Is Goldman Capital safe?

Pros

Cons

Is Goldman Capital Safe or Scam?

Introduction

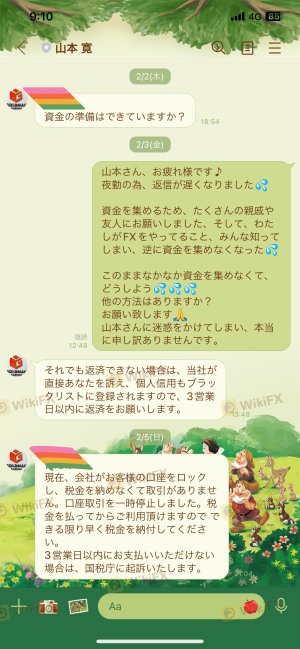

Goldman Capital is a forex broker that has emerged in the financial services sector, positioning itself as a provider of various trading opportunities. However, as the forex market continues to attract both seasoned traders and novices, the importance of conducting thorough due diligence on brokers cannot be overstated. With numerous reports of scams and fraudulent activities in the industry, traders must be vigilant in assessing the credibility and safety of their chosen brokers. This article aims to analyze whether Goldman Capital is a safe trading option or a potential scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

To investigate Goldman Capital's legitimacy, we utilized a comprehensive framework that includes an analysis of its regulatory environment, company history, customer feedback, and market practices. This structured approach allows us to provide a balanced view of the broker's operations and to determine its standing in the forex community.

Regulation and Legitimacy

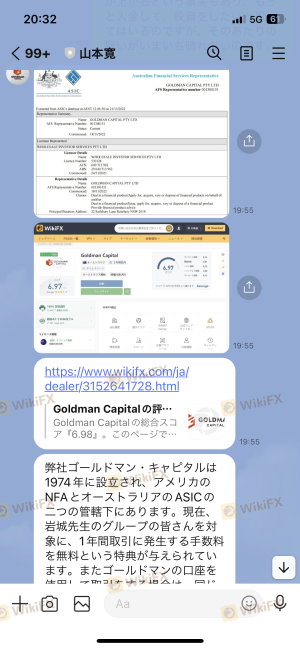

The regulatory status of a broker is a critical factor in assessing its safety and credibility. A well-regulated broker typically adheres to strict operational guidelines, ensuring the protection of traders' funds and promoting fair trading practices. Unfortunately, Goldman Capital's regulatory standing raises significant concerns.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | Suspicious Clone | Australia | Not Valid |

Goldman Capital claims to be regulated by the Australian Securities and Investments Commission (ASIC). However, reports indicate that its ASIC license is a "suspicious clone," suggesting that it may not be a legitimate regulatory entity. This lack of valid regulation means that Goldman Capital does not provide the necessary oversight that reputable brokers are required to maintain. Furthermore, the absence of a functional website and direct contact options further complicates the verification of its claims.

The implications of being unregulated are profound. Traders using Goldman Capital may find themselves vulnerable to various risks, including the potential loss of their investments without any recourse for recovery. Given these factors, it is imperative to approach Goldman Capital with caution, as the lack of credible regulation raises serious questions about its reliability.

Company Background Investigation

Goldman Capital's history and ownership structure are vital components in evaluating its legitimacy. The broker claims to have been established within the last couple of years, but the lack of comprehensive information regarding its founders and management team is concerning.

The absence of transparency in its operations raises red flags about the broker's intentions and credibility. A legitimate broker typically provides detailed information about its history, operational practices, and management team, which helps build trust with potential clients. In Goldman Capital's case, the limited available information suggests a lack of transparency that could indicate underlying issues.

Additionally, the company's claims of being an internationally renowned financial service provider seem exaggerated, especially given the reports of customer complaints and withdrawal difficulties. Without a clear understanding of its operational history and management expertise, it is challenging to ascertain whether Goldman Capital is a trustworthy broker or a facade for fraudulent activities.

Trading Conditions Analysis

Evaluating the trading conditions offered by Goldman Capital is essential for understanding its operational model and potential costs to traders. The broker claims to provide competitive trading conditions; however, the specifics of its fee structure remain unclear.

