ZhanHuang 2025 Review: Everything You Need to Know

Executive Summary

This zhanhuang review gives you a complete look at ZhanHuang Intl, a CFD broker that works in the busy forex market. Our study shows mixed results, with the broker offering some good features but also having big concerns about rules and oversight.

ZhanHuang stands out mainly because it offers high leverage up to 1:500 and has different account types, including VIP and Mini accounts made for different kinds of traders. The broker lets you trade over 40 forex pairs plus commodities, precious metals, indices, and energy products through the popular MetaTrader 4 platform.

But our study finds big problems with the broker's rules and whether it's real. The lack of clear rule information and limited customer feedback makes us question if trading with this company is safe and reliable.

These issues greatly affect our overall view and we suggest being very careful if you're thinking about using this broker. The broker seems to target traders who want high leverage chances and different trading tools, especially those who are okay with taking extra rule risks for possibly better trading conditions.

Important Notice

Since there's not much complete rule information about ZhanHuang, traders must do their own research and risk checks, especially about legal compliance in their own countries. Different rules in different regions may greatly affect whether the broker is legal and what protections traders have.

This review is based on public information and market study. The lack of good user feedback and clear rule papers limits how much we can assess.

Potential clients should be extra careful and think about getting more proof before working with this broker.

Scoring Framework

Broker Overview

ZhanHuang Intl works as a CFD broker in global financial markets, though we don't know exactly when it started based on current papers. The company seems to position itself as an international trading provider, with signs suggesting it might have Canadian headquarters, though this needs to be checked through official channels.

The broker's business plan focuses on giving Contract for Difference trading services across multiple asset types. ZhanHuang works on giving access to forex markets plus commodities, precious metals, and other financial tools through established trading platforms.

The company targets retail traders who want leveraged trading chances with competitive conditions. Working through the well-known MetaTrader 4 platform, ZhanHuang offers trading access to over 40 forex pairs, various commodities including gold and silver, market indices, and energy products such as oil.

The broker's asset selection seems designed to meet different trading strategies and portfolio needs. However, the lack of detailed rule information in available sources raises important questions about how transparent and compliant operations are that potential clients should carefully think about before starting account opening procedures.

Regulatory Jurisdictions: Current available information does not specify particular regulatory authorities overseeing ZhanHuang's operations, which presents significant concerns for trader protection and operational legitimacy.

