Shard Review 1

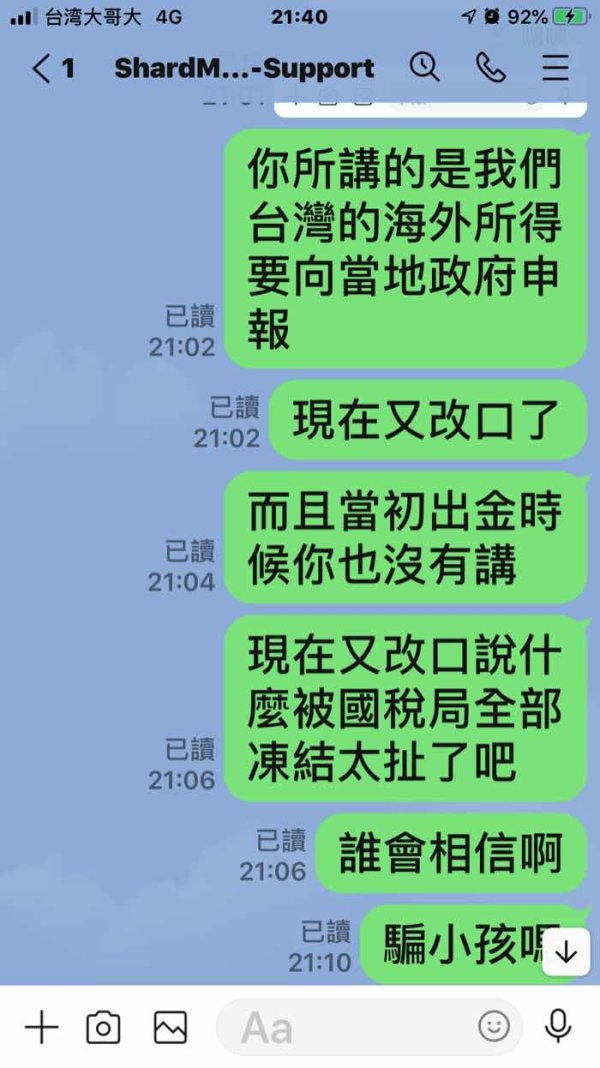

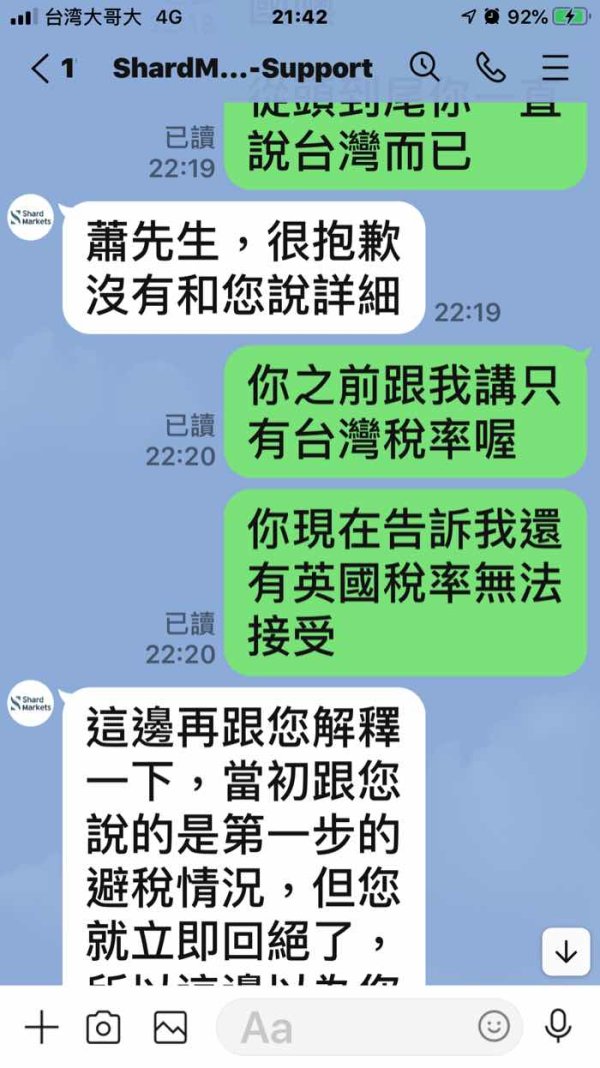

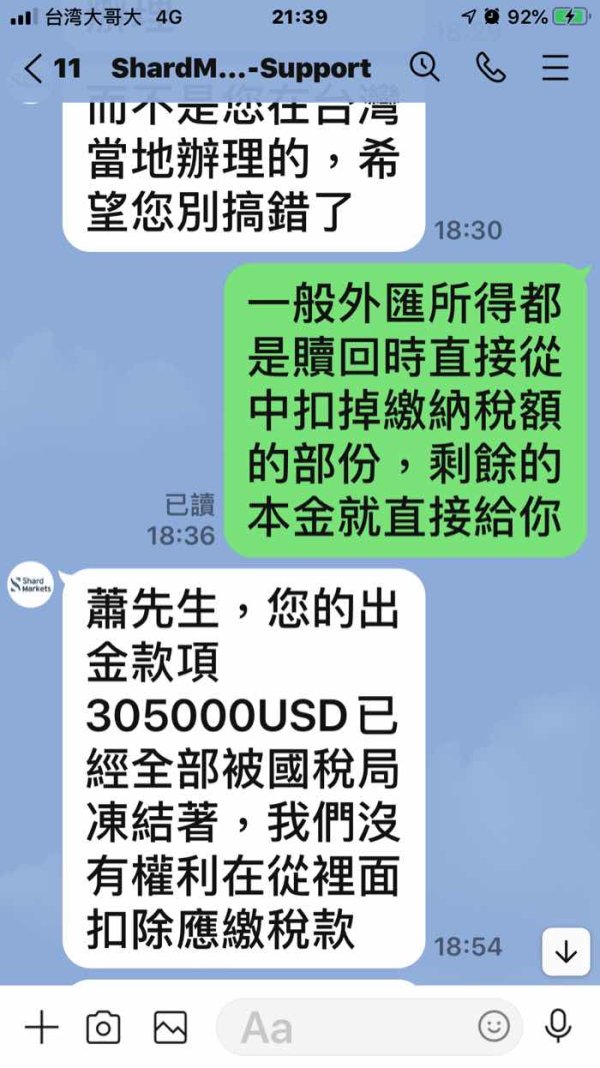

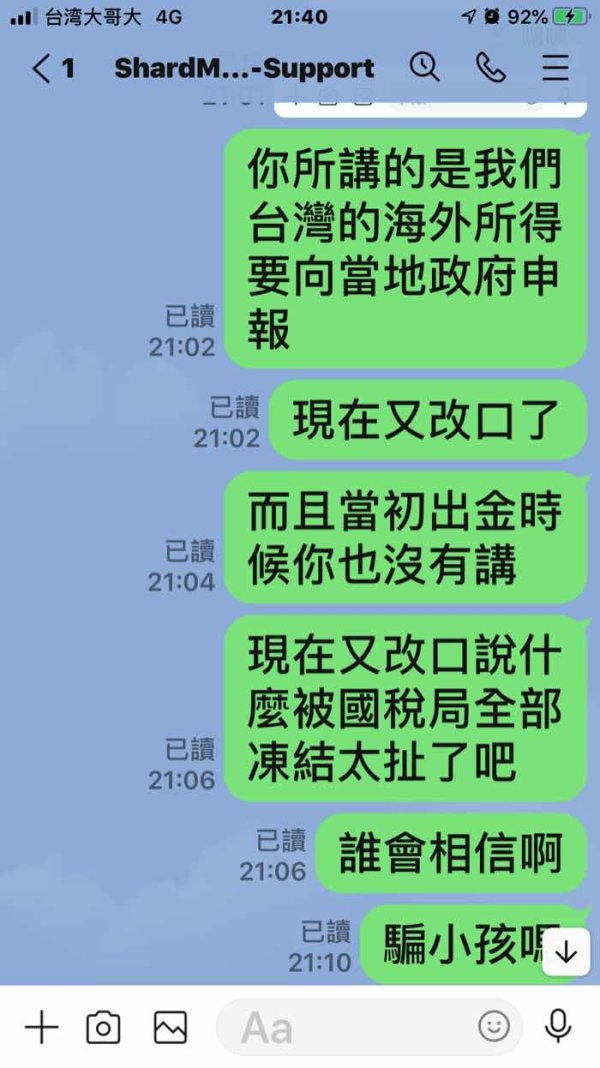

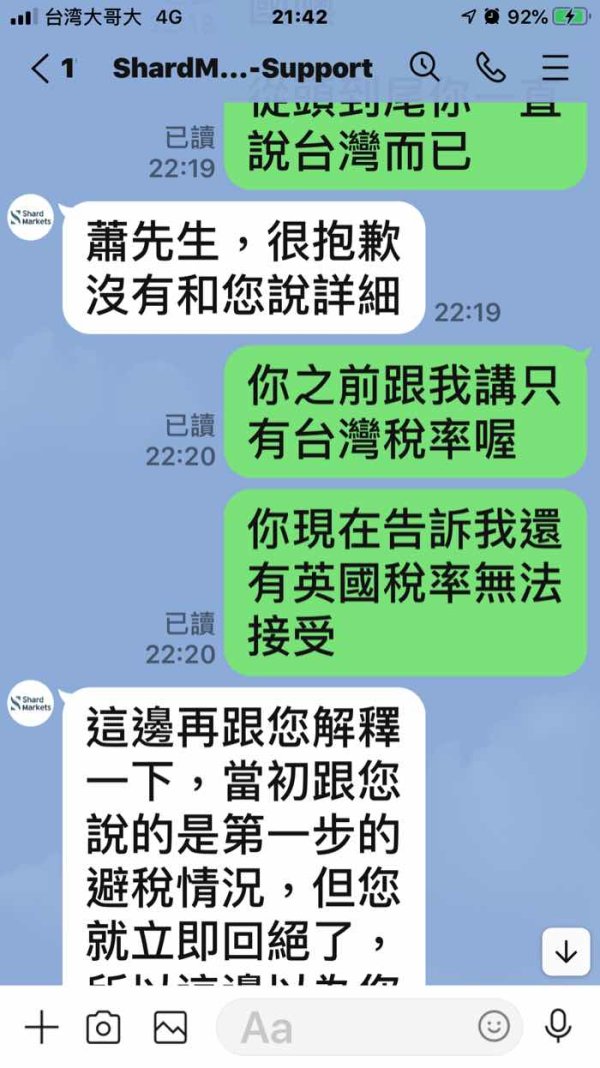

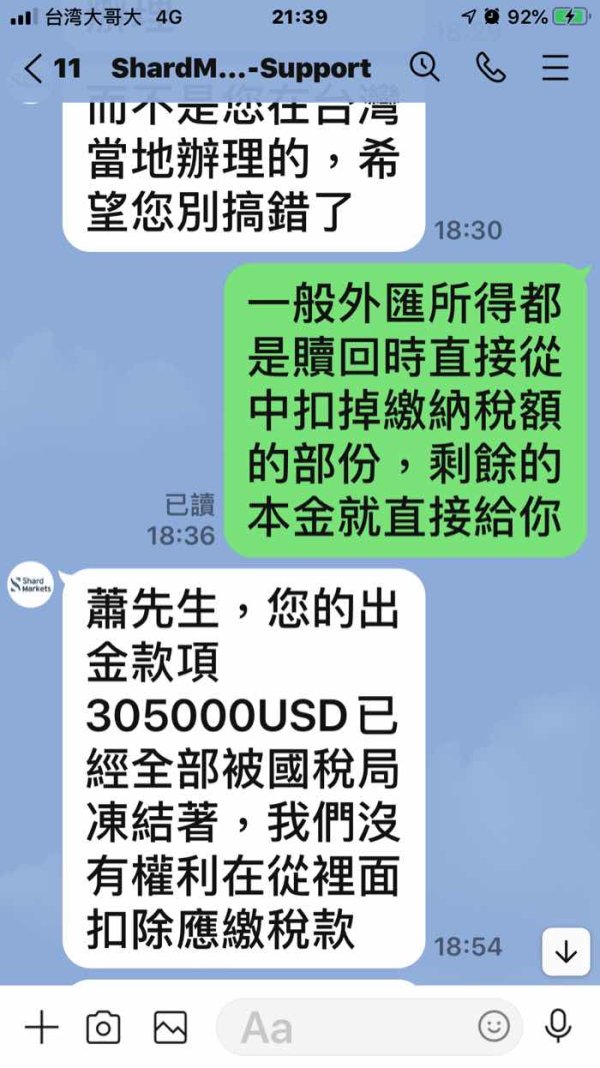

Beware of this person. Wang Li tempts you to invest in foreign exchange and gold and then introduces the fake British brand Shard, the fraud platform. When the investment is profitable, you can't withdraw money at all

Shard Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Beware of this person. Wang Li tempts you to invest in foreign exchange and gold and then introduces the fake British brand Shard, the fraud platform. When the investment is profitable, you can't withdraw money at all

Shard Capital is a unique player in London's financial services world. The company has been around since 2013 as an award-winning stockbroking and wealth management firm. This shard review shows a company that six investment managers started with a clear goal to deliver custom investment services for all experience levels.

