Eastpac 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Eastpac review examines the foreign exchange broker's performance based on user feedback and market analysis. Eastpac positions itself as a forex trading service provider specializing in foreign exchange trading services, with their official operations accessible through their platform. Based on available user evaluations, the broker demonstrates a mixed performance profile with both positive aspects and notable concerns that traders should understand.

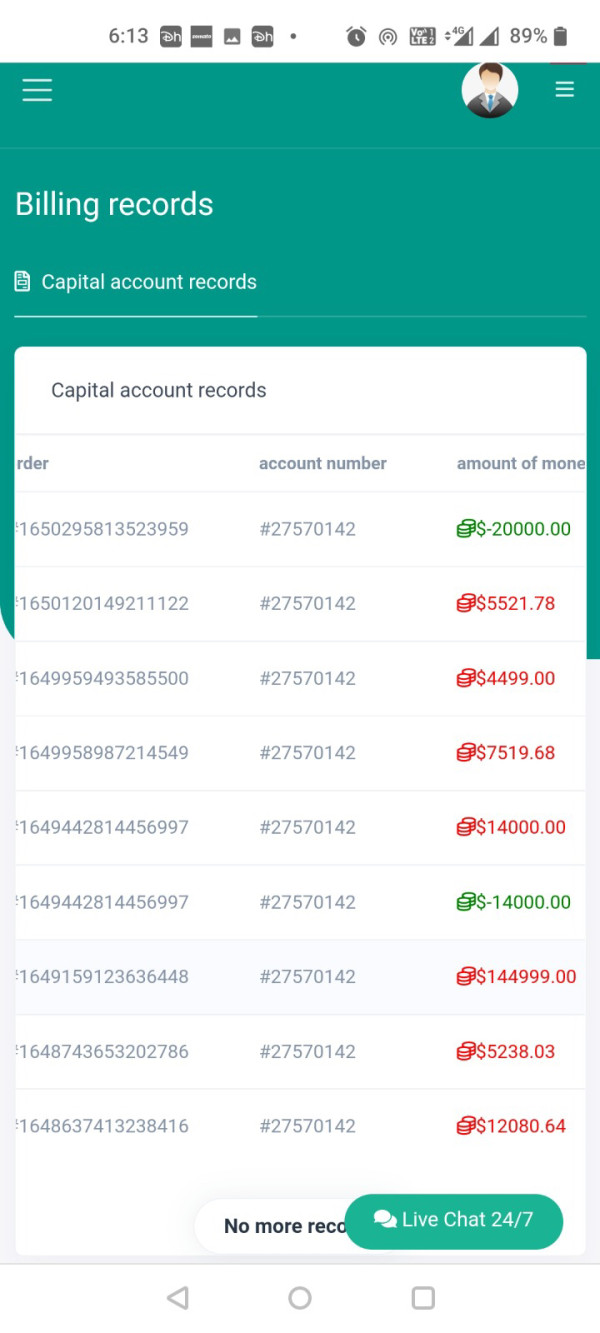

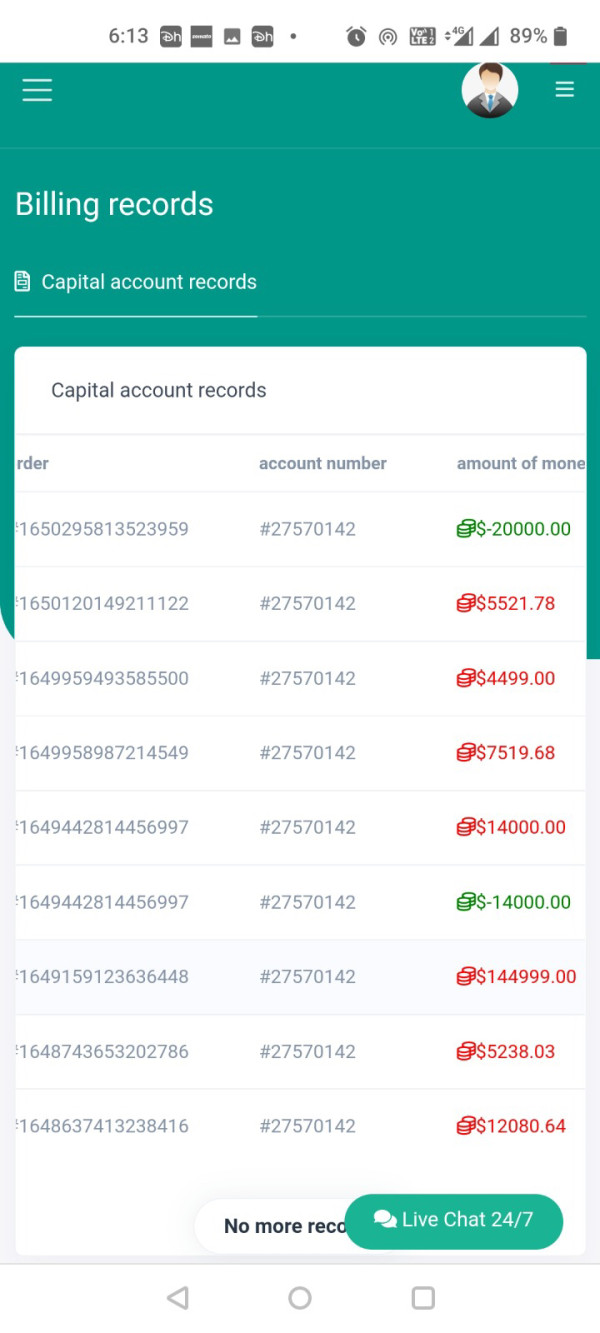

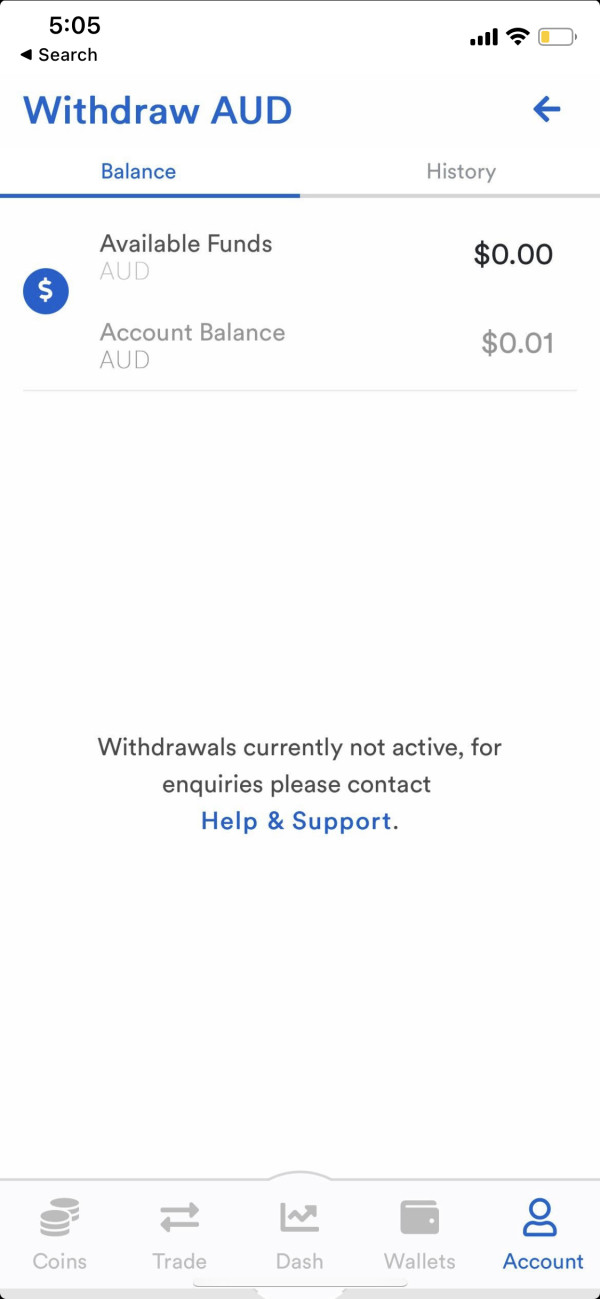

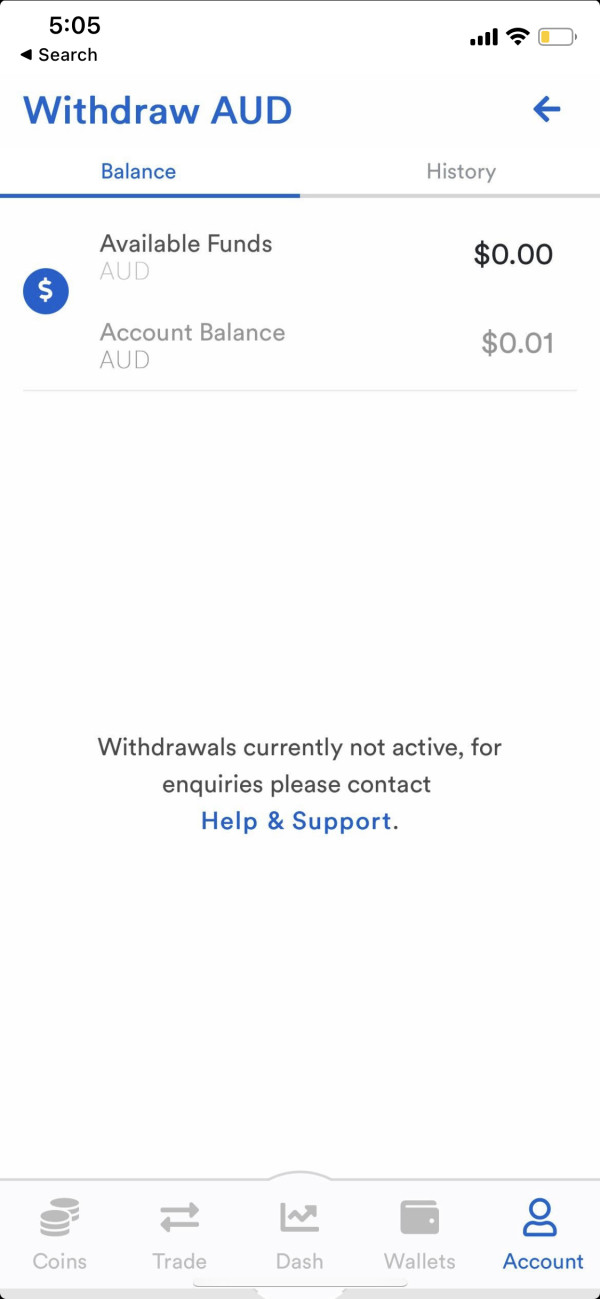

User feedback reveals that Eastpac has received positive reviews for their trading services and customer support quality. However, several users have reported significant withdrawal issues, with some stating that withdrawal requests were not granted until additional tax payments were made, which creates concerning patterns. This problem should make potential traders think carefully about using this broker.

The broker appears to target beginner and intermediate traders seeking straightforward forex trading solutions. While some users appreciate the platform's trading conditions and support services, the withdrawal problems significantly impact the overall user experience and raise questions about operational transparency that cannot be ignored.

Important Notice

This Eastpac review is compiled based on available user feedback and market analysis from various external sources. Specific regulatory information for Eastpac was not detailed in available materials, which may affect user confidence across different regions and represents a major concern for potential clients. The lack of comprehensive regulatory disclosure represents a significant information gap that potential clients should consider when evaluating this broker.

Our evaluation methodology relies on user testimonials, platform analysis, and publicly available information that we could find. Readers should note that regulatory oversight details were not specified in available sources, and this absence of regulatory transparency may impact the broker's credibility assessment in ways that could affect trading decisions.

