Regarding the legitimacy of GKFX Prime forex brokers, it provides MFSA, SERC, CNMV, FSC and WikiBit, (also has a graphic survey regarding security).

Is GKFX Prime safe?

Pros

Cons

Is GKFX Prime markets regulated?

The regulatory license is the strongest proof.

MFSA Market Making License (MM)

Malta Financial Services Authority

Malta Financial Services Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

TRIVE FINANCIAL SERVICES EUROPE LTD.

Effective Date: Change Record

2013-06-12Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://trive.comExpiration Time:

--Address of Licensed Institution:

FLOOR 5, THE PENTHOUSE, LIFESTAR, TESTAFERRATA STREET, TA XBIEX MALTA XBX1403Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

SERC Derivatives Trading License (EP)

Securities and Exchange Regulator of Cambodia

Securities and Exchange Regulator of Cambodia

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

GKFX (Cambodia) Co., Ltd

Effective Date:

--Email Address of Licensed Institution:

james.sida@gkfxcambodia.comSharing Status:

No SharingWebsite of Licensed Institution:

http://www.gkfxcambodia.comExpiration Time:

--Address of Licensed Institution:

No. 13, St. 608, Sankat Beoung Kokll, Khan Toul Kok, Phnom Penh.Phone Number of Licensed Institution:

068 999 026, 090 666 026Licensed Institution Certified Documents:

CNMV Market Making License (MM)

Comisión Nacional del Mercado de valores

Comisión Nacional del Mercado de valores

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

GKFX FINANCIAL SERVICES LIMITED, SUCURSAL EN ESPAÑA

Effective Date:

2013-08-08Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

soportegkfx.comExpiration Time:

2019-07-08Address of Licensed Institution:

SERRANO, 38, 4ª PLANTAPhone Number of Licensed Institution:

915752504Licensed Institution Certified Documents:

FSC Market Making License (MM)

British Virgin Islands Financial Services Commission

British Virgin Islands Financial Services Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Trive International Ltd.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is GKFX Prime A Scam?

Introduction

GKFX Prime is a forex and CFD broker that has positioned itself in the competitive landscape of online trading since its establishment in 2012. Operating under the umbrella of the Global Kapital Group, GKFX Prime offers a range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. However, in an industry rife with scams and unreliable brokers, it is crucial for traders to exercise caution and conduct thorough evaluations before engaging with any trading platform. This article aims to provide a comprehensive analysis of GKFX Prime's legitimacy, focusing on its regulatory status, company background, trading conditions, customer fund security, customer experiences, and risk assessment. Our investigation draws from various sources, including user reviews, regulatory data, and expert analyses, ensuring a balanced and objective evaluation.

Regulation and Legitimacy

The regulatory framework surrounding a broker is a critical aspect that directly impacts its legitimacy and the safety of client funds. GKFX Prime claims to be regulated by multiple authorities, including the Financial Services Commission (FSC) of the British Virgin Islands (BVI) and the Securities and Exchange Commission (SECC) of Cambodia. However, the effectiveness and stringency of these regulatory bodies are often questioned.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Commission (FSC) | BVI SIBA/L/1066 | British Virgin Islands | Active |

| Securities and Exchange Commission (SECC) | 026 | Cambodia | Active |

The FSC is known for its relatively lenient regulatory requirements, which may not provide the same level of investor protection as more stringent regulators such as the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). Additionally, several reviews have categorized GKFX Prime as a "suspicious clone," indicating potential issues with the authenticity of its claimed licenses. This lack of robust regulatory oversight raises concerns about GKFX Prime's practices and the safety of client funds.

Company Background Investigation

GKFX Prime is part of the Global Kapital Group, which has established a presence in various international markets. The broker's operational history since 2012 has seen it grow its client base, but the ownership structure and management team raise questions about transparency. While the Global Kapital Group is recognized in the financial sector, detailed information about the management team and their qualifications is not readily available.

The company's transparency regarding its operations, including the disclosure of management experience and business practices, is critical for building trust with potential clients. The absence of comprehensive information can hinder investors from making informed decisions, especially for those new to trading. A broker that operates under opaque conditions may be perceived as less trustworthy, leading to skepticism among potential clients.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and spreads, is essential. GKFX Prime offers various account types, including Standard Fixed, Standard Variable, VIP Variable, and ECN Zero accounts. Each account type has its own fee structure and trading conditions.

| Fee Type | GKFX Prime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips (Standard Fixed) | 1.0-1.5 pips |

| Commission Model | $10 per lot (ECN) | $7 per lot |

| Overnight Interest Range | Varies based on position | Varies |

The spreads offered by GKFX Prime, particularly on the Standard Fixed account, are higher than the industry average, which may not be attractive to cost-conscious traders. Additionally, the ECN account, while providing tighter spreads, incurs a commission that might deter some traders. The overall cost structure suggests that while GKFX Prime offers competitive options, the higher fees could be a drawback for many users.

