Zeno Markets 2025 Review: Everything You Need to Know

Executive Summary

This detailed zeno markets review shows major concerns about this offshore forex broker. Traders should think carefully before investing their money with this company. Zeno Markets Limited started in 2021 and registered in Saint Vincent and the Grenadines. The company works without proper rules watching over it, which creates big red flags for people who might want to trade.

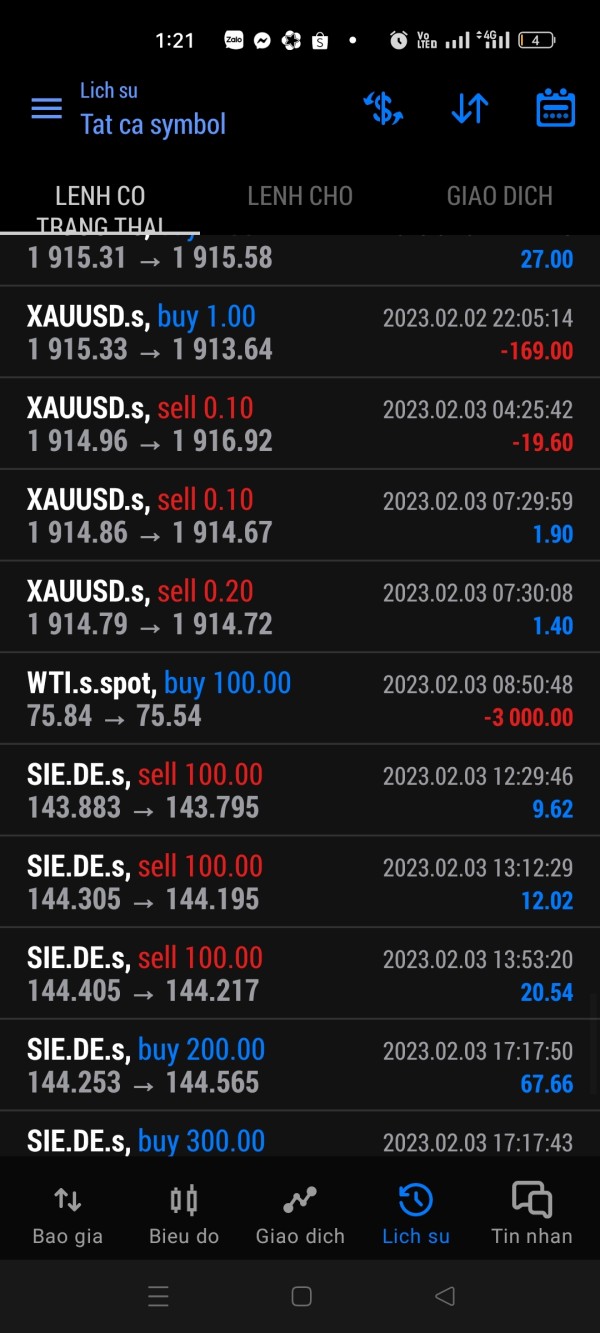

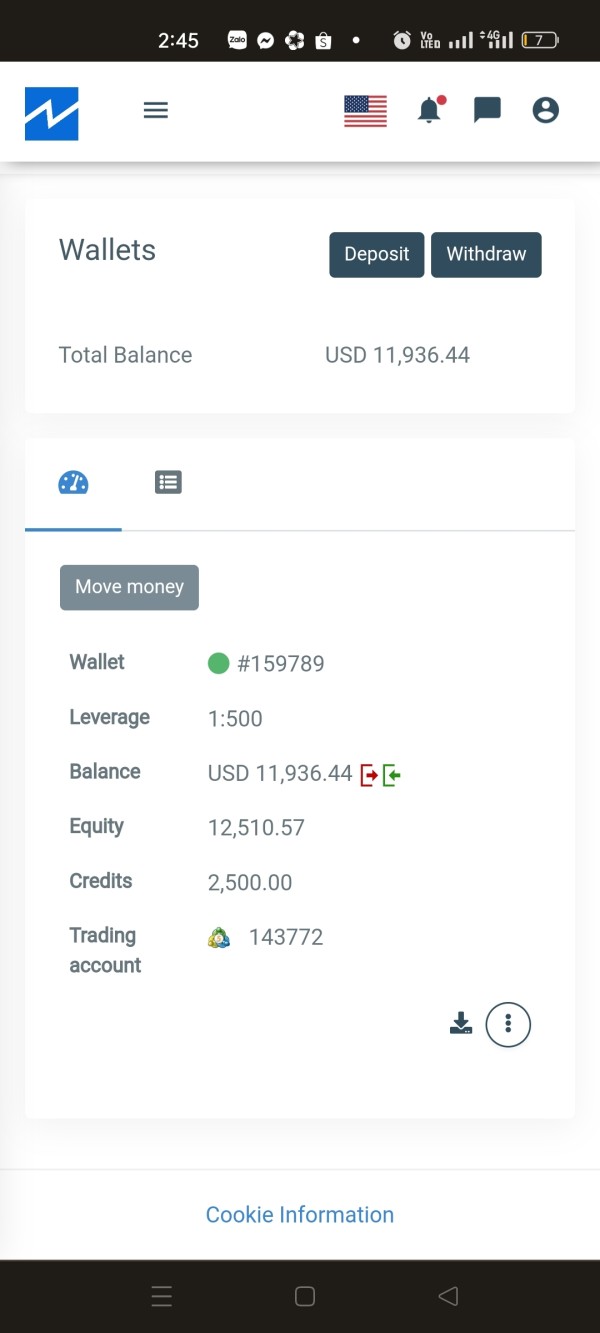

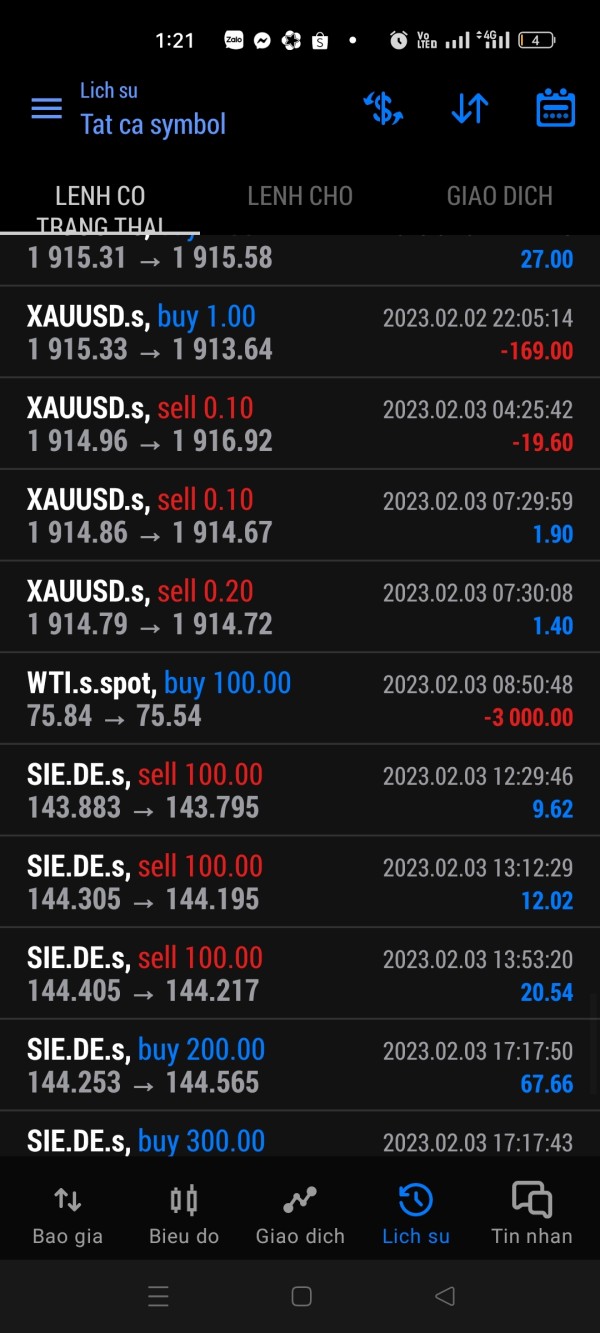

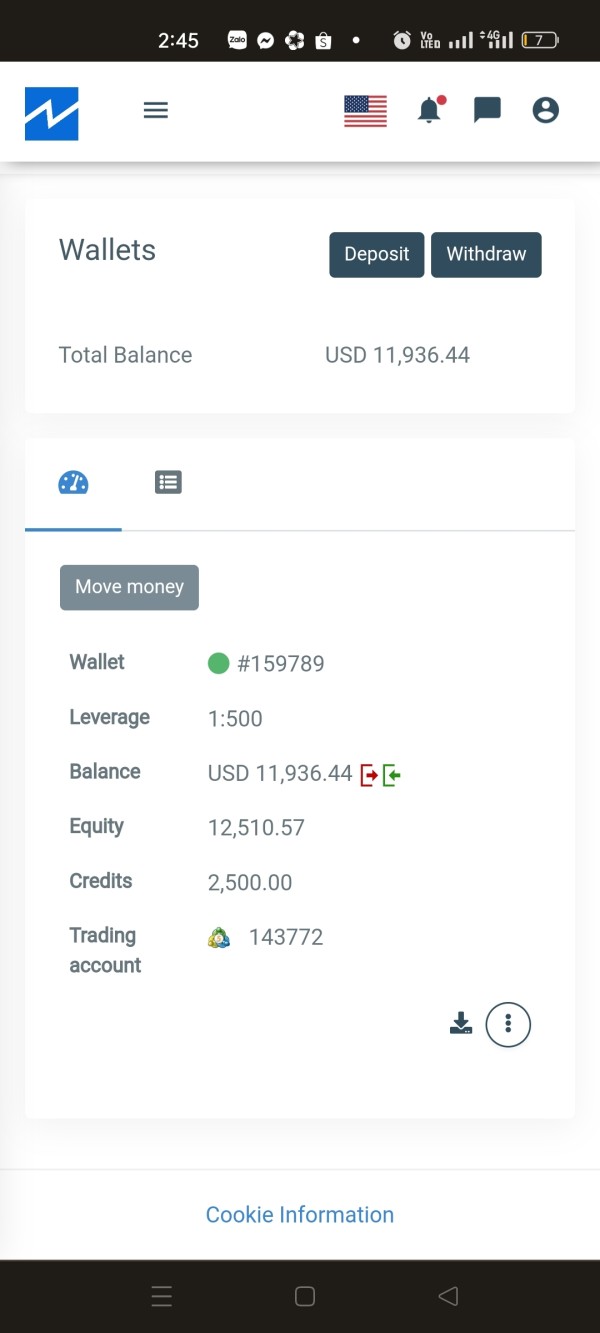

FxGecko gives Zeno Markets a low score of 2.02 out of 10. Many traders report bad experiences and possible fraud. The broker offers attractive features like maximum leverage up to 1:500 and spreads starting from 0 pips. However, serious trust and safety problems overshadow these benefits.

The broker seems to target traders who accept high risks and want competitive trading conditions over regulatory protection. The lack of clear information about trading platforms, asset types, customer support, and deposit methods creates more uncertainty. Based on available information and user feedback, Zeno Markets presents major risks that outweigh its advertised benefits.

The combination of poor user ratings, lack of regulatory supervision, and insufficient transparency makes this broker unsuitable for most traders. People seeking a reliable trading environment should look elsewhere.

Important Disclaimer

Regional Entity Differences: Zeno Markets Limited is registered in Saint Vincent and the Grenadines. This jurisdiction is known for minimal regulatory oversight of financial services providers. This registration does not provide the same level of investor protection as brokers regulated by major financial authorities such as the FCA, ASIC, or CySEC.

Review Methodology: This evaluation is based on available user feedback, third-party ratings, and publicly accessible information about Zeno Markets. Due to limited official documentation and transparency from the broker, some aspects of this review rely on user reports and industry assessments rather than verified company data.

Rating Framework

Broker Overview

Zeno Markets Limited entered the forex brokerage market in 2021 as an offshore financial services provider. The company operates from Saint Vincent and the Grenadines. This jurisdiction attracts many forex brokers because of its relaxed regulatory environment. However, this also means traders have limited options if disputes or issues arise with the broker.

