Evolve Markets 2025 Review: Everything You Need to Know

Executive Summary

Evolve Markets presents itself as a Bitcoin-based forex and CFD trading provider. The company has operated as an offshore broker since 2016. This evolve markets review reveals a trading platform that offers certain attractive features for cryptocurrency-oriented traders, though regulatory concerns may give some investors pause. The broker operates under MISA regulation from Saint Vincent and the Grenadines. This positions it in the offshore brokerage space.

Key highlights include an exceptionally low minimum deposit requirement of just 0.0001 BTC. The broker also offers leverage capabilities reaching up to 1:1000. The company operates through a Straight Through Processing model via the MetaTrader 4 platform. This provides access to forex, CFDs, and cryptocurrency pairs. However, the limited regulatory oversight and sparse user feedback data present considerations for potential clients.

The broker primarily targets investors seeking high leverage opportunities and cryptocurrency-based trading solutions. These traders are particularly comfortable with offshore regulatory frameworks. While the low entry barrier makes it accessible to beginners, the regulatory structure may be more suitable for experienced traders. These traders understand the implications of offshore broker relationships.

Important Notice

Evolve Markets operates as an offshore broker. This means it operates under a different regulatory and legal framework compared to brokers licensed in major financial jurisdictions. The regulatory oversight provided by MISA may differ significantly from standards maintained by authorities like the FCA, ASIC, or CySEC. This review is based on publicly available information and limited user feedback. Some data is potentially subject to update delays. Prospective clients should conduct thorough due diligence regarding the regulatory implications. They should also ensure compliance with their local jurisdiction's trading regulations before engaging with offshore brokers.

Rating Framework

Broker Overview

Evolve Markets established operations in 2016. The company positioned itself as a specialized provider of Bitcoin-based forex and CFD trading services. According to fx-list.com, the company maintains its headquarters in Saint Vincent and the Grenadines with additional offices in Kingstown and Fomboni. The broker has carved out a niche in the cryptocurrency-integrated trading space. This appeals to traders who prefer Bitcoin-denominated accounts and transactions.

The company operates exclusively through a Straight Through Processing business model. This theoretically ensures rapid and transparent trade execution without dealer desk intervention. The approach aligns with the preferences of traders seeking direct market access and minimal conflict of interest with their broker. The STP model, combined with the broker's focus on cryptocurrency integration, distinguishes Evolve Markets within the competitive offshore brokerage landscape.

Trading activities are facilitated through the widely recognized MetaTrader 4 platform. This provides access to forex pairs, contracts for difference, and cryptocurrency trading pairs. The broker operates under MISA regulation, though specific license numbers are not prominently disclosed in available documentation. This regulatory framework, while providing some oversight, may not offer the same level of client protection as major financial authorities.

Key Trading Details

Regulatory Jurisdiction: Evolve Markets operates under MISA regulation. The specific license number is not clearly stated in available sources. This regulatory body oversees financial services in the Comoros Islands jurisdiction.

