Is Kemik safe?

Pros

Cons

Is Kemik Safe or Scam?

Introduction

In the rapidly evolving landscape of forex trading, the emergence of numerous brokers has made it increasingly challenging for traders to identify trustworthy platforms. One such broker is Kemik, which claims to offer a range of trading services, including forex and cryptocurrency trading. However, the need for caution cannot be overstated, as the forex market has its share of unscrupulous entities seeking to exploit unsuspecting traders. This article aims to provide an objective assessment of whether Kemik is a safe broker or a potential scam. Our investigation is based on a thorough analysis of regulatory compliance, company background, trading conditions, customer feedback, and security measures.

Regulation and Legitimacy

A broker's regulatory status is one of the most critical factors influencing its legitimacy. Regulation serves as a safeguard for traders, ensuring that brokers adhere to industry standards and best practices. Unfortunately, Kemik does not provide any information regarding its regulatory status, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of regulatory oversight implies that Kemik operates without the accountability that comes with being regulated. Regulated brokers are required to maintain a certain level of transparency, including the disclosure of their financial standing and operational practices. In contrast, Kemik has not provided any details about its registration or compliance with regulatory bodies. This lack of transparency is a red flag for potential investors, as it suggests that the broker may not be subject to the rigorous checks and balances that protect traders' interests. As a result, it is advisable to approach Kemik with caution, as the absence of regulation significantly increases the risk of fraud or mismanagement.

Company Background Investigation

Understanding the company behind a trading platform is crucial for evaluating its trustworthiness. Kemik has not disclosed significant information about its history, ownership structure, or management team. This lack of transparency makes it difficult for traders to ascertain the broker's reliability and operational integrity.

Many reputable brokers provide insights into their management teams, including their professional backgrounds and experience in the financial industry. However, Kemik fails to deliver such information, leaving potential clients in the dark regarding who is managing their investments. The absence of a clear ownership structure can often indicate a lack of accountability, which is essential for any financial service provider.

Moreover, the absence of contact information, such as a physical address, phone number, or email, further complicates matters. Traders may find it challenging to reach out for support or to resolve issues, which is a critical aspect of a broker's responsibility. Given these factors, the lack of a transparent company background raises serious questions about whether Kemik is safe to use.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is paramount. This includes the fee structure, spreads, and commissions. Kemik presents itself as a competitive broker, but the lack of clear information regarding its trading fees raises concerns.

| Fee Type | Kemik | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific figures for spreads and commissions makes it difficult to assess the overall cost of trading with Kemik. Traders should be wary if a broker does not provide clear and upfront information about its fees, as hidden charges can eat into profits and lead to unexpected losses. Additionally, the lack of a transparent fee structure may indicate that Kemik could impose unfavorable trading conditions on its clients.

Furthermore, the absence of details about overnight interest rates and other potential fees can lead to confusion and mismanagement of trader expectations. A broker that is not transparent about its fee structure may not have the best interests of its clients in mind. Therefore, the lack of clarity regarding trading conditions raises significant concerns about whether Kemik is safe for traders looking to invest their money.

Customer Funds Security

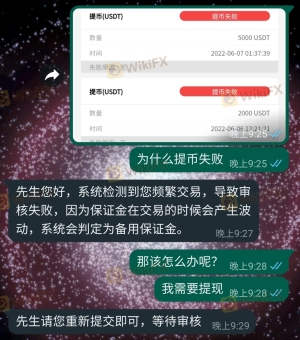

The safety of customer funds is a paramount concern for any trader considering a broker. Kemik has not provided sufficient information regarding its security measures for client funds. Effective fund security practices typically include the segregation of client accounts, investor protection schemes, and negative balance protection policies.

Kemik does not appear to implement any of these essential safety measures. The lack of information about fund segregation raises concerns about the potential misuse of client funds. In regulated environments, brokers are required to keep client funds in separate accounts, ensuring that traders' money is not used for the broker's operational expenses. However, without any regulatory oversight, Kemik may not be bound by such obligations.

Additionally, the absence of investor protection schemes means that traders may not have recourse in the event of a broker default. This lack of protection can lead to significant financial losses for traders who may find themselves unable to recover their investments. Given these factors, it is crucial for potential clients to consider whether Kemik is truly safe for their funds.