The broker focuses on providing high-leverage trading opportunities with competitive spreads. They target traders willing to accept higher risks for potentially better trading conditions. Unfortunately, the lack of detailed information about the company's management team, operational history, and business practices creates major transparency concerns. Potential clients should carefully consider these issues.

According to available sources, Zeno Markets offers multiple tradeable financial instruments. However, specific asset categories and the total number of available instruments remain unclear. This zeno markets review found that the broker's website and promotional materials lack the detailed information typically expected from established, reputable brokers.

The absence of clear information about trading platforms, account types, and operational procedures suggests either poor communication practices or deliberate secrecy. Both of these possibilities are concerning for potential clients seeking a reliable trading partner.

Regulatory Status: Zeno Markets operates under registration in Saint Vincent and the Grenadines. This provides minimal regulatory oversight compared to major financial jurisdictions. This offshore status means the broker is not subject to strict capital requirements, segregated client fund rules, or regular compliance audits. Well-regulated brokers must follow these important protections.

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and associated fees is not readily available in public sources. This creates uncertainty about the practical aspects of account management.

Minimum Deposit Requirements: The broker has not clearly disclosed minimum deposit amounts for different account types. This makes it difficult for potential clients to plan their initial investment.

Bonus and Promotions: Available information does not include details about welcome bonuses, loyalty programs, or promotional offers. New or existing clients cannot determine what incentives might be available.

Available Assets: Zeno Markets claims to offer various tradeable financial instruments. However, specific categories such as forex pairs, commodities, indices, or cryptocurrencies are not clearly outlined in available documentation.

Cost Structure: The broker advertises spreads starting from 0 pips, which appears competitive. However, the absence of information about commission rates, overnight fees, and other trading costs makes it impossible to assess the true cost of trading. This lack of transparency is concerning for potential clients.

Leverage Options: Maximum leverage of 1:500 is available. This is attractive for traders seeking high exposure with limited capital, though this also significantly increases risk exposure.