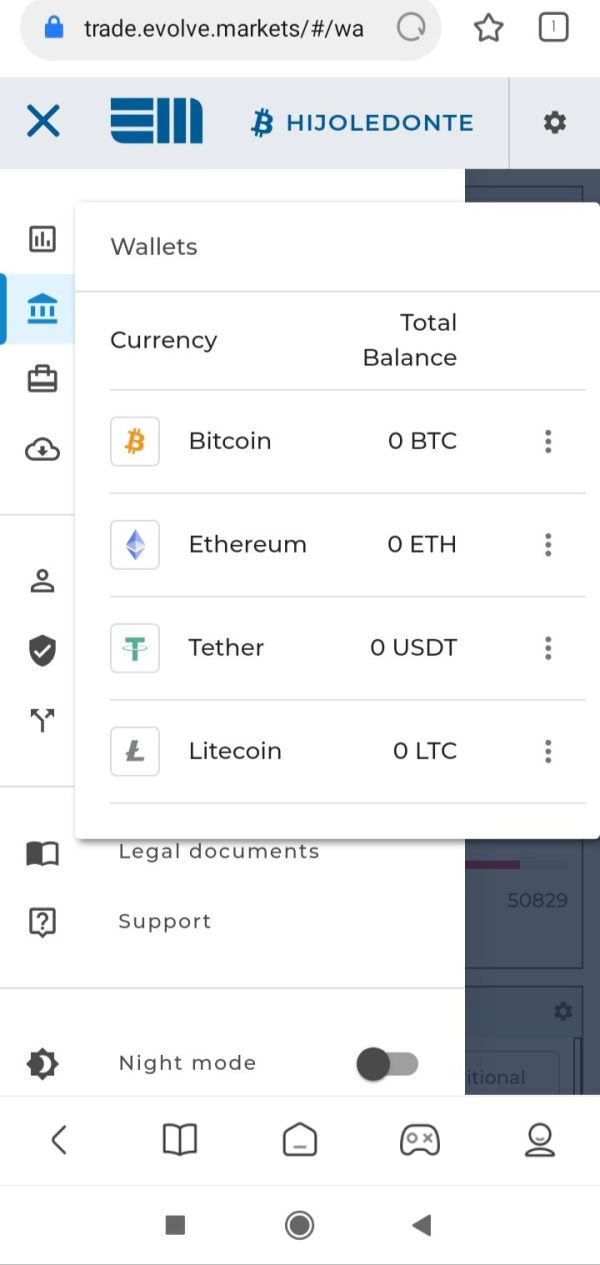

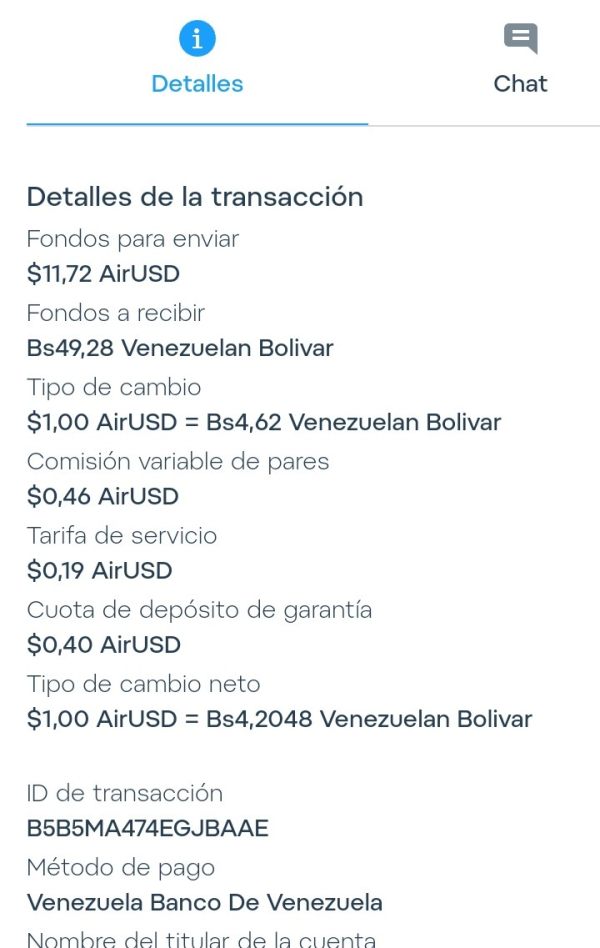

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available sources. The Bitcoin-focused nature suggests cryptocurrency payment options are likely prioritized.

Minimum Deposit Requirements: The broker maintains an exceptionally low minimum deposit threshold of 0.0001 BTC. This makes it accessible to traders with limited initial capital. The Bitcoin-denominated requirement reflects the broker's cryptocurrency-centric approach.

Promotional Offers: Available sources do not provide specific information regarding bonus programs or promotional incentives. These would be offered by Evolve Markets to new or existing clients.

