Is EASTPAC safe?

Pros

Cons

Is Eastpac Safe or Scam?

Introduction

Eastpac Capital Limited, operating under the name Eastpac, has emerged as a player in the Forex trading market, attracting attention with its promises of high leverage and competitive trading conditions. However, the rise of online trading platforms has also led to an increase in fraudulent activities, making it crucial for traders to thoroughly evaluate the legitimacy of any broker before investing their hard-earned money. This article aims to investigate whether Eastpac is a trustworthy broker or if it falls into the category of scams.

To conduct this assessment, we utilized a comprehensive approach that combines regulatory analysis, company background checks, trading conditions evaluation, customer feedback analysis, and risk assessments. By synthesizing information from various reputable sources, we aim to provide a balanced and informed judgment on the safety and reliability of Eastpac.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy. Brokers that operate without proper oversight pose significant risks to traders, including potential loss of funds and lack of recourse in case of disputes. Eastpac claims to be regulated in the U.S. under a "money services business license," but this assertion raises red flags as it lacks credible verification from recognized regulatory bodies.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation is concerning, especially since brokers in the U.S. must be registered with the Commodity Futures Trading Commission (CFTC) and be members of the National Futures Association (NFA). Eastpac is not listed in either of these databases, suggesting it operates without the necessary oversight. This lack of regulation, combined with the broker's claims of operating under U.S. laws, strongly indicates that Eastpac may not be a legitimate trading platform.

Company Background Investigation

Eastpac Capital Limited lacks transparency regarding its corporate structure and history. The company's website provides little information about its founding, management team, or operational history, which is a common characteristic of fraudulent brokers. A thorough background check reveals that Eastpac has not established a credible presence in the financial services industry, and its ownership structure remains obscure.

Furthermore, the management teams qualifications and experience are not disclosed, raising concerns about the broker's competency and operational integrity. The lack of transparency regarding the company's operations and ownership is a significant warning sign for potential investors. In a legitimate brokerage, detailed information about the company's background and management team is typically readily available to build trust with clients.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Eastpac claims to provide competitive spreads and high leverage options, which can be enticing for traders. However, the absence of clear information about fees and commissions raises questions about the broker's overall cost structure.

| Cost Type | Eastpac | Industry Average |

|---|---|---|

| Spread for Major Pairs | 3 pips | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread for major currency pairs at Eastpac appears significantly higher than the industry average, which could reduce profitability for traders. The lack of a defined commission structure and overnight interest rates further complicates the understanding of overall trading costs. This ambiguity can lead to unexpected expenses, making it challenging for traders to accurately gauge their potential returns.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. Eastpac does not provide clear information regarding its fund security measures, such as segregated accounts or investor protection policies.

Traders should be aware that reputable brokers often have strict policies in place to ensure the safety of client funds, including the use of segregated accounts to protect against insolvency risks. Unfortunately, Eastpac does not appear to offer these safeguards, leaving clients vulnerable to potential losses. The absence of negative balance protection is also a concern, as it means clients could lose more than their initial investment.

Customer Experience and Complaints

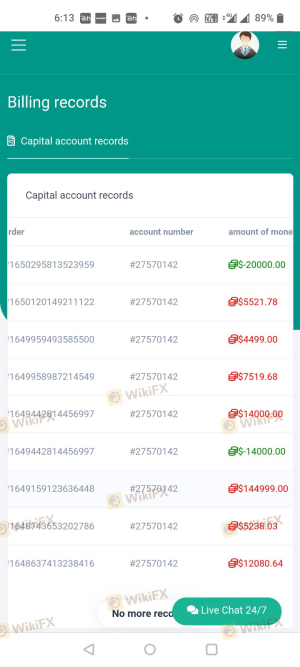

Customer feedback is a vital element in assessing a broker's reliability. Reviews of Eastpac indicate a pattern of dissatisfaction among clients, with common complaints revolving around withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

Many users have reported struggling to withdraw their funds, often facing delays or outright refusals. This pattern is alarming and suggests that Eastpac may employ tactics to prevent clients from accessing their money, a hallmark of many scam brokers.

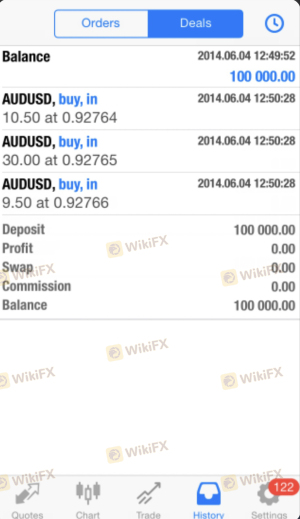

Platform and Trade Execution

The trading platform offered by Eastpac is another critical aspect to consider. While they claim to use the popular MetaTrader 5 platform, reports indicate that users experience issues with order execution, including slippage and rejections.

These execution problems can significantly impact trading performance and raise suspicions about the broker's integrity. A reliable broker should provide a stable trading environment with minimal disruptions, whereas Eastpacs reported issues may reflect underlying operational inefficiencies or deliberate manipulation.

Risk Assessment

Using Eastpac carries inherent risks, primarily due to its unregulated status and questionable operational practices.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker, no oversight |

| Withdrawal Risk | High | Difficulties reported by clients |

| Execution Risk | Medium | Issues with order fills and slippage |

Given these risks, potential traders should exercise extreme caution and consider alternative options. It is advisable to conduct thorough research and only engage with brokers that have established regulatory oversight and positive user experiences.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Eastpac is not a safe trading option. The lack of regulation, transparency issues, high costs, and negative customer experiences all point to significant risks for potential investors.

For traders seeking a reliable Forex broker, it is essential to prioritize safety and regulatory compliance. We recommend exploring alternatives that are well-regulated by reputable authorities, such as the FCA or ASIC, and have a proven track record of customer satisfaction. Always ensure that you are dealing with a broker that prioritizes client fund safety and provides transparent trading conditions.

In light of our findings, we can confidently state that Eastpac is not safe and should be approached with caution.

Is EASTPAC a scam, or is it legit?

The latest exposure and evaluation content of EASTPAC brokers.

EASTPAC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EASTPAC latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.