DSY 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive DSY review presents a neutral assessment of the broker based on available information and user feedback. While specific regulatory details and trading conditions remain unclear from current sources, user satisfaction data suggests mixed performance across different DSY entities. DSY Hospitality demonstrates notably high employee satisfaction ratings. DSY Solutions maintains a moderate score of 3 according to AmbitionBox evaluations.

The broker appears to target users who prioritize workplace environment and advancement opportunities. The lack of detailed trading specifications raises questions about transparency. Our analysis indicates that potential clients should exercise caution due to limited publicly available information regarding regulatory compliance, trading conditions, and platform specifications. This DSY review aims to provide traders with essential insights while acknowledging the constraints of available data sources.

Important Notice

Potential clients should be aware that information regarding DSY's regulatory status varies significantly across different regions and may not be comprehensively documented in public sources. The regulatory framework governing DSY operations appears to differ between jurisdictions. Specific licensing details were not clearly identified in available materials.

This evaluation is based exclusively on publicly accessible information and user feedback data, without direct account testing or hands-on platform experience. Traders are strongly advised to conduct independent verification of regulatory status and trading conditions before making any investment decisions.

Rating Framework

Based on available information, our evaluation framework assesses DSY across six critical dimensions:

Broker Overview

DSY's operational history and founding details remain unclear from available documentation. This presents challenges for comprehensive evaluation. The company structure appears to encompass multiple entities across different sectors, including hospitality and solutions divisions. The specific relationship between these entities and any forex trading operations requires clarification.