Customer Fund Security

The safety of client funds is paramount when choosing a broker. GKFX Prime claims to implement various measures to protect customer funds, including segregating client accounts from operational funds. However, the absence of negative balance protection and the reliance on a less stringent regulatory framework raise concerns about the overall safety of client deposits.

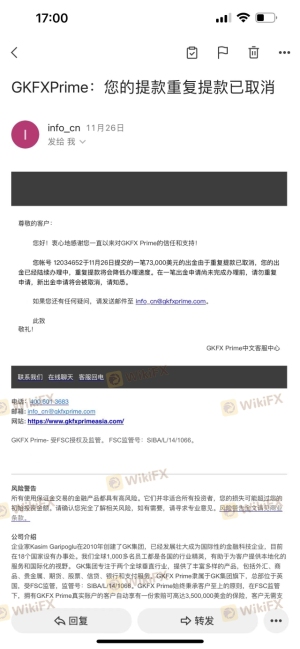

While GKFX Prime does maintain that it segregates funds, the lack of oversight from a robust regulatory authority, coupled with the high leverage options offered (up to 1000:1), poses a risk of significant losses for traders. Historical issues regarding fund security, including complaints about withdrawal difficulties, further exacerbate concerns about the safety of trading with GKFX Prime.

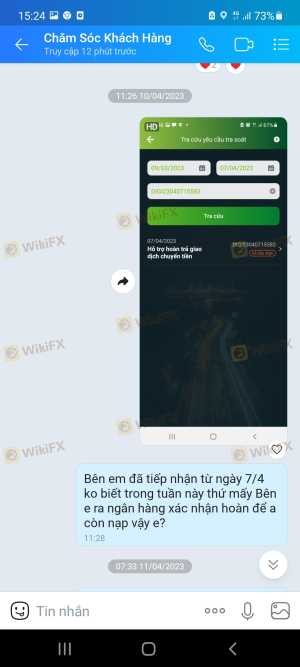

Customer Experience and Complaints

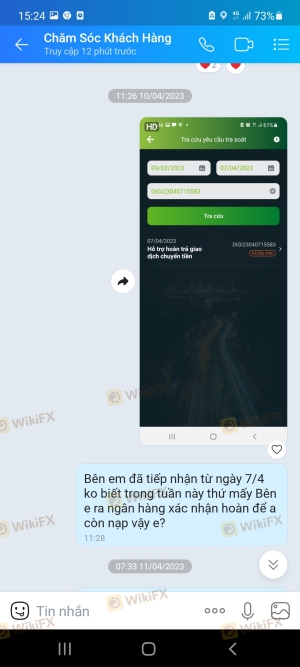

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews and testimonials regarding GKFX Prime reveal a mixed bag of experiences. While some traders report satisfactory experiences with the platform, others have raised serious concerns regarding withdrawal issues and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Slow response times |

| Account Blocking | High | Unresolved issues |

| Poor Customer Support | Medium | Largely unresponsive |

Notably, several users have reported being unable to withdraw funds or encountering delays in processing requests. This pattern of complaints indicates a potential systemic issue within the broker's operational framework, which could deter potential clients from trusting GKFX Prime with their investments.

Platform and Trade Execution

The performance and reliability of the trading platform are critical for traders. GKFX Prime offers the widely-used MetaTrader 4 and MetaTrader 5 platforms, which are known for their robust features and customizability. However, the execution quality, including slippage and order rejection rates, has been a point of contention among users.

Reports of significant slippage during volatile market conditions and instances of rejected orders have surfaced, raising concerns about the broker's execution practices. Such issues can severely impact trading outcomes, particularly for scalpers and high-frequency traders who rely on precise execution.

Risk Assessment

Trading with GKFX Prime comes with inherent risks, particularly due to the broker's regulatory status and customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Oversight | High | Weak regulatory framework raises concerns. |

| Fund Security | High | Lack of negative balance protection and withdrawal issues. |

| Execution Quality | Medium | Reports of slippage and order rejections. |

| Customer Support | Medium | Mixed reviews on responsiveness and effectiveness. |

To mitigate these risks, traders are advised to conduct thorough research, utilize demo accounts, and start with smaller investments until they are confident in the broker's reliability.

Conclusion and Recommendations

In conclusion, while GKFX Prime presents itself as a legitimate broker with a range of trading options, several red flags warrant caution. The lack of robust regulatory oversight, combined with numerous complaints about fund security and customer support, suggests that potential clients should approach this broker with care.

For traders looking for reliability and security, it may be prudent to consider alternative brokers with stronger regulatory backgrounds and better customer reviews. Brokers such as IG, OANDA, and Forex.com have established reputations and regulatory frameworks that provide greater peace of mind for traders.

Ultimately, the decision to trade with GKFX Prime should be made with careful consideration of the associated risks and a thorough understanding of the broker's operational practices.

Is GKFX Prime a scam, or is it legit?

The latest exposure and evaluation content of GKFX Prime brokers.

GKFX Prime Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GKFX Prime latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.