ESTA 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive esta review examines the Electronic System for Travel Authorization mobile application and its associated trading services. Our analysis covers over 3,768 user reviews from app stores, and ESTA presents a mixed picture for potential users. While the platform maintains an overall rating of 4 stars, significant operational challenges have emerged that warrant careful consideration.

ESTA Trade positions itself as a forex broker offering low spreads, high leverage, and an intuitive trading platform. However, our evaluation reveals concerning gaps in regulatory transparency and operational reliability that cannot be ignored. The platform appears to target investors seeking low-cost forex trading solutions, but fundamental issues with core functionality raise questions about its suitability for serious traders who demand reliability and transparency.

User feedback highlights both positive aspects, such as responsive customer service, and critical problems including technical malfunctions and incomplete features. The absence of clear regulatory information in available documentation further compounds concerns about the platform's credibility and long-term viability in the competitive forex market where trust is paramount.

Important Notice

This review is based on publicly available information and user feedback analysis. Specific regulatory details and comprehensive trading conditions were not clearly specified in available sources, which raises immediate concerns. Our assessment methodology combines natural language processing analysis of user reviews with evaluation of publicly accessible platform information. Readers should conduct independent due diligence and verify current regulatory status before making any trading decisions.

Rating Framework

Broker Overview

The Electronic System for Travel Authorization represents a unique case in the forex brokerage landscape. Originally established as an automated electronic system for travel authorization under the 9/11 Commission Act of 2007, the ESTA brand has expanded into financial services, specifically forex trading, creating an unusual transition that lacks clear documentation. This transition from travel authorization to financial services creates an unusual corporate background that differs significantly from traditional forex broker origins.

The company's evolution into forex trading services appears to be a recent development, though specific founding dates for the trading division are not clearly documented in available sources. This lack of historical clarity in the trading sector raises questions about the platform's experience and track record in financial markets where experience matters significantly.

ESTA's business model focuses on providing accessible forex trading services with emphasis on competitive spreads and leverage options. The platform markets itself as user-friendly, targeting both novice and experienced traders seeking cost-effective trading solutions that promise low costs and high accessibility. However, the absence of detailed information about trading platforms, specific asset offerings, and regulatory oversight suggests a developing infrastructure that may not yet match established industry standards.

The company's regulatory status remains unclear based on available documentation, which represents a significant concern for potential clients seeking regulated trading environments. This esta review found no clear references to major regulatory bodies or compliance frameworks, which is unusual for legitimate forex brokers operating in established markets where regulation is standard.

Regulatory Status

Available sources do not specify concrete regulatory information for ESTA's trading operations. This absence of regulatory clarity represents a significant red flag for potential users, as legitimate forex brokers typically prominently display their regulatory credentials and compliance status to build trust.

