Is MSMAX safe?

Pros

Cons

Is Msmax Safe or a Scam?

Introduction

Msmax is a forex broker that has emerged in the competitive landscape of online trading, offering a variety of services to traders globally. Positioned as a platform for forex, indices, stocks, and cryptocurrency trading, Msmax aims to cater to both novice and experienced traders. However, the rise of online trading has also led to an increase in fraudulent activities, making it crucial for traders to carefully evaluate the legitimacy and safety of their chosen brokers. This article investigates whether Msmax is safe or a scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

To conduct this investigation, we analyzed multiple sources, including user reviews, regulatory filings, and expert opinions. Our evaluation framework focuses on key areas such as regulatory compliance, company history, financial security, customer feedback, and trading conditions. By synthesizing this information, we aim to provide a comprehensive assessment of Msmax's trustworthiness.

Regulation and Legitimacy

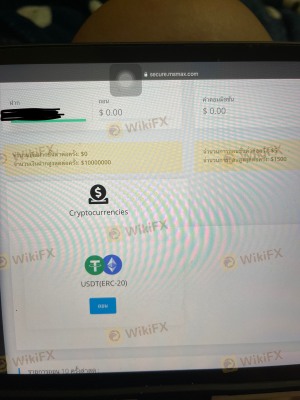

Understanding the regulatory environment in which a broker operates is essential for assessing its safety. Regulatory bodies enforce rules and standards that protect traders and ensure fair practices in the financial markets. Unfortunately, Msmax operates without any valid regulatory oversight. According to various sources, including WikiFX and Brokersome, Msmax does not hold any licenses from recognized regulatory authorities, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulation means that Msmax is not subject to the same rigorous oversight that regulated brokers face. This lack of accountability can lead to potential risks for traders, including the possibility of unfair practices or the mishandling of client funds. Moreover, the broker's low score of 1.41 out of 10 on WikiFX highlights the potential dangers associated with trading through an unregulated platform. Traders should be particularly cautious and consider the implications of trading with a broker that lacks regulatory legitimacy.

Company Background Investigation

Msmax is reportedly registered in St. Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment. Established in 2020, the company claims to offer a diverse range of trading services. However, the specifics regarding its ownership structure and management team remain vague, which can be a red flag for potential clients. Transparency in company operations is crucial for building trust, and Msmax's lack of clear information about its management can lead to concerns about its reliability.

The management team's background is another critical aspect of assessing the broker's credibility. A well-experienced team can significantly enhance a broker's reputation, but there is little publicly available information about the qualifications or expertise of Msmax's leadership. Without this information, traders may find it challenging to gauge the broker's commitment to ethical practices and customer service.

Trading Conditions Analysis

Msmax advertises competitive trading conditions, including low spreads and high leverage. However, the absence of detailed information about its fee structure raises concerns. Transparency regarding fees is vital for traders to make informed decisions and avoid unexpected costs.

| Fee Type | Msmax | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 0.2 - 0.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While Msmax claims to offer spreads starting from 0.1 pips, the lack of clarity regarding commissions and overnight interest rates can lead to confusion. Traders should be wary of any hidden fees that may not be disclosed upfront. Moreover, the broker's minimum deposit requirement of $10 is appealing, but it may also attract inexperienced traders who may not fully understand the risks involved in forex trading.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Msmax's website provides limited information about its security measures, which is a significant drawback. The absence of investor protection mechanisms, such as segregated accounts or negative balance protection, raises questions about how the broker safeguards client funds.

Traders should be aware that without proper fund protection, their investments could be at risk. Historical data on Msmax does not indicate any major financial disputes, but the lack of transparency regarding its financial practices could lead to potential issues in the future.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews for Msmax are mixed, with some users praising its trading platform, while others report issues with withdrawals and customer support. Common complaints include difficulties in accessing funds and a lack of responsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Limited Availability |

For instance, some traders have reported significant delays in processing withdrawal requests, which can be frustrating for clients who expect timely access to their funds. The quality of customer support is another area of concern, with many users noting that responses to inquiries are often slow or unhelpful. These issues can create a negative trading experience and contribute to the perception that Msmax may not be a trustworthy broker.

Platform and Execution

The trading platform offered by Msmax is based on MetaTrader 4, a widely recognized and respected platform in the forex industry. While MT4 is known for its reliability and user-friendly interface, concerns about execution quality have been raised. Some traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

The broker's claims of providing a seamless trading experience may not align with the experiences of all users. Traders should be cautious and consider the implications of potential execution issues when trading with Msmax.

Risk Assessment

Using Msmax comes with a range of risks that traders should carefully consider. The lack of regulation, limited transparency, and mixed customer reviews all contribute to a higher risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | Medium | Lack of information on fund protection |

| Customer Service Risk | High | Poor responsiveness and withdrawal issues |

To mitigate these risks, traders should conduct thorough research before committing funds to Msmax. It may also be advisable to start with a small investment to assess the broker's reliability before scaling up.

Conclusion and Recommendations

In conclusion, the investigation into Msmax raises several red flags regarding its safety and legitimacy. The absence of regulatory oversight, limited transparency, and mixed customer feedback suggest that traders should exercise caution when considering this broker. While Msmax may offer attractive trading conditions, the potential risks associated with trading through an unregulated platform cannot be overlooked.

For traders seeking a reliable and secure trading environment, it may be prudent to consider alternative brokers that are regulated by reputable authorities. Brokers such as OANDA, IG, or Forex.com offer robust regulatory frameworks and better customer support, making them safer choices for traders.

In summary, while Msmax may not necessarily be a scam, its lack of regulation and transparency raises significant concerns. Traders should carefully weigh these factors before deciding to open an account, and always prioritize safety and security when choosing a trading partner.

Is MSMAX a scam, or is it legit?

The latest exposure and evaluation content of MSMAX brokers.

MSMAX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MSMAX latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.