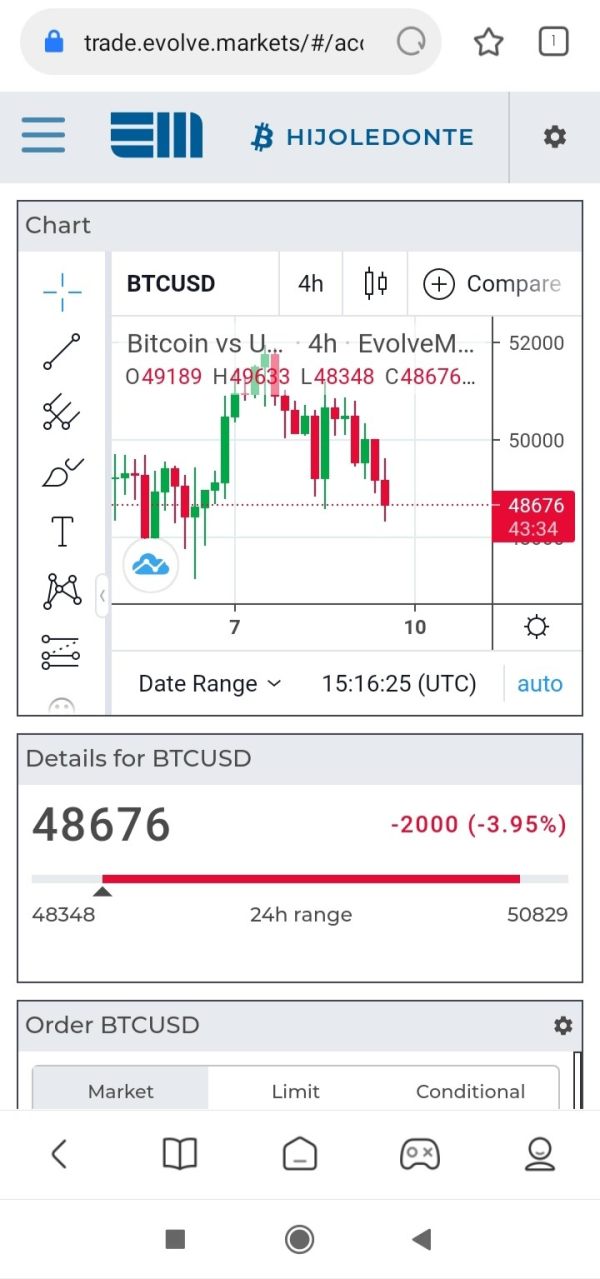

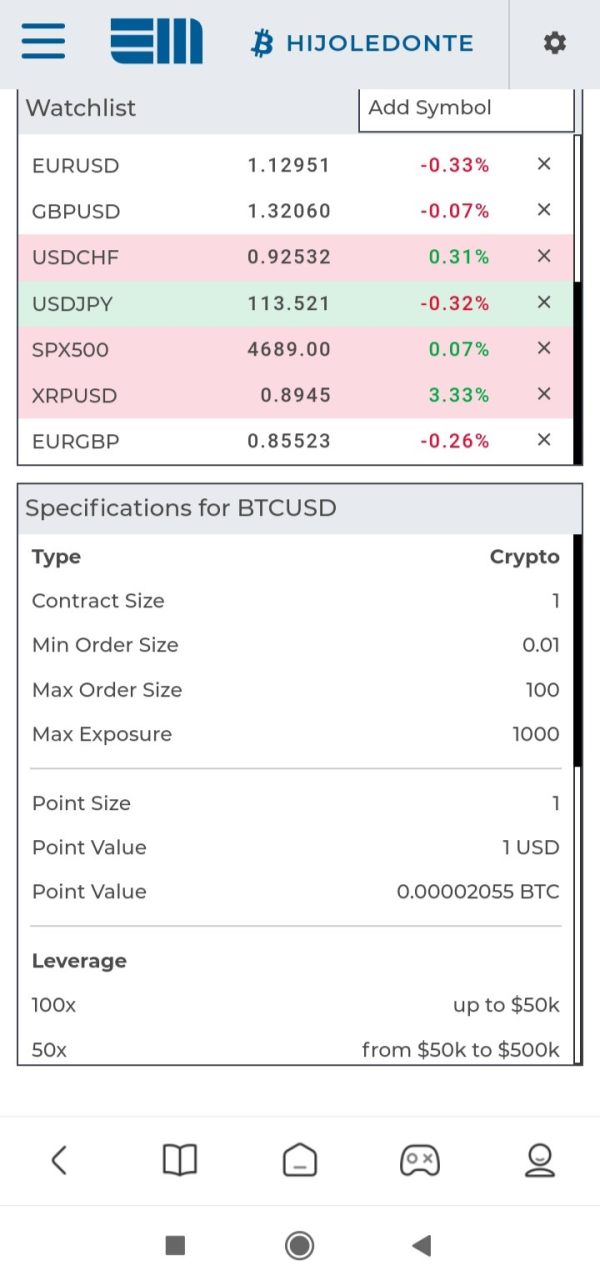

Available Trading Instruments: The platform provides access to forex currency pairs, contracts for difference across various asset classes, and cryptocurrency trading pairs. The exact number of instruments is not specified in current documentation.

Cost Structure and Pricing: Detailed information regarding spreads, commissions, and