Is Rodrik safe?

Pros

Cons

Is Rodrik Safe or Scam?

Introduction

Rodrik is a relatively new player in the forex market, having been established in 2021. As a forex broker, it aims to provide trading services to both novice and experienced traders. However, the forex market is notorious for its complexity and the presence of unscrupulous brokers, making it essential for traders to conduct thorough evaluations before engaging with any broker. This article aims to investigate whether Rodrik is a safe option for traders or if it exhibits characteristics typical of a scam. We will utilize a comprehensive assessment framework that includes regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and risk evaluation.

Regulation and Legitimacy

One of the most critical aspects of evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards of conduct and financial practices. Unfortunately, Rodrik has not provided any verifiable information regarding its regulatory status. According to various sources, the broker claims to operate under the auspices of certain regulatory bodies, but these claims lack verification.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation raises significant concerns about the safety of funds and the overall legitimacy of Rodrik. Unregulated brokers often operate with less transparency and can engage in practices that may not be in the best interest of their clients. Furthermore, the lack of historical compliance data makes it challenging to assess the broker's past conduct. Therefore, the question remains: Is Rodrik safe? Based on the available information, it appears that traders should proceed with caution.

Company Background Investigation

Rodrik Information Limited, the company behind the Rodrik trading platform, is relatively obscure. Founded in 2021, it lacks a detailed history that could provide insights into its operational practices and ownership structure. The absence of transparent information about the company's management team and their qualifications raises additional red flags. A reputable broker typically discloses information about its founders and management, including their professional backgrounds and experience in the financial sector.

Transparency is a vital factor for traders when selecting a broker. In Rodriks case, the lack of information about its ownership and management team could indicate a potential lack of accountability. Without a transparent structure, it is difficult for traders to ascertain whether the broker operates ethically and responsibly. Consequently, this leads to further skepticism regarding the question: Is Rodrik safe?

Trading Conditions Analysis

When examining a broker's trading conditions, it is essential to consider the overall cost structure associated with trading. Rodrik advertises competitive spreads and low fees, but a closer examination reveals potential concerns. Many traders have reported hidden fees and unclear commission structures, which can significantly impact profitability.

| Fee Type | Rodrik | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | Unclear | Varies |

| Overnight Interest Range | High (up to 5%) | Low (1-2%) |

The discrepancies in the fee structure, particularly with higher overnight interest rates, could deter traders from utilizing Rodrik as their primary trading platform. Furthermore, the lack of clarity regarding commissions raises questions about the broker's transparency. Traders should be cautious and fully understand the fee structure before committing their funds. This leads us back to the critical inquiry: Is Rodrik safe? Given the potential for unexpected costs, traders should consider other options.

Client Fund Safety

Client fund safety is paramount when evaluating a forex broker. Traders need assurance that their funds are secure and that the broker has measures in place to protect them. Unfortunately, Rodrik has not provided sufficient information regarding its client fund safety protocols. The absence of segregated accounts, investor protection measures, and negative balance protection raises significant concerns.

Historically, unregulated brokers have been known to mismanage client funds, leading to substantial losses for traders. Without clear policies on fund safety, it becomes increasingly difficult to trust Rodrik with hard-earned capital. The question remains: Is Rodrik safe? Based on the lack of transparency and safety measures, it is prudent for traders to think twice before investing with this broker.

Customer Experience and Complaints

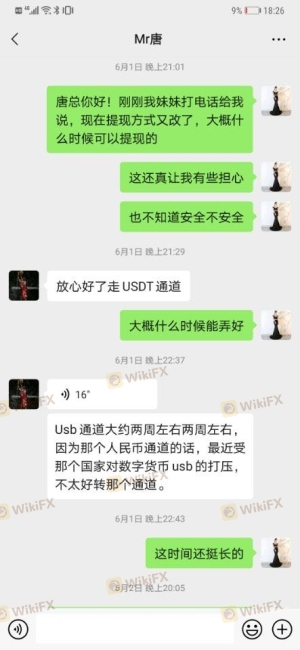

Customer feedback plays a crucial role in assessing a broker's reliability. Unfortunately, reviews for Rodrik have been mixed, with a notable number of complaints regarding withdrawal issues and poor customer service. Many users have reported difficulties in retrieving their funds, which is a serious red flag for any broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service | Medium | Unresponsive |

| Fee Transparency | High | Vague explanations |

The recurring theme of withdrawal problems indicates a potential operational issue within Rodrik, leading to questions about its trustworthiness. The lack of timely responses from customer service further exacerbates the situation. Therefore, the question persists: Is Rodrik safe? Given the complaints and the severity of the issues, traders should be extremely cautious.

Platform and Execution

The performance of a trading platform is critical for a seamless trading experience. Rodrik claims to offer a user-friendly platform with advanced features. However, user experiences suggest that the platform suffers from stability issues, leading to concerns about order execution quality. Reports of slippage and order rejections have surfaced, which can severely impact trading outcomes.

A reliable trading platform should provide consistent performance, minimal slippage, and a high fill rate. The presence of execution issues raises further doubts about Rodrik's operational integrity and reliability. As such, traders must ask themselves: Is Rodrik safe? The indications of platform instability suggest that it may not be the best choice for serious traders.

Risk Assessment

When considering the overall risk of using Rodrik, several factors come into play. The lack of regulation, transparency issues, questionable trading conditions, and customer complaints all contribute to a higher risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | Potential for hidden fees and withdrawal issues. |

| Operational Risk | Medium | Platform stability and execution problems. |

Given the comprehensive risk assessment, it is clear that trading with Rodrik carries significant risks. Traders should be aware of these risks and consider mitigating strategies, such as starting with a small deposit or exploring alternative brokers.

Conclusion and Recommendations

In conclusion, the investigation into Rodrik raises several concerns regarding its safety and reliability. The absence of regulation, lack of transparency, and numerous customer complaints suggest that traders should approach this broker with caution. The question, Is Rodrik safe?, is met with a resounding "no" based on the evidence gathered.

For traders seeking reliable alternatives, it is advisable to consider brokers that are well-regulated by reputable authorities, have transparent fee structures, and demonstrate a commitment to customer service. Options such as brokers regulated by the FCA, ASIC, or NFA should be prioritized for safer trading experiences. Ultimately, informed decision-making is essential to safeguard your investments in the forex market.

Is Rodrik a scam, or is it legit?

The latest exposure and evaluation content of Rodrik brokers.

Rodrik Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Rodrik latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.