Is BlackHorse safe?

Pros

Cons

Is Blackhorse Safe or Scam?

Introduction

Blackhorse is a forex broker that positions itself as a player in the competitive landscape of the online trading market. Established in 2017, the broker claims to offer a variety of trading instruments, including forex, commodities, and cryptocurrencies. However, as with any financial service, traders must exercise caution and conduct thorough evaluations before engaging with a broker. This is particularly crucial in the forex market, where the risks of scams and fraudulent activities can be high. In this article, we will investigate whether Blackhorse is safe or potentially a scam by analyzing its regulatory status, company background, trading conditions, client safety measures, customer experiences, and overall risk profile.

Our investigation will rely primarily on reviews and reports from reputable financial websites, user testimonials, and regulatory databases. We will evaluate Blackhorse against established criteria for assessing the safety and reliability of forex brokers, aiming to provide a comprehensive overview for potential traders.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. Blackhorse claims to be regulated by the Financial Conduct Authority (FCA) in the UK. However, it is essential to note that the FCA revoked its license, which raises significant concerns regarding its operational legality and compliance with financial regulations.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA | 770859 | United Kingdom | Revoked |

The revocation of Blackhorse's FCA license indicates serious issues with its compliance and operational standards. This lack of regulatory oversight means that traders have little to no protection if something goes wrong, making it imperative to question is Blackhorse safe for trading. Without a valid license, Blackhorse operates in a high-risk environment, leaving clients vulnerable to potential fraud and financial misconduct.

Company Background Investigation

Understanding the history and structure of a company can provide valuable insights into its reliability. Blackhorse was founded in 2017 and is registered as Black Horse Investment Services (UK) Limited. However, the details surrounding its ownership and management team remain vague, which is a red flag for potential investors. A transparent company should provide clear information about its leadership and corporate governance.

The management team‘s qualifications and backgrounds are also crucial in evaluating the company's integrity. Unfortunately, there is limited information available regarding the professional experience of Blackhorse’s management, which can lead to concerns about their capability to manage client funds responsibly.

Furthermore, the level of transparency in a companys operations is a critical factor in assessing its trustworthiness. Blackhorse's lack of detailed disclosures and its revoked regulatory status contribute to an overall perception of opacity. Therefore, traders should remain skeptical and carefully consider whether is Blackhorse safe for their investments.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Blackhorse claims to offer competitive spreads and various account types, including standard and ECN accounts. However, the absence of a clear fee structure raises questions about the overall cost of trading with this broker.

| Fee Type | Blackhorse | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | From 0.4 pips | 1.0 pips |

| Commission Model | Varies by account | Varies widely |

| Overnight Interest Range | Not specified | 2-3% |

The spreads offered by Blackhorse appear competitive; however, the lack of transparency regarding other fees and commissions can be problematic. Traders may encounter unexpected costs that could significantly impact their trading profitability. Additionally, the absence of information about overnight interest rates can lead to further complications, especially for those engaged in longer-term trading strategies.

Given these factors, potential clients must question is Blackhorse safe when it comes to understanding the true cost of trading. A broker that lacks clarity in its fee structure may not prioritize the interests of its clients.

Client Fund Safety

The safety of client funds is paramount when considering whether a broker is trustworthy. Blackhorse claims to implement various measures to protect client funds, including segregated accounts and investor protection policies. However, without a valid regulatory framework, the effectiveness of these measures is uncertain.

Traders should be aware of the importance of fund segregation, as it ensures that client funds are kept separate from the broker's operational funds. This practice protects clients in the event of the broker's insolvency. Additionally, the presence of negative balance protection is crucial, as it prevents clients from losing more than their initial investment.

Despite these claims, the lack of regulatory oversight raises significant concerns about the actual implementation of these safety measures. Historical data regarding any past incidents or disputes involving fund security at Blackhorse is also limited. Thus, potential traders must carefully evaluate whether is Blackhorse safe in terms of client fund protection.

Customer Experience and Complaints

Customer feedback offers valuable insights into a broker's reliability and service quality. Reviews of Blackhorse indicate a mixed bag of experiences, with numerous complaints regarding customer service responsiveness and trading execution quality.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

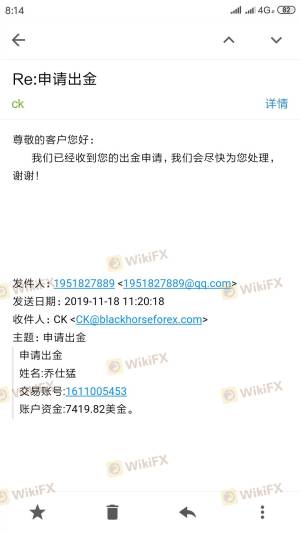

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inadequate |

| Execution Issues | High | Unresolved |

Common complaints revolve around withdrawal delays and inadequate customer support. Many users have reported difficulties in accessing their funds, which can be a significant issue for traders. Additionally, the quality of trade execution has been questioned, with reports of slippage and rejected orders.

These patterns of complaints raise serious concerns about the overall client experience with Blackhorse. Potential clients must consider whether is Blackhorse safe based on the experiences of others and the broker's ability to resolve issues effectively.

Platform and Execution

The trading platform is a critical component of a trader's experience. Blackhorse primarily uses the MetaTrader 4 (MT4) platform, which is widely recognized but may not meet the needs of all traders. While MT4 offers stability, its outdated interface and limited functionalities compared to newer platforms could deter some users.

Furthermore, the quality of order execution is essential for successful trading. Reports of slippage and rejected orders at Blackhorse suggest that traders may experience challenges in executing their strategies effectively. The lack of transparency regarding order execution policies raises questions about potential manipulation or unfair practices.

Given these factors, traders must carefully evaluate whether is Blackhorse safe in terms of platform reliability and execution quality.

Risk Assessment

Engaging with any broker carries inherent risks. In the case of Blackhorse, the absence of regulation, mixed customer feedback, and questionable trading conditions contribute to a higher risk profile.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Broker operates without valid oversight |

| Financial Transparency | Medium | Lack of clear fee structure and disclosures |

| Client Fund Safety | High | Uncertain safety measures due to revoked license |

To mitigate these risks, traders should conduct thorough research, consider using smaller amounts for initial trades, and remain vigilant regarding their trading activities. It is crucial to stay informed about any changes in the broker's status or regulatory landscape.

Conclusion and Recommendations

In summary, the investigation into Blackhorse raises significant concerns regarding its legitimacy and safety for traders. The revoked FCA license, lack of transparency, mixed customer feedback, and questionable trading conditions suggest that potential clients should exercise extreme caution.

For traders seeking reliable alternatives, it may be wise to consider brokers with valid regulatory oversight, transparent fee structures, and positive customer reviews. Some reputable options in the forex market include brokers like IG, OANDA, and Forex.com, which offer robust regulatory frameworks and positive client experiences.

Ultimately, before engaging with Blackhorse or any broker, traders should carefully assess their risk tolerance and ensure that they are comfortable with the potential drawbacks. The question of is Blackhorse safe remains a pressing concern that should not be taken lightly.

Is BlackHorse a scam, or is it legit?

The latest exposure and evaluation content of BlackHorse brokers.

BlackHorse Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BlackHorse latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.