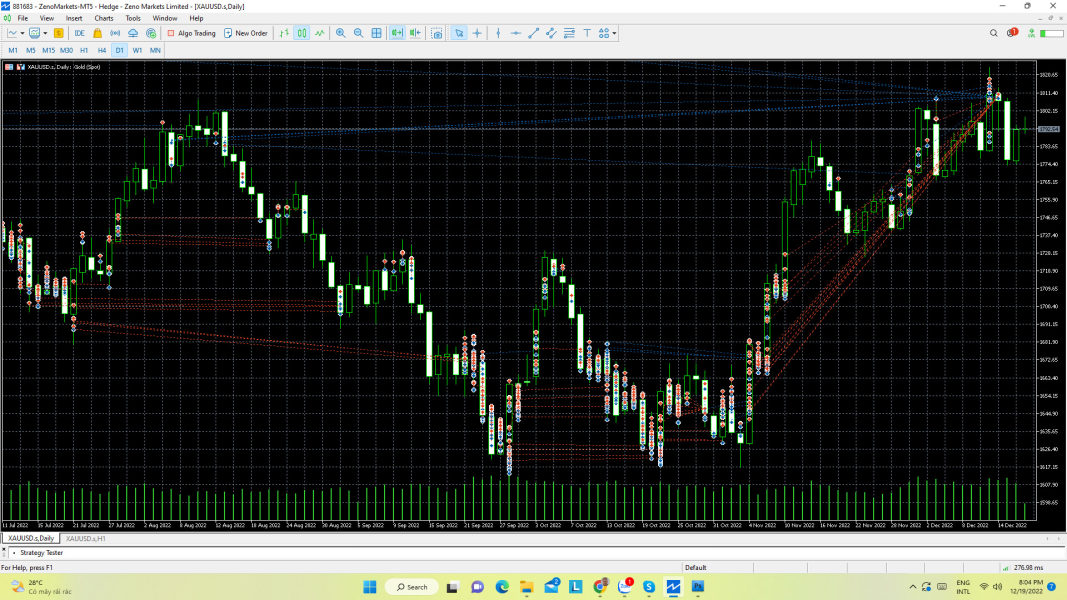

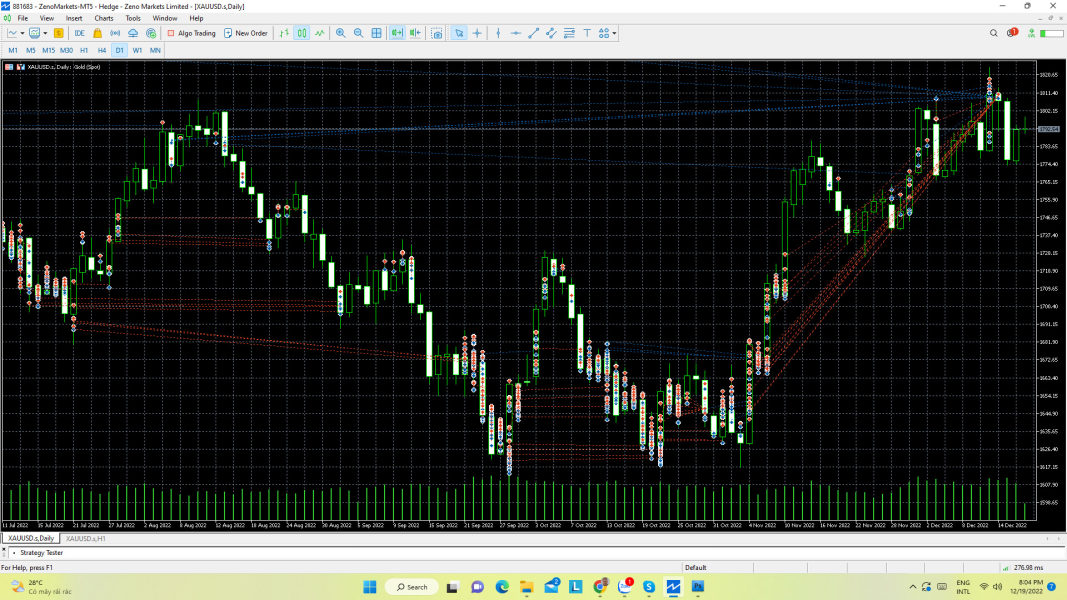

Trading Platforms: Specific information about available trading platforms is not clearly documented in available sources. This includes whether they offer MetaTrader 4, MetaTrader 5, or proprietary solutions.

This zeno markets review highlights the concerning lack of transparency in basic operational information. Reputable brokers typically provide this information clearly to potential clients.

