Is FXT Brokers safe?

Business

License

Is FXT Brokers a Scam?

Introduction

FXT Brokers is a trading platform that positions itself as a provider of forex and cryptocurrency trading services. It offers a variety of account types, appealing to both novice and experienced traders. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The importance of thorough evaluations cannot be overstated, as many traders have fallen victim to scams in the past. This article aims to analyze FXT Brokers' legitimacy through a comprehensive investigation, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

A broker's regulatory status is crucial for ensuring the safety and security of traders' funds. FXT Brokers claims to be based in the United Kingdom, but it lacks regulation from any reputable authority. This absence of oversight raises significant concerns about its legitimacy and operational integrity. Below is a summary of the regulatory information regarding FXT Brokers:

| Regulator | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The lack of regulation means that FXT Brokers does not adhere to the strict standards imposed by financial authorities, such as capital requirements, client fund segregation, and compliance with anti-money laundering (AML) practices. This unregulated status is a red flag, as it suggests that the broker may not be held accountable for any misconduct or mismanagement of client funds. Furthermore, several regulatory bodies, including the Financial Market Authority (FMA) in Austria, have blacklisted FXT Brokers for operating without authorization. This history of non-compliance further diminishes the broker's credibility.

Company Background Investigation

FXT Brokers was established relatively recently, and its ownership structure remains unclear. The company claims to provide comprehensive trading solutions, yet there is little transparency regarding its management team. The absence of publicly available information about key personnel raises questions about their experience and qualifications in the financial sector. A lack of transparency can often indicate underlying issues within a company, making it difficult for potential clients to trust the broker.

Moreover, the company's operational history is marred by complaints from users who have faced difficulties with withdrawals and customer support. This history of negative feedback suggests that FXT Brokers may not be a reliable partner for traders seeking a trustworthy platform. In the absence of solid evidence about the company's stability and management, it is prudent for traders to approach FXT Brokers with caution.

Trading Conditions Analysis

FXT Brokers presents a variety of trading conditions, including high leverage ratios and different account types. However, the overall fee structure raises concerns. Below is a comparison of FXT Brokers' core trading costs:

| Fee Type | FXT Brokers | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.4 pips | 1.0 – 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While FXT Brokers offers competitive spreads, the lack of clarity regarding commissions and overnight interest can be problematic. Traders may find themselves facing unexpected fees that could significantly impact their profitability. Additionally, the high leverage of 1:500 can be enticing, but it also amplifies risk, particularly for inexperienced traders. The potential for significant losses increases when trading with such high leverage, making it essential for traders to implement robust risk management strategies.

Customer Fund Security

The safety of customer funds is paramount when evaluating a broker. FXT Brokers does not provide sufficient information about its fund security measures, which is concerning. Without regulatory oversight, there are no guarantees that client funds are held in segregated accounts or protected by investor compensation schemes. The absence of negative balance protection policies further exposes traders to potential losses that exceed their initial deposits.

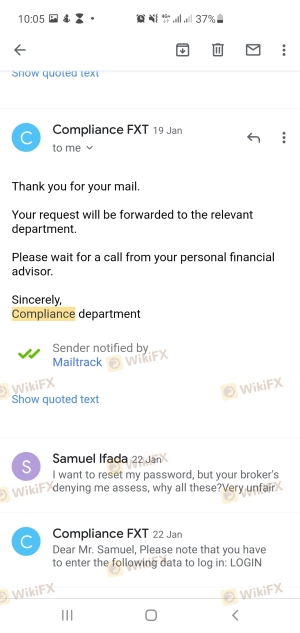

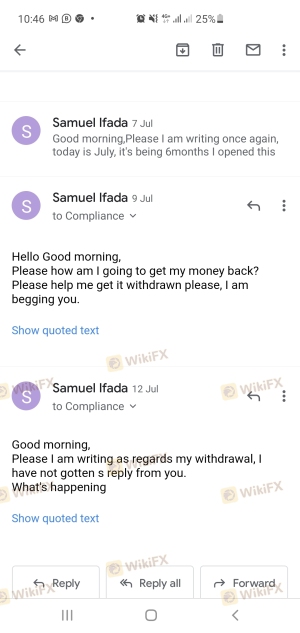

Historically, FXT Brokers has faced allegations of mishandling client funds, with reports of delayed withdrawals and unresponsive customer service. Such issues can lead to severe financial repercussions for traders, making it crucial to assess a broker's fund security measures before engaging in trading activities.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. FXT Brokers has received mixed reviews, with many users expressing dissatisfaction with the level of service provided. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | High | Poor |

| Misleading Promotions | Medium | Poor |

One notable case involved a trader who experienced significant difficulties when attempting to withdraw funds. After initially receiving positive returns, the trader was unable to access their account and faced unresponsive customer service. This pattern of complaints suggests a troubling trend, indicating that FXT Brokers may not prioritize customer support or transparency.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for a successful trading experience. FXT Brokers offers the widely recognized MetaTrader 5 platform, which is known for its comprehensive trading tools and features. However, user experiences indicate that the platform may suffer from stability issues, including slippage and order rejections. Such problems can significantly hinder trading performance, particularly in volatile market conditions.

Additionally, there are concerns about potential platform manipulation, as some users have reported discrepancies between expected and executed trade prices. These issues could further undermine traders' confidence in FXT Brokers and its trading environment.

Risk Assessment

Engaging with FXT Brokers presents several risks that potential traders should be aware of. Below is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection for funds. |

| Fund Security Risk | High | Lack of fund segregation and investor protection. |

| Customer Service Risk | Medium | Poor responsiveness and support from the broker. |

| Platform Risk | Medium | Potential stability issues and trade execution problems. |

To mitigate these risks, traders should conduct thorough research, consider using regulated brokers, and implement strict risk management strategies when trading.

Conclusion and Recommendations

In conclusion, the evidence suggests that FXT Brokers exhibits several red flags that indicate it may not be a safe trading environment. The absence of regulation, coupled with a history of customer complaints and insufficient transparency, raises serious concerns about the broker's legitimacy. Therefore, traders are advised to exercise extreme caution when considering FXT Brokers for their trading activities.

For those seeking reliable alternatives, it is recommended to explore brokers that are regulated by reputable authorities, such as the FCA, ASIC, or CySEC. These brokers offer a higher level of security, transparency, and customer support, making them more suitable for traders looking to safeguard their investments. Ultimately, the decision to engage with FXT Brokers should be approached with careful consideration of the associated risks and potential consequences.

Is FXT Brokers a scam, or is it legit?

The latest exposure and evaluation content of FXT Brokers brokers.

FXT Brokers Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXT Brokers latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.