Rating Framework

Broker Overview

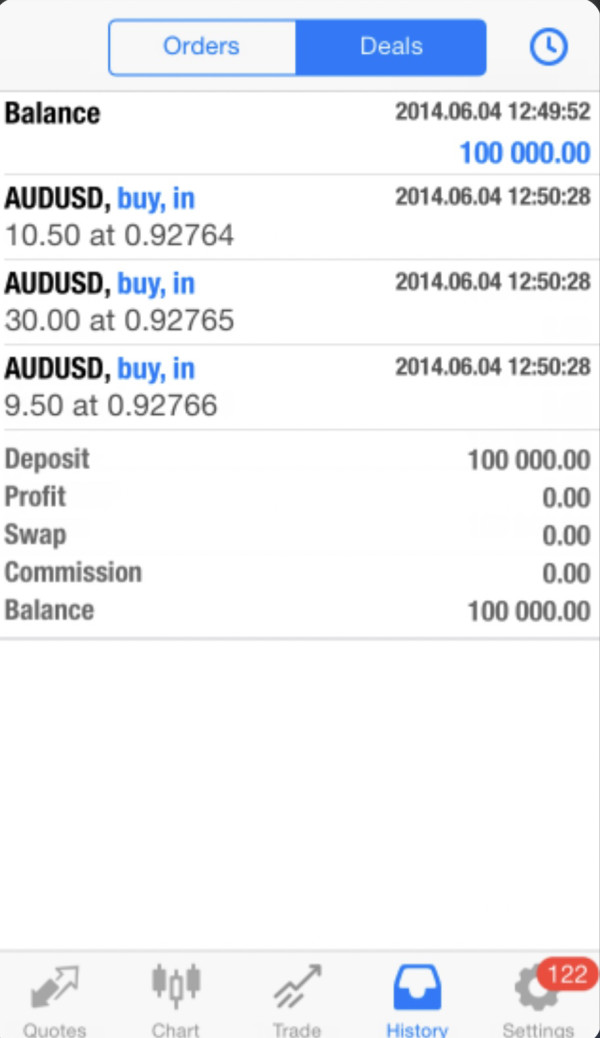

Eastpac operates as a foreign exchange broker specializing in providing forex trading services to retail traders. According to available information, the company positions itself as a service provider focused on meeting client trading needs in the foreign exchange market, though many details about their operations remain unclear. The broker's official website operates through their user platform, though specific establishment dates and detailed company history were not provided in available sources.

The company appears to focus primarily on the Southeast Asian market region, targeting traders who seek accessible forex trading solutions. Their business model centers around providing foreign exchange trading services, though specific details about their operational structure, company ownership, or management team were not detailed in available materials, which creates transparency concerns.

Regarding trading infrastructure, available information indicates that Eastpac primarily offers forex trading services. The specific trading platform types, technological infrastructure, or proprietary trading tools were not detailed in source materials, making it hard to assess their technical capabilities. Similarly, comprehensive information about regulatory oversight, licensing jurisdictions, or compliance frameworks was not specified in available documentation, representing a significant transparency gap for potential clients.

Regulatory Regions: Specific regulatory information was not mentioned in available sources, which represents a significant concern for trader protection and regulatory oversight.

Deposit and Withdrawal Methods: Available sources did not specify the exact deposit and withdrawal methods supported by the platform, though user feedback indicates withdrawal processing issues that could affect your trading.

Minimum Deposit Requirements: Minimum deposit amounts were not specified in available source materials.

Bonuses and Promotions: Information regarding bonus programs or promotional offers was not detailed in available sources.

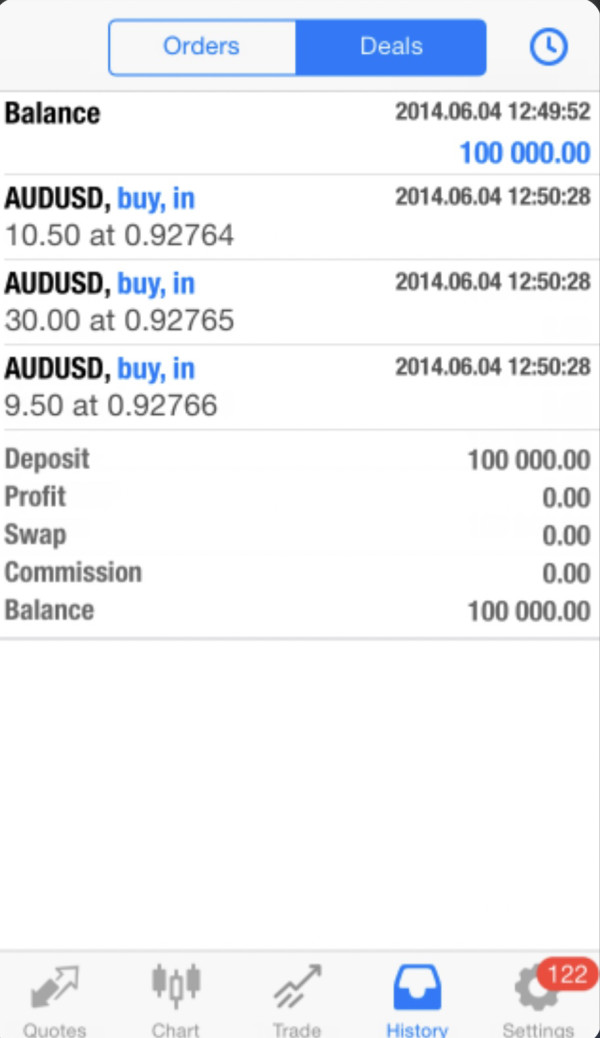

Tradeable Assets: The platform primarily focuses on foreign exchange trading services, though the specific currency pairs or additional asset classes were not comprehensively detailed.

Cost Structure: Specific information about spreads, commissions, swap rates, or other trading costs was not provided in available sources, making cost comparison difficult.

Leverage Ratios: Leverage options and maximum leverage ratios were not specified in available materials.

Platform Options: Specific trading platform software or proprietary platform features were not detailed in source materials.

Regional Restrictions: Geographic limitations or restricted countries were not specified in available information.

Customer Service Languages: Supported languages for customer service were not detailed in available sources.