The firm calls itself a specialist in small-cap stock trading. It also gives retail investors access to institutional fundraising opportunities like placings and IPOs that they couldn't get before.

The company's main selling point is low-cost custody paired with top-quality execution services. Shard Capital has found its place in the small-cap sector by using deep background and skills in trading smaller stocks. Their services include complete stockbroking and wealth management solutions for people who want different products and services no matter their investment experience.

But detailed information about specific rules, trading conditions, and platform details is hard to find in public documents.

This review uses publicly available information and should not be seen as complete investment advice. Potential clients should check Shard Capital's current regulatory status and compliance in different areas before using their services.

Since there is limited public information about specific trading conditions, platform features, and regulatory details, investors should contact the firm directly for complete service details. This review does not include hands-on testing of trading platforms or direct checking of customer service quality.

| Criteria | Score | Status |

|---|---|---|

| Account Conditions | N/A | Insufficient Information |

| Tools and Resources | N/A | Insufficient Information |

| Customer Service and Support | N/A | Insufficient Information |

| Trading Experience | N/A | Insufficient Information |

| Trustworthiness | N/A | Insufficient Information |

| User Experience | N/A | Insufficient Information |

Note: Scoring unavailable due to limited publicly accessible detailed information about specific service parameters.

Shard Capital Stockbrokers started in London's financial district in 2013. The firm represents a team effort by six experienced investment managers who saw gaps in traditional stockbroking services.

The company has grown into an award-winning business that focuses on personalized investment solutions for different levels of market experience and investment knowledge. Their basic approach centers on making institutional-grade investment opportunities available to everyone while keeping costs competitive.

The company's business model combines traditional stockbroking services with specialized wealth management skills. This creates a complete service system for retail investors. Shard Capital has positioned itself as a bridge between institutional investment opportunities and individual investor access, especially through their placings and IPO programs.

This shard review shows that the firm's focus on small-cap securities trading reflects deep market knowledge in this specialized area. However, specific details about trading platforms, available asset types, and regulatory oversight remain unclear from available public information.

Regulatory Jurisdictions: Specific regulatory information was not detailed in available sources. Direct verification with the firm is needed regarding FCA authorization and compliance frameworks.

Deposit and Withdrawal Methods: Payment processing options and funding methods are not specified in publicly accessible documents.

Minimum Deposit Requirements: Minimum investment amounts and account opening requirements are not disclosed in available materials.

Bonuses and Promotions: Current promotional offerings and incentive programs are not detailed in accessible sources.

Tradeable Assets: While small-cap stock specialization is confirmed, the complete range of available instruments requires direct inquiry.

Cost Structure: Specific information about spreads, commissions, and fee schedules is not available in public documents. However, the firm advertises "low-cost custody" services.

Leverage Ratios: Leverage availability and maximum ratios are not specified in available sources.

Platform Options: Trading platform specifications and technology infrastructure details are not provided in accessible materials.

Geographic Restrictions: Service availability across different regions and jurisdictions is not clearly outlined.

Customer Support Languages: Multilingual support capabilities are not specified in available documents.

This shard review highlights the need for potential clients to contact Shard Capital directly for complete service details.

The evaluation of Shard Capital's account conditions faces big limitations due to insufficient publicly available information about account types, structures, and specific terms. Available sources show that the firm serves "individuals seeking a range of products and services for all levels of investment experience."

This suggests multiple account tiers or customizable solutions, but specific details about minimum deposits, account categories, or special features remain undisclosed. The firm's positioning as a provider of "tailored investment services for all levels of experience" implies flexible account structures that can work for both new and sophisticated investors.

However, without detailed information about Islamic accounts, professional trading accounts, or specific onboarding requirements, it becomes challenging to assess how competitive their account offerings are against industry standards. The absence of clear information about account opening procedures, verification requirements, or ongoing maintenance conditions represents a significant transparency gap.