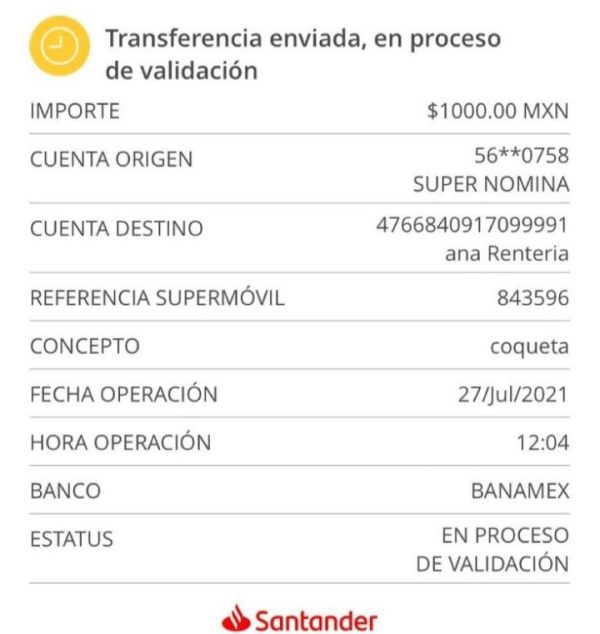

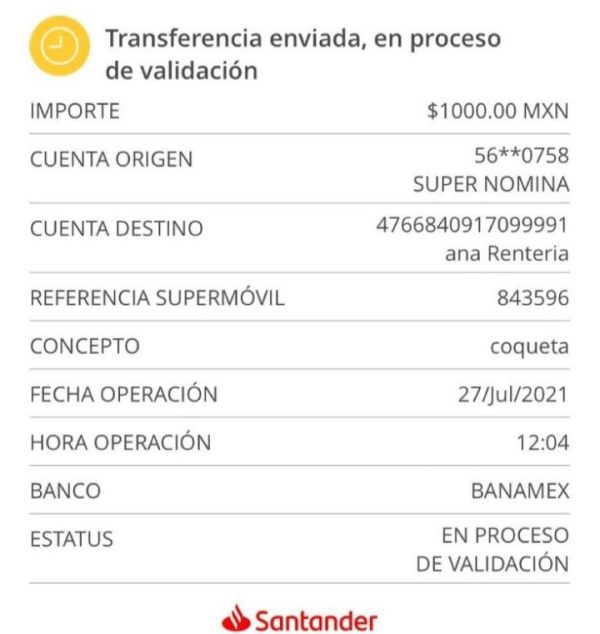

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal options was not detailed in available sources. This lack of transparency regarding funding methods creates uncertainty for potential users about transaction processes and associated costs that could impact their trading profitability.

Minimum Deposit Requirements

Minimum deposit thresholds are not specified in accessible documentation, making it difficult for potential clients to assess entry requirements and account accessibility. This information gap prevents traders from planning their initial investment appropriately.

Current bonus structures and promotional campaigns are not clearly outlined in available materials, suggesting either limited promotional activity or inadequate marketing transparency. Most established brokers clearly communicate their promotional offers to attract new clients.

Trading Assets

While the platform appears to focus on forex trading, specific asset categories, currency pairs, and CFD offerings are not comprehensively detailed in source materials. This esta review found references to forex and potentially CFD trading, but comprehensive asset listings remain unclear, limiting traders' ability to assess market opportunities.

Cost Structure

Available information mentions low spreads as a key feature, but specific spread ranges, commission structures, and additional fees are not detailed. This lack of cost transparency makes it challenging to compare ESTA's pricing with established competitors who typically provide detailed pricing information.

Leverage Options

High leverage is mentioned as a platform feature, but specific leverage ratios and their application across different asset classes are not clearly specified in available documentation. Traders need this information to manage their risk appropriately.

Trading platform specifications, including whether the broker offers MetaTrader 4, MetaTrader 5, or proprietary platforms, are not clearly indicated in source materials. Platform choice significantly impacts trading effectiveness and user experience.

Geographic Restrictions

Regional availability and restrictions are not specified, though user feedback suggests some functionality limitations that may be geography-related. Understanding geographic limitations is crucial for international traders.

Customer Support Languages

Multi-language support capabilities are not detailed in available sources. This information gap could affect international users who require support in their native language.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

ESTA's account conditions receive a below-average rating due to insufficient transparency and documentation. Available sources provide minimal information about account types, their specific features, or differentiation between service levels, creating confusion for potential clients. This lack of clarity makes it impossible for potential clients to make informed decisions about which account structure might suit their trading needs.