This Eastpac review highlights significant information gaps that potential traders should consider when evaluating the broker's services.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

The account conditions evaluation for Eastpac faces limitations due to insufficient detailed information in available sources. Specific account types, their features, and differentiation were not comprehensively outlined in accessible materials, which makes it challenging for potential traders to understand what account options are available. This lack of transparency creates problems for traders who need to know how different accounts might suit their trading styles or experience levels.

Minimum deposit requirements, which are crucial for trader decision-making, were not specified in available documentation. Similarly, the account opening process, required documentation, verification procedures, and timeline for account activation were not detailed, creating uncertainty for potential clients who need to understand the commitment required to begin trading.

Special account features such as Islamic accounts, VIP accounts, or accounts with enhanced conditions were not mentioned in available sources. The absence of information about account-specific benefits, exclusive features, or tiered service levels suggests either limited account variety or inadequate disclosure of available options that traders typically expect from modern brokers.

User feedback did not specifically address account condition satisfaction, making it difficult to assess whether traders find the available account structures suitable for their needs. This Eastpac review indicates that prospective clients should directly contact the broker for comprehensive account information before making commitments, though the lack of transparency raises concerns about what they might discover.

The evaluation of trading tools and resources available through Eastpac encounters significant limitations due to insufficient information in available sources. Specific trading tools, their quality, functionality, and user interface were not detailed in accessible materials, which makes it challenging to assess the platform's technological capabilities or competitive position. This absence of information raises questions about whether the platform provides adequate analytical support for trader decision-making.

Research and analysis resources, which are essential for informed trading decisions, were not mentioned in available documentation. The availability of market analysis, economic calendars, technical analysis tools, or fundamental research was not specified, creating gaps in understanding what support traders can expect.

Educational resources, including tutorials, webinars, trading guides, or educational materials for different experience levels, were not detailed in source materials. For brokers targeting beginner and intermediate traders, educational support typically plays a crucial role in client development and satisfaction, making this absence particularly concerning.

Automated trading support, including Expert Advisors, algorithmic trading capabilities, or API access, was not mentioned in available information. User feedback did not specifically address the quality or effectiveness of available tools and resources, making comprehensive evaluation difficult and leaving potential traders without clear expectations.

Customer Service and Support Analysis (7/10)

Customer service represents one of Eastpac's stronger performance areas based on available user feedback. Users have provided positive evaluations regarding the quality of customer support and service responsiveness, which suggests that the broker invests effort in maintaining satisfactory customer relations. This positive feedback indicates that when traders need help, they are likely to receive adequate assistance from the support team.

However, specific customer service channels, availability hours, and contact methods were not detailed in available sources. The absence of information about live chat, phone support, email response times, or support ticket systems makes it difficult to assess the comprehensiveness of customer service infrastructure that traders can rely on.

Response time performance, while receiving positive user mentions, lacks specific metrics or detailed user experiences that would provide deeper insight into service efficiency. The quality of support interactions appears satisfactory based on user feedback, though detailed case studies or problem resolution examples were not available to confirm consistent performance.

Multi-language support capabilities were not specified in available materials, which could be important for the broker's target market in Southeast Asia. Despite positive user feedback, the lack of detailed customer service information represents an area where greater transparency would benefit potential clients who need to understand what support they can expect.

Trading Experience Analysis (6/10)

The trading experience evaluation reveals a mixed performance profile based on user feedback. While some users report satisfactory trading conditions and platform functionality, significant concerns emerge regarding withdrawal processes that substantially impact the overall trading experience and create serious problems for fund access.

Platform stability and execution speed were not specifically detailed in available sources, making it difficult to assess the technical performance of the trading infrastructure. Order execution quality appears to be affected by withdrawal processing issues, as user feedback indicates problems with fund access that can impact trading confidence and experience in ways that could affect your trading success.

Platform functionality completeness was not comprehensively detailed in available materials. The absence of information about advanced trading features, order types, risk management tools, or platform customization options makes it challenging to evaluate the sophistication of the trading environment that experienced traders might expect.

Mobile trading experience details were not provided in available sources, though mobile accessibility is increasingly important for modern forex traders. User feedback indicates some satisfaction with trading flow and platform usability, but withdrawal problems create significant concerns that overshadow positive trading aspects and could affect your ability to access profits.

This Eastpac review emphasizes that withdrawal issues represent a critical factor affecting overall trading experience satisfaction.