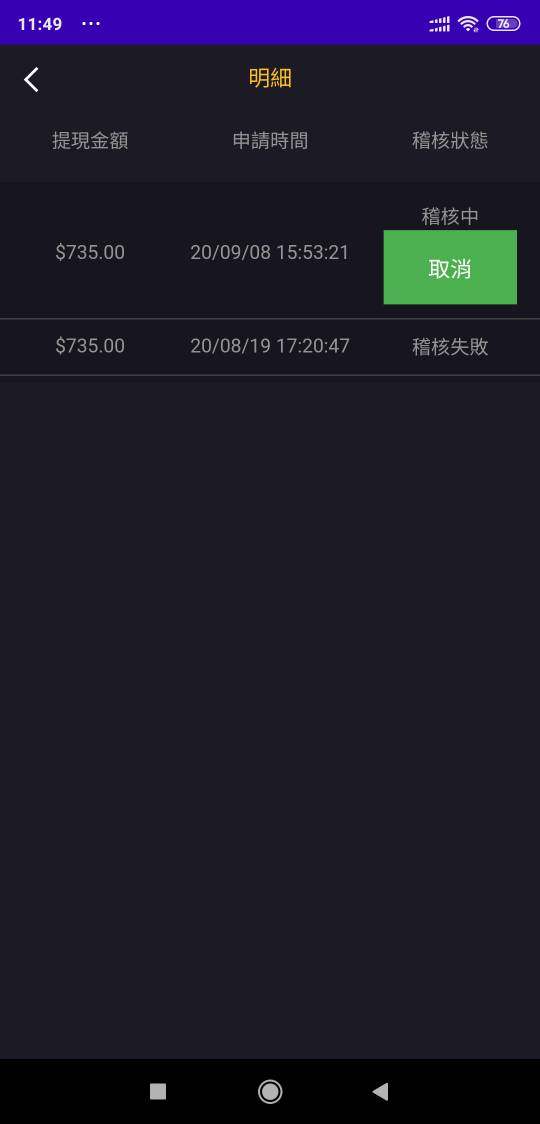

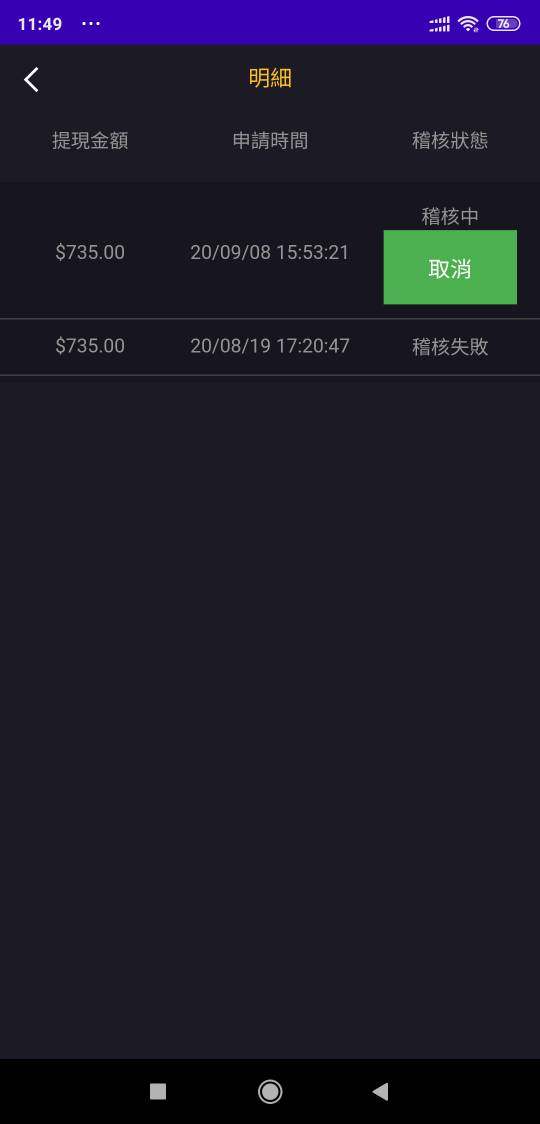

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal procedures is not detailed in available documentation, requiring direct inquiry with the broker. Minimum Deposit Requirements: The exact minimum deposit amounts for different account types are not specified in current sources.

Bonus and Promotions: Information about promotional offerings or bonus programs is not available in current documentation. Tradeable Assets: ZhanHuang provides access to more than 40 forex currency pairs, commodities including agricultural and energy products, precious metals such as gold and silver, major market indices, and crude oil products.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not comprehensively outlined in available sources, necessitating direct communication with the broker for accurate pricing details. Leverage Ratios: The broker offers leverage up to 1:500, which represents one of the higher leverage offerings in the retail trading market.

Platform Options: Trading is conducted through the MetaTrader 4 platform, providing access to standard charting tools, technical indicators, and automated trading capabilities. Geographic Restrictions: Specific information about regional trading restrictions is not detailed in current sources.

Customer Service Languages: Available documentation does not specify the range of languages supported by customer service representatives. This zhanhuang review finds that while the broker offers some competitive features, the lack of comprehensive information about key operational aspects raises concerns about transparency and regulatory compliance.

Detailed Scoring Analysis

Account Conditions Analysis

ZhanHuang's account structure includes VIP and Mini account options, suggesting an attempt to cater to different trader segments and capital levels. However, the evaluation reveals significant gaps in available information about specific account features and requirements.

The absence of detailed minimum deposit information makes it difficult for potential traders to assess accessibility and plan their trading capital allocation effectively. Without clear documentation of account opening procedures, verification requirements, and specific benefits associated with each account tier, traders cannot make fully informed decisions about which account type best suits their needs.

The broker does not provide information about specialized account features such as Islamic accounts for traders requiring Sharia-compliant trading conditions. Additionally, details about account maintenance fees, inactivity charges, or other ongoing costs are not readily available in current documentation.

While the availability of multiple account types suggests some level of service differentiation, the lack of transparent information about account specifications significantly impacts the overall assessment. This zhanhuang review notes that comprehensive account information is essential for trader decision-making and the current gaps represent a substantial limitation.

The scoring reflects the positive aspect of offering different account types while penalizing the significant lack of detailed information that traders require to make informed choices about their trading arrangements.

ZhanHuang demonstrates strength in its asset selection, offering access to over 40 forex currency pairs alongside a diverse range of other financial instruments. This variety provides traders with opportunities to diversify their portfolios and explore different market sectors including commodities, precious metals, and energy products.

The broker's use of the MetaTrader 4 platform provides traders with access to professional-grade trading tools, comprehensive charting capabilities, and extensive technical analysis resources. MT4's proven reliability and widespread acceptance in the trading community represents a significant advantage for both novice and experienced traders.

However, the evaluation identifies notable gaps in educational resources and market analysis support. Current documentation does not detail whether the broker provides market commentary, economic calendars, trading guides, or other educational materials that many traders consider essential for developing their skills and staying informed about market developments.

The absence of information about research and analysis resources limits the broker's appeal to traders who rely on fundamental analysis and market insights to inform their trading decisions. Additionally, details about automated trading support, expert advisors, and other advanced trading tools are not comprehensively covered in available sources.

While the asset diversity and platform selection earn positive marks, the lack of comprehensive educational and analytical resources prevents a higher score in this category.

Customer Service and Support Analysis

ZhanHuang's customer support setup appears limited based on available information, with email communication representing the primary documented contact method. This restricted approach to customer service raises concerns about accessibility and response efficiency, particularly during urgent trading situations.

