Is Evolve Markets safe?

Pros

Cons

Is Evolve Markets Safe or Scam?

Introduction

Evolve Markets is an online trading platform that primarily focuses on cryptocurrency and forex trading. Established in 2016, it has positioned itself as a broker that offers high leverage and a unique trading experience for its clients. However, as with any trading platform, potential users must exercise caution and conduct thorough research before committing their funds. The forex market is rife with opportunities, but it is also home to numerous scams and unreliable brokers. This necessitates a careful evaluation of any trading platform to ensure it meets safety and regulatory standards.

In this article, we will investigate the safety of Evolve Markets by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and overall risk assessment. Our analysis is based on a review of multiple sources, including user feedback, regulatory information, and expert reviews, to provide a comprehensive overview of whether Evolve Markets is a safe trading option for investors.

Regulation and Legitimacy

Evolve Markets operates under the jurisdiction of Saint Vincent and the Grenadines and is registered with the Mwali International Services Authority (MISA). However, it is crucial to note that MISA is not considered a top-tier regulatory body, which raises questions about the level of investor protection offered. The absence of stringent regulatory oversight can expose traders to higher risks, especially in terms of fund security and dispute resolution.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Mwali International Services Authority (MISA) | T2023208 | Saint Vincent and the Grenadines | Active |

The quality of regulation is a significant factor in determining the safety of a broker. While Evolve Markets does hold a license, it is essential to understand that the regulatory framework in Saint Vincent and the Grenadines is generally less rigorous compared to jurisdictions like the UK‘s FCA or Australia’s ASIC. This lack of robust regulatory oversight may lead to concerns regarding compliance and protection for traders. Historically, Evolve Markets has faced scrutiny for its operational practices, including issues related to fund withdrawals and customer service responsiveness.

Company Background Investigation

Evolve Markets was founded by a group of early Bitcoin adopters and forex brokerage veterans, which lends it some credibility in the cryptocurrency trading space. The company has been operational since 2016 and claims to provide a user-friendly trading experience with a focus on cryptocurrency and forex markets. However, the lack of transparency regarding its ownership structure and management team raises concerns about accountability.

The company's location in Saint Vincent and the Grenadines, a known offshore financial center, adds another layer of complexity. While this jurisdiction allows for higher leverage and a broader range of trading instruments, it also poses risks due to the limited regulatory framework. Furthermore, Evolve Markets does not provide adequate information about its management team, which is crucial for assessing the broker's reliability and trustworthiness.

The transparency of a broker is vital for building trust with potential clients. Evolve Markets website lacks comprehensive disclosures about its operational practices, financial health, and the individuals behind the company. This absence of information can lead to skepticism among traders, making it essential for prospective clients to approach the platform with caution.

Trading Conditions Analysis

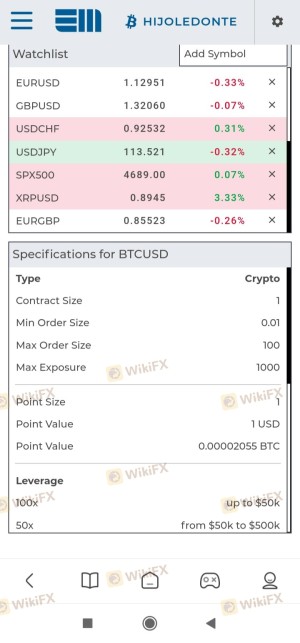

Evolve Markets offers a range of trading conditions that are generally competitive, particularly in terms of leverage. The broker provides leverage of up to 1:1000 on forex pairs, which can be attractive for experienced traders looking to maximize their trading potential. However, such high leverage also increases the risk of significant losses, making it crucial for traders to understand their risk tolerance.