Customer Experience and Complaints

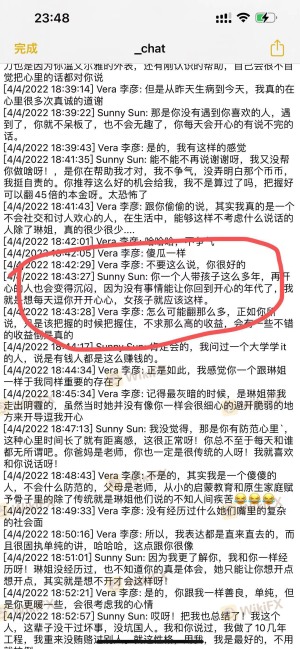

Customer feedback is an essential indicator of a broker's reliability and service quality. Unfortunately, Kemik has received numerous negative reviews and complaints from users, highlighting a pattern of issues that potential clients should be aware of.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | High | Poor |

| Misleading Promotions | Medium | Poor |

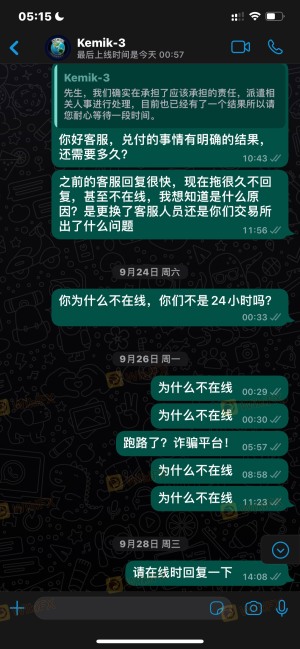

Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and accusations of misleading promotions. Many traders have reported being unable to access their funds after making deposits, which raises significant concerns about the broker's operational integrity. Additionally, the lack of effective customer support can leave traders feeling abandoned and frustrated, particularly when they encounter issues that require immediate attention.

For instance, one user reported attempting to withdraw funds for several months without success, only to receive vague responses from customer service. This type of experience is alarming and suggests that Kemik may not prioritize its clients' needs. The accumulation of negative feedback indicates that potential users should be cautious when considering whether Kemik is safe for trading.

Platform and Execution

The performance of a trading platform is crucial for traders, as it directly impacts their trading experience. Kemik claims to offer a proprietary trading platform, but details about its performance, stability, and user experience are scarce.

Traders have reported issues with order execution, including slippage and rejected orders. Such problems can significantly affect trading outcomes, particularly for those employing high-frequency trading strategies. Moreover, the absence of information regarding the platform's stability raises concerns about potential downtime or technical failures that could disrupt trading activities.

Furthermore, there are indications that Kemik may not provide the level of transparency expected from reputable brokers. Traders should be cautious of platforms that do not offer clear information about their execution quality, as this can be a sign of potential manipulation or subpar service.

Risk Assessment

Using Kemik as a trading platform presents several risks that potential clients should carefully consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | Lack of transparency regarding fund protection. |

| Customer Service Risk | High | Numerous complaints about withdrawal issues. |

| Trading Conditions Risk | Medium | Unclear fee structure and potential hidden charges. |

Given these risks, traders should exercise extreme caution when considering whether Kemik is safe for their trading activities. It is advisable to conduct thorough research and to consider alternative brokers that offer better protection and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that Kemik may not be a safe broker for traders. The lack of regulatory oversight, transparency regarding company operations, and numerous customer complaints indicate a high level of risk associated with using this platform. Traders should be particularly wary of the withdrawal issues reported by users, as this can lead to significant financial losses.

For those seeking to engage in forex trading, it is recommended to consider regulated brokers with a proven track record of reliability and customer service. Alternatives that are well-regulated and transparent in their operations would provide a more secure trading environment. Ultimately, the decision to trade with Kemik should be approached with caution, as the potential for loss may outweigh any perceived benefits.

Is Kemik a scam, or is it legit?

The latest exposure and evaluation content of Kemik brokers.

Kemik Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Kemik latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.