The absence of multiple communication channels such as live chat, telephone support, or social media assistance represents a significant limitation compared to industry standards. Modern traders expect immediate access to support representatives, especially when dealing with technical issues or account-related concerns that could impact their trading activities.

Current documentation does not provide information about customer service response times, which is crucial for evaluating the effectiveness of support operations. Additionally, details about service quality, problem resolution procedures, and escalation processes are not available in current sources.

The lack of information about multilingual support capabilities may limit the broker's accessibility to international traders who prefer communication in their native languages. Operating hours for customer service are also not specified, creating uncertainty about when traders can expect to receive assistance.

Without substantial user feedback about customer service experiences, it becomes difficult to assess the practical effectiveness of ZhanHuang's support operations. The limited communication options and lack of detailed service information result in a moderate score that reflects these significant limitations.

Trading Experience Analysis

The trading experience evaluation centers primarily on ZhanHuang's use of the MetaTrader 4 platform, which provides a foundation of reliable trading functionality and familiar interface design. MT4's established reputation for stability and comprehensive trading tools offers some assurance about the technical aspects of the trading environment.

However, the assessment is significantly limited by the absence of user feedback and performance data about the broker's specific implementation of the platform. Critical factors such as order execution speed, slippage rates, and platform stability during high-volatility periods cannot be adequately evaluated without user testimonials or independent testing data.

The lack of information about mobile trading capabilities represents another limitation in the current evaluation. Modern traders increasingly rely on mobile platforms for market monitoring and trade execution, making this a crucial component of the overall trading experience.

Details about trading environment characteristics such as execution models, typical spreads during different market conditions, and requote frequency are not available in current documentation. These factors significantly impact the practical trading experience and cost efficiency for active traders.

This zhanhuang review acknowledges that while the MT4 platform provides a solid foundation, the absence of specific performance data and user experience feedback prevents a more comprehensive assessment of the actual trading conditions traders can expect.

Trust and Reliability Analysis

The trust and reliability assessment reveals the most significant concerns about ZhanHuang, primarily stemming from the absence of clear regulatory information and oversight documentation. The lack of identifiable regulatory authority supervision raises fundamental questions about trader protection and operational legitimacy.

Without proper regulatory oversight, traders face increased risks regarding fund safety, dispute resolution mechanisms, and recourse options in case of operational issues. Regulatory compliance typically provides essential protections including segregated client funds, compensation schemes, and standardized operational procedures that are crucial for trader security.

The absence of detailed company transparency information, including comprehensive business registration details, financial statements, or operational history, further compounds trust concerns. Traders rely on such information to assess the stability and reliability of their chosen broker.

Current documentation does not provide information about fund protection measures, insurance coverage, or client money handling procedures that regulated brokers typically implement to safeguard trader interests. Additionally, there is no available information about the broker's track record in handling client complaints or resolving operational disputes.

The lack of third-party reviews, industry recognition, or regulatory compliance certifications significantly impacts the overall trust assessment. Without these credibility indicators, potential traders cannot adequately assess the safety and reliability of committing their trading capital to this provider.

User Experience Analysis

The user experience evaluation is substantially limited by the absence of comprehensive user feedback and detailed interface information beyond the basic MT4 platform implementation. Without actual user testimonials and satisfaction data, it becomes challenging to assess the practical aspects of trading with ZhanHuang.

Available information does not detail the account registration and verification processes, which are crucial components of the initial user experience. The efficiency and user-friendliness of these procedures significantly impact trader satisfaction and the overall onboarding experience.

The lack of information about funding and withdrawal experiences represents another significant gap in the user experience assessment. Traders consider the ease, speed, and cost-effectiveness of financial transactions as critical factors in their broker selection process.

Interface design and navigation efficiency beyond the standard MT4 features are not documented in current sources. Additionally, there is no available information about common user complaints, satisfaction surveys, or feedback mechanisms that would provide insights into the actual user experience.

The absence of detailed user profiles or case studies makes it impossible to determine how well the broker serves different types of traders or whether the service quality meets various trading style requirements. Without this feedback, the assessment can only reflect the moderate score based on limited available information and the inherent limitations this creates for potential users.

Conclusion

This comprehensive zhanhuang review reveals a broker with mixed characteristics that require careful consideration by potential traders. While ZhanHuang offers some attractive features including high leverage ratios and diverse trading instruments, significant concerns about regulatory transparency and operational oversight substantially impact the overall assessment.

The broker appears most suitable for experienced traders who prioritize high leverage opportunities and are comfortable assuming additional regulatory risks. However, the absence of clear regulatory information makes it unsuitable for traders seeking maximum security and protection for their trading capital.

The primary advantages include competitive leverage ratios up to 1:500, access to diverse trading instruments through the reliable MT4 platform, and multiple account type options. Conversely, the main disadvantages encompass the lack of regulatory oversight, limited customer support channels, and insufficient transparency about operational procedures and cost structures.

Potential traders should conduct thorough due diligence and carefully assess their risk tolerance before considering ZhanHuang as their trading provider.