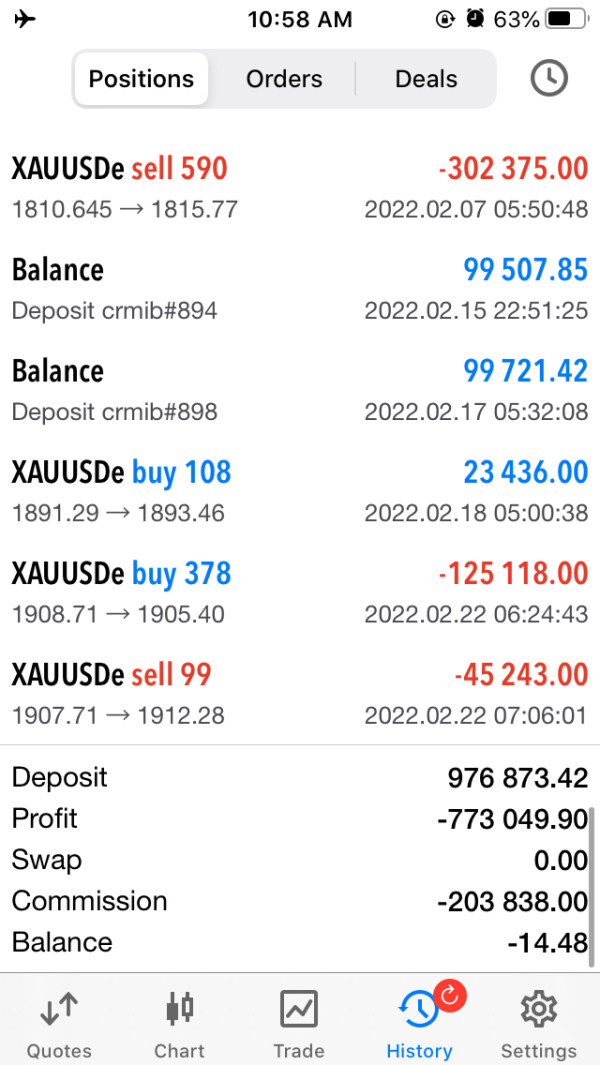

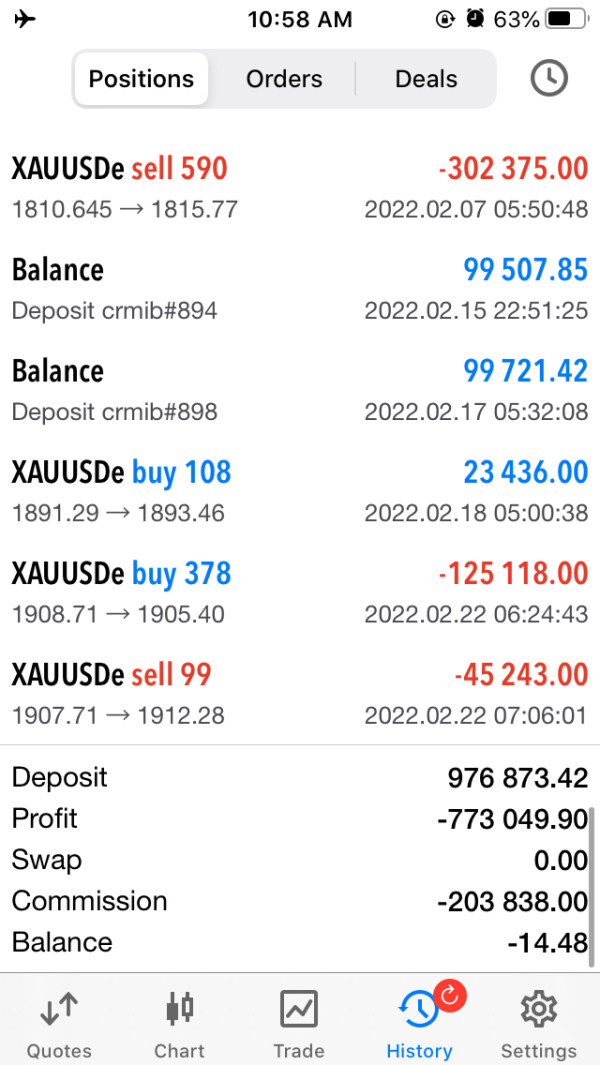

Trust and Reliability Analysis (4/10)

Trust and reliability represent significant concern areas for Eastpac based on available information. The absence of specific regulatory authority details, licensing numbers, or regulatory oversight information creates substantial transparency gaps that affect credibility assessment and should worry potential traders.

