Is OneTrade safe?

Pros

Cons

Is OneTrade A Scam?

Introduction

OneTrade is a forex broker that has been operating since 2010, positioning itself as a direct market access (DMA) provider catering to both retail and institutional traders. With the rise of online trading platforms, it is vital for traders to carefully evaluate the legitimacy and reliability of brokers before committing their funds. The forex market is rife with potential risks, including scams and fraudulent activities, which can result in significant financial losses. Therefore, understanding the regulatory framework, company background, and customer experiences is crucial in determining whether OneTrade is a safe option for traders.

This article aims to provide a comprehensive analysis of OneTrade by examining its regulatory status, company history, trading conditions, customer safety measures, and user feedback. The information presented is based on a thorough review of various online sources, including regulatory bodies, user reviews, and financial analysis platforms.

Regulation and Legitimacy

OneTrade operates under the regulation of the Financial Conduct Authority (FCA) in the United Kingdom. This regulatory body is known for its stringent oversight of financial institutions, ensuring that they adhere to high standards of conduct and consumer protection. The significance of regulation cannot be overstated, as it provides traders with a level of assurance regarding the safety of their funds and the integrity of the brokers operations.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

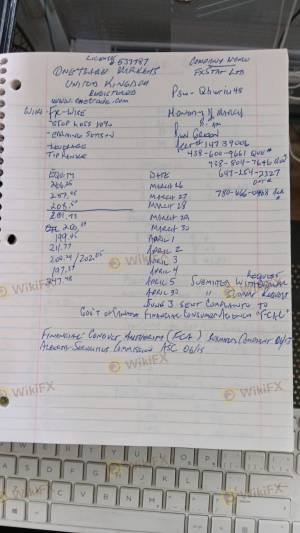

| FCA | 537787 | United Kingdom | Active |

The FCA requires brokers to maintain segregated accounts for client funds, ensuring that these funds are kept separate from the broker's operational funds. This regulatory framework also includes participation in compensation schemes, which can protect traders in the event of broker insolvency. However, it is essential to note that while OneTrade is regulated, some sources have raised concerns about its status, suggesting it may be a "suspicious clone." This term indicates that while the broker claims to be regulated, there may be doubts about the authenticity of its license and the services it offers.

Company Background Investigation

OneTrade is a trading name of FX Stat Ltd, which was founded in 2010. Initially established as a financial social networking provider, the company has since evolved into a broker offering a range of trading services. The ownership structure of OneTrade is not extensively detailed in available resources, which raises questions about transparency.

The management team behind OneTrade comprises professionals with experience in financial markets, though specific details about their backgrounds are somewhat limited. This lack of transparency can be concerning for potential clients, as it is crucial to understand who is managing the broker and their qualifications.

In terms of information disclosure, OneTrade provides some details about its services and trading conditions, but there is room for improvement. Clearer communication regarding ownership and management could enhance trust and credibility among potential clients.

Trading Conditions Analysis

OneTrade offers a competitive trading environment, with a focus on providing direct market access. The broker claims to offer low latency execution and a range of trading instruments, including forex, commodities, and indices. However, the overall fee structure and trading conditions deserve careful examination.

The broker's commission model is based on a small floating inter-bank spread, complemented by a commission of $0.35 per mini lot per side for forex trading. While this may appear competitive, it is essential to compare these costs against industry averages to gauge their competitiveness.

| Fee Type | OneTrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (from 0.6 pips) | 1.0-1.5 pips |

| Commission Model | $0.35 per mini lot | $0.20-$0.40 per mini lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by OneTrade can be competitive, particularly for major currency pairs. However, the commission structure may be higher than some other brokers in the market. Traders should carefully consider these costs when evaluating OneTrade as a potential trading partner.

Customer Funds Security

OneTrade emphasizes the safety of client funds through various measures, including the segregation of client accounts. This practice ensures that client funds are held in separate accounts from the broker's operational funds, providing an additional layer of protection.

Furthermore, OneTrade participates in the FCA's compensation scheme, which can provide compensation to clients in the unlikely event of broker insolvency. This scheme protects up to £85,000 per client, offering some reassurance to traders regarding the safety of their investments.

Despite these measures, there have been historical concerns regarding the security of funds with OneTrade. Some users have reported difficulties in withdrawing their funds, raising red flags about the broker's operational integrity. It is crucial for potential clients to be aware of these issues and to conduct thorough research before depositing funds.

Customer Experience and Complaints

Customer feedback plays a significant role in assessing the reliability of a broker like OneTrade. Reviews from users indicate a mixed experience, with some praising the trading platform's functionality and others expressing dissatisfaction with customer service and withdrawal processes.

Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service | Medium | Inconsistent |

| Platform Stability | Low | Generally stable |

One notable case involved a trader who experienced difficulties in withdrawing funds after requesting account closure. This incident highlights potential concerns regarding the broker's responsiveness and operational practices. While some users report satisfactory experiences, the presence of significant complaints warrants caution.

Platform and Trade Execution

OneTrade provides access to popular trading platforms, including MetaTrader 4 (MT4) and its proprietary WebTrader. The platforms are designed to offer robust trading capabilities, including advanced charting tools and automated trading options.

In terms of order execution, OneTrade claims to provide low latency and high execution quality. However, users have reported occasional issues with slippage and order rejections, which can impact trading performance. It is essential for traders to be aware of these potential issues and to monitor their trading conditions closely.

Risk Assessment

Using OneTrade involves various risks that traders should consider before engaging with the broker. The following risk areas are noteworthy:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Concerns about regulatory status and authenticity. |

| Withdrawal Risk | High | Reports of withdrawal difficulties and delays. |

| Trading Cost Risk | Medium | Competitive spreads, but commission structure may be higher. |

| Platform Stability Risk | Medium | Generally stable, but some users report slippage issues. |

To mitigate these risks, traders should conduct thorough due diligence, maintain awareness of their trading activities, and consider using smaller amounts for initial trades until they are comfortable with the broker's operations.

Conclusion and Recommendations

In conclusion, the question of whether OneTrade is a scam or a safe broker is nuanced. While it operates under FCA regulation, which provides a level of credibility, concerns about its operational practices, particularly regarding withdrawals and customer service, cannot be overlooked.

Traders should approach OneTrade with caution, particularly if they are new to the forex market. For those who prioritize regulatory safety and are willing to navigate potential challenges, OneTrade may be a viable option. However, it is advisable to consider alternative brokers with a stronger reputation for customer service and fewer complaints regarding fund withdrawals.

For traders seeking reliable alternatives, brokers such as eToro or IG may offer more favorable trading conditions and a more transparent operational framework. Always conduct thorough research and consider your trading needs before making a decision.

In summary, while OneTrade may not be outright fraudulent, the presence of significant complaints and operational challenges suggests that potential clients should exercise caution and consider all available options.

Is OneTrade a scam, or is it legit?

The latest exposure and evaluation content of OneTrade brokers.

OneTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OneTrade latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.