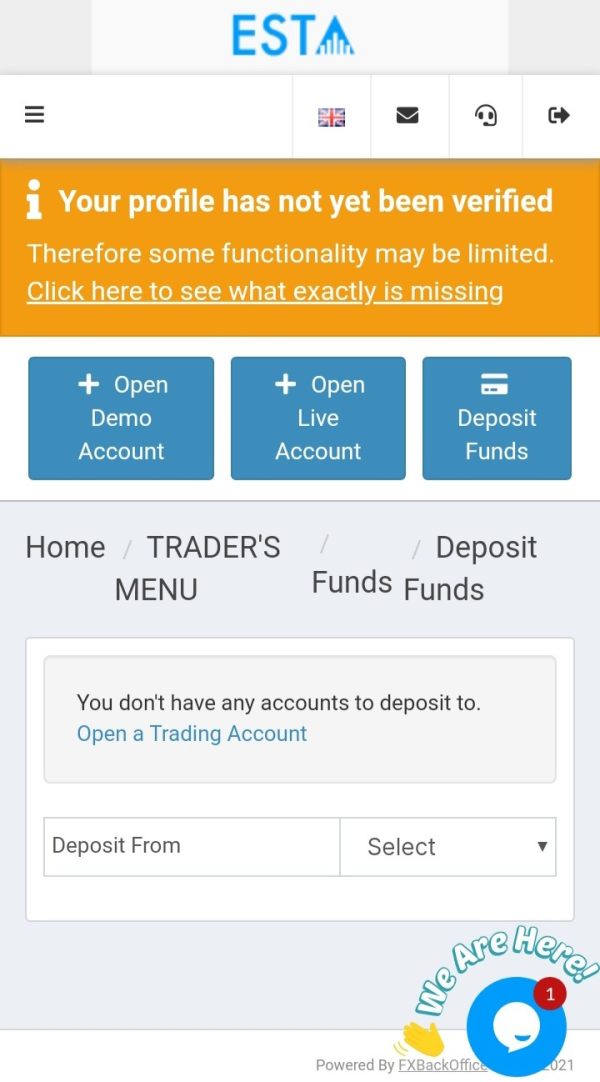

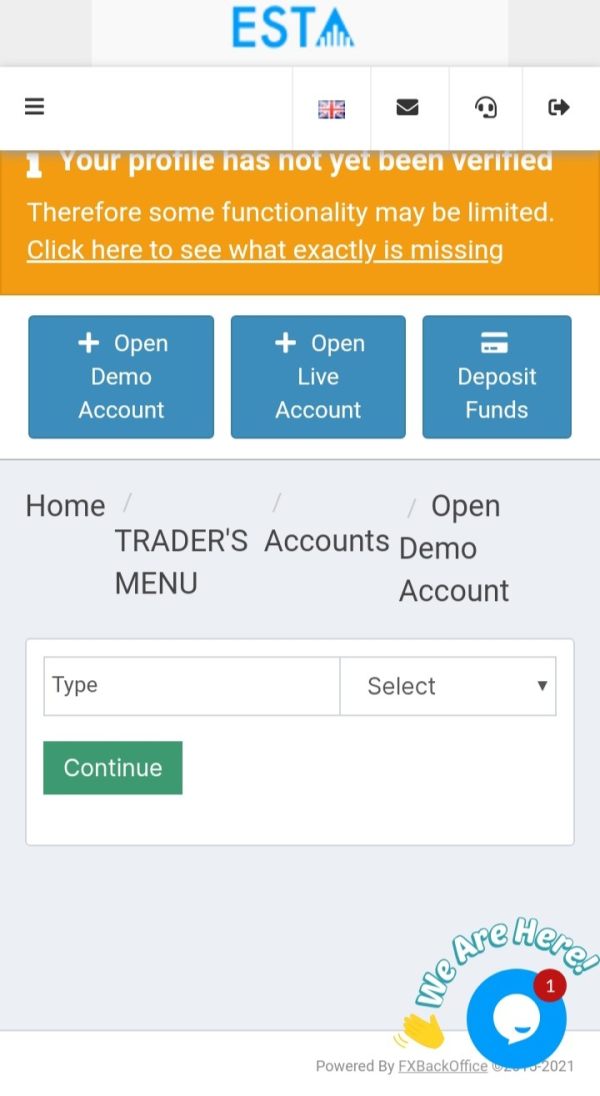

The absence of clearly stated minimum deposit requirements further complicates account assessment. While some platforms offer micro or cent accounts for beginners, ESTA's documentation does not specify such options or their associated benefits, limiting accessibility for new traders. This opacity extends to account opening procedures, verification requirements, and timeline expectations.

Special account features, such as Islamic accounts for Muslim traders or professional accounts for qualified investors, are not mentioned in available materials. This suggests either limited account variety or inadequate marketing communication about available options that could serve diverse client needs. The platform's approach to account management and client categorization remains unclear based on current information.

User feedback analysis reveals confusion about basic account functionality, with some users reporting difficulties in fundamental processes like country selection during registration. These operational issues compound the already problematic lack of clear account documentation, resulting in a poor overall account conditions assessment for this esta review.