Regulatory compliance is fundamental for trader protection and platform legitimacy. Fund security measures, including segregated accounts, investor compensation schemes, or third-party fund custody arrangements, were not detailed in available sources, which raises important questions about financial security and risk management that could affect your money's safety.

Company transparency regarding financial reporting, management team information, operational history, or corporate governance was not provided in accessible materials. Such transparency is typically expected from reputable financial service providers and its absence may concern potential clients who need to trust their broker with significant funds.

Industry reputation and third-party endorsements were not mentioned in available sources. The handling of negative events, particularly the reported withdrawal problems, appears to be a significant issue that affects user trust and platform reliability in ways that could impact your trading decisions.

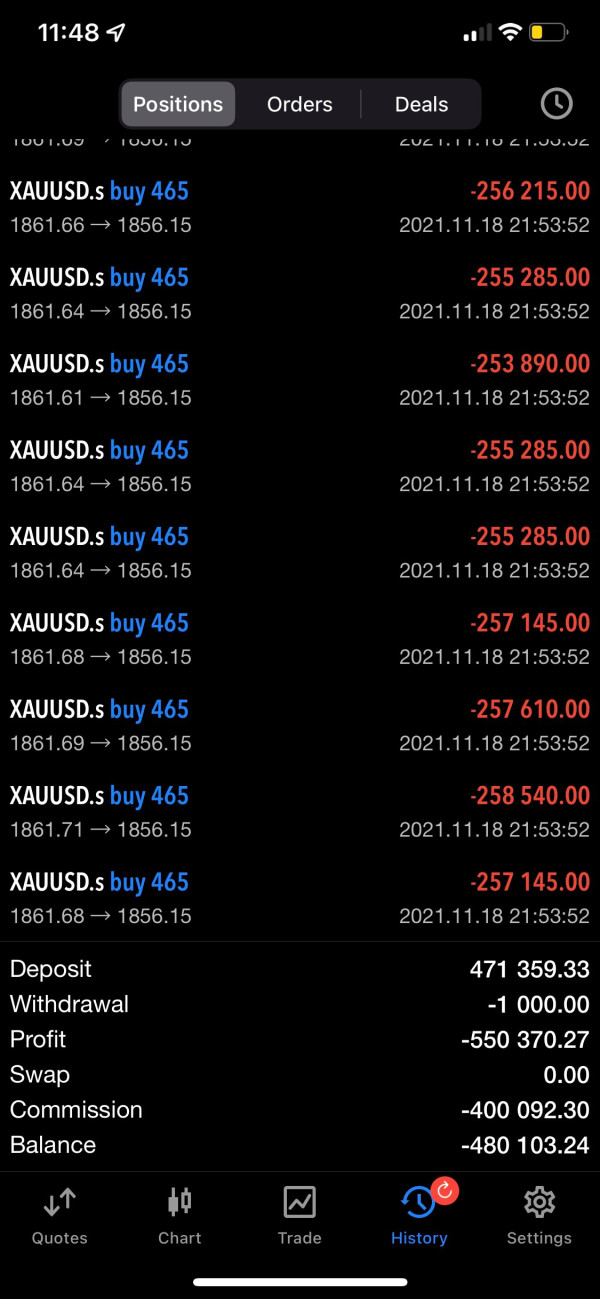

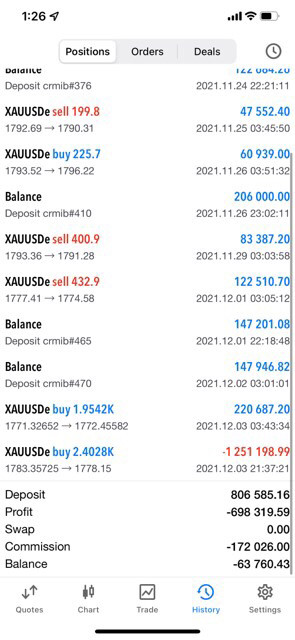

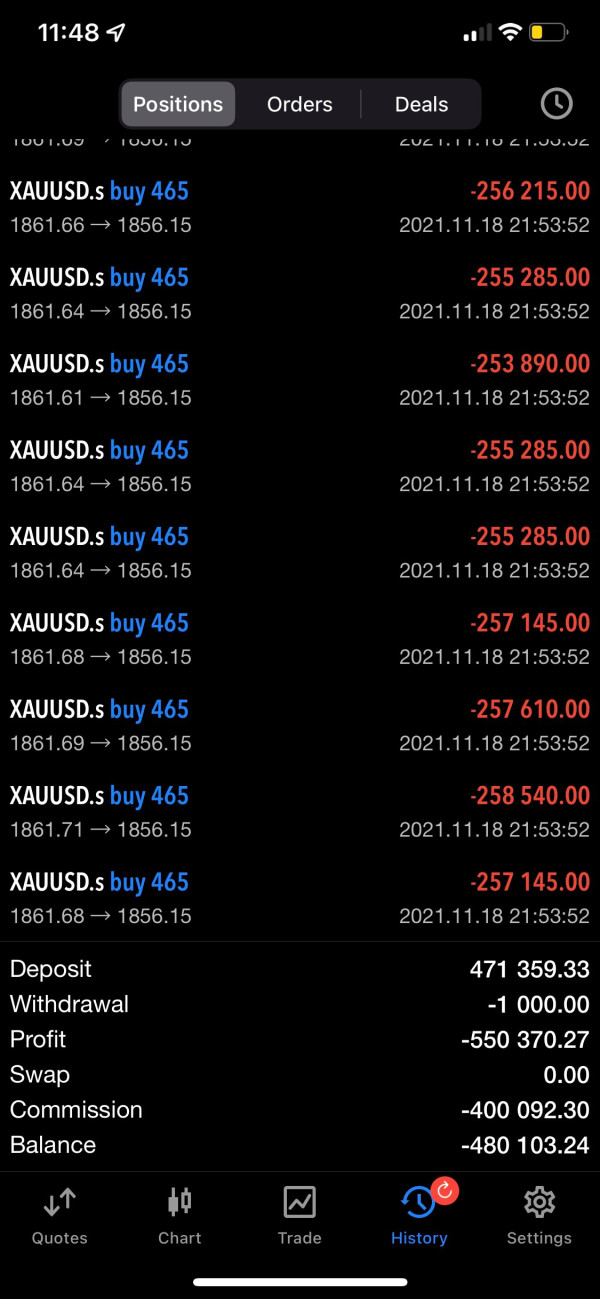

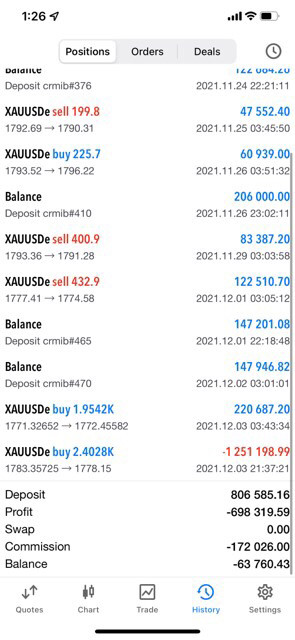

User feedback specifically mentions withdrawal request denials until additional tax payments are made, which represents a concerning pattern that significantly impacts trust and reliability assessment.

User Experience Analysis (6/10)

Overall user satisfaction with Eastpac presents a mixed picture based on available feedback. Users report both positive aspects, particularly regarding customer service quality, and significant negative concerns related to withdrawal processing that create serious problems for traders trying to access their funds.

This balance of feedback suggests that while some platform aspects function satisfactorily, critical operational issues affect overall user experience. Interface design and platform usability were not specifically detailed in available sources, making it difficult to assess the user-friendliness of the trading environment that new traders would encounter.

