Is GeminiFx safe?

Business

License

Is GeminiFX Safe or a Scam?

Introduction

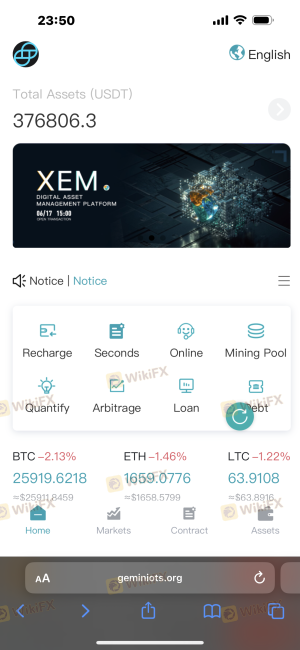

GeminiFX is a trading platform that has gained attention in the forex market, particularly among those looking for alternative trading options. As with any financial service provider, it is crucial for traders to thoroughly assess the legitimacy and safety of such platforms. The forex market is rife with scams and unregulated entities, making it imperative for traders to conduct due diligence before committing their funds. This article aims to evaluate the safety and reliability of GeminiFX by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risk profile. The investigation draws on various sources, including regulatory warnings, user reviews, and expert analyses.

Regulatory and Legality

One of the first steps in assessing whether GeminiFX is safe involves examining its regulatory status. Regulation is vital as it ensures that a broker adheres to specific standards that protect investors. A lack of regulation can be a significant red flag, indicating that a broker may not be trustworthy.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

Currently, GeminiFX does not hold any licenses from major financial regulatory bodies, which raises concerns about its legitimacy. The Financial Conduct Authority (FCA) in the UK has issued warnings against GeminiFX, indicating that the firm may be operating without proper authorization. This lack of regulatory oversight means that users of GeminiFX have limited recourse in the event of disputes or financial losses, making it a high-risk choice for traders.

The absence of a regulatory framework not only questions the safety of the trading environment but also suggests potential issues with transparency and accountability. Without the oversight of a regulatory body, traders may find it challenging to trust that their funds are managed responsibly. Therefore, it is essential to consider these factors when determining whether GeminiFX is safe.

Company Background Investigation

Understanding the company behind a trading platform is crucial in assessing its reliability. GeminiFX claims to offer a sophisticated trading experience but lacks transparency regarding its ownership and management team.

The company's history is vague, with limited information available about its establishment and operational practices. This obscurity raises questions about the legitimacy of its claims. Furthermore, a credible trading platform usually provides detailed information about its founders and management team, including their qualifications and experience in the financial industry.

When a broker does not disclose this information, it can lead to concerns about its trustworthiness. Transparency is a key indicator of a company's reliability, and GeminiFX appears to fall short in this regard. Therefore, potential users should be cautious and consider the implications of such opacity when evaluating whether GeminiFX is safe.

Trading Conditions Analysis

Examining the trading conditions offered by GeminiFX is essential for understanding the potential costs and risks associated with using the platform. A broker's fee structure can significantly impact a trader's profitability, making it crucial to analyze any unusual or problematic fees.

Core Trading Costs Comparison Table

| Fee Type | GeminiFX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Not Specified | 0.1% - 1.0% |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | 0.5% - 2.5% |

Currently, GeminiFX does not provide clear information regarding its fee structure, which is a significant concern. The lack of transparency in fees can lead to unexpected costs for traders, which is not typical of reputable brokers. Industry standards usually dictate that brokers should clearly outline any fees associated with trading, including spreads, commissions, and overnight interest rates.

Given that GeminiFX does not specify these costs, traders may find themselves facing hidden fees that can erode their profits. The absence of a clear fee structure raises further doubts about whether GeminiFX is safe for traders looking to maximize their investment returns.

Customer Fund Security

The safety of customer funds is paramount when evaluating any trading platform. GeminiFX's approach to securing customer funds is a critical factor in determining its reliability.

A trustworthy broker typically employs measures such as segregated accounts to protect client funds, ensuring that investor money is kept separate from the broker's operational funds. Additionally, reputable brokers often offer negative balance protection, which prevents traders from losing more money than they have deposited.

However, there is no available information indicating that GeminiFX implements such security measures. The lack of transparency regarding fund protection policies raises significant concerns about the safety of customer investments. Historical issues related to fund security can also be a red flag; if a broker has faced complaints or disputes regarding fund access or withdrawals, it is crucial to take those into account.

In light of these factors, traders should carefully consider whether GeminiFX is safe for their investments, particularly given the potential for financial loss without adequate protections in place.

Customer Experience and Complaints

User feedback can provide valuable insights into the reliability of a trading platform. Analyzing customer experiences with GeminiFX reveals a mixed bag of opinions, with several users expressing concerns about the platform's operations.

Common Complaint Types and Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Average |

| Transparency Concerns | High | Poor |

A significant number of complaints revolve around difficulties with withdrawals, which is a critical aspect of any trading experience. Users have reported issues accessing their funds, raising serious questions about the platform's reliability. Additionally, many users have noted a lack of responsive customer support, which can exacerbate issues when traders encounter problems.

These complaints highlight potential risks associated with GeminiFX, suggesting that traders may face challenges in retrieving their funds or receiving timely assistance. Given these factors, it is crucial for potential users to weigh these experiences when determining whether GeminiFX is safe.

Platform and Trade Execution

The performance of a trading platform is another essential factor in evaluating its reliability. An effective trading platform should offer stable performance, quick order execution, and minimal slippage.

However, there are concerns regarding the execution quality at GeminiFX. Users have reported instances of significant slippage and order rejections, which can adversely affect trading outcomes. Such issues can be particularly detrimental in fast-moving markets where timely execution is crucial.

Additionally, any signs of platform manipulation, such as consistently poor execution or unexpected changes in pricing, can further erode trust in a trading platform. Traders should be particularly vigilant about these aspects when considering whether GeminiFX is safe.

Risk Assessment

Engaging with any trading platform involves inherent risks. Understanding the specific risks associated with GeminiFX is crucial for traders looking to protect their investments.

Risk Rating Summary Table

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Fund Security Risk | High | Lack of clear fund protection measures |

| Transparency Risk | Medium | Limited information about operations |

| Execution Risk | High | Issues with order execution and slippage |

Given the high-risk levels across multiple categories, it is essential for traders to approach GeminiFX with caution. To mitigate these risks, potential users should consider diversifying their investments, using smaller amounts when starting, and exploring alternative, regulated trading platforms.

Conclusion and Recommendations

In conclusion, the investigation into GeminiFX reveals several red flags that raise concerns about its safety and reliability. The lack of regulatory oversight, opaque fee structures, and negative user experiences suggest that potential traders should exercise caution.

While some traders may still choose to engage with GeminiFX, it is crucial to remain aware of the inherent risks involved. For those seeking a more secure trading environment, it may be advisable to consider alternative platforms with established regulatory frameworks and positive user feedback.

Ultimately, the question remains: Is GeminiFX safe? The evidence suggests that traders should be wary and conduct thorough research before committing their funds to this platform.

Is GeminiFx a scam, or is it legit?

The latest exposure and evaluation content of GeminiFx brokers.

GeminiFx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GeminiFx latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.