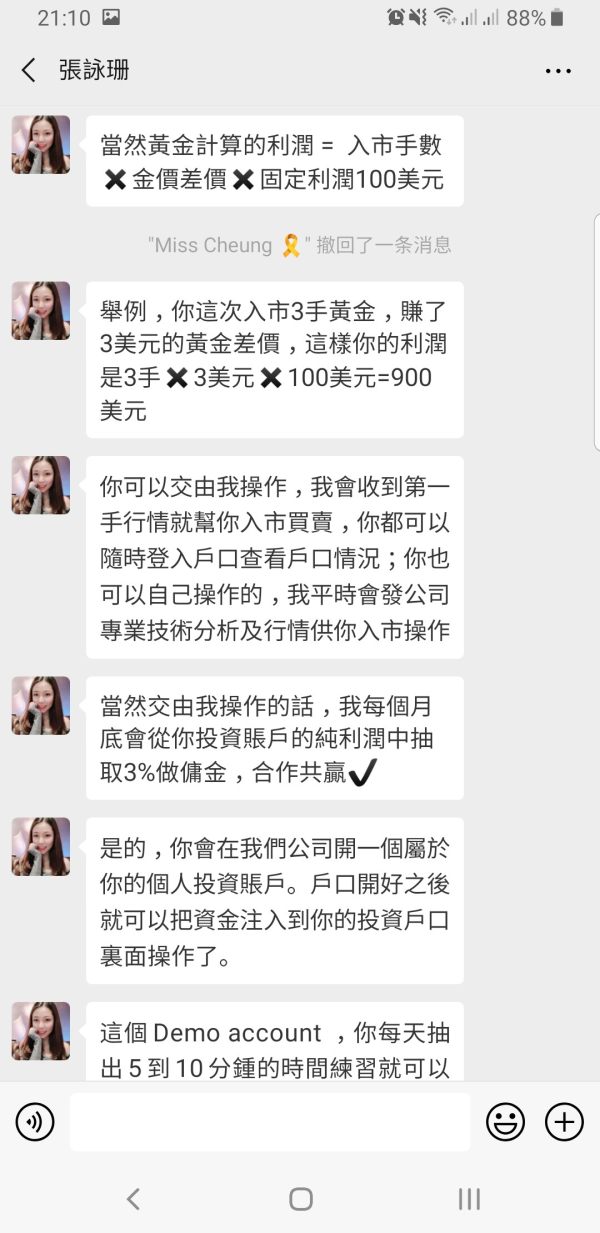

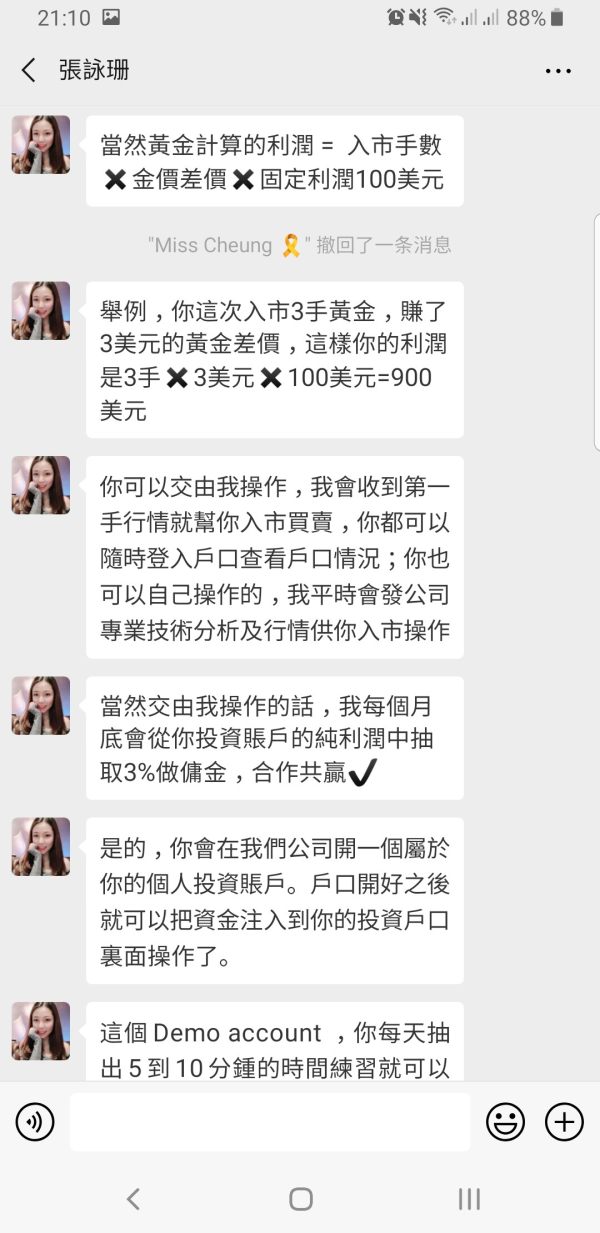

The business model employed by DSY in the financial services sector is not explicitly detailed in current source materials. Without clear information about the company's approach to market making, ECN operations, or STP processing, potential clients cannot adequately assess the broker's execution methodology or potential conflicts of interest.

Trading platform specifications, asset class offerings, and primary regulatory oversight remain inadequately documented in available sources. This DSY review emphasizes the importance of obtaining detailed platform information directly from the broker before considering account opening. The absence of clear regulatory authority identification raises significant concerns about compliance oversight and client fund protection.

Regulatory Regions: Specific regulatory jurisdictions are not clearly identified in available source materials. This creates uncertainty about compliance frameworks.

Deposit and Withdrawal Methods: Payment processing options and procedures are not detailed in current documentation.

Minimum Deposit Requirements: Entry-level funding thresholds are not specified in available information.

Bonus and Promotional Offers: Marketing incentives and promotional structures are not documented in source materials.

Tradeable Assets: The range of available financial instruments remains unspecified in current sources.

Cost Structure: Commission rates, spreads, and fee schedules are not detailed in available documentation. This prevents accurate cost comparison.

Leverage Ratios: Maximum leverage offerings are not specified in source materials.

Platform Options: Trading software and platform alternatives are not comprehensively documented.

Regional Restrictions: Geographic limitations on service availability are not clearly outlined.

Customer Service Languages: Multilingual support options are not specified in available sources.

This DSY review highlights significant information gaps that potential clients should address through direct broker communication.

Account Conditions Analysis

Account type variety and characteristics cannot be adequately assessed due to insufficient information in available source materials. The diversity of account offerings, ranging from basic retail accounts to potentially premium institutional options, remains undocumented in current sources. Without clear specifications regarding account tiers, features, and associated benefits, potential clients cannot make informed decisions about optimal account selection.

Minimum deposit requirements and their reasonableness compared to industry standards cannot be evaluated based on available information. The absence of clear funding thresholds prevents assessment of accessibility for different trader demographics and experience levels.

Account opening procedures and verification requirements are not detailed in current documentation. The complexity and timeline of onboarding processes remain unclear, potentially impacting user experience for new clients seeking rapid market access.

Specialized account features, including Islamic-compliant trading options, VIP services, or institutional accommodations, are not mentioned in available sources. This DSY review emphasizes the need for direct broker consultation to understand available account structures and their suitability for specific trading requirements.

Trading tool availability and quality cannot be comprehensively evaluated due to limited information in source materials. The sophistication of analytical instruments, charting capabilities, and technical indicators remains undocumented. This prevents assessment of platform competitiveness against industry standards.

Research and analytical resource provision appears inadequately documented in current sources. The availability of market commentary, economic calendars, fundamental analysis, and trading signals cannot be verified through available information, limiting evaluation of educational and decision-support resources.

Educational content quality and comprehensiveness remain unclear from available documentation. The presence of trading tutorials, webinars, market education programs, and skill development resources cannot be confirmed through current source materials.

Automated trading support, including Expert Advisor compatibility, algorithmic trading infrastructure, and API access, is not detailed in available information. The platform's capability to accommodate sophisticated trading strategies and systematic approaches remains unverified.

Customer Service and Support Analysis

Customer service channel availability and accessibility cannot be adequately assessed based on current source materials. The range of support options, including live chat, telephone support, email assistance, and social media engagement, remains undocumented in available information.

Response time performance and service quality metrics are not provided in current sources. The efficiency of issue resolution, technical support effectiveness, and overall client satisfaction levels cannot be evaluated through available documentation.

Multilingual support capabilities and geographic coverage remain unclear from source materials. The ability to provide assistance in multiple languages and across different time zones cannot be verified through current information.

Customer service operating hours and availability schedules are not specified in available sources. The extent of 24/7 support, weekend assistance, and holiday coverage remains undocumented, potentially impacting client experience during critical trading periods.