Registration and verification processes were not described in accessible materials, though these factors significantly impact initial user experience. Fund operation experience represents a critical weakness based on user feedback, with reports of withdrawal request denials until additional payments are made creating significant user experience problems.

These withdrawal issues appear to be a primary source of user dissatisfaction. Common user complaints center around withdrawal processing problems, with specific mentions of requests not being granted until certain tax payments are completed, which suggests systemic issues that potential users should carefully consider before depositing money.

The platform appears suitable for beginner and intermediate traders seeking straightforward forex trading solutions, though withdrawal concerns significantly impact the overall user experience assessment.

Conclusion

This comprehensive Eastpac review reveals a forex broker with mixed performance characteristics that potential traders should carefully evaluate. While the platform demonstrates strengths in customer service quality and receives some positive user feedback regarding trading conditions, significant concerns emerge around withdrawal processing and regulatory transparency that cannot be ignored.

The broker appears most suitable for beginner and intermediate traders seeking basic forex trading services, though the withdrawal issues and lack of regulatory information create important considerations for all potential users. The positive aspects include responsive customer support and satisfactory trading conditions for some users, while the primary disadvantages center on withdrawal processing problems and insufficient regulatory disclosure that could affect your trading success.

Potential traders should carefully weigh these factors and consider conducting thorough due diligence, including direct communication with the broker about withdrawal policies and regulatory compliance, before committing funds to the platform.