Is Gotlon safe?

Business

License

Is Gotlon Safe or a Scam?

Introduction

Gotlon, a relatively new player in the forex market, has positioned itself as a financial service platform offering a variety of trading instruments, including forex, commodities, and contracts for difference (CFDs). With claims of competitive spreads and high leverage ratios, Gotlon aims to attract both novice and experienced traders. However, the rise of unregulated brokers in the forex industry has made it crucial for traders to thoroughly evaluate the legitimacy and safety of their chosen platforms. This article provides a comprehensive analysis of Gotlon, focusing on its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risk assessment. The investigation incorporates data from various reputable financial sources, ensuring an objective and well-rounded evaluation.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the critical factors influencing its credibility and safety. Gotlon claims to be based in the United Kingdom, yet it operates without authorization from any recognized financial authority. This lack of regulation raises significant concerns regarding investor protection and the overall legitimacy of the broker.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| NFA | Unauthorized | United States | Not Verified |

| FCA | No License | United Kingdom | Not Verified |

| ASIC | No License | Australia | Not Verified |

The absence of a valid regulatory license means that Gotlon does not adhere to the stringent compliance standards typically enforced by top-tier regulators such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). As a result, traders using Gotlon may find themselves exposed to unregulated trading practices, lack of fund protection, and limited recourse in the event of disputes. Therefore, it is essential to ask, is Gotlon safe? The evidence suggests that it is not.

Company Background Investigation

Gotlon Investment Ltd, the entity behind the Gotlon brand, has been operational for approximately 2 to 5 years. However, the companys history is shrouded in ambiguity, with scant information available about its ownership structure and management team. This lack of transparency is concerning, as reputable brokers typically provide detailed information about their founders, management, and operational history.

The absence of an official website further complicates the situation, as traders cannot verify the company's claims or access essential information regarding its services and policies. The reliance on a generic email address for customer support, instead of a corporate domain, raises additional red flags about the legitimacy of the operations. In the absence of transparent information, potential clients are left wondering, is Gotlon safe? The evidence suggests that the company lacks the transparency and credibility necessary for a trustworthy trading environment.

Trading Conditions Analysis

Gotlon presents an attractive trading environment with claims of competitive spreads and high leverage. However, the overall fee structure and trading conditions warrant careful scrutiny. The company offers a leverage ratio of up to 1:500, which is significantly higher than the industry average. While this may seem appealing to traders looking to maximize their profits, it also amplifies risk, especially for inexperienced investors.

| Fee Type | Gotlon | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1-2 pips |

| Commission Model | Not Disclosed | Varies |

| Overnight Interest Range | Not Disclosed | Varies |

The lack of clarity regarding commission structures and overnight interest fees raises concerns about hidden costs that could affect the overall profitability of trades. Furthermore, the absence of detailed information about withdrawal fees and deposit methods suggests that traders may encounter unexpected costs when trying to access their funds. Therefore, while the initial conditions may appear favorable, the potential for undisclosed fees and high-risk trading practices leads to the conclusion that is Gotlon safe? remains an open question.

Customer Fund Safety

The safety of customer funds is paramount in evaluating any forex broker. Unfortunately, Gotlon does not provide adequate information regarding its fund security measures. The absence of segregated accounts means that client funds may not be held separately from the company's operational funds, increasing the risk of misuse or loss. Additionally, Gotlon does not offer any investor protection schemes, which are typically in place with regulated brokers to safeguard client funds in the event of insolvency.

The lack of transparency regarding fund safety measures raises alarms about the potential for financial mismanagement or fraud. Historical complaints about fund withdrawal difficulties and excessive fees further exacerbate concerns about the broker's reliability. Given these factors, it is reasonable to question, is Gotlon safe? The evidence points to significant risks associated with fund security.

Customer Experience and Complaints

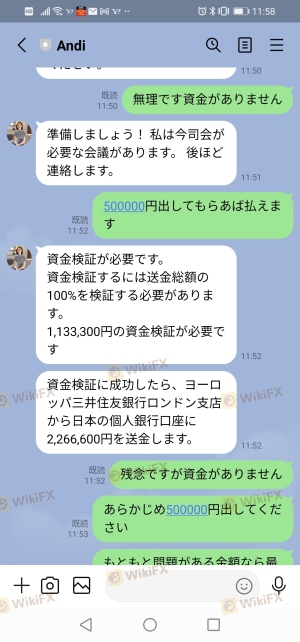

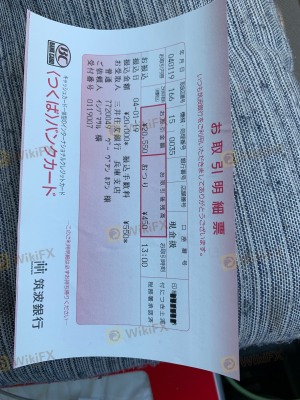

When assessing the reliability of a broker, customer feedback and experiences play a crucial role. Unfortunately, Gotlon has garnered a notable number of complaints from users, primarily regarding withdrawal issues and unresponsive customer support. Many users have reported delays in processing withdrawals and difficulties in receiving timely assistance from the support team.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Unclear Fee Structures | High | Poor |

Several users have shared their experiences of being pressured to deposit additional funds, raising suspicions about the broker's intentions. These patterns of complaints suggest a concerning trend that further complicates the question of is Gotlon safe? The evidence indicates that customer experiences are largely negative, pointing towards a potentially fraudulent operation.

Platform and Trade Execution

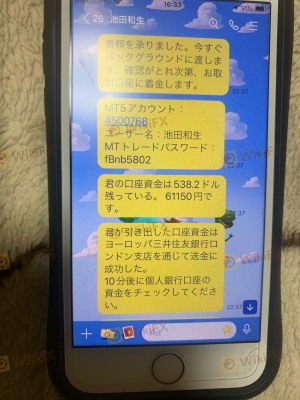

The performance of a trading platform is critical for a seamless trading experience. Gotlon claims to use the MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, the lack of detailed information about platform stability, order execution quality, and slippage rates raises concerns about whether traders will receive the expected performance.

Reports of execution delays and high slippage further complicate the situation, as traders may find themselves unable to capitalize on market opportunities effectively. Additionally, any signs of platform manipulation could lead to significant financial losses. Thus, the question remains, is Gotlon safe? The evidence suggests that traders may face challenges in achieving reliable execution and performance.

Risk Assessment

Given the various factors discussed, the overall risk associated with trading through Gotlon is considerable. The lack of regulation, transparency, and customer support creates a precarious environment for investors. Below is a risk assessment summary.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Fund Security Risk | High | No segregated accounts |

| Customer Support Risk | Medium | Poor response times |

| Trading Conditions Risk | High | High leverage and hidden fees |

To mitigate these risks, potential traders are advised to conduct thorough research, avoid investing more than they can afford to lose, and consider using regulated brokers with a proven track record.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Gotlon is not safe for traders. The lack of regulation, transparency, and negative customer experiences paint a concerning picture of the broker's operations. Traders should exercise extreme caution when considering Gotlon as their trading platform and may be better off exploring regulated alternatives that offer a higher degree of safety and reliability.

For those seeking trustworthy options, consider brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC, which provide robust investor protection and transparent trading conditions. Ultimately, ensuring the safety of your funds and trading experience should be the top priority for any forex trader.

Is Gotlon a scam, or is it legit?

The latest exposure and evaluation content of Gotlon brokers.

Gotlon Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Gotlon latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.