Detailed Rating Analysis

Account Conditions Analysis

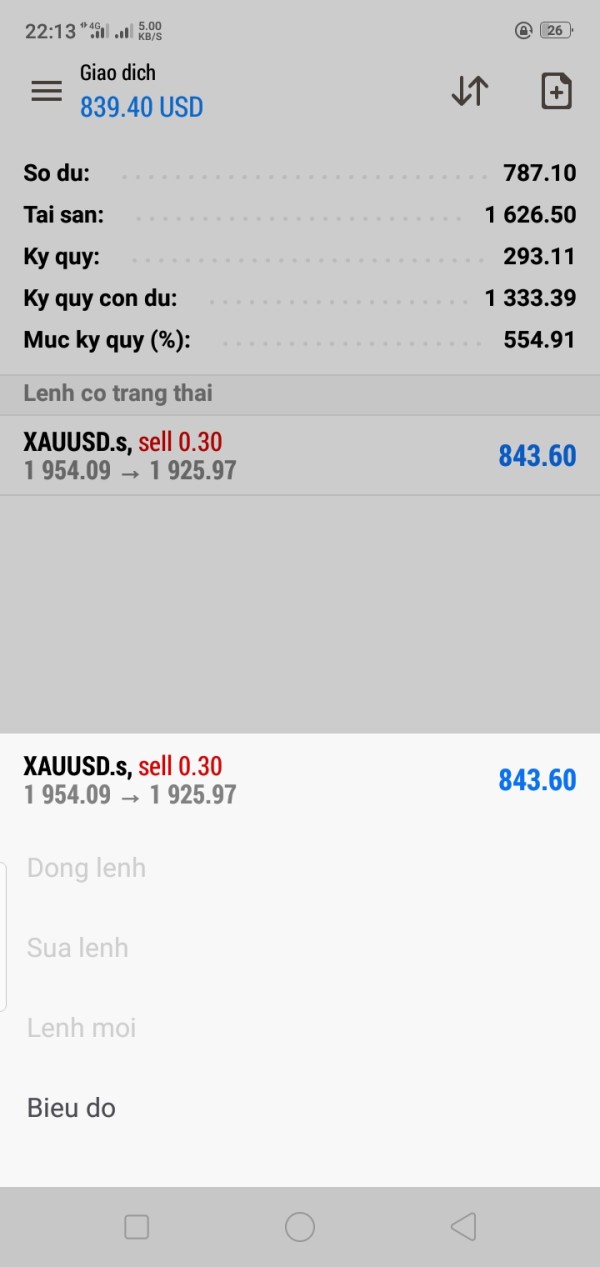

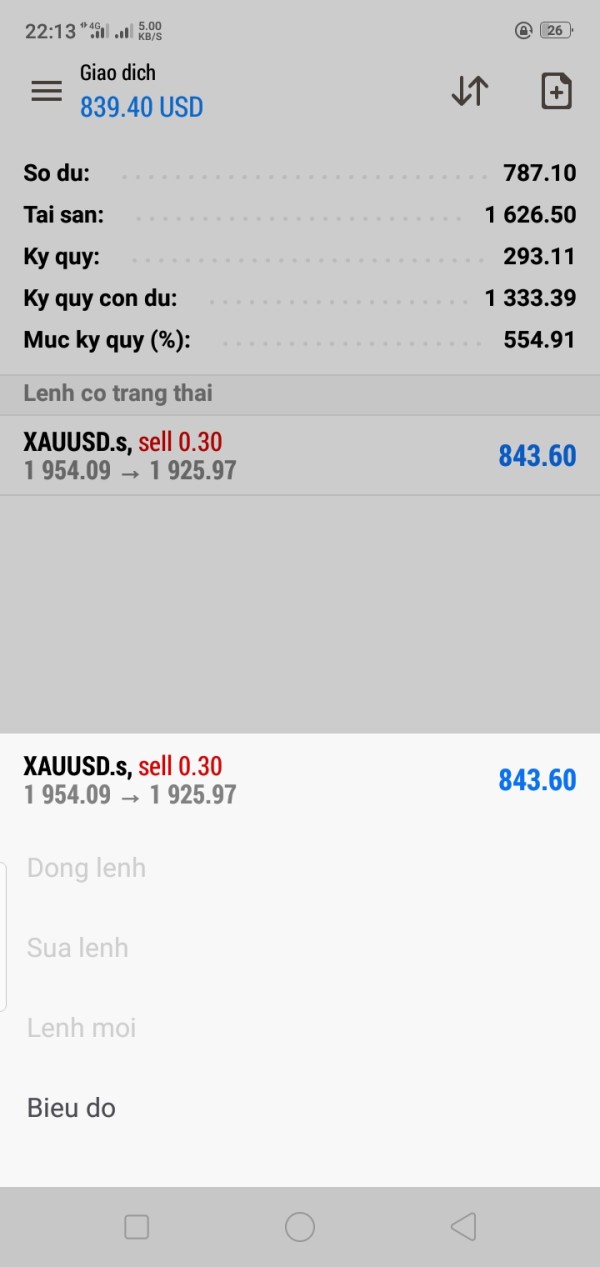

The account conditions offered by Zeno Markets present major concerns due to the lack of transparent information available to potential clients. Unlike established brokers that provide detailed account specifications, fee structures, and terms of service, Zeno Markets fails to offer clear documentation. This creates significant uncertainty for traders.

The absence of information regarding different account types, minimum deposit requirements, and specific features creates problems for traders. People cannot evaluate whether the broker meets their needs without this basic information. This lack of transparency is particularly concerning since account conditions form the foundation of the client-broker relationship.