The fee structure at Evolve Markets is relatively straightforward, with no minimum deposit required to open an account. However, the broker primarily accepts cryptocurrency for deposits and withdrawals, which may not be suitable for all traders. Below is a comparison of core trading costs at Evolve Markets versus industry averages:

| Fee Type | Evolve Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Variable (0.2 pips) | 1-2 pips |

| Commission Structure | 0.0035% per trade | 0.1-0.5% |

| Overnight Interest Range | Not applicable | Varies widely |

While Evolve Markets claims to offer competitive spreads, user reviews suggest that the actual trading experience may differ, with reports of slippage and execution delays. This discrepancy highlights the importance of conducting thorough due diligence before trading on the platform. Additionally, the absence of a demo account limits traders' ability to test the platform's features before committing real funds.

Customer Fund Security

The security of customer funds is a critical concern for any trader. Evolve Markets claims to prioritize fund safety by implementing measures such as two-factor authentication and cold storage for cryptocurrencies. However, the lack of comprehensive information regarding fund segregation and investor protection schemes raises red flags.

Evolve Markets does not participate in any investor compensation schemes, which means that if the broker were to face financial difficulties, clients might have limited recourse to recover their funds. The absence of a robust regulatory framework further complicates the situation, as traders may find it challenging to seek redress in case of disputes.

It is also worth noting that Evolve Markets has faced allegations and complaints from users regarding difficulties in withdrawing funds and accessing customer support. These issues underscore the importance of assessing a brokers fund security measures before investing.

Customer Experience and Complaints

User feedback regarding Evolve Markets is mixed, with some traders praising the platform's ease of use and competitive trading conditions, while others report significant issues. Common complaints include difficulties with fund withdrawals, unresponsive customer support, and platform stability problems.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Technical Support | Medium | Limited availability |

| Platform Stability | High | Unresolved |

Several users have reported negative experiences, such as unexpected account closures and unfulfilled withdrawal requests. For instance, one trader claimed that their account was closed without notice after experiencing significant losses, raising concerns about the broker's practices. Another user reported issues with trade execution, stating that their stop-loss orders did not trigger as expected, leading to substantial losses.

These complaints highlight the need for prospective clients to conduct thorough research and consider the potential risks associated with trading on Evolve Markets.

Platform and Trade Execution

Evolve Markets offers multiple trading platforms, including MetaTrader 4 and 5, as well as its proprietary web trading platform. While the platforms are generally user-friendly, there have been reports of technical issues, including lagging execution times and order rejections.

The quality of trade execution is a crucial factor for traders, as delays can significantly impact profitability. User reviews indicate that some traders have experienced slippage and difficulties in executing trades during volatile market conditions.

Moreover, the absence of a demo account limits traders' ability to practice and familiarize themselves with the platform before trading with real money. This lack of testing opportunities may deter potential clients who prefer to evaluate a broker's performance before committing their funds.

Risk Assessment

Trading with Evolve Markets presents several risks that potential clients should consider. The combination of high leverage, limited regulatory oversight, and mixed user feedback creates a challenging environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Minimal oversight from MISA |

| Operational Risk | Medium | Technical issues and withdrawal delays |

| Financial Risk | High | High leverage increases potential losses |

To mitigate these risks, traders should approach Evolve Markets with caution. It is advisable to start with a small investment, utilize risk management strategies, and stay informed about the broker's practices and user experiences.

Conclusion and Recommendations

In conclusion, the question of whether Evolve Markets is safe or a scam is complex. While the broker does offer some attractive trading conditions, the lack of robust regulation, mixed user feedback, and reports of operational issues raise significant concerns.

Traders should be particularly wary of the high leverage offered and the potential difficulties in withdrawing funds. Given the broker's history and the regulatory environment in which it operates, it is essential for potential clients to conduct thorough research and consider alternative options.

For those seeking a safer trading experience, it may be worth exploring brokers with stronger regulatory oversight and a proven track record of reliability. Some reputable alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which offer greater investor protection and transparency. Always prioritize safety and due diligence when selecting a trading platform.

Is Evolve Markets a scam, or is it legit?

The latest exposure and evaluation content of Evolve Markets brokers.

Evolve Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Evolve Markets latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.