Is bofu210 safe?

Business

License

Is Bofu210 Safe or a Scam?

Introduction

Bofu210 is a forex broker that has recently garnered attention in the trading community. Positioned as a platform for forex trading, it claims to offer various trading opportunities and financial instruments. However, with the increasing number of scams in the forex market, traders must exercise caution when selecting a broker. Evaluating the legitimacy of a broker like Bofu210 is crucial to ensure the safety of your investments. In this article, we will investigate the safety and reliability of Bofu210 through a comprehensive analysis of its regulatory status, company background, trading conditions, customer feedback, and risk factors.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its legitimacy. A well-regulated broker is typically seen as safer, providing a level of assurance to traders regarding the security of their funds. Unfortunately, Bofu210 lacks any valid regulatory information, which raises significant red flags.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of regulation implies that Bofu210 is not overseen by any recognized financial authority. This lack of oversight can expose traders to significant risks, including the potential for fraudulent activities. Furthermore, the broker has been noted to have a suspicious regulatory license and a low score in various assessments, indicating a high-risk profile. Traders should be particularly wary of platforms without regulatory oversight, as they may not adhere to industry standards and may lack transparency in their operations.

Company Background Investigation

Bofu210, operated by 柏富有限公司 (Bofu Limited), has been active in the forex market for approximately 2 to 5 years. However, details about its ownership structure and management team are sparse. This lack of transparency can be concerning for potential clients, as it makes it difficult to ascertain the credibility of the individuals behind the broker.

While the company claims to offer a wide range of trading services, the absence of detailed information about its history and management raises questions about its legitimacy. A reputable broker typically provides comprehensive information about its team and operational history, which Bofu210 fails to do. This lack of clarity can lead to doubts regarding the broker's reliability and commitment to ethical trading practices.

Trading Conditions Analysis

The trading conditions offered by Bofu210 are another critical aspect to consider. A thorough understanding of the fee structure and potential hidden costs is essential for traders. Bofu210's fees and commissions are not transparently disclosed, making it challenging for traders to evaluate the overall cost of trading on the platform.

| Fee Type | Bofu210 | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The lack of clear information on spreads, commissions, and overnight interest rates is concerning. Traders should be cautious about brokers that do not provide transparent fee structures, as this may indicate potential hidden charges that could significantly impact trading profitability. Given these factors, it is essential to approach Bofu210 with skepticism regarding its trading conditions.

Client Fund Safety

The safety of client funds is a critical consideration when evaluating a forex broker. Bofu210's policies regarding fund security, including fund segregation and negative balance protection, are not clearly outlined. This lack of information is alarming, as traders need to know how their funds are protected.

Without adequate measures in place, such as segregated accounts or investor compensation schemes, traders are at risk of losing their money in the event of a broker failure. Additionally, there have been no documented instances of Bofu210 addressing any past fund security issues, which further emphasizes the need for caution when considering this broker.

Customer Experience and Complaints

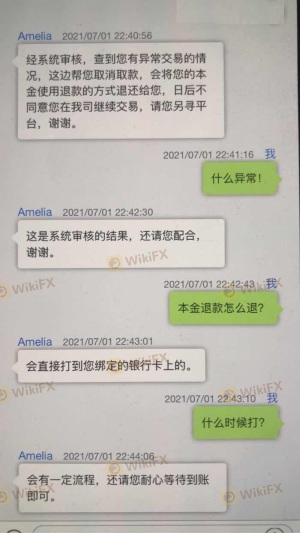

Analyzing customer feedback can provide valuable insights into a broker's reliability and service quality. Unfortunately, Bofu210 has received numerous complaints from users regarding withdrawal issues and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Issues | Medium | Poor |

Common complaints include difficulties in withdrawing funds, which is a significant concern for any trader. A broker's inability to facilitate withdrawals can be a major indicator of potential fraud or mismanagement. While some users may have positive experiences, the prevalence of negative feedback suggests that Bofu210 may not be a trustworthy choice for traders.

Platform and Execution

The trading platform's performance is essential for a seamless trading experience. Bofu210's platform has been criticized for its stability and execution quality. Reports of slippage and order rejections have surfaced, which can severely impact trading outcomes.

Traders have noted that during volatile market conditions, the platform often fails to execute orders at the desired price, leading to unexpected losses. Such issues can be indicative of platform manipulation or inadequate infrastructure, further raising concerns about the broker's reliability.

Risk Assessment

Using Bofu210 involves several risks that traders should be aware of. The absence of regulation, unclear trading conditions, and negative customer feedback contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | Medium | Lack of transparency in fees and conditions |

| Operational Risk | High | Poor platform performance and execution |

To mitigate these risks, traders should conduct thorough research, consider using a demo account, and only deposit amounts they can afford to lose. It is also advisable to explore alternative brokers with better regulatory standing and customer reviews.

Conclusion and Recommendations

Based on the evidence presented, it is clear that Bofu210 raises several red flags that suggest it may not be a safe trading option. The lack of regulation, unclear trading conditions, and negative customer experiences indicate that traders should approach this broker with caution.

For those seeking reliable alternatives, consider brokers that are regulated by top-tier authorities such as the FCA, ASIC, or CySEC. These brokers typically offer better protection for client funds and more transparent trading conditions. In summary, if you are asking, "Is Bofu210 safe?" the answer leans towards skepticism, and it may be wise to explore other options in the forex market.

Is bofu210 a scam, or is it legit?

The latest exposure and evaluation content of bofu210 brokers.

bofu210 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

bofu210 latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.