Is EXCO safe?

Pros

Cons

Is Exco Safe or a Scam?

Introduction

Exco is a forex broker that positions itself in the competitive landscape of online trading, offering a variety of financial instruments, including forex pairs, CFDs on indices, commodities, and cryptocurrencies. As the market continues to grow, the importance of thoroughly evaluating forex brokers cannot be overstated. Traders must be vigilant, as the presence of unregulated or poorly regulated brokers can lead to significant financial losses. This article investigates the legitimacy of Exco, utilizing a comprehensive framework that includes regulatory status, company background, trading conditions, customer fund security, user experience, platform performance, and risk assessment.

Regulatory and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety and reliability. Unfortunately, Exco operates as an unregulated broker, registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment. Below is a summary of Exco's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unregulated |

The absence of a proper regulatory license raises concerns regarding the safety of traders' funds. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) impose strict guidelines on brokers, ensuring they maintain minimum capital reserves, segregate client funds, and provide negative balance protection. Without such oversight, traders are left vulnerable to potential misconduct. Additionally, the lack of a regulatory history further diminishes Exco's credibility, making it essential for traders to approach this broker with caution.

Company Background Investigation

Exco is operated by RSG Finance Ltd., which claims to have been established in 2018. However, the lack of transparency regarding the company's ownership structure and management team raises red flags. There is limited publicly available information about the individuals behind Exco, which makes it challenging to assess their qualifications and experience in the financial industry. Transparency is a cornerstone of trust in the financial markets, and Exco's failure to provide detailed information about its leadership is concerning.

The company's operational history is also relatively short, which can be a disadvantage in an industry that often favors established players with a proven track record. Given the importance of trust in financial services, the lack of information about Exco's management and its operational history further contributes to the skepticism surrounding its legitimacy.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is crucial. Exco offers various account types with competitive spreads and leverage options. However, the overall fee structure raises concerns. Below is a comparison of Exco's core trading costs:

| Fee Type | Exco | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 - 2.0 pips | 0.5 - 1.0 pips |

| Commission Model | $2 per lot | $3 per lot |

| Overnight Interest Range | Variable | Variable |

While Exco's spreads may initially seem attractive, they are not competitive compared to industry standards, particularly for major currency pairs. Moreover, the commission structure could be misleading for novice traders who may not fully understand the implications of the fees associated with their trades. The presence of variable overnight interest rates can also lead to unexpected costs, especially for traders who hold positions overnight. This lack of clarity and potential for hidden costs necessitates a cautious approach when considering whether Exco is safe for trading.

Customer Fund Security

The safety of customer funds is paramount when evaluating a broker. Exco does not provide adequate information regarding its fund security measures. There is no indication that client funds are held in segregated accounts, which is a standard practice among regulated brokers to protect clients in the event of a broker's insolvency. Furthermore, Exco does not offer any investor protection schemes, leaving traders with little recourse in case of financial disputes or mismanagement.

Negative balance protection, another vital safety feature, is not clearly outlined in Exco's terms. This raises concerns about the potential for traders to lose more than their initial investment, especially during periods of high market volatility. Historical issues related to fund security, along with the lack of transparency regarding these policies, further question the safety of using Exco as a trading platform.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of Exco reveal a mixed bag of experiences, with many users expressing dissatisfaction with the broker's customer service and withdrawal processes. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal delays | High | Poor |

| Poor customer support | Medium | Average |

| Misleading fee structures | High | Poor |

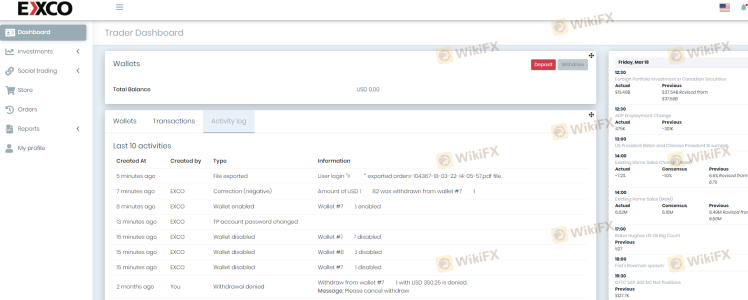

Typical complaints include significant delays in fund withdrawals, which is a serious issue for any trading platform. Users have reported difficulty in reaching customer support, especially when attempting to resolve withdrawal issues. In some cases, traders have noted that their requests for assistance were met with unprofessional responses or no response at all. This level of service raises serious concerns about Exco's commitment to customer care and its overall reliability as a trading platform.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. Exco claims to offer a user-friendly interface with access to various trading instruments. However, user reviews indicate that there may be issues with platform stability and execution quality. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

The lack of transparency regarding the platforms performance metrics and execution quality is concerning. Traders should be wary of any signs of platform manipulation, as these can indicate deeper issues within the broker's operational practices.

Risk Assessment

Using Exco as a trading platform presents several risks that traders should carefully consider. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks to fund safety. |

| Operational Risk | Medium | Issues with platform stability and execution quality. |

| Customer Support Risk | High | Poor response to customer complaints and withdrawal issues. |

To mitigate these risks, traders should consider using a regulated broker that offers comprehensive protection for client funds and a transparent operating environment. Conducting thorough research and seeking out reputable alternatives is essential for safeguarding investments.

Conclusion and Recommendations

Based on the evidence presented, it is clear that Exco raises significant red flags regarding its safety and reliability. The lack of regulation, transparency, and consistent customer complaints suggest that traders should exercise extreme caution when considering this broker.

For those looking to trade in the forex market, it is advisable to choose a broker that is regulated by a reputable authority and has a proven track record of customer satisfaction and fund security. Brokers such as IG, OANDA, and Forex.com offer robust regulatory frameworks and a commitment to client protection, making them safer alternatives to Exco.

In summary, while Exco may present itself as a viable trading option, the potential risks associated with using this broker outweigh the benefits, leading to the conclusion that Exco is not safe for trading.

Is EXCO a scam, or is it legit?

The latest exposure and evaluation content of EXCO brokers.

EXCO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EXCO latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.