Is CRYPTO OPTIONS safe?

Pros

Cons

Is Crypto Options Safe or a Scam?

Introduction

Crypto Options is a trading platform that has gained attention in the forex market for its offerings in cryptocurrency options trading. As the cryptocurrency landscape continues to evolve, traders are increasingly drawn to platforms that promise high returns and innovative trading options. However, the rapid growth of this market also brings about a myriad of risks, making it essential for traders to exercise caution when evaluating forex brokers. This article aims to provide a comprehensive analysis of Crypto Options, assessing its safety, regulatory status, company background, trading conditions, and overall reliability. Our investigation is based on a thorough review of multiple sources, including regulatory databases, user feedback, and industry reports.

Regulation and Legitimacy

The regulatory status of a trading platform is a crucial factor in determining its legitimacy and safety. Crypto Options is not regulated by any major financial authority, which raises significant concerns about its trustworthiness. The absence of regulatory oversight means that traders have limited recourse in the event of disputes or issues. Below is a summary of the regulatory information regarding Crypto Options:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulation by a recognized authority such as the FCA (Financial Conduct Authority) in the UK, SEC (Securities and Exchange Commission) in the US, or ASIC (Australian Securities and Investments Commission) is alarming. Top-tier regulators enforce strict standards that protect traders from fraud and ensure fair trading practices. The absence of such oversight indicates that Crypto Options operates in a high-risk environment where the potential for scams and fraudulent activities is elevated.

Additionally, the platform has been flagged by various sources for its questionable practices, including unrealistic promises of high returns and difficulties in withdrawing funds. This history of non-compliance and lack of transparency raises significant red flags about the safety of using Crypto Options.

Company Background Investigation

A thorough investigation into the companys background can provide valuable insights into its credibility. Crypto Options claims to have been established to provide traders with access to cryptocurrency options; however, detailed information about its history, ownership structure, and management team is scarce. This lack of transparency is concerning, as reputable trading platforms typically disclose their operational history and key personnel.

The management team behind Crypto Options remains largely anonymous, which is atypical for established brokers. A transparent company usually provides information about its founders and executives, showcasing their experience and qualifications in the financial industry. The absence of this information raises questions about the platforms legitimacy and the competence of its management.

Furthermore, the lack of a verified physical address or contact information makes it difficult for traders to reach out for support or assistance. This opacity can be a tactic employed by fraudulent platforms to evade accountability. Overall, the limited information available about Crypto Options significantly undermines its credibility and raises concerns about its operational integrity.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its overall value and safety. Crypto Options presents a trading structure that may initially appear appealing to potential investors. However, upon closer inspection, several concerning practices come to light.

The platform claims to offer competitive spreads and low fees, but the lack of clarity regarding its fee structure is troubling. Heres a simplified comparison of the core trading costs associated with Crypto Options:

| Fee Type | Crypto Options | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | 0.1-0.5% |

| Overnight Interest Range | N/A | 0.5-2% |

The absence of specific details regarding spreads and commissions raises concerns about hidden fees that could significantly impact a traders profitability. Additionally, the lack of transparency regarding overnight interest rates and other potential charges may lead to unexpected costs for traders, further complicating their trading experience.

Moreover, the platforms promotional materials often highlight enticing returns without adequately disclosing the risks involved. This practice is commonly associated with less reputable brokers that prioritize attracting new customers over providing a fair trading environment. Therefore, potential users must approach Crypto Options with caution and carefully consider the potential pitfalls associated with its trading conditions.

Client Fund Security

The security of client funds is paramount in evaluating a trading platform‘s reliability. Crypto Options claims to implement various security measures, but the lack of detailed information regarding these practices raises concerns. A thorough analysis of their fund security protocols is necessary to assess the platform’s safety.

Typically, reputable brokers maintain strict fund segregation policies, ensuring that client funds are kept separate from the company‘s operational funds. This practice protects traders in the event of the broker’s insolvency. However, Crypto Options has not provided any verifiable information regarding its fund segregation policies or investor protection mechanisms.

Investors should also be wary of platforms that do not offer negative balance protection. This feature ensures that traders cannot lose more than their deposited funds, providing an additional layer of security. Without such protection, traders risk incurring significant losses during volatile market conditions.

