Is APPDINERO safe?

Business

License

Is AppDinero A Scam?

Introduction

AppDinero is an online forex broker that has emerged in the financial trading landscape, targeting a diverse range of traders interested in forex, commodities, and cryptocurrencies. As with any trading platform, it is crucial for traders to carefully evaluate the legitimacy and safety of such brokers before committing their funds. The forex market is rife with scams and unregulated entities, which can lead to significant financial losses for unsuspecting investors. This article aims to provide an objective analysis of AppDinero by examining its regulatory status, company background, trading conditions, and customer feedback. Our investigation is based on data gathered from reputable financial sources, user reviews, and expert analyses to assess whether AppDinero is indeed safe or a potential scam.

Regulation and Legitimacy

The regulatory environment is paramount in determining the safety of a trading platform. AppDinero claims to operate within a regulated framework; however, our research indicates otherwise. The platform is not registered with any reputable financial authority, raising red flags about its legitimacy. Below is a summary of the regulatory information regarding AppDinero:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a regulatory license means that AppDinero is not subject to oversight by any financial authority, which is essential for protecting investors. This lack of regulation is concerning, especially given that the Spanish National Securities Market Commission (CNMV) has previously blacklisted AppDinero, warning traders to avoid this platform. Such warnings from recognized regulatory bodies highlight the risks associated with trading through unregulated brokers.

Company Background Investigation

AppDinero's operational history is relatively short, having been established in 2019. The company claims to be registered in Malta, but further investigation reveals that the ownership structure is opaque and lacks transparency. The broker is allegedly owned by Papilio Capital Ltd, yet there is no verifiable information regarding this entity in the Maltese financial register. The management team behind AppDinero remains largely unknown, with little to no professional experience disclosed. This lack of transparency raises questions about the broker's credibility and trustworthiness. In a market where accountability and clear communication are critical, AppDinero's failure to provide such information is a significant red flag.

Trading Conditions Analysis

An essential aspect of evaluating any broker is understanding its trading conditions. AppDinero presents itself as a competitive trading platform, but a closer inspection reveals potential issues. The broker's fee structure is vague, with limited information available about spreads, commissions, and other trading costs. Below is a comparison of core trading costs:

| Fee Type | AppDinero | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | N/A | 1-2 pips |

| Commission Model | 2% per trade | 0-0.5% |

| Overnight Interest Range | N/A | Varies |

The lack of clarity regarding spreads and commissions is concerning, as traders need to understand the full cost of trading to make informed decisions. Furthermore, the absence of a well-defined commission structure could lead to unexpected fees, making it difficult for traders to manage their investment strategies effectively.

Client Fund Safety

The safety of client funds is a crucial consideration when evaluating a broker. AppDinero does not provide adequate information regarding its fund security measures. There are no indications of segregated accounts or investor protection policies in place, which are standard practices among regulated brokers. The lack of transparency surrounding fund management raises significant concerns about the safety of deposits made by clients. Historical reports of withdrawal issues and fund mismanagement associated with unregulated brokers further exacerbate these concerns.

Customer Experience and Complaints

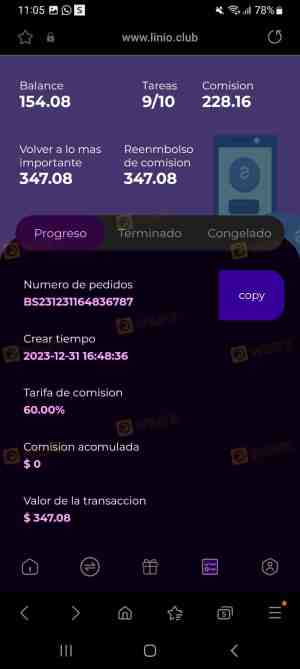

Analyzing customer feedback is vital to understanding the overall user experience with a broker. Reviews of AppDinero reveal a mix of positive and negative experiences, but many complaints focus on withdrawal difficulties and unresponsive customer service. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Blocking | Medium | Poor |

| Lack of Communication | High | Poor |

One notable case involved a trader who reported being unable to withdraw their funds despite multiple requests. This type of complaint is common among unregulated brokers, where clients often face significant barriers when attempting to access their money. Such experiences contribute to the growing perception that AppDinero is not a trustworthy platform.

Platform and Execution

The performance of a trading platform is critical for traders seeking a seamless trading experience. AppDinero offers a web-based trading interface, but user reviews indicate that it lacks essential features and stability. Issues such as slippage and order rejections have been reported, which can significantly impact trading outcomes. Furthermore, the absence of advanced trading tools and third-party software integration raises concerns about the platform's overall functionality and reliability.

Risk Assessment

Using AppDinero presents various risks that potential traders should consider. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated platform with no oversight. |

| Fund Security Risk | High | Lack of transparency regarding fund management. |

| Withdrawal Risk | High | Frequent complaints about withdrawal issues. |

| Platform Reliability Risk | Medium | Reports of execution problems and slippage. |

To mitigate these risks, traders should conduct thorough research and consider using regulated brokers with established reputations.

Conclusion and Recommendations

In conclusion, the evidence suggests that AppDinero is not a safe trading platform. Its lack of regulation, transparency issues, and history of customer complaints indicate a high level of risk for potential investors. Traders should exercise extreme caution and avoid depositing funds with AppDinero. For those seeking safer alternatives, it is advisable to consider brokers that are regulated by reputable financial authorities, such as the FCA or ASIC, which offer robust investor protection and transparent trading conditions.

In summary, is AppDinero safe? The answer is a resounding no. It is imperative for traders to prioritize their financial safety and choose brokers that demonstrate a commitment to transparency and regulatory compliance.

Is APPDINERO a scam, or is it legit?

The latest exposure and evaluation content of APPDINERO brokers.

APPDINERO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

APPDINERO latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.