other trading costs is not available in the reviewed sources. This represents a significant information gap for potential clients conducting cost comparisons.

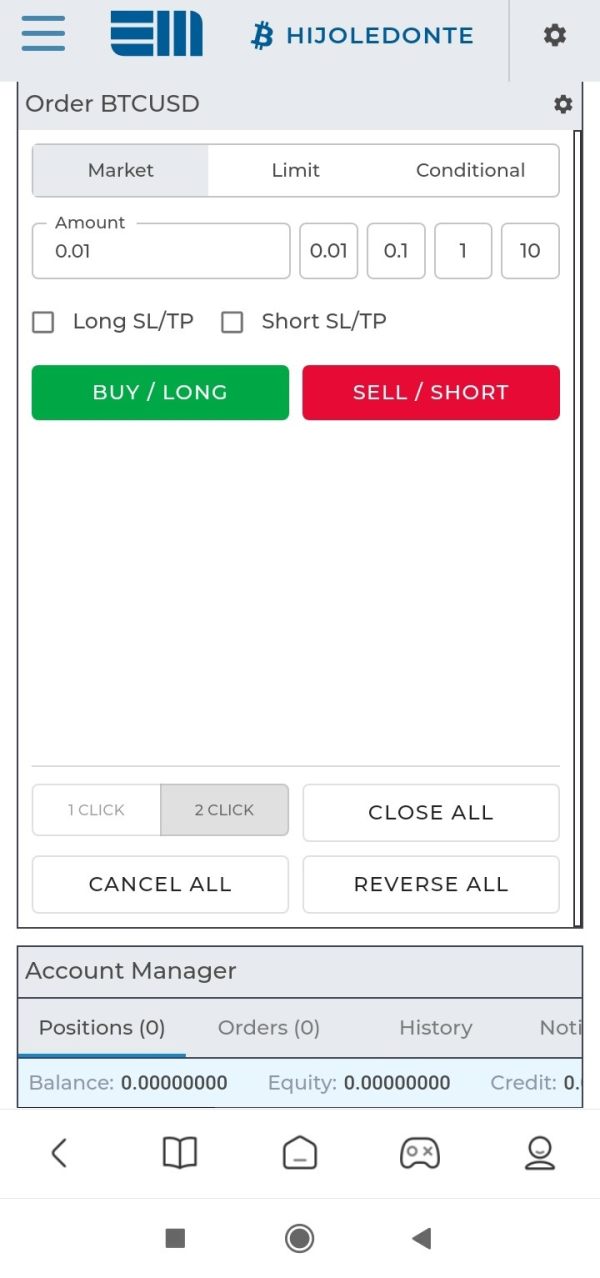

Leverage Options: Maximum leverage reaches 1:1000. This provides substantial amplification opportunities for experienced traders while requiring careful risk management due to the associated exposure levels.

