Is FOTM safe?

Pros

Cons

Is FOTM A Scam?

Introduction

FOTM is an online forex broker that claims to be registered in China, positioning itself within the competitive landscape of the foreign exchange market. However, the lack of transparency regarding its founding, management, and regulatory status raises significant concerns for potential traders. In an industry rife with scams and unregulated entities, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their funds. This article aims to assess the legitimacy and safety of FOTM by examining its regulatory compliance, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a broker is a key indicator of its legitimacy and reliability. FOTM has not provided any valid licensing information on its website, which suggests that it operates without regulatory oversight. This lack of regulation is a major red flag, as regulated brokers are required to adhere to strict standards designed to protect client funds and ensure fair trading practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a regulatory framework means that FOTM is not held accountable for its trading practices or the safety of client funds. Traders should be aware that engaging with an unregulated broker poses significant risks, including the potential for fraud and the inability to recover lost funds. The importance of regulation in the forex industry cannot be overstated, as it provides essential protections for traders and ensures that brokers operate in a transparent and ethical manner.

Company Background Investigation

FOTM's company background is shrouded in mystery, with little information available regarding its history, ownership structure, or management team. The lack of transparency raises concerns about the broker's credibility and operational integrity. A reputable broker typically provides detailed information about its founding, management, and business practices, allowing traders to assess its legitimacy.

Furthermore, the absence of a clear corporate structure and identifiable management team makes it difficult for potential clients to trust FOTM. Without knowing who is behind the broker, traders are left vulnerable to potential scams and unethical practices. Transparency in company operations is essential for building trust, and FOTM's failure to provide this information further exacerbates concerns about its legitimacy.

Trading Conditions Analysis

A thorough analysis of FOTM's trading conditions reveals a concerning fee structure. The broker claims to offer low spreads and high leverage, but these assertions require careful scrutiny. The lack of specific information regarding spreads and commissions on the website is troubling, as reputable brokers typically provide clear details on their trading costs.

| Fee Type | FOTM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1.0 - 1.5 pips |

| Commission Model | Not Specified | $3 - $7 per lot |

| Overnight Interest Range | Not Specified | Varies |

The absence of clear information about trading costs can be a tactic used by unregulated brokers to attract clients, only to impose hidden fees later. Traders should be wary of brokers that do not disclose their fee structures, as this lack of transparency can lead to unexpected expenses and losses.

Customer Funds Safety

The safety of client funds is a paramount concern for any trader. FOTM's lack of regulatory oversight raises serious questions about its capital safety measures. Regulated brokers are required to implement stringent protocols for fund segregation, investor protection, and negative balance protection. However, without a regulatory framework, FOTM cannot guarantee the safety of client funds.

It is essential for traders to understand the implications of trading with an unregulated broker. The absence of investor protection mechanisms means that in the event of insolvency or fraudulent practices, clients may have no recourse to recover their funds. This reality underscores the importance of choosing a regulated broker that prioritizes client safety.

Customer Experience and Complaints

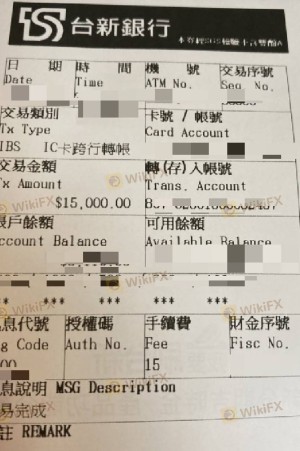

Customer feedback and experiences play a critical role in assessing the reliability of a broker. FOTM has received numerous complaints from clients, particularly regarding withdrawal issues and poor customer service. Many users have reported difficulties in accessing their funds, with some claiming they were unable to withdraw their money altogether.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Support | Medium | Mixed Reviews |

The prevalence of complaints regarding withdrawal difficulties is a significant concern. Traders should be cautious of brokers that do not respond adequately to client issues, as this can indicate a lack of commitment to customer satisfaction and transparency.

Platform and Trade Execution

FOTM does not appear to offer widely recognized trading platforms such as MetaTrader 4 or MetaTrader 5, which raises questions about the reliability and functionality of its trading infrastructure. The quality of trade execution is critical for traders, and any signs of manipulation or slippage can severely impact trading performance.

Furthermore, the absence of information regarding order execution quality and potential slippage raises concerns about the broker's operational integrity. Traders should prioritize brokers that provide transparent information about their trading platforms and execution practices.

Risk Assessment

Engaging with FOTM carries inherent risks that potential traders should carefully consider. The lack of regulation, transparency, and customer complaints all contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No regulatory oversight |

| Fund Safety | High | Lack of investor protection |

| Customer Service | Medium | Numerous complaints regarding support |

To mitigate risks, traders should be cautious when considering FOTM as a trading option. It is advisable to conduct thorough research and consider alternative brokers that are regulated and have a proven track record of customer satisfaction.

Conclusion and Recommendations

Based on the comprehensive analysis, FOTM exhibits several red flags that suggest it may not be a safe choice for traders. The lack of regulatory oversight, transparency regarding company operations, and numerous customer complaints raise significant concerns about the broker's legitimacy.

For traders seeking a reliable and secure trading experience, it is advisable to consider regulated alternatives that prioritize client safety and transparency. Brokers with established regulatory frameworks, positive customer feedback, and comprehensive trading conditions can provide a more trustworthy environment for trading.

In summary, traders should exercise extreme caution when evaluating FOTM, as the potential risks associated with this broker outweigh any perceived benefits. Always prioritize safety and conduct thorough due diligence before engaging with any forex broker.

Is FOTM a scam, or is it legit?

The latest exposure and evaluation content of FOTM brokers.

FOTM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FOTM latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.