Trading Experience Analysis

Platform stability and execution speed cannot be evaluated due to insufficient technical information in available sources. The reliability of order processing, system uptime statistics, and performance during high-volatility periods remains undocumented in current materials.

Order execution quality and pricing transparency are not detailed in available information. The effectiveness of trade fills, slippage management, and price improvement practices cannot be assessed through current source documentation.

Platform functionality completeness and user interface design remain inadequately documented. The sophistication of trading tools, customization options, and workflow efficiency cannot be evaluated based on available materials.

Mobile trading experience and application quality are not specified in current sources. The functionality of smartphone and tablet applications, synchronization with desktop platforms, and mobile-specific features cannot be verified through available information.

This DSY review emphasizes the critical importance of platform testing through demo accounts or direct consultation before committing capital to live trading environments.

Trust and Reliability Analysis

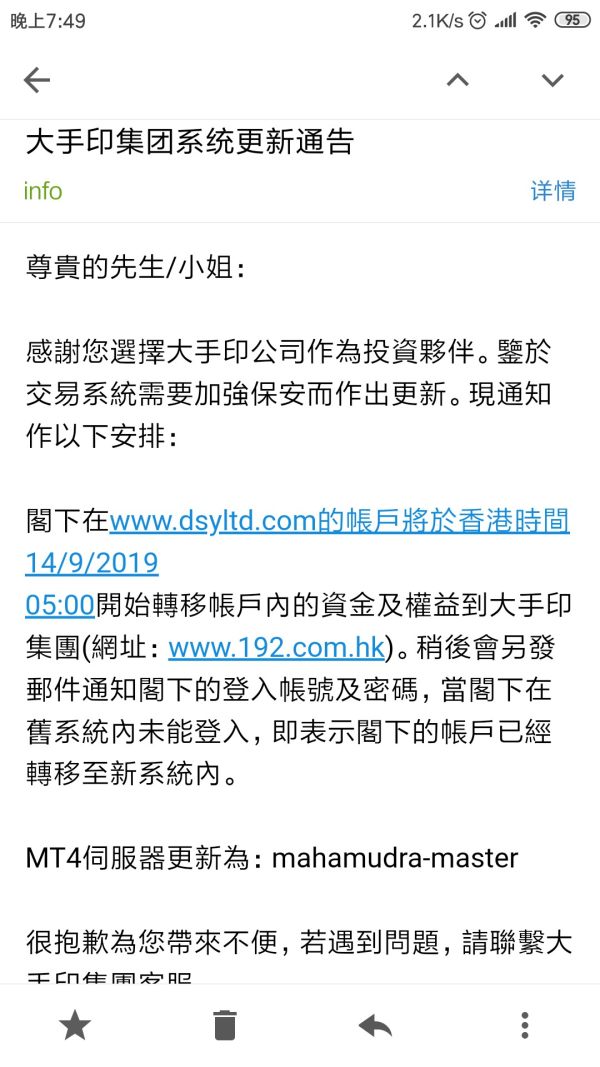

Regulatory credentials and compliance status cannot be comprehensively verified through available source materials. The absence of clear licensing information, regulatory authority oversight, and compliance framework details raises significant concerns about operational legitimacy and client protection measures.

Fund security arrangements and segregation practices are not detailed in current documentation. The implementation of client money protection, segregated account structures, and deposit insurance coverage cannot be confirmed through available information sources.

Company transparency and operational disclosure remain inadequately documented. The availability of detailed company information, ownership structures, financial reporting, and operational statistics cannot be verified through current source materials.

Industry reputation and peer recognition are not clearly established in available documentation. The broker's standing within professional trading communities, industry awards, and third-party endorsements cannot be confirmed through current sources.