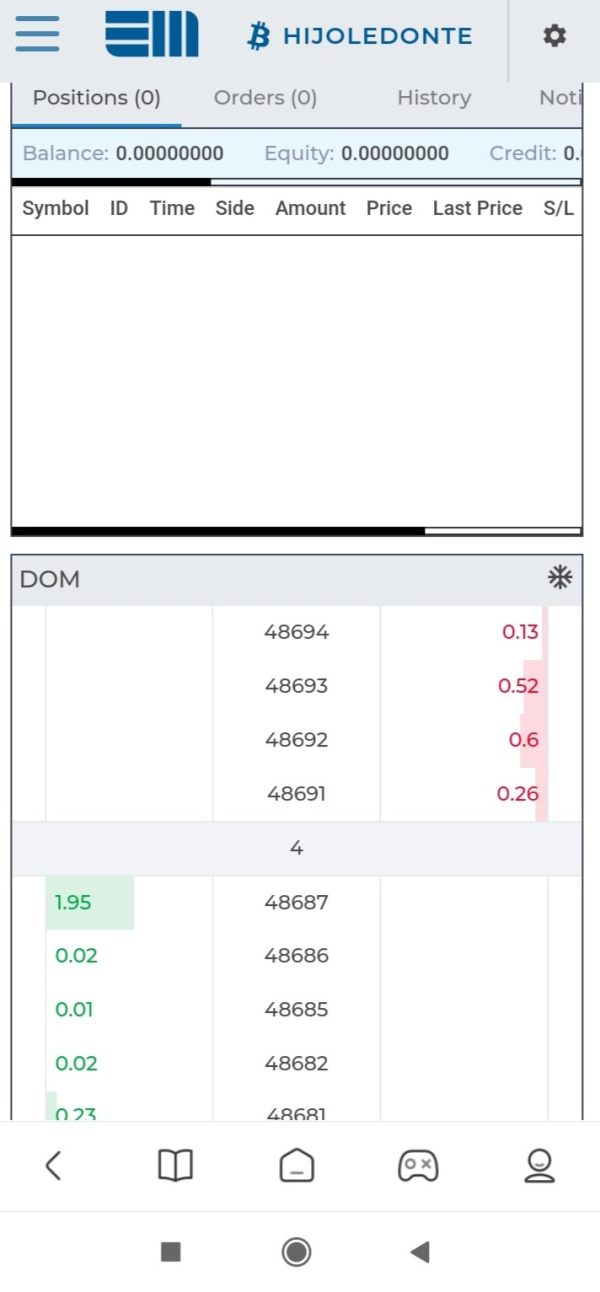

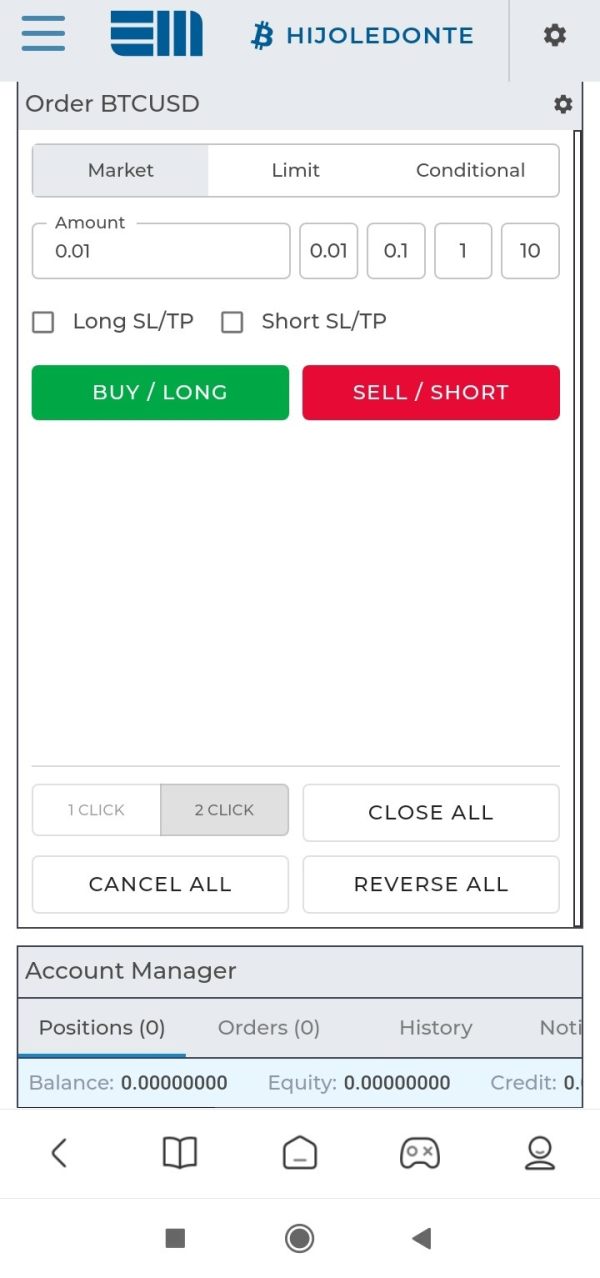

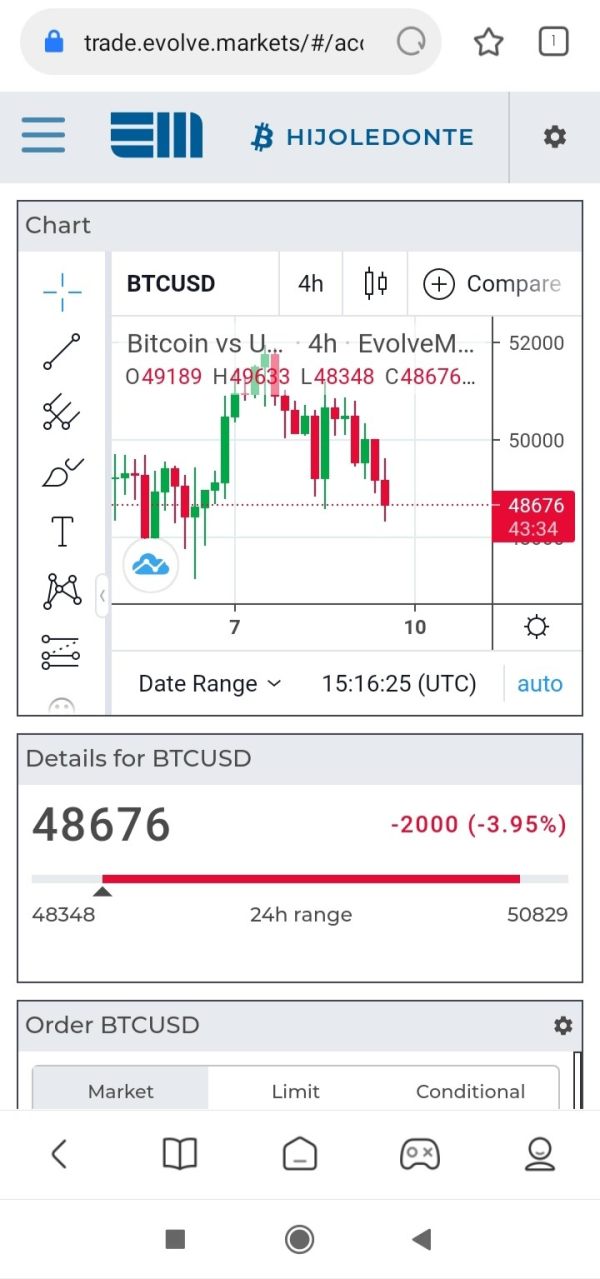

Platform Technology: Trading is conducted exclusively through the MetaTrader 4 platform. This offers standard charting tools, technical indicators, and automated trading capabilities familiar to most forex traders.

Geographic Restrictions: Specific information regarding geographic trading restrictions or prohibited jurisdictions is not detailed in available sources.

Customer Support Languages: Available documentation does not specify the range of languages supported by customer service teams. The availability of multilingual support options is also not specified.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

Evolve Markets demonstrates strength in account accessibility through its remarkably low minimum deposit requirement of 0.0001 BTC. This threshold significantly lowers the barrier to entry compared to many traditional brokers. It makes the platform particularly attractive for newcomers to forex trading or those testing the platform's capabilities. The Bitcoin-denominated requirement aligns with the broker's cryptocurrency focus while providing flexibility for clients already holding digital assets.

The leverage offering of up to 1:1000 represents another compelling account feature. It provides substantial amplification opportunities for experienced traders. However, this high leverage also introduces significant risk factors that require careful consideration and robust risk management strategies. The combination of low entry requirements and high leverage creates an account structure that appeals to both conservative beginners and aggressive traders.

