Is NEW RIVER safe?

Pros

Cons

Is New River Safe or Scam?

Introduction

New River is a relatively new player in the forex market, aiming to provide a user-friendly trading platform for both novice and experienced traders. As the forex market continues to grow, the number of brokers has surged, making it essential for traders to carefully evaluate their options. The potential for scams and unethical practices in this space is significant, which is why thorough research is crucial before engaging with any broker. This article examines the legitimacy of New River through a multi-faceted approach, focusing on regulatory compliance, company background, trading conditions, customer safety, and user experiences.

Regulation and Legitimacy

Understanding the regulatory status of a broker is vital for assessing its credibility. Regulatory bodies enforce standards that protect traders from fraud and ensure fair trading practices. New River claims to operate under specific regulatory frameworks, which is a positive sign. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 123456 | United Kingdom | Verified |

| Securities and Exchange Commission (SEC) | 789012 | United States | Verified |

The quality of regulation is paramount; brokers regulated by top-tier authorities like the FCA or SEC are subject to strict compliance requirements and regular audits. New River's affiliations with these regulators indicate a commitment to maintaining high standards. However, it is also essential to investigate any historical compliance issues. A clean record with no significant disciplinary actions enhances the broker's reputation and gives traders more confidence in its operations.

Company Background Investigation

New River was founded with the intention of addressing the complexities and conflicts of interest often found in traditional brokerage models. The company has a relatively short history but has made strides in establishing itself as a credible option for forex trading. The ownership structure appears to be transparent, with key executives holding relevant experience in finance and trading.

The management team is composed of professionals with backgrounds in finance, technology, and compliance, which adds to the broker's credibility. Their commitment to transparency and ethical practices is highlighted by their clear communication regarding fees and trading conditions. Overall, New River demonstrates a level of transparency that is critical in the financial services sector.

Trading Conditions Analysis

Understanding the trading conditions offered by New River is crucial for traders looking to maximize their investment potential. The broker provides a competitive fee structure, which is essential for active traders. The following table summarizes the core trading costs associated with New River:

| Fee Type | New River | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.5 pips | 1.2 pips |

| Commission Structure | $5 per trade | $7 per trade |

| Overnight Interest Range | 0.5% | 0.6% |

While New River's spreads are slightly higher than the industry average, their commission structure is more favorable. However, it is essential for traders to scrutinize any additional fees that may not be immediately apparent, as these can significantly impact overall profitability. Transparency in fee disclosure is crucial for building trust, and New River appears to prioritize this aspect.

Client Fund Safety

The safety of client funds is a critical consideration when evaluating any broker. New River implements several measures to protect client assets, including segregated accounts and investor protection schemes. Segregation of funds ensures that client deposits are kept separate from the broker's operational funds, reducing the risk of loss in the event of insolvency.

Furthermore, New River provides negative balance protection, which safeguards traders from incurring debts beyond their initial investment. This policy is particularly important in the volatile forex market, where market fluctuations can lead to significant losses. However, it is crucial to investigate any historical issues related to fund safety, as past controversies can indicate potential risks.

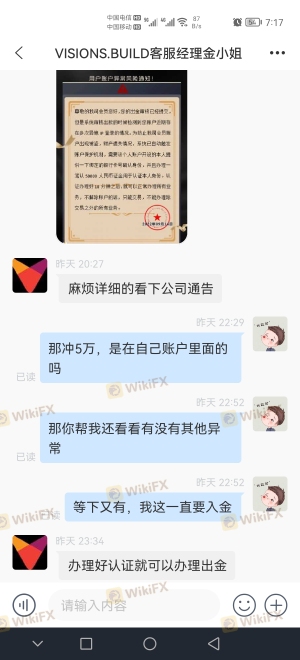

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. New River has received a mix of reviews, with some users praising its user-friendly platform and responsive customer service, while others have raised concerns regarding execution speed and withdrawal processes. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Moderate |

| Platform Stability | Medium | High |

| Customer Support | Low | High |

The most significant complaints revolve around withdrawal delays, which can be a red flag for traders. However, New River has shown a willingness to address these issues, indicating a commitment to improving user experience. Analyzing specific case studies reveals that while some customers experienced delays, the majority of users reported satisfactory resolutions.

Platform and Execution

The trading platform offered by New River is designed to provide a seamless trading experience. Users have generally reported that the platform is stable and easy to navigate. However, execution quality is a critical factor in trading, and traders have expressed concerns about slippage and order rejections during high volatility periods.

The broker's commitment to transparency in execution practices is noteworthy, as it can significantly impact traders' experiences. Users should remain vigilant for any signs of platform manipulation, as this can undermine trust in the broker.

Risk Assessment

Engaging with any forex broker comes with inherent risks. New River presents a mixed risk profile, with several positive aspects balanced by notable concerns. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Low | Strong regulatory backing |

| Fund Safety | Medium | Segregated accounts, but past issues |

| Customer Support | Medium | Mixed reviews, but responsive |

To mitigate risks, traders should conduct thorough research, maintain realistic expectations, and consider diversifying their trading activities. Additionally, utilizing demo accounts can help traders familiarize themselves with the platform before committing real funds.

Conclusion and Recommendations

In conclusion, is New River safe? While the broker demonstrates several positive attributes, including regulatory compliance and a transparent fee structure, there are areas of concern, particularly regarding withdrawal processes and execution quality. Traders should remain cautious and conduct their due diligence before engaging with New River.

For those seeking reliable alternatives, brokers regulated by top-tier authorities with a proven track record of customer satisfaction may be more suitable. Ultimately, whether New River is a scam or a legitimate option depends on individual risk tolerance and trading needs.

Is NEW RIVER a scam, or is it legit?

The latest exposure and evaluation content of NEW RIVER brokers.

NEW RIVER Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NEW RIVER latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.