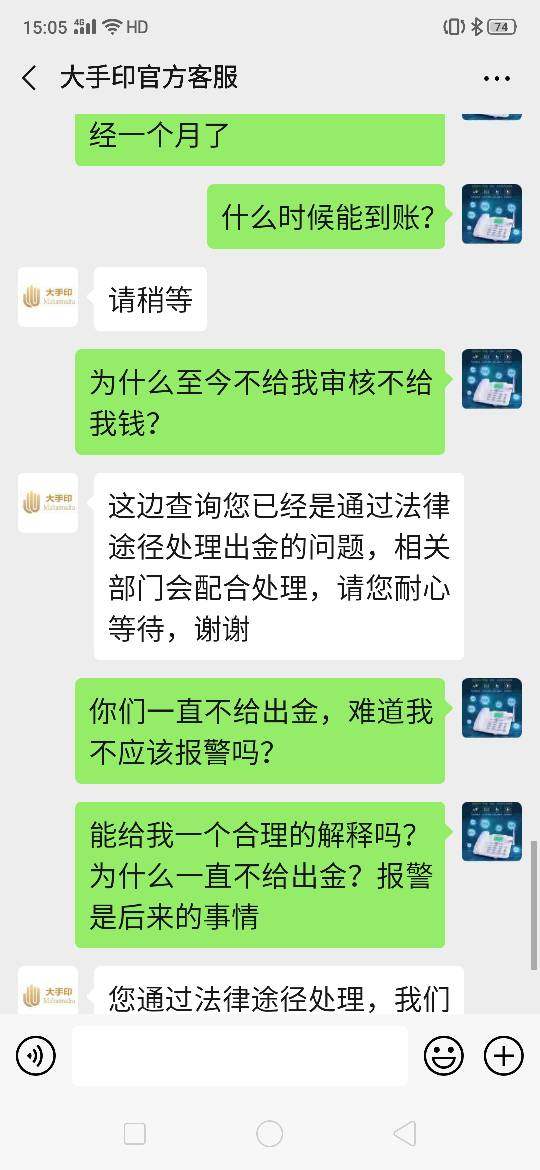

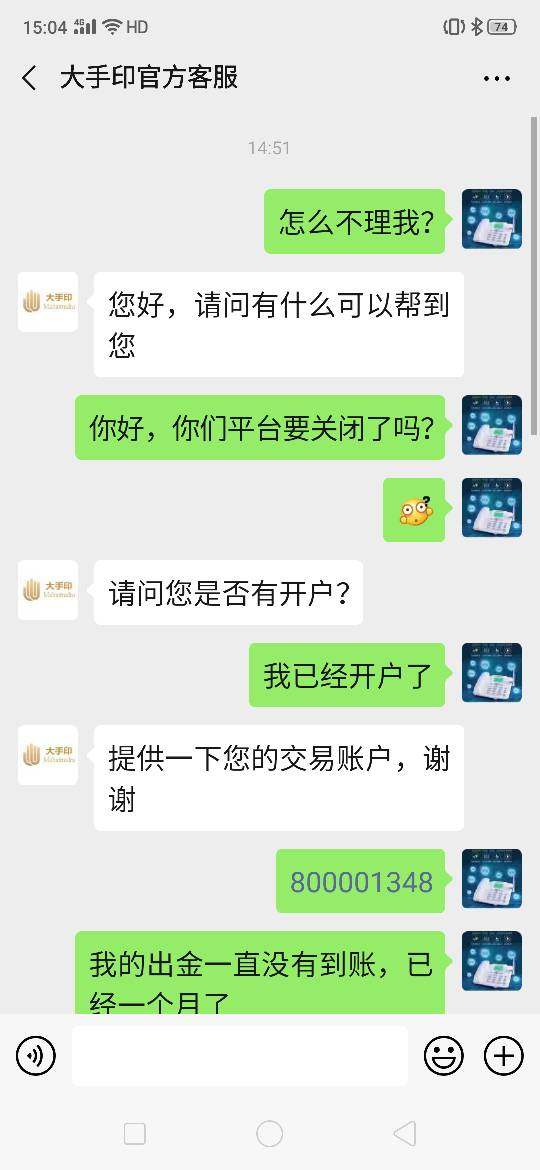

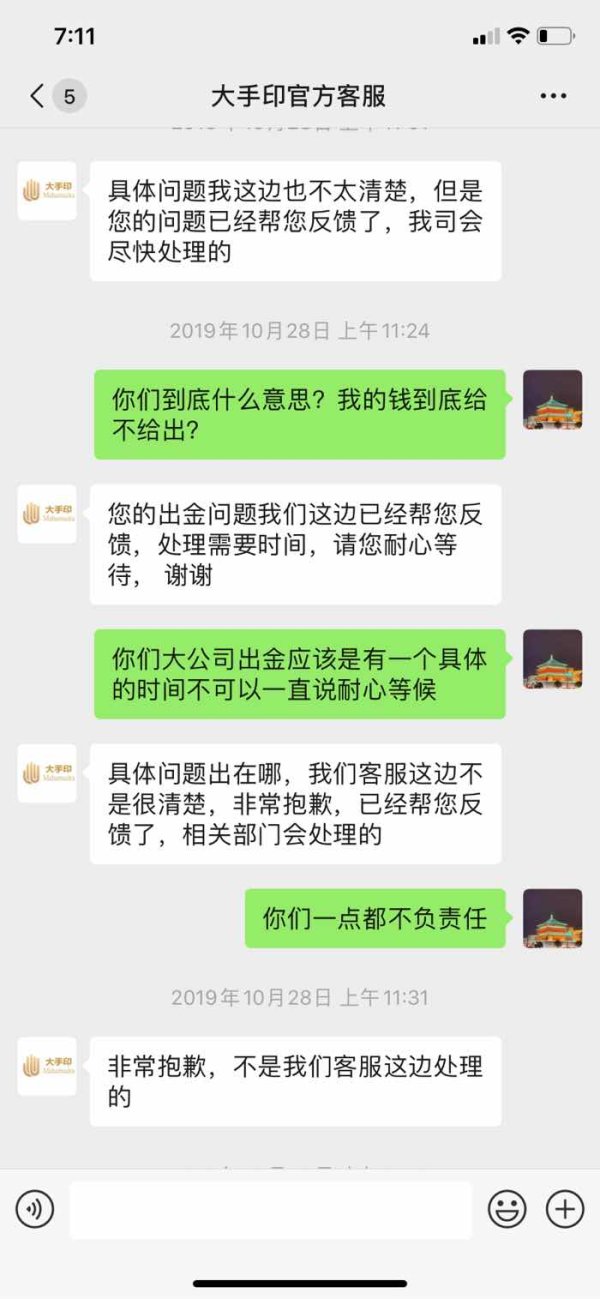

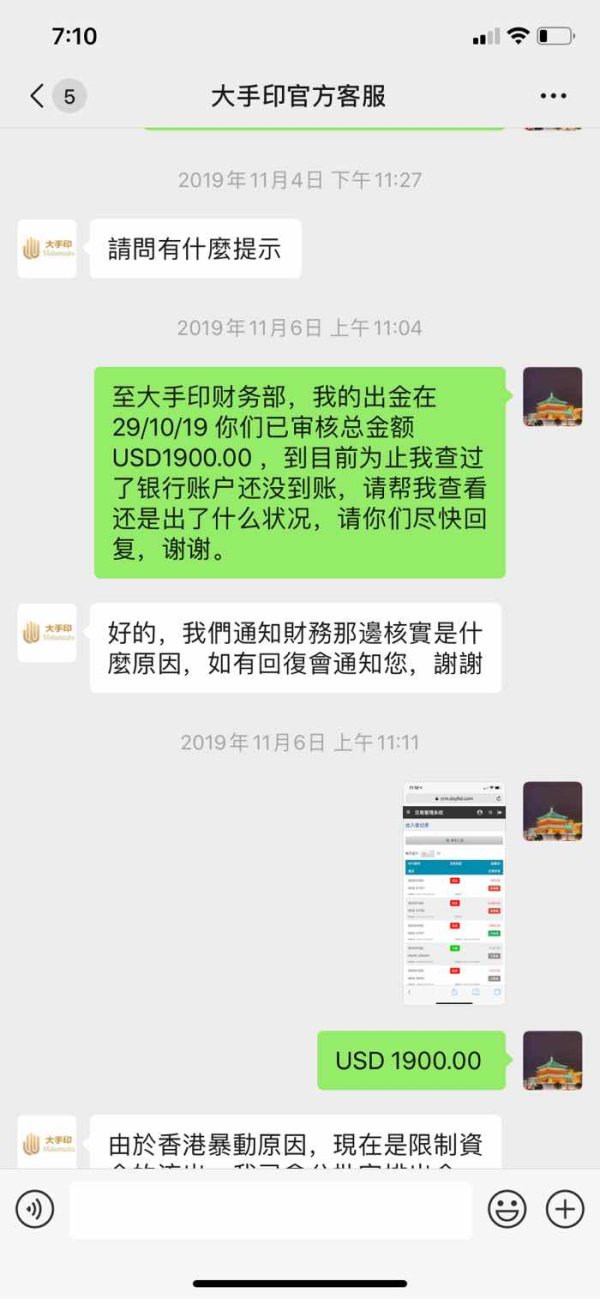

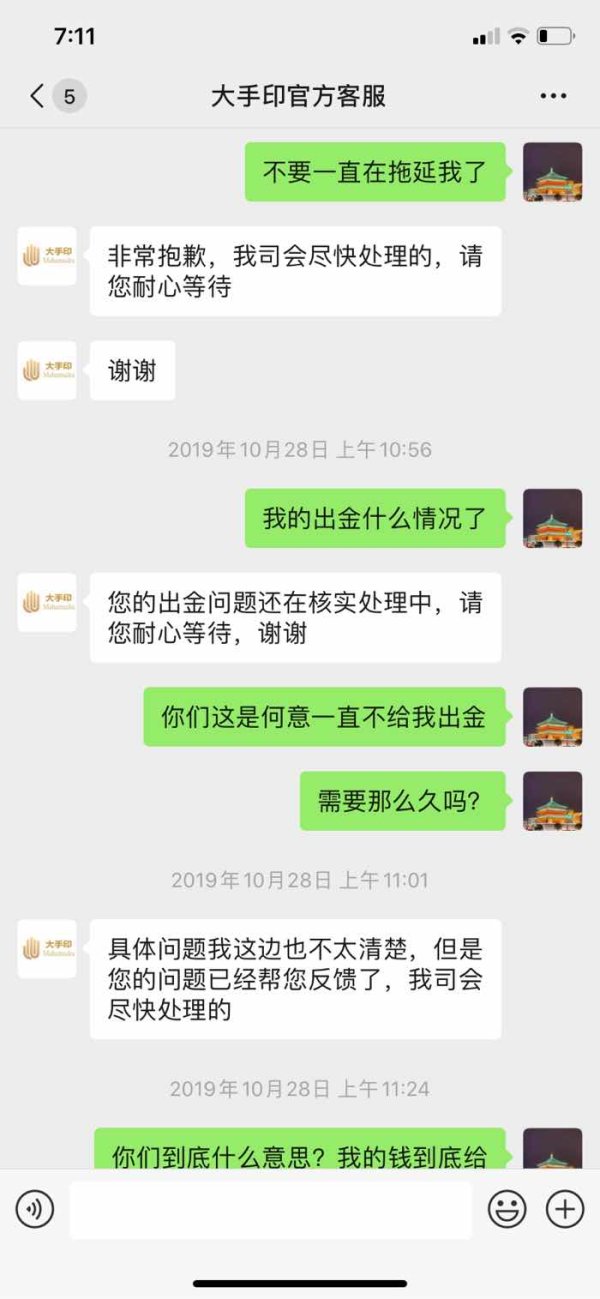

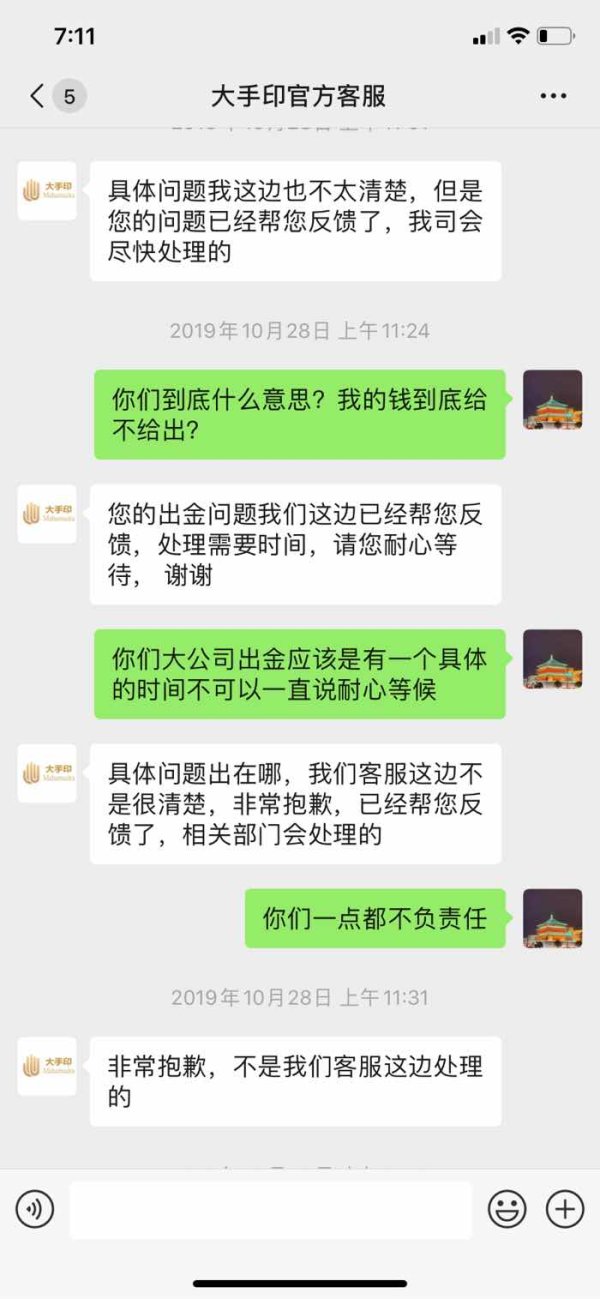

Negative incident handling and dispute resolution procedures are not outlined in available materials. The effectiveness of complaint processing, regulatory investigation responses, and client compensation arrangements remains undocumented.

User Experience Analysis

Overall user satisfaction levels cannot be comprehensively assessed due to limited feedback data in available sources. While DSY Solutions maintains a moderate rating of 3 according to AmbitionBox, this information appears related to employment satisfaction rather than trading platform experience.

Interface design quality and platform usability remain inadequately documented in current sources. The intuitiveness of navigation, visual design effectiveness, and user workflow optimization cannot be evaluated through available materials.

Registration and verification process efficiency are not detailed in current documentation. The complexity of account opening procedures, document submission requirements, and approval timelines cannot be assessed through available information.