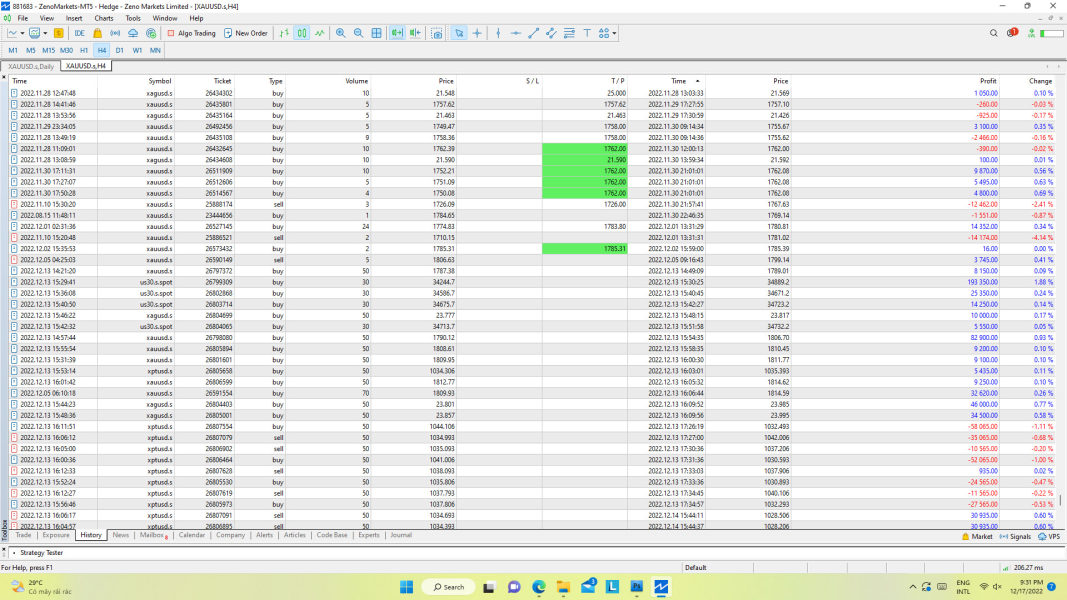

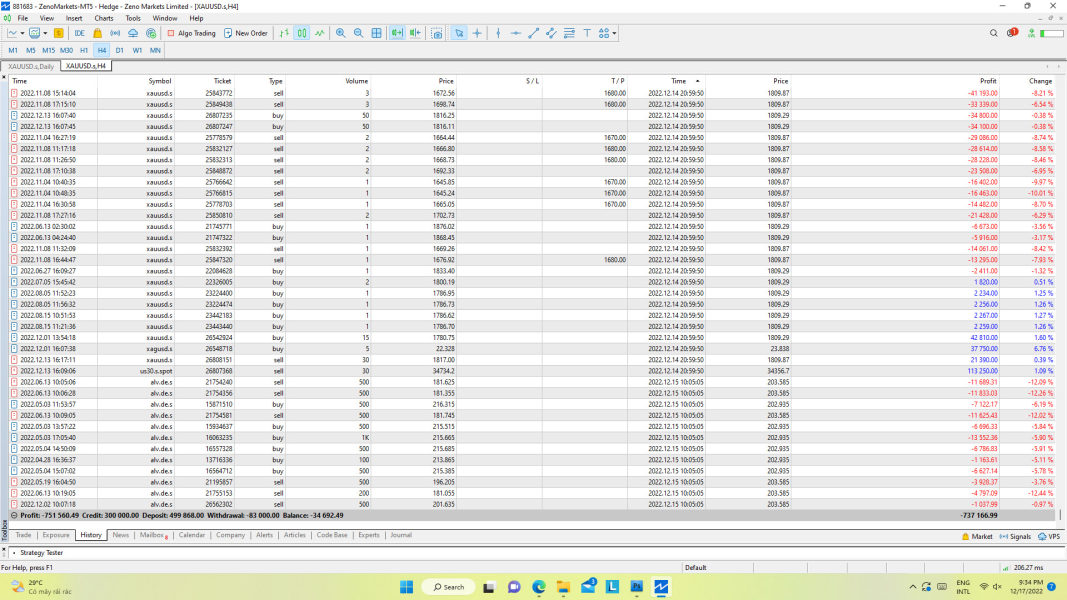

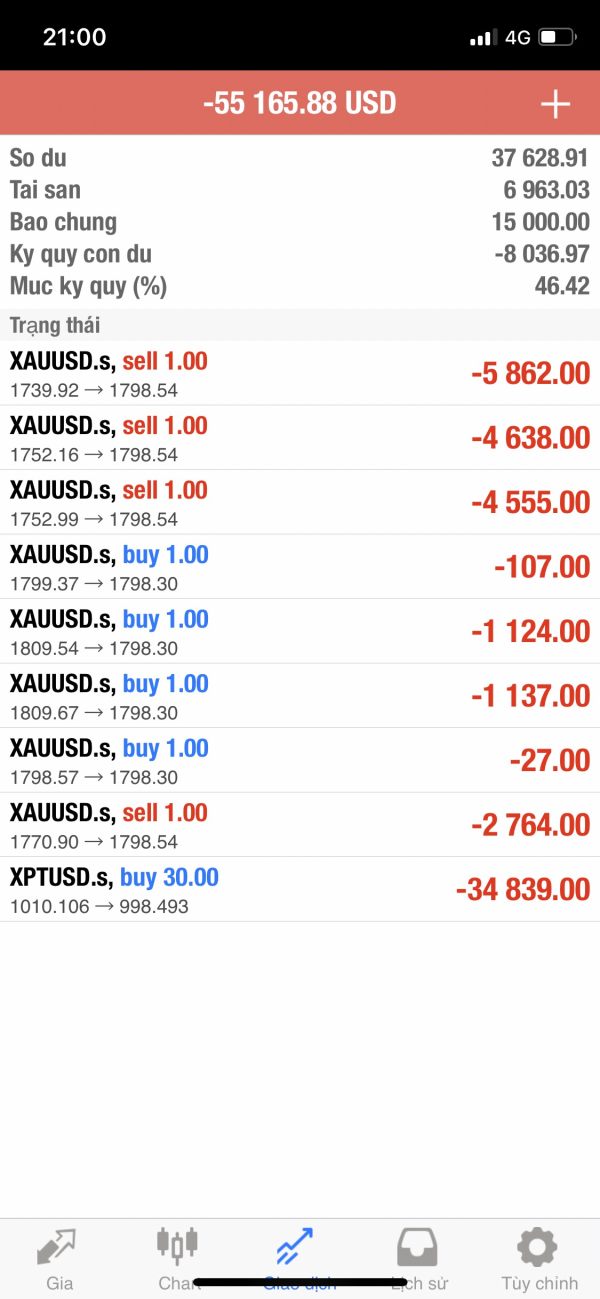

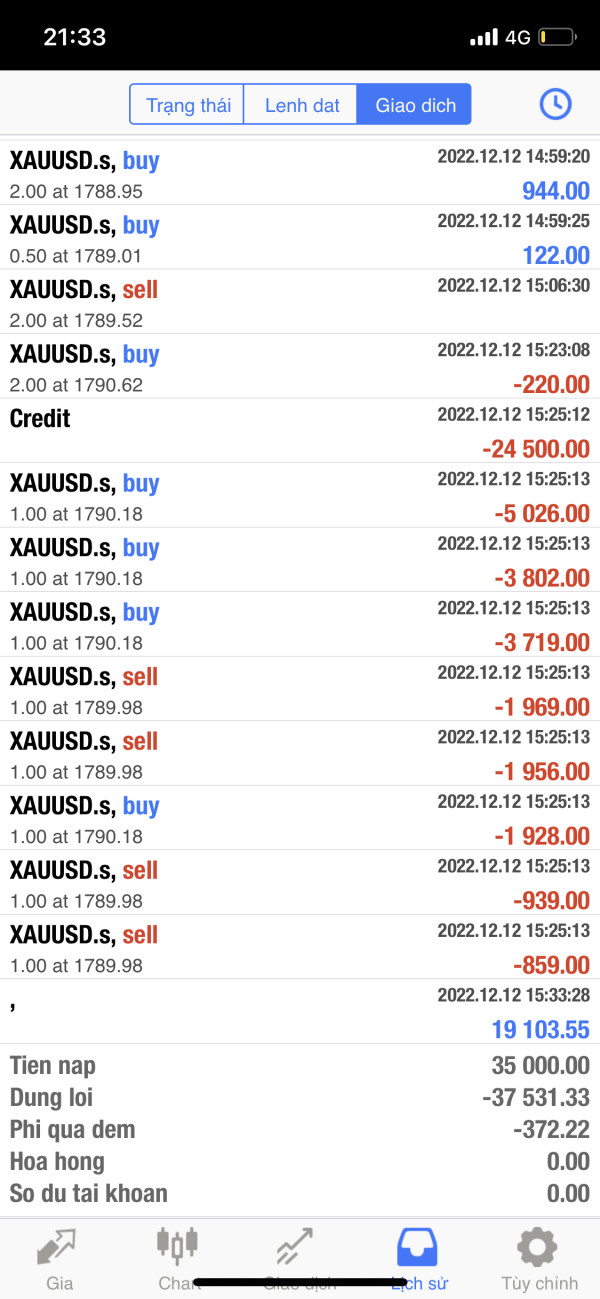

User feedback consistently reports negative experiences with account management. However, specific details about account-related issues are limited in available sources. The FxGecko rating of 2.02/10 suggests that traders have encountered significant problems with account functionality, terms, or management processes.

Without clear information about Islamic accounts, professional trader accounts, or other specialized account types, certain traders cannot determine if the broker accommodates their specific requirements. Muslim traders and institutional clients face particular uncertainty. This zeno markets review finds that the broker's approach to account condition transparency falls well below industry standards.

The trading tools and resources provided by Zeno Markets remain largely undocumented in available public information. This creates significant uncertainty about the broker's technological capabilities and support offerings. Professional traders typically require comprehensive analytical tools, real-time market data, and educational resources to make informed trading decisions.

Available sources do not provide specific information about charting software, technical analysis tools, economic calendars, or market research services. This absence of information suggests either limited tool availability or poor communication about existing resources. Both possibilities are concerning for serious traders.

Educational resources appear to be minimal or non-existent based on available information. These resources are crucial for developing trader skills and understanding market dynamics. Reputable brokers typically offer webinars, tutorials, market analysis, and educational articles to support client development.

The lack of information about automated trading support, API access, or third-party tool integration limits the broker's appeal. Sophisticated traders who rely on algorithmic strategies or advanced trading systems need these features. User feedback suggests that traders have experienced difficulties with available tools, though specific details are limited in public sources.