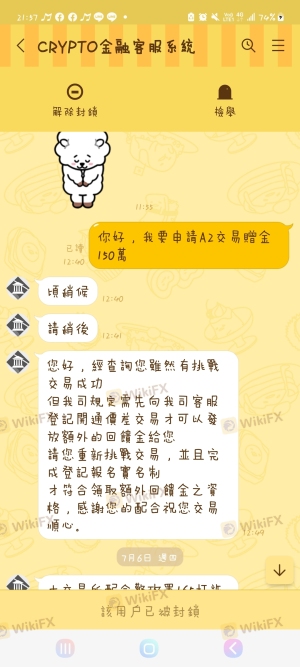

Furthermore, there have been reports of users experiencing difficulties in withdrawing their funds, a common issue associated with scam brokers. This history of complaints regarding fund accessibility is a major red flag and underscores the importance of ensuring that any trading platform has robust security measures in place.

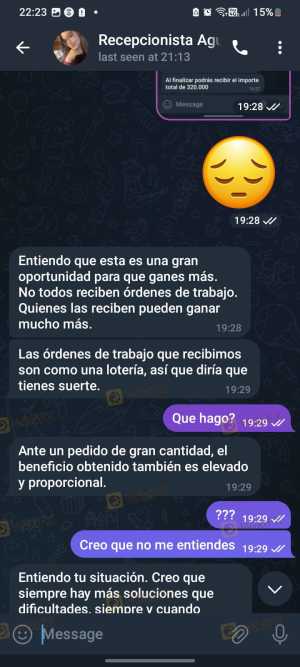

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding a platform's reputation and user experience. Reviews of Crypto Options reveal a mixed bag of experiences, with many users expressing dissatisfaction with the platforms services.

Common complaints include issues with account verification, withdrawal difficulties, and unresponsive customer support. Heres a summary of the main complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Account Verification Delays | Medium | Slow |

| Poor Customer Support | High | Unresolved |

The severity of complaints regarding withdrawal issues is particularly alarming, as it indicates potential fraud or mismanagement of client funds. Users have reported being unable to access their funds for extended periods, which is a significant concern for any trader looking to invest their capital.

Additionally, the platforms customer support has been criticized for being slow to respond or entirely unresponsive. This lack of support can leave traders feeling frustrated and helpless, especially when dealing with urgent issues related to their accounts or funds.

Platform and Execution Quality

The performance of a trading platform is critical for ensuring a smooth trading experience. Users have reported mixed experiences with the Crypto Options trading platform, with some citing issues related to stability and execution quality.

A well-functioning platform should provide seamless order execution with minimal slippage and a low rejection rate. However, reports of significant slippage and frequent order rejections on Crypto Options indicate potential problems with its execution quality. This can be particularly detrimental in fast-moving markets, where every second counts.

Moreover, there have been allegations of platform manipulation, which can severely undermine a traders trust in the broker. If traders feel that their orders are being manipulated or that they are not receiving fair prices, it can lead to significant losses and a lack of confidence in the trading environment.

Risk Assessment

Trading with Crypto Options presents several risks that potential users should consider. Heres a summary of the key risk areas associated with this platform:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No major regulatory oversight. |

| Fund Security Risk | High | Lack of information on fund protection measures. |

| Execution Risk | Medium | Issues with order execution and potential manipulation. |

| Customer Service Risk | High | Unresponsive support and withdrawal issues. |

The high regulatory risk associated with Crypto Options is a significant concern, as traders have limited protections in place. Additionally, the lack of transparency regarding fund security measures raises alarms about the safety of client funds.

To mitigate these risks, potential users should conduct thorough research, consider using demo accounts to evaluate the platform, and only invest funds they can afford to lose. Seeking out platforms with strong regulatory oversight and positive user feedback can also help traders avoid potential pitfalls.

Conclusion and Recommendations

In conclusion, the evidence suggests that Crypto Options presents several red flags that warrant caution. The lack of regulatory oversight, transparency regarding fund security, and numerous customer complaints indicate that the platform may not be a safe choice for traders.

While there are opportunities in the cryptocurrency options market, it is crucial to prioritize safety and reliability when selecting a trading platform. Traders should consider using well-regulated platforms with a proven track record, such as Binance or Bybit, which offer more robust security measures and better customer support.

In summary, while Crypto Options may appear attractive at first glance, the potential risks and concerns surrounding its operations suggest that traders should proceed with caution and consider alternative, more trustworthy options.

Is CRYPTO OPTIONS a scam, or is it legit?

The latest exposure and evaluation content of CRYPTO OPTIONS brokers.

CRYPTO OPTIONS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CRYPTO OPTIONS latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.