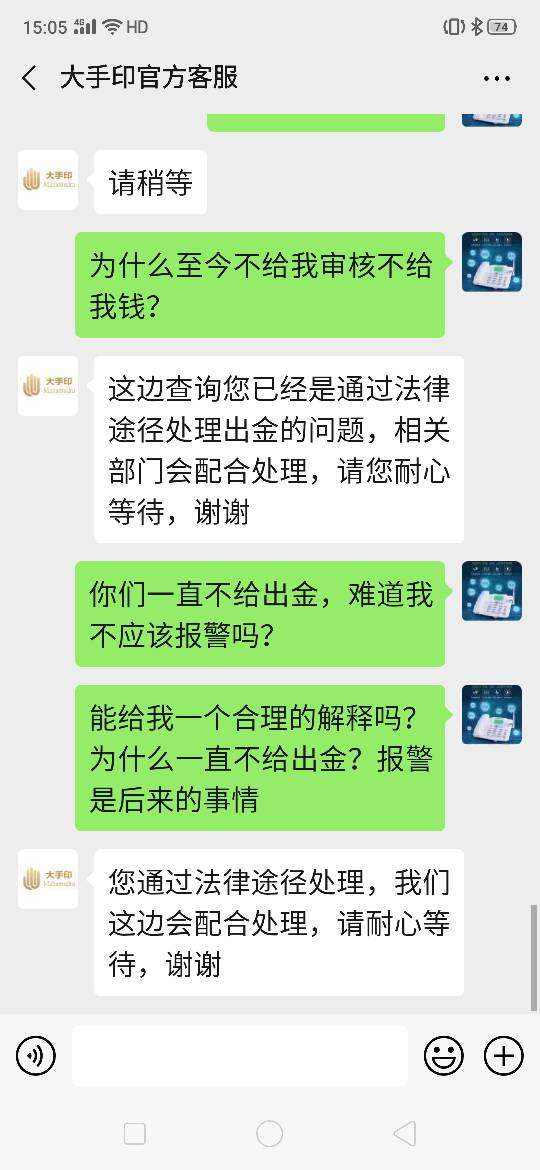

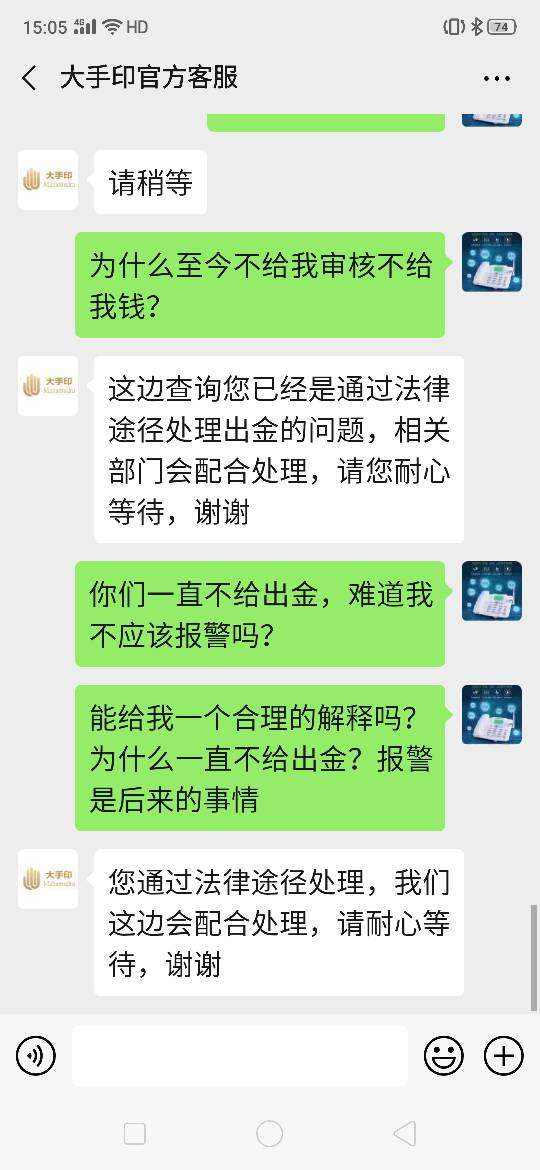

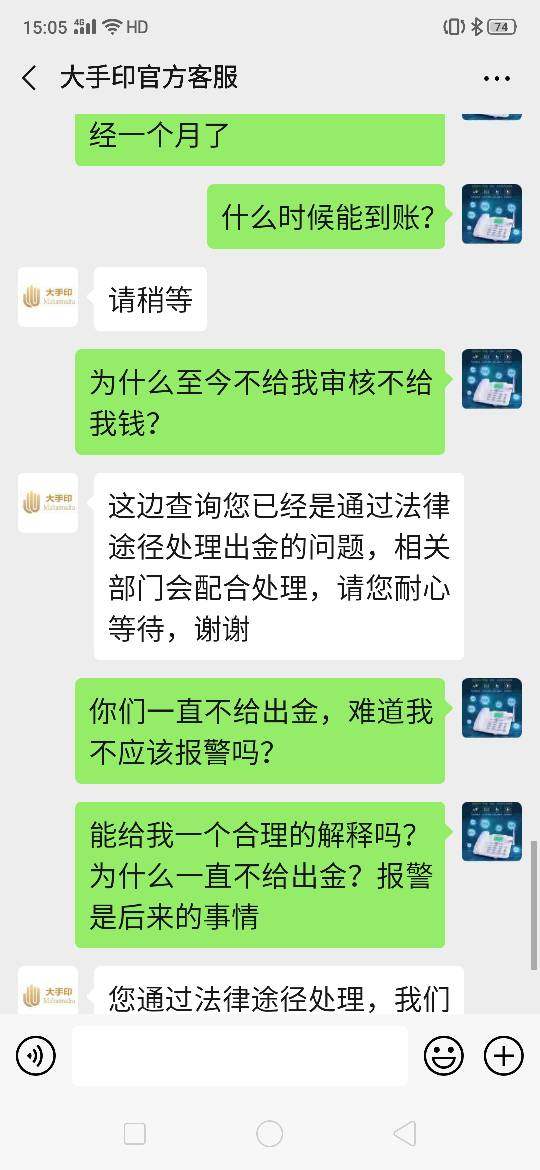

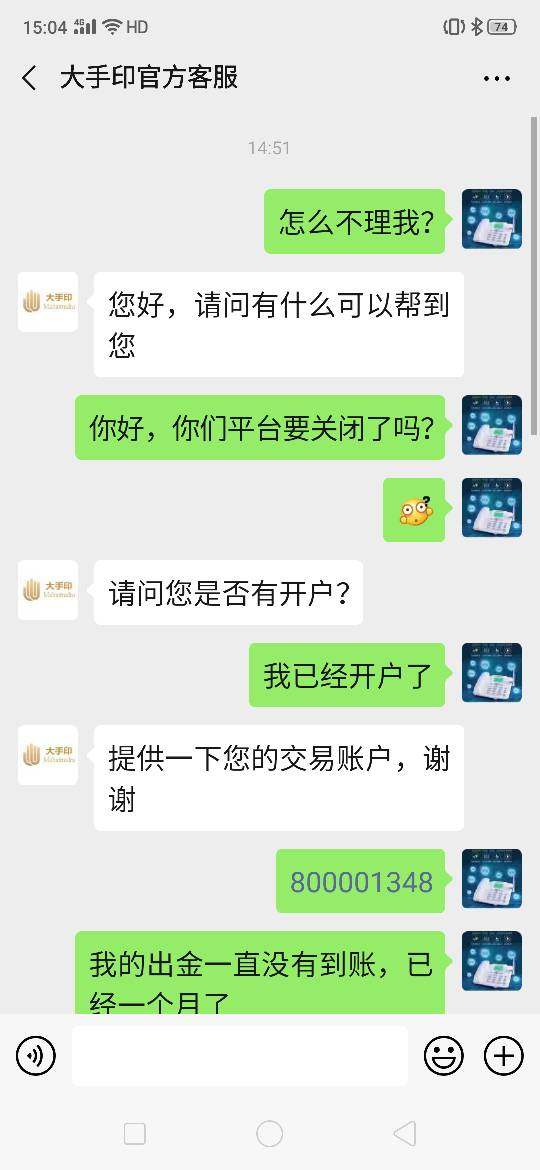

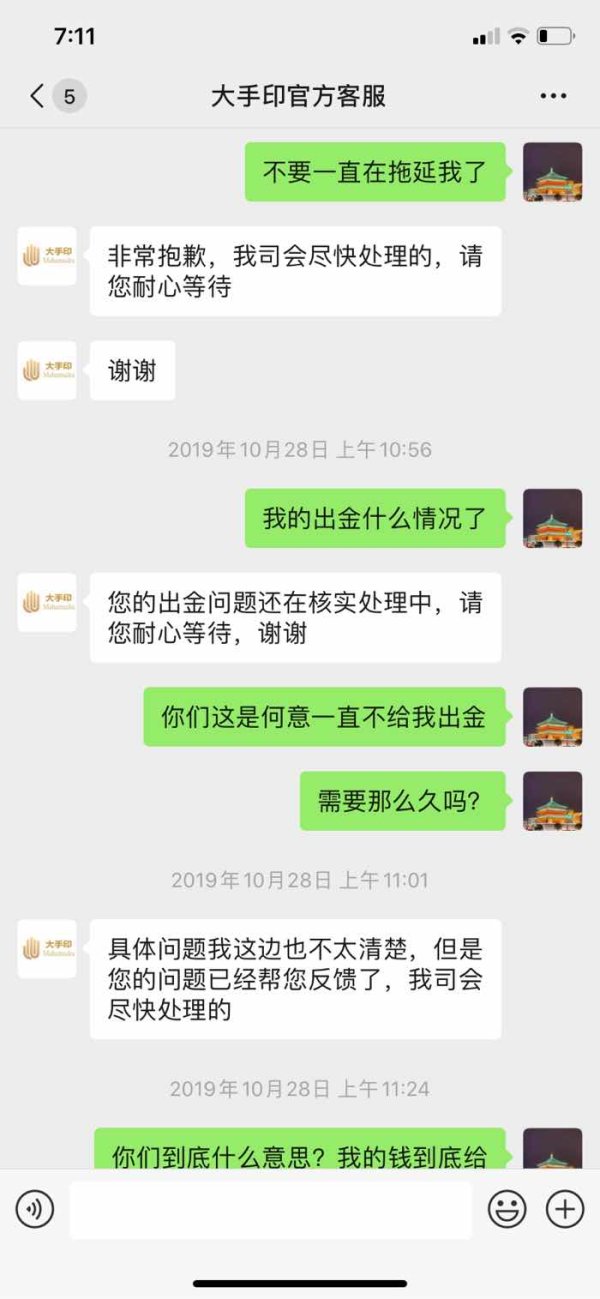

Funding operation experience and transaction processing remain unclear from source materials. The efficiency of deposit and withdrawal procedures, processing times, and fee structures cannot be verified through current sources.

Common user complaints and satisfaction drivers are not documented in available information. The identification of frequent issues, resolution effectiveness, and overall client retention factors cannot be established through current source materials.

Conclusion

This DSY review presents a neutral assessment complicated by significant information gaps in available source materials. The absence of detailed regulatory information, trading conditions, and platform specifications prevents comprehensive evaluation of the broker's suitability for different trader types.

While DSY Hospitality demonstrates positive employee satisfaction ratings, the lack of specific trading-related information raises concerns about transparency and operational clarity. Potential clients seeking reliable forex trading services should prioritize brokers with comprehensive regulatory disclosure and detailed platform documentation.

The primary limitation identified in this evaluation is the insufficient availability of critical trading information, including regulatory compliance, cost structures, and platform capabilities, which are essential for informed broker selection decisions.