Customer Service and Support Analysis

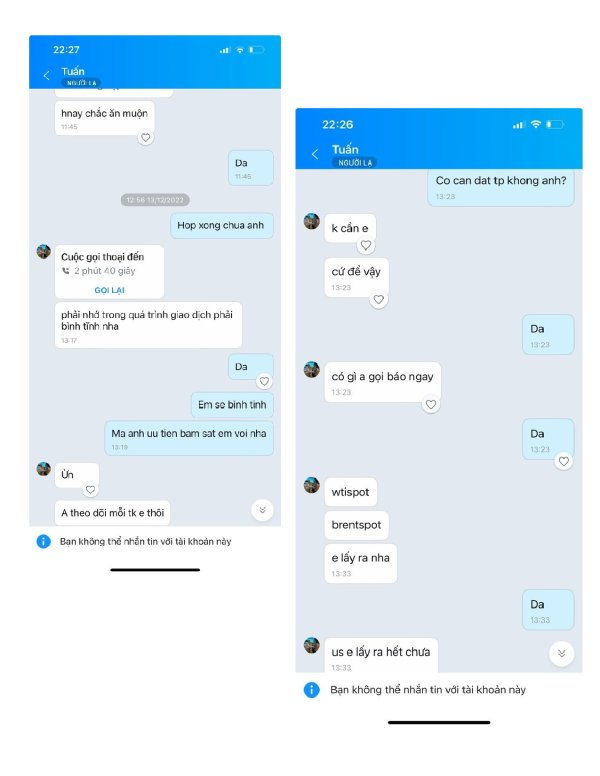

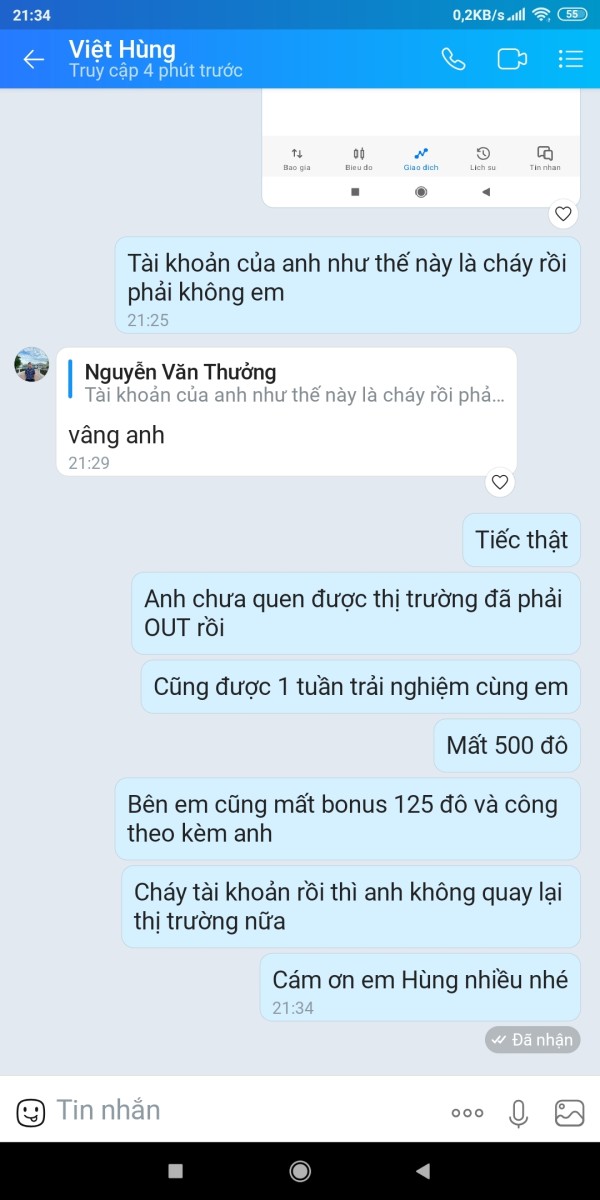

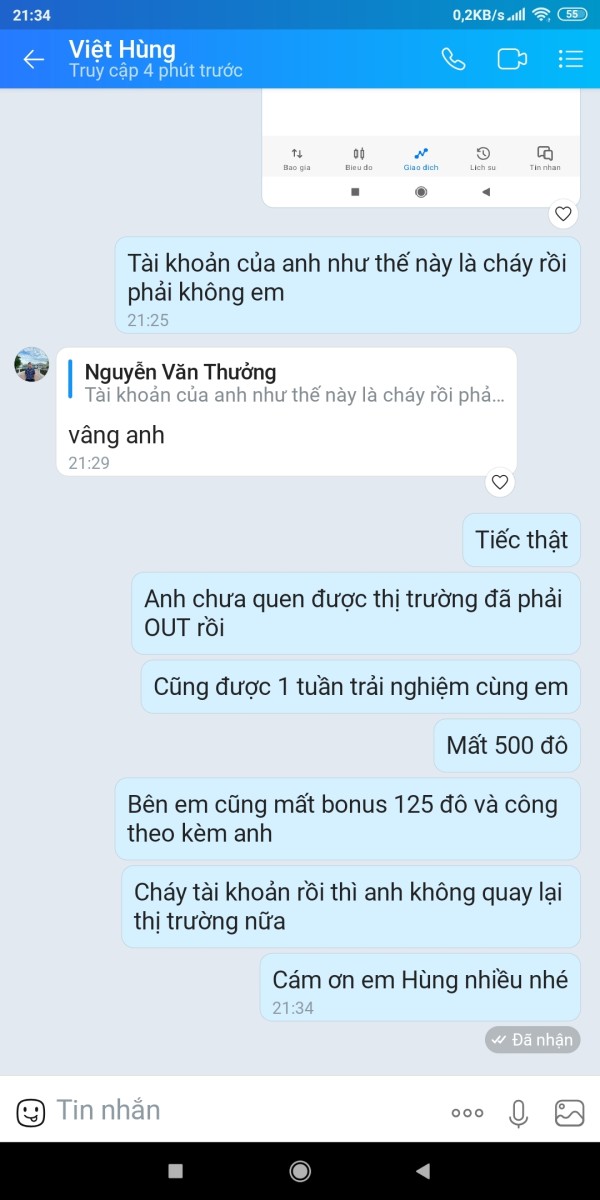

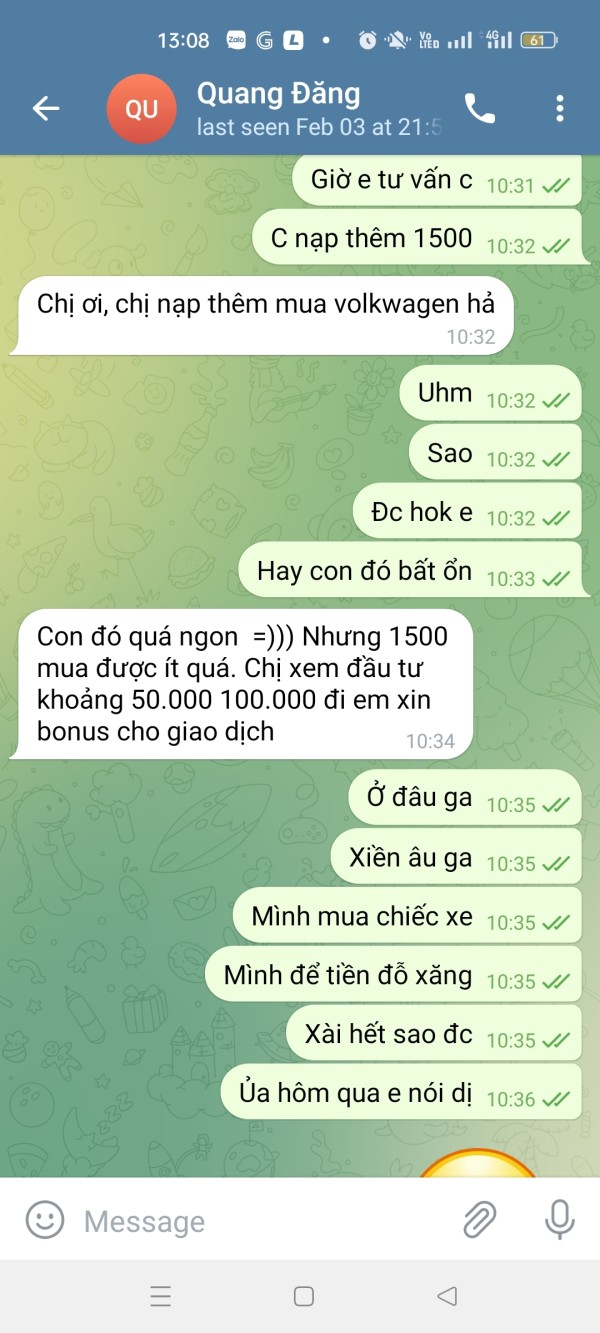

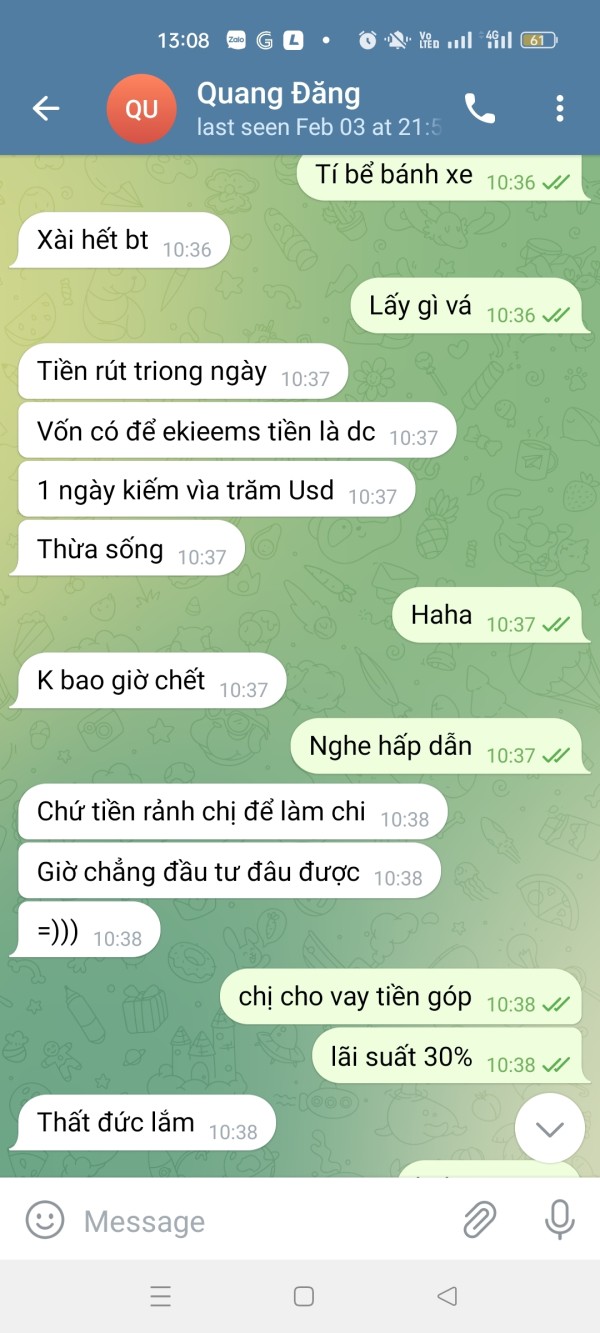

Customer service quality represents one of the most significant weaknesses identified in this evaluation. User feedback consistently reports poor experiences with Zeno Markets' support team. The lack of clear information about available support channels, operating hours, and response time commitments creates additional uncertainty for potential clients.

Available sources do not specify whether the broker offers live chat, email support, phone assistance, or other communication methods. Clients need to know how they can resolve issues or seek assistance. This information gap is particularly concerning given the negative user feedback regarding support quality and responsiveness.

The absence of multilingual support information makes it unclear whether the broker can assist clients in languages other than English. This potentially limits accessibility for international traders. Professional customer service typically includes multiple language options and 24/7 availability during market hours.

Problem resolution capabilities appear limited based on user reports. Traders express frustration about unresolved issues and inadequate support responses. The combination of poor user feedback and lack of transparent support information contributes significantly to trust concerns about this broker.