The tools and resources category receives one of the lowest scores in this evaluation due to minimal information about trading tools, analytical resources, and educational materials. Available sources do not specify the range of technical indicators, charting tools, or analytical features available to traders on the ESTA platform, which are essential for informed trading decisions.

Research capabilities appear limited or undocumented, with no clear references to market analysis, economic calendars, or research reports that typically support informed trading decisions. This absence of analytical support tools significantly hampers the platform's utility for serious traders who rely on comprehensive market analysis to make profitable trades.

Educational resources, which are crucial for developing trader skills and platform familiarity, are not prominently featured or detailed in available materials. The lack of tutorials, webinars, trading guides, or educational content suggests minimal investment in client development and support, which is concerning for new traders.

Automated trading support, including expert advisors or algorithmic trading capabilities, is not clearly specified. This limitation may restrict the platform's appeal to advanced traders who utilize automated strategies for consistent performance.

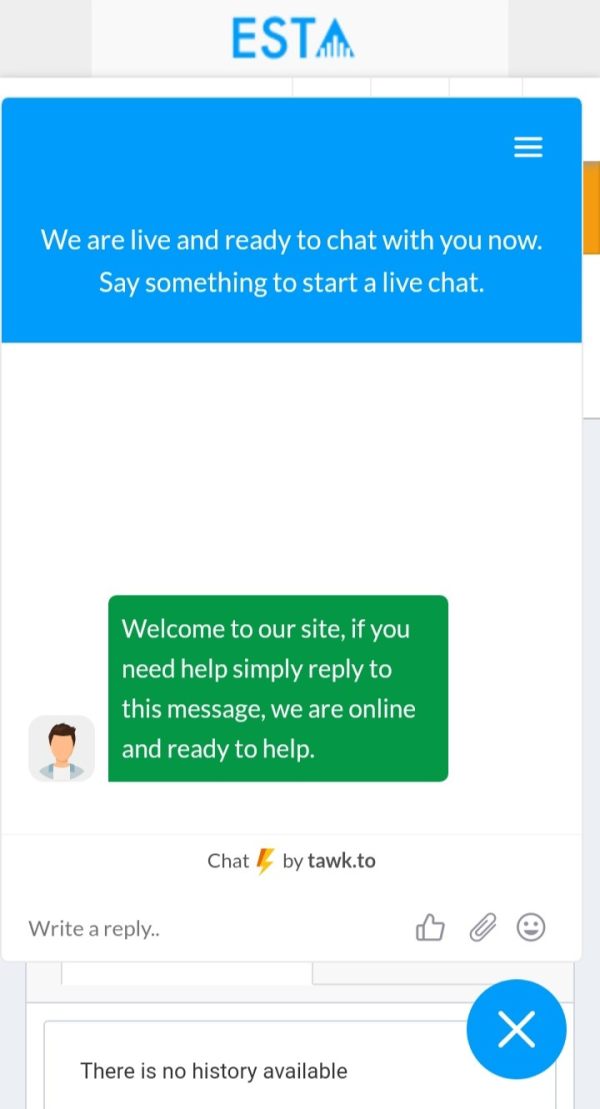

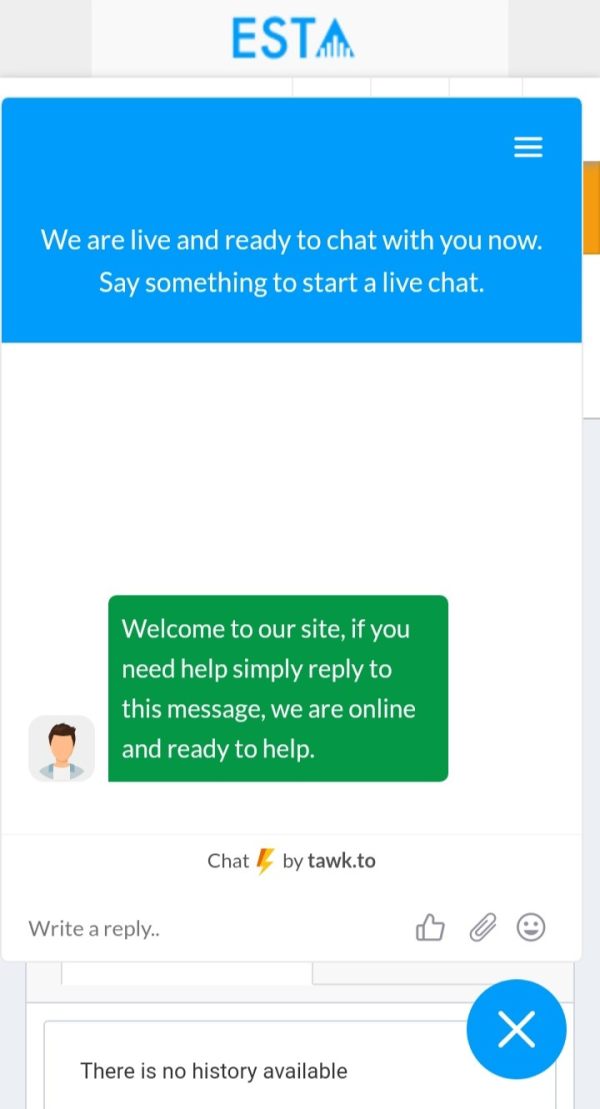

Customer Service and Support Analysis (6/10)

Customer service represents one of ESTA's stronger performance areas, earning an average rating based on user feedback highlighting responsive and efficient support. According to user reviews analyzed, the platform demonstrates quick response times and professional service delivery when clients encounter issues or require assistance, which is encouraging for potential users.

User feedback specifically praises the timeliness and professionalism of customer support interactions. This positive reception suggests that ESTA has invested in developing competent support infrastructure, which partially compensates for other platform limitations and shows commitment to client satisfaction.

However, the evaluation is limited by lack of detailed information about support channels, availability hours, and multi-language capabilities. While user experiences suggest positive interactions, the absence of comprehensive support infrastructure documentation prevents a higher rating and creates uncertainty about support accessibility.

The customer service team's ability to resolve technical issues, particularly given the platform's documented functionality problems, remains a critical test of their effectiveness. Overall support quality appears adequate but requires broader documentation and expanded accessibility information for a complete assessment.