Trading Costs Comparison Table

| Cost Type | Goldman Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3.0 pips | 1.5 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | 0.5% - 2.0% |

The spreads offered by Goldman Capital appear significantly higher than the industry average, which could lead to increased trading costs for clients. High spreads can erode potential profits, making it difficult for traders to succeed in the long term. Moreover, the lack of clarity regarding commissions and overnight interest rates further complicates the cost analysis for prospective clients.

Unusual fees, such as withdrawal charges or hidden commissions, can also be indicative of a broker's intentions. In the case of Goldman Capital, the absence of clear information about these costs raises concerns about potential exploitation of traders. Without transparency in its fee structure, traders may find themselves facing unexpected charges that could impact their overall trading experience.

Customer Funds Safety

The safety of customer funds is a paramount concern when assessing any broker. A reputable broker typically employs measures such as segregated accounts, investor protection schemes, and negative balance protection to ensure the safety of client funds.

Unfortunately, Goldman Capital's practices in this area are unclear. There is no available information on whether the broker utilizes segregated accounts to protect client funds from operational risks. Additionally, the absence of investor protection mechanisms raises alarms about the potential for significant losses in the event of the broker's insolvency.

Historical issues related to fund safety can also provide insights into a broker's reliability. Reports of clients being unable to withdraw their funds from Goldman Capital are particularly troubling and suggest a lack of accountability. Such incidents are often indicative of a broker that may not prioritize the security and well-being of its clients, further reinforcing the need for caution when considering Goldman Capital as a trading partner.

Customer Experience and Complaints

Analyzing customer feedback and experiences is crucial for understanding the overall sentiment surrounding Goldman Capital. A significant number of complaints have been reported, particularly concerning withdrawal issues and unresponsive customer service.

Complaint Types and Severity Assessment

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Poor |

| Lack of Communication | Medium | Poor |

| Misleading Information | High | Poor |

The predominant complaint among users is the difficulty in withdrawing funds, with many traders reporting that their requests go unanswered or are met with arbitrary excuses. This pattern of behavior is a major red flag, as it indicates a potential scam operation designed to trap clients' funds rather than facilitate legitimate trading activities.

Additionally, the lack of effective communication channels, such as live chat or phone support, exacerbates the situation. Customers often feel abandoned when they encounter issues, leading to frustration and distrust in the broker's operations.

Platform and Trade Execution

The performance and reliability of the trading platform are critical factors in a trader's experience. A robust platform should offer stability, quick order execution, and a user-friendly interface.

Goldman Capital's platform, however, has been described as basic and lacking essential features that are standard among reputable brokers. Users have reported issues with order execution, including slippage and rejected orders, which can severely impact trading performance. The absence of advanced trading tools, such as MetaTrader 4 or 5, further limits traders' ability to analyze the market effectively.

The potential for platform manipulation is also a concern. Traders should be wary of brokers that do not provide transparent information about their trading infrastructure, as this can be indicative of underlying issues that may affect the integrity of the trading environment.

Risk Assessment

Using Goldman Capital involves various risks that traders must consider before investing their funds. The combination of unregulated status, poor customer feedback, and unclear trading conditions contributes to an overall high-risk profile for this broker.

Risk Rating Summary Table

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation, potential for fraud. |

| Financial Risk | High | Reports of withdrawal issues and fund safety concerns. |

| Operational Risk | Medium | Lack of transparency and customer support. |

To mitigate these risks, traders should exercise extreme caution when dealing with Goldman Capital. It may be wise to consider alternative, well-regulated brokers that provide a safer trading environment and better customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that Goldman Capital presents several warning signs that indicate it may not be a safe trading option. The lack of valid regulation, coupled with numerous complaints regarding fund withdrawals and poor customer service, raises serious concerns about the broker's legitimacy.

For traders considering their options, it is advisable to avoid Goldman Capital and seek out brokers with a proven track record of reliability and transparency. Reputable alternatives include well-regulated brokers like XM, Plus500, and eToro, which offer competitive trading conditions and robust customer support.

In light of the findings, it is clear that Goldman Capital is not safe for traders seeking a trustworthy forex broker. Caution is paramount, and potential clients should prioritize their financial security by choosing regulated and reputable trading platforms.

Is Goldman Capital a scam, or is it legit?

The latest exposure and evaluation content of Goldman Capital brokers.

Goldman Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Goldman Capital latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.