Is FMIL safe?

Pros

Cons

Is FMIL Safe or Scam?

Introduction

FMIL, short for Fullerton Markets International Limited, positions itself within the highly competitive forex trading market, claiming to provide a platform for traders to engage in various financial instruments. As the forex market continues to expand, it becomes increasingly important for traders to carefully evaluate the legitimacy and safety of brokers they choose to work with. With numerous reports of scams and fraudulent activities in the industry, the need for thorough due diligence cannot be overstated. This article aims to assess whether FMIL is a reliable broker or if it falls into the category of scams. Our evaluation is based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer experiences, and risk assessments.

Regulatory and Legitimacy

The regulatory status of a broker is a critical factor that traders must consider when determining if a broker is safe. FMIL has been flagged as a “suspicious clone” by various regulatory bodies, indicating that it may not operate under legitimate oversight. According to sources, it is purportedly registered in the United Kingdom but lacks a valid license from a top-tier regulatory authority. Below is a summary of the regulatory information regarding FMIL:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Suspicious Clone |

The lack of proper regulation raises significant concerns regarding the safety of funds and the overall integrity of FMILs operations. Regulatory bodies play a crucial role in ensuring that brokers adhere to strict standards that protect traders from fraud and malpractice. The absence of a credible license from a recognized authority such as the FCA (Financial Conduct Authority) in the UK suggests that FMIL may not be compliant with necessary regulations, which is a red flag for potential investors.

Company Background Investigation

FMIL's history and ownership structure offer further insight into its legitimacy. The company claims to have been in operation for several years, but the details surrounding its inception and ownership remain vague. A lack of transparency in this area can often be a warning sign for potential traders.

The management team‘s background is equally important. Information regarding the qualifications and experience of FMIL’s leadership is limited, which raises questions about their expertise in the financial sector. A competent management team is essential for ensuring that a brokerage operates smoothly and adheres to industry standards. Furthermore, the companys transparency regarding its operational practices and financial disclosures is crucial in building trust with clients.

In summary, the lack of clear information about FMILs history and ownership, combined with the absence of a reputable regulatory license, contributes to concerns about its credibility and safety.

Trading Conditions Analysis

When evaluating whether FMIL is safe, it is essential to analyze its trading conditions, including fees and commissions. A broker's fee structure can significantly impact a trader's profitability. FMIL claims to offer competitive spreads and low commissions; however, several reviews indicate that traders have encountered unexpected fees and charges. Below is a comparison of FMIL's core trading costs:

| Fee Type | FMIL | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 pips |

| Commission Model | N/A | $5 per lot |

| Overnight Interest Range | N/A | 0.5% |

The absence of clear information regarding these fees raises concerns about potential hidden costs that could affect traders bottom lines. Additionally, the lack of transparency regarding how these fees are applied can lead to confusion and mistrust among clients. Such practices are often associated with brokers that are not fully committed to providing a fair trading environment.

Client Funds Safety

The safety of client funds is paramount when assessing whether FMIL is safe. A reputable broker should implement robust measures to protect client deposits and ensure that funds are kept secure. FMIL claims to offer segregated accounts for client funds, which is a standard practice among legitimate brokers. However, the lack of regulatory oversight raises questions about the effectiveness of these measures.

Investors should also consider whether FMIL provides investor protection schemes, such as negative balance protection. This feature is crucial for safeguarding traders against significant losses that could exceed their initial deposits. Unfortunately, there is little information available regarding FMIL's policies on these matters, which is concerning for potential clients.

Moreover, historical data indicates that some users have reported issues with fund withdrawals, which is a common complaint among traders dealing with unregulated brokers. Such reports further contribute to the perception that FMIL may not be a safe choice for forex trading.

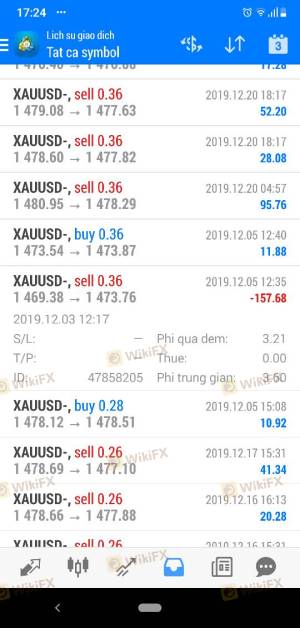

Customer Experience and Complaints

Analyzing customer feedback is vital in determining whether FMIL is safe. A thorough examination of online reviews reveals a mixed bag of experiences from users. While some traders report satisfactory experiences, others have voiced serious concerns regarding the quality of customer support and the handling of complaints.

Common complaints include issues with account freezes, withdrawal difficulties, and unresponsive customer service. Below is a summary of the main types of complaints received about FMIL:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Freezes | Medium | Unresponsive |

| Customer Service Complaints | High | Poor |

Two notable cases involve users who experienced prolonged delays in fund withdrawals, leading to frustration and financial loss. Such patterns of complaints indicate potential systemic issues within FMIL's operations, further questioning its reliability as a broker.

Platform and Trade Execution

The performance of a trading platform is crucial for a positive trading experience. FMIL claims to offer a user-friendly trading platform with advanced features; however, user reviews suggest that the platform may suffer from stability issues and occasional downtime.

Order execution quality is another critical aspect to consider. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes. Such issues are often indicative of poor platform management and may suggest that FMIL does not prioritize the trading experience of its clients.

Risk Assessment

When evaluating whether FMIL is safe, it is essential to consider the overall risk associated with trading with this broker. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation raises significant concerns. |

| Financial Risk | Medium | Unclear fee structure may lead to unexpected costs. |

| Operational Risk | High | Reports of withdrawal issues and platform instability. |

To mitigate risks while trading with FMIL, potential clients are advised to conduct thorough research, start with a small investment, and remain vigilant regarding their trading activities.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about whether FMIL is safe or a scam. The lack of regulatory oversight, combined with reports of customer complaints and operational issues, suggests that traders should exercise caution when considering this broker.

For traders seeking a reliable forex trading experience, it is advisable to explore alternatives that are regulated by reputable authorities and have a proven track record of customer satisfaction. Some recommended alternatives include brokers that are overseen by the FCA, ASIC, or similar regulatory bodies, ensuring a higher level of safety and transparency for traders.

Ultimately, it is critical for traders to prioritize their safety and choose brokers that demonstrate a commitment to ethical practices and regulatory compliance.

Is FMIL a scam, or is it legit?

The latest exposure and evaluation content of FMIL brokers.

FMIL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FMIL latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.