Unfortunately, specific details regarding account types, tier structures, or specialized account features such as Islamic accounts are not available in current documentation. This information gap limits the ability to fully assess the broker's accommodation of diverse trading preferences and religious requirements. The absence of detailed account specifications in this evolve markets review suggests potential clients should seek direct clarification from the broker regarding available account variations and their respective features.

The broker provides access to a reasonable variety of trading instruments including forex pairs, CFDs, and cryptocurrency trading pairs through the MetaTrader 4 platform. This asset diversity allows for portfolio diversification across traditional currency markets and emerging cryptocurrency opportunities. However, the exact number of available instruments and specific market coverage details are not clearly documented in available sources.

MetaTrader 4 brings standard analytical tools, technical indicators, and charting capabilities that most traders expect from a professional trading platform. The platform's automated trading support through Expert Advisors provides additional functionality for algorithmic trading strategies. However, information regarding proprietary trading tools, research resources, or enhanced analytical features specific to Evolve Markets is not available in current documentation.

Educational resources, market analysis, and research materials are not detailed in available sources. This represents a significant gap in the broker's resource offering assessment. Many modern brokers provide comprehensive educational content, daily market analysis, and research reports to support trader development and decision-making. The absence of such information in this review suggests either limited resource provision or inadequate documentation of available materials.

Customer Service and Support Analysis (5/10)

Available documentation provides no specific information regarding customer service channels, availability hours, or support quality metrics. This represents a critical information gap for potential clients who prioritize responsive and effective customer support. The absence of customer service details makes it impossible to assess whether the broker provides 24/5 market hours support, live chat capabilities, or phone support options.

Response time expectations, service quality standards, and problem resolution procedures are not documented in available sources. These factors significantly impact the overall trading experience, particularly during market volatility when rapid support response becomes crucial. The lack of customer service information in available sources suggests potential clients should directly inquire about support capabilities before committing to the platform.

Multilingual support availability and the range of languages accommodated by customer service teams remain unspecified. For international clients, language support can be a determining factor in broker selection. This makes this information gap particularly relevant for non-English speaking traders considering Evolve Markets as their trading partner.

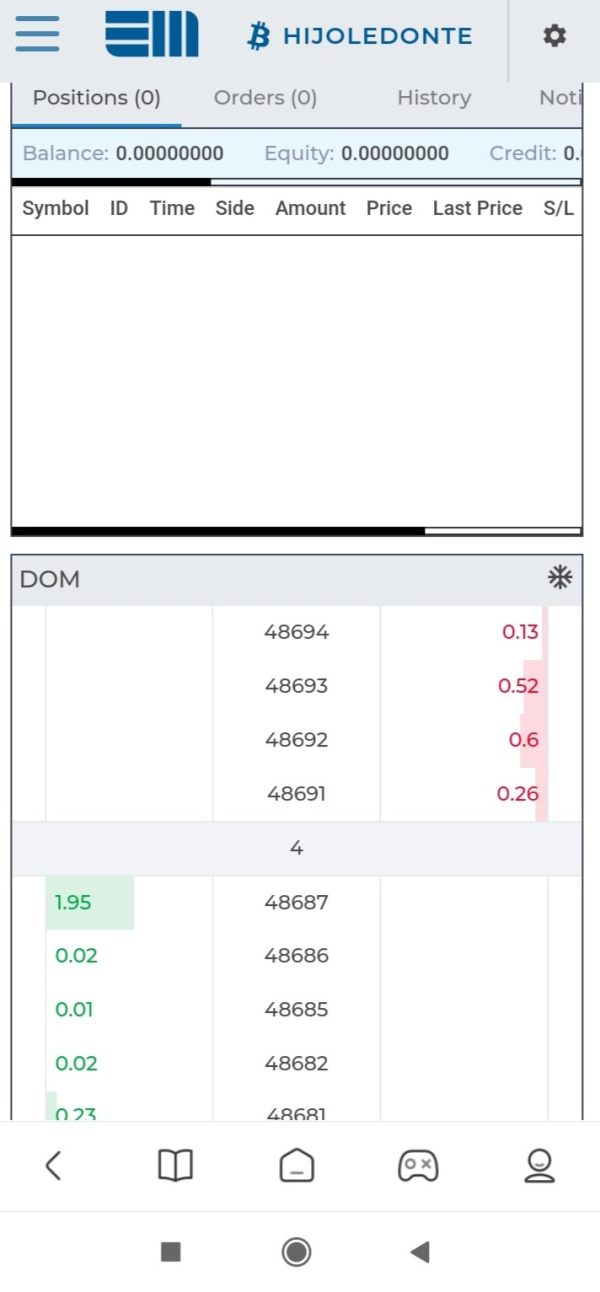

Trading Experience Analysis (6/10)

