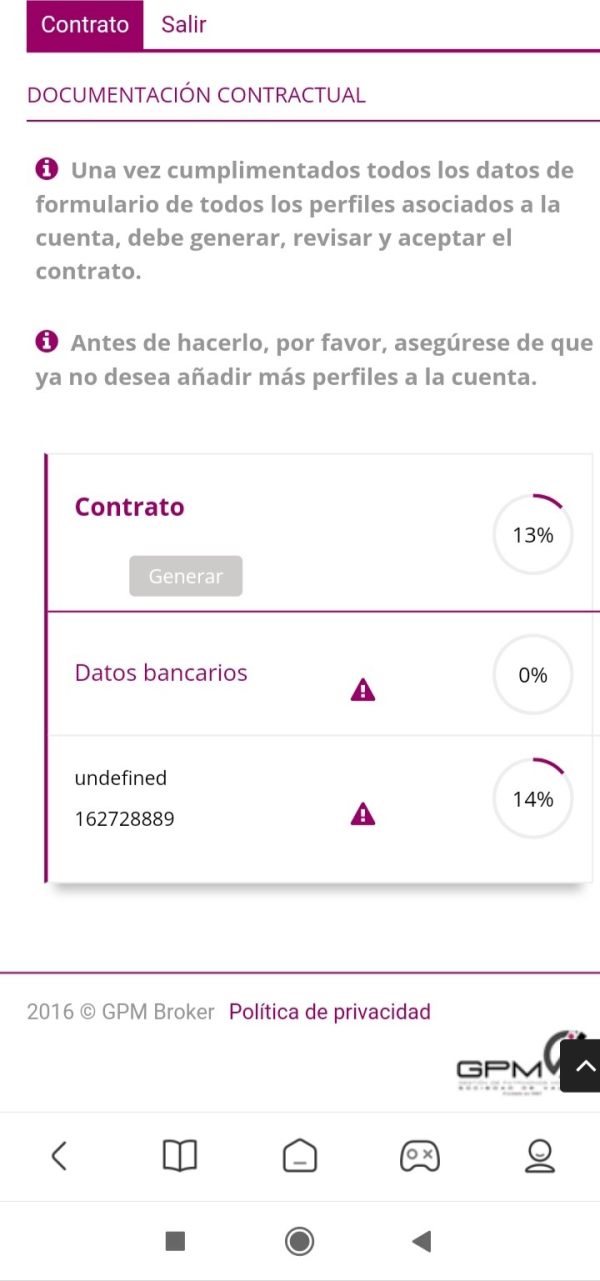

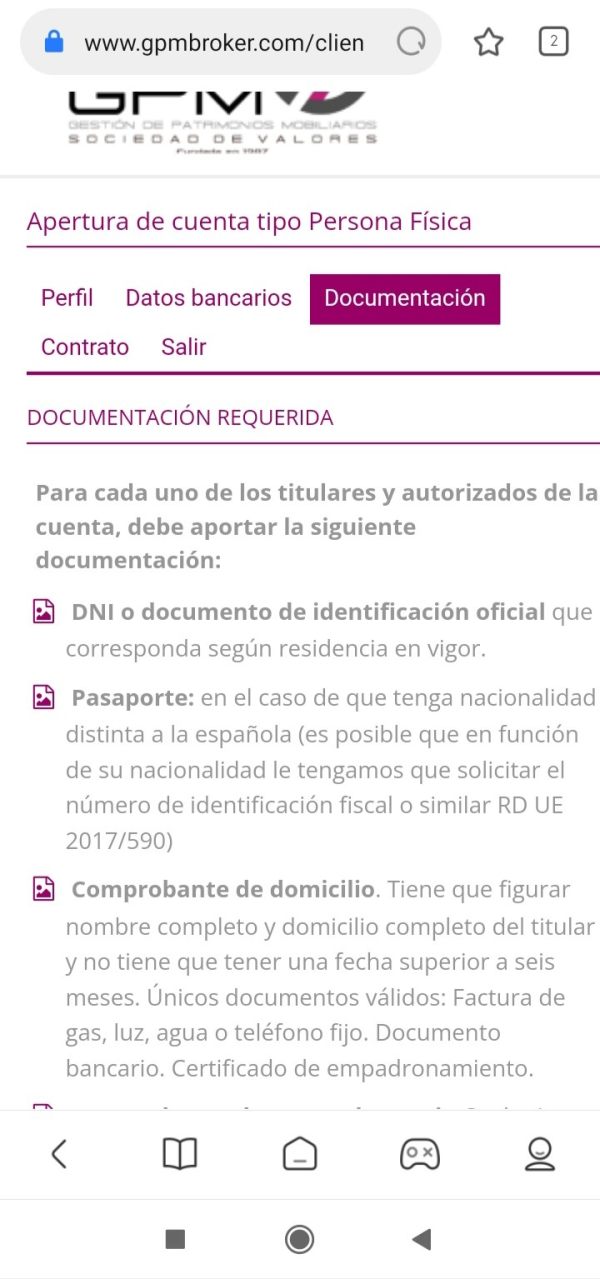

Creating an account with GTM is relatively simple, allowing newcomers to begin trading. The broker supports streamlined processes, ensuring users can transition into trading without excessive delays.

Trading Experience

Many users have described the trading experience positively, especially regarding the MT4 interface. Nevertheless, dissatisfaction grows around operational issues such as idle response times and transaction delays that can impede effective trading.

User Feedback Summary

Overall user experiences are varied, with positives regarding accessibility and platform features but negatives regarding customer support availability and operational concerns. Traders should be prepared for potential frustrations given the feedback.