This shard review cannot provide definitive guidance on account suitability without access to detailed terms and conditions, fee structures, or minimum balance requirements that typically influence account selection decisions.

Assessment of Shard Capital's trading tools and analytical resources proves difficult due to limited publicly available technical specifications. While the firm emphasizes "market leading execution" capabilities, specific details about trading platforms, analytical tools, research resources, or educational materials are not fully documented in accessible sources.

The company's specialization in small-cap securities suggests they likely maintain sophisticated research capabilities and market analysis tools specific to this sector. However, without detailed information about chart analysis software, automated trading support, or third-party platform integrations, evaluating the quality and completeness of their tool suite remains challenging.

Educational resources and client support materials, which are crucial for investors across different experience levels, are not detailed in available documents. The absence of information about webinars, market commentary, or educational content represents a significant evaluation gap for this review.

Evaluating Shard Capital's customer service capabilities encounters substantial limitations due to insufficient publicly available information about support channels, availability, and service quality metrics. While the firm positions itself as providing personalized services across all experience levels, specific details about customer support infrastructure remain undisclosed.

The company's emphasis on tailored investment services suggests a consultative approach to client relationships. This potentially indicates higher levels of personalized support compared to purely digital platforms.

However, without information about support hours, response times, available communication channels, or multilingual capabilities, assessing service quality becomes problematic. Client feedback and testimonials, which would typically provide insights into service quality and responsiveness, are not readily available in accessible sources.

This absence of user experience data significantly limits the ability to evaluate customer satisfaction levels or identify common service-related concerns.

The assessment of Shard Capital's trading experience faces considerable challenges due to limited technical information about platform performance, execution quality, and user interface design. While the firm advertises "market leading execution," specific performance metrics, order types, or platform stability data are not available in public documents.

The company's focus on small-cap securities trading suggests specialized execution capabilities in this market segment. This potentially offers advantages in terms of liquidity access and pricing for smaller capitalization stocks.

However, without detailed information about execution speeds, slippage rates, or platform uptime statistics, evaluating trading quality remains speculative. Mobile trading capabilities, which are increasingly important for modern investors, are not specifically addressed in available sources.

The absence of information about mobile apps, responsive web platforms, or on-the-go trading features represents a significant evaluation gap in this shard review.

Evaluating Shard Capital's trustworthiness encounters significant limitations due to insufficient publicly available regulatory and compliance information. While the firm operates from London and describes itself as award-winning, specific regulatory authorizations, compliance frameworks, and oversight mechanisms are not detailed in accessible sources.

The company's establishment in 2013 and continued operation suggests regulatory compliance and market acceptance. However, without specific FCA authorization numbers or other regulatory confirmations, verifying oversight status becomes challenging.

Client fund protection measures, segregation policies, and compensation schemes are not detailed in available documents. The absence of information about negative events, regulatory actions, or dispute resolution mechanisms limits the ability to assess potential risk factors.

Without access to regulatory filings or detailed compliance disclosures, this review cannot provide definitive guidance on the firm's regulatory standing.

Assessment of user experience at Shard Capital faces substantial limitations due to insufficient publicly available feedback and detailed service descriptions. While the firm emphasizes serving "all levels of investment experience," specific information about user satisfaction, interface design, or client journey optimization is not readily accessible.

The company's positioning as providing tailored services suggests a consultative approach that may enhance user experience through personalized attention. However, without detailed information about onboarding processes, platform usability, or client feedback mechanisms, evaluating overall user satisfaction becomes challenging.

Common user concerns, improvement areas, or satisfaction metrics that would typically inform user experience evaluation are not available in accessible sources. This absence of user-generated content and feedback significantly limits the completeness of this user experience assessment.

This shard review reveals Shard Capital as a specialized London-based stockbroker with a clear focus on small-cap securities and personalized investment services. While the firm's positioning as an award-winning business founded by experienced investment managers suggests credibility and market expertise, the limited publicly available information about specific services, regulatory status, and operational details presents significant evaluation challenges.

The company appears most suitable for investors specifically interested in small-cap stock opportunities and those seeking access to institutional fundraising events like placings and IPOs. However, potential clients should conduct thorough due diligence and direct engagement with the firm to obtain complete service details, regulatory confirmations, and specific terms before making investment decisions.

The transparency gaps identified in this review underscore the importance of direct communication with Shard Capital to fully understand their service offerings and suitability for individual investment needs.

FX Broker Capital Trading Markets Review