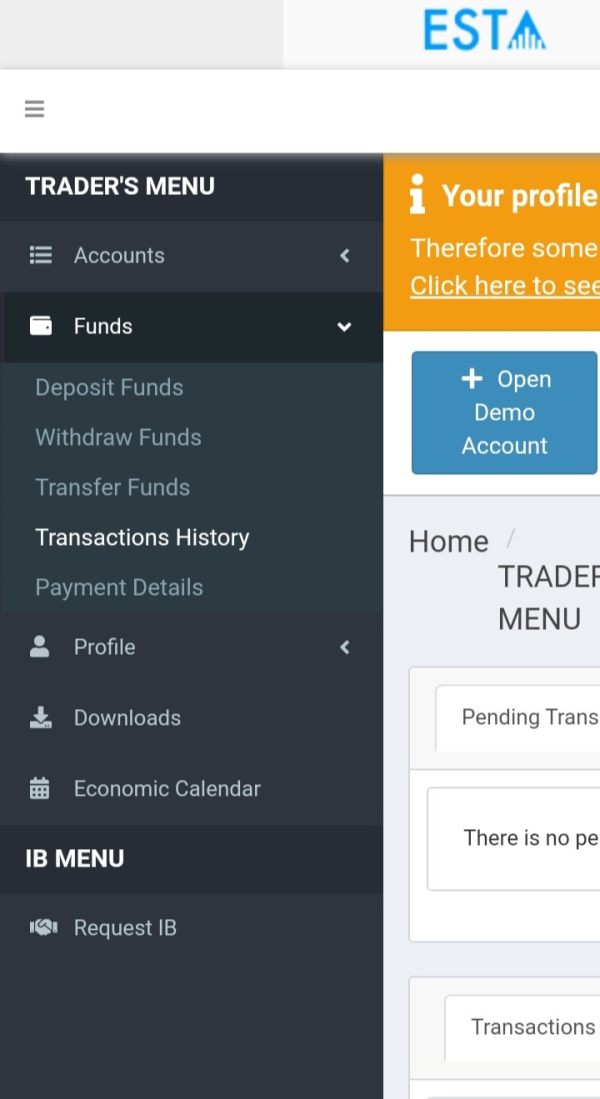

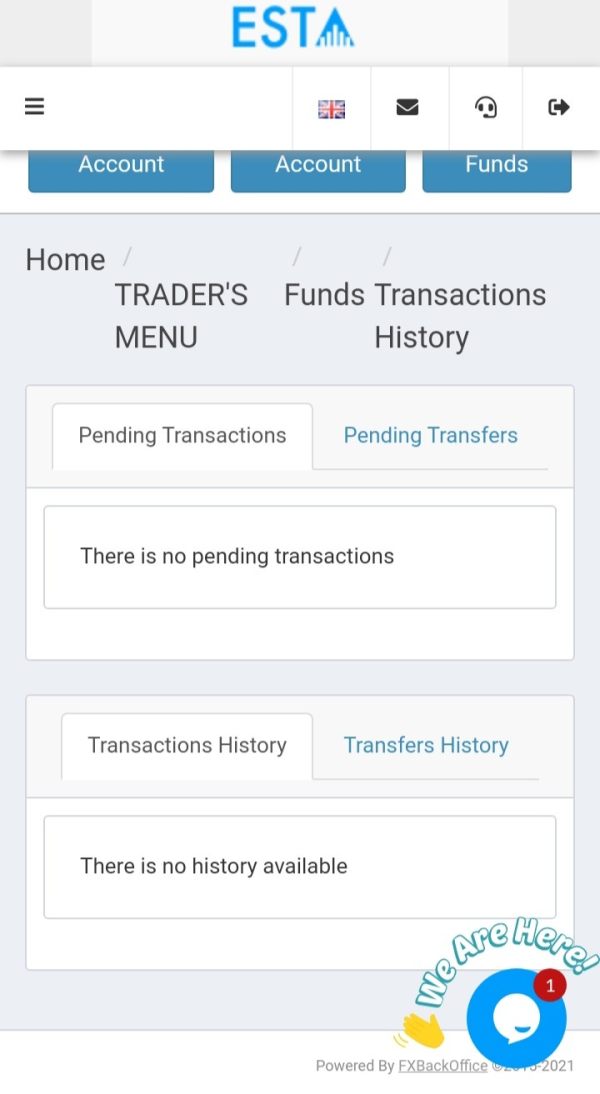

Trading Experience Analysis (5/10)

The trading experience receives a below-average rating due to documented functionality issues and limited transparency about platform capabilities. User feedback reveals significant technical problems that directly impact trading effectiveness and user satisfaction, which is concerning for active traders.

Platform stability and execution quality concerns emerge from user reports of technical malfunctions, including camera functionality failures and navigation issues. These problems suggest underlying technical infrastructure weaknesses that could affect trading performance and reliability during critical market moments.