Customer Support Analysis

Support Channels Available

GTM provides multiple avenues for customer service, including telephone and email support. However, efficiency and responsiveness are areas of concern, with reports of unresponsive support channels dampening the user experience.

Response Times and Effectiveness

Users indicate significant delays in receiving help, leading to frustration during urgent trading scenarios. Complaints often suggest that inquiries take an unwarranted amount of time before being acknowledged and resolved.

Overall Satisfaction Summary

The sentiment around customer support is decidedly unfavorable, with a rating of 1.0 reflecting pervasive discontent among users. This aspect alone can be a critical deterrent for prospective customers.

Account Conditions Analysis

Account Types Offered

GTM provides two primary account types designed to cater to various trader needs: Standard and ECN accounts. Each has distinctive features that may appeal to different segments within the trading community.

Minimum Deposits and Leverage

The minimum deposit requirement is comparatively low, set at $10 for the Standard account, while the ECN account requires a deposit of $2,000. This structure allows flexibility for new traders while offering substantial leverage options—up to 1:500—for advanced strategies.

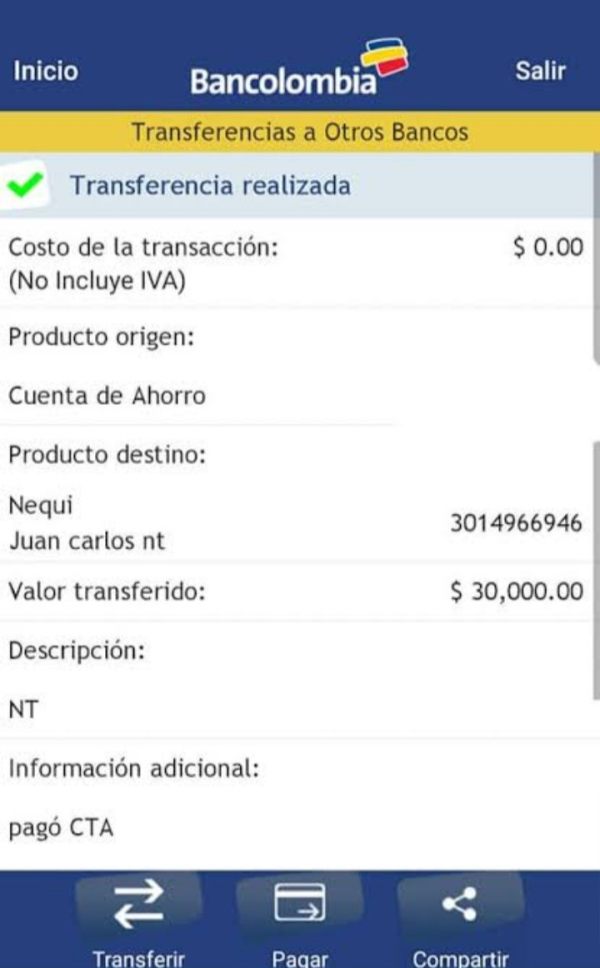

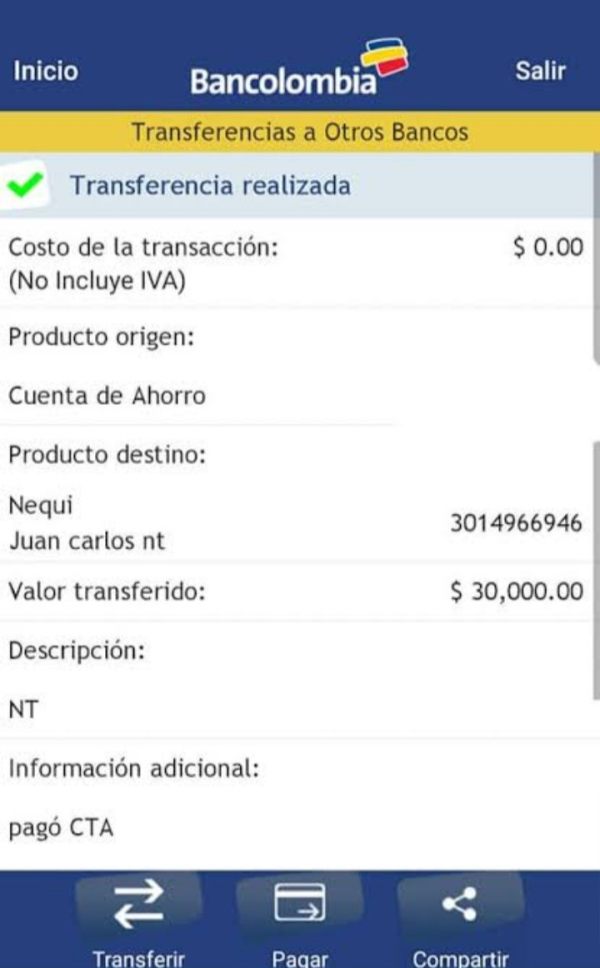

Withdrawal Conditions Summary

While GTM allows for substantial leverage and initial investments, withdrawal conditions can be a major sticking point. Users report high fees and complications during withdrawal processes, raising red flags about the reliability of their funds.

Conclusion

In summary, GTM Broker presents a blended scenario for potential traders: attractive trading conditions against the backdrop of serious risk factors related to trustworthiness and operational integrity. While the broker's low entry points and access to a diverse set of financial instruments can afford users numerous opportunities, the unequivocal challenges posed by dubious regulatory compliance and unsatisfactory user experiences cannot be overlooked.

Prospective traders should exercise comprehensive due diligence before deciding to engage with GTM, ensuring that the allure of low-cost trading does not obscure the underlying risks involved.