The MetaTrader 4 platform provides a familiar trading environment for most forex traders. It offers standard functionality including real-time charting, technical analysis tools, and order management capabilities. However, specific information regarding platform stability, execution speed, or server performance is not available in current documentation. This limits the ability to assess the technical trading experience quality.

Order execution quality, slippage rates, and requote frequency are critical factors affecting the trading experience. These metrics are not documented in available sources. The broker's STP model theoretically supports transparent execution, but without specific performance data or user feedback, it's challenging to verify execution quality claims.

Mobile trading capabilities and the availability of mobile applications for iOS and Android devices are not detailed in current documentation. Given the increasing importance of mobile trading functionality, this information gap represents a significant limitation in assessing the complete trading experience offered by Evolve Markets. This evolve markets review cannot provide comprehensive insight into the mobile trading experience without additional documentation.

Trust and Regulation Analysis (4/10)

Evolve Markets operates under MISA regulation from Saint Vincent and the Grenadines. This provides limited regulatory oversight compared to major financial authorities like the FCA, ASIC, or CySEC. While MISA regulation offers some level of oversight, it may not provide the same comprehensive client protection mechanisms, dispute resolution procedures, or capital adequacy requirements found in major financial jurisdictions.

The absence of specific license numbers or detailed regulatory compliance information in available documentation raises transparency concerns. Reputable brokers typically prominently display their regulatory credentials and license numbers to demonstrate compliance and build client confidence. The limited regulatory disclosure makes it difficult for potential clients to verify the broker's regulatory standing independently.

Client fund protection measures, segregated account policies, and compensation schemes are not detailed in available sources. These factors are crucial for assessing the safety of client deposits and the broker's commitment to client fund security. The absence of such information in this review highlights the need for potential clients to seek direct clarification regarding fund protection measures before depositing funds.

User Experience Analysis (5/10)

Overall user satisfaction metrics and client feedback data are not available in current documentation. This makes it impossible to assess the general user experience quality. User reviews, testimonials, and satisfaction surveys provide valuable insights into the practical trading experience, but such information is notably absent from available sources.

Interface design quality, platform usability, and navigation efficiency cannot be assessed without specific user feedback or detailed platform documentation. These factors significantly impact daily trading activities and overall user satisfaction. Their absence makes this a notable limitation in this comprehensive assessment.

Registration and account verification processes, including required documentation and approval timeframes, are not detailed in available sources. The efficiency and user-friendliness of onboarding procedures can significantly impact the initial user experience, yet this information remains unavailable for review. Similarly, fund deposit and withdrawal experiences, processing times, and associated fees are not documented. This limits the ability to assess the complete user journey with Evolve Markets.

Conclusion

Evolve Markets presents a mixed proposition for potential traders. It offers attractive entry-level conditions through its minimal 0.0001 BTC deposit requirement and high leverage capabilities up to 1:1000. The broker's Bitcoin-focused approach and STP execution model may appeal to cryptocurrency-oriented traders seeking direct market access. However, the limited regulatory oversight through MISA and the significant gaps in available information regarding customer service, trading costs, and user experiences present considerable evaluation challenges.

This platform appears most suitable for experienced traders comfortable with offshore regulatory frameworks and those specifically seeking cryptocurrency-integrated trading solutions. The high leverage offerings make it potentially attractive for aggressive trading strategies, though the associated risks require careful consideration and robust risk management approaches.

The primary advantages include low barrier to entry and substantial leverage opportunities. The main concerns center on limited regulatory protection and insufficient transparency regarding operational details, customer service quality, and user satisfaction metrics.