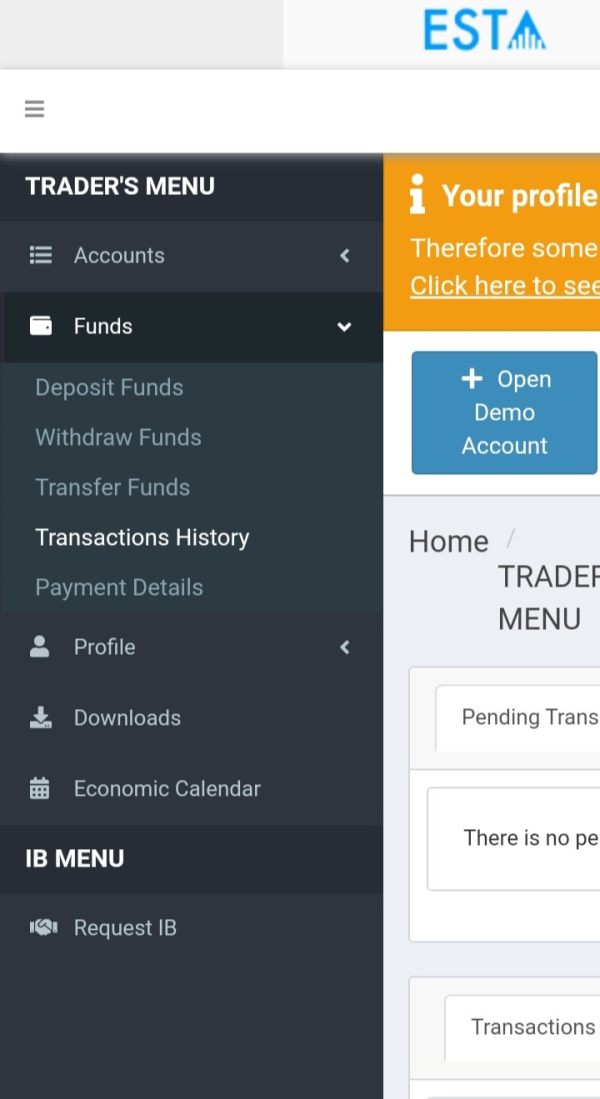

Mobile application functionality appears particularly problematic, with users reporting inability to complete basic tasks such as document scanning and country selection. These fundamental operational failures significantly impact the overall trading experience and suggest inadequate platform testing and development processes.

The trading environment's competitiveness, while featuring mentioned low spreads, lacks comprehensive documentation about execution speeds, slippage rates, and order processing quality. Without detailed performance metrics, traders cannot adequately assess whether the platform meets professional trading requirements that are essential for consistent profitability.

Trust and Reliability Analysis (2/10)

Trust and reliability receive the lowest rating in this evaluation due to fundamental concerns about regulatory transparency and operational credibility. The absence of clear regulatory information represents a critical deficiency that undermines platform trustworthiness and client protection, which are non-negotiable for serious traders.

Legitimate forex brokers typically maintain prominent regulatory disclosures, client fund segregation policies, and compliance documentation. ESTA's lack of such transparency raises serious questions about regulatory oversight and client protection measures that could leave traders vulnerable to financial loss.

Company transparency regarding ownership, management, and operational history is insufficient based on available sources. The platform's evolution from travel authorization services to forex trading creates an unusual corporate background that lacks clear explanation or transition documentation, raising questions about expertise and commitment.

Industry reputation and third-party evaluations are limited, making it difficult to assess the platform's standing within the forex community. The absence of regulatory oversight and limited operational transparency combine to create substantial trust concerns that potential users must carefully consider before risking their capital.

User Experience Analysis (4/10)

User experience receives a below-average rating reflecting mixed feedback and significant functionality challenges. While the platform maintains a 4-star overall rating from user reviews, specific operational problems significantly impact usability and satisfaction, creating frustration for users attempting to access services.

Interface design and navigation effectiveness are questioned by user reports of basic functionality failures. The inability to select countries during registration and camera access problems for document verification represent fundamental user experience failures that suggest inadequate platform development and testing procedures.

Registration and verification processes appear problematic based on user feedback, with multiple reports of technical barriers preventing successful account setup. These issues create frustration and may prevent legitimate users from accessing platform services effectively, limiting the platform's reach and usability.

The overall user satisfaction appears mixed, with positive feedback about customer service efficiency balanced against significant technical and operational complaints. The platform's user experience suggests a developing system that has not yet achieved the reliability and functionality standards expected by modern forex traders who demand seamless operation.

Conclusion

This comprehensive esta review reveals a platform with significant developmental challenges and transparency concerns that potential users must carefully consider. While ESTA offers some attractive features such as low spreads and responsive customer service, fundamental issues with regulatory disclosure and operational reliability create substantial risks for prospective clients who prioritize security and reliability.

The platform may appeal to traders seeking low-cost forex trading solutions, but the absence of regulatory oversight and documented technical problems make it unsuitable for serious trading activities. Users prioritizing security, reliability, and comprehensive trading tools should consider more established alternatives with clear regulatory credentials and proven track records that demonstrate long-term stability.

ESTA's main advantages include competitive pricing and efficient customer support, but these benefits are overshadowed by regulatory opacity, technical functionality issues, and insufficient platform documentation. Until these fundamental concerns are addressed through proper regulatory compliance and technical improvements, traders are advised to exercise extreme caution when considering this platform for their trading activities.