Trading Experience Analysis

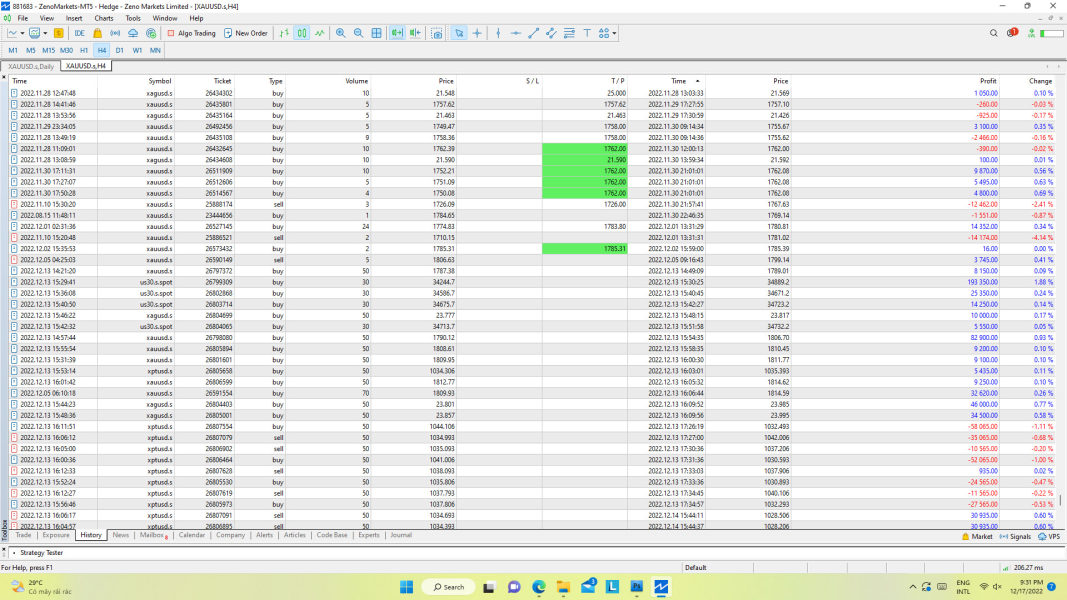

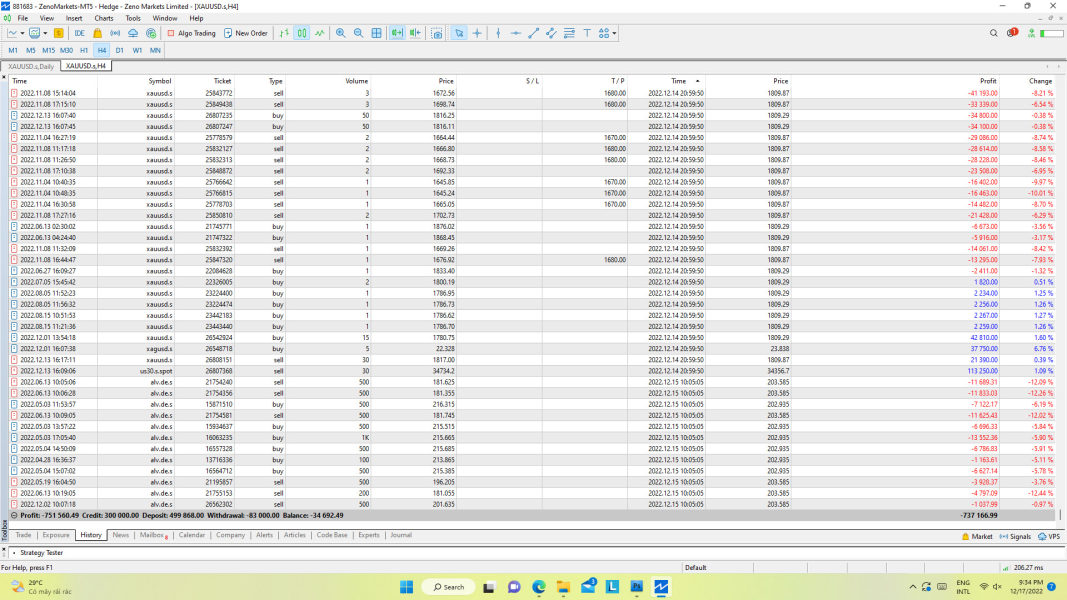

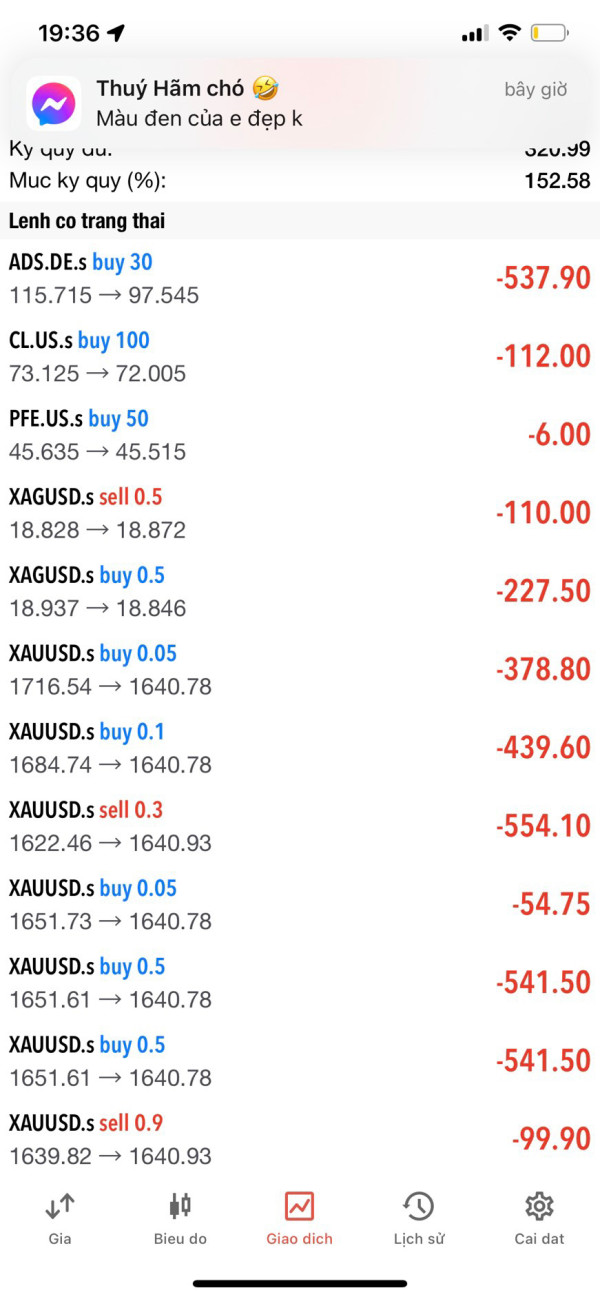

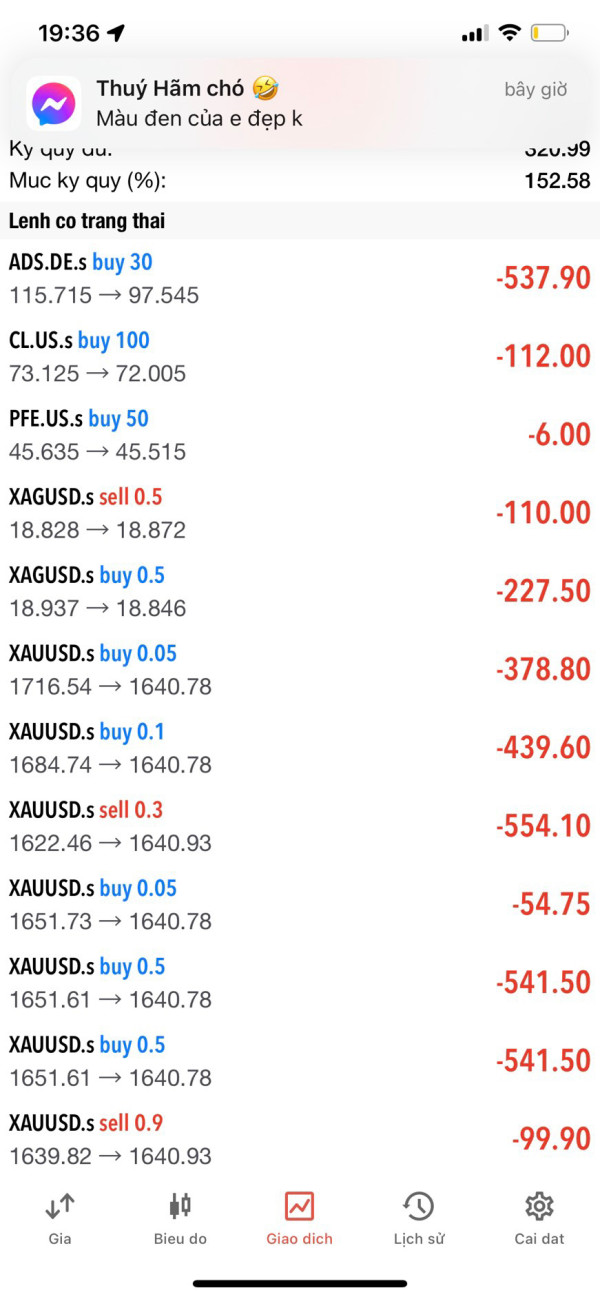

The trading experience offered by Zeno Markets presents a mixed picture. Some competitive features are offset by significant concerns about platform reliability and overall service quality. While the broker advertises attractive spreads starting from 0 pips, the practical trading experience appears problematic based on user feedback.

Platform stability and execution speed information is not readily available. This makes it difficult to assess whether the broker can provide the reliable trading environment that active traders require. Order execution quality, including slippage rates and fill rates during volatile market conditions, remains undocumented in available sources.

The lack of specific information about trading platforms limits traders' ability to evaluate whether the broker's technology meets their requirements. Features like charting, order management, and market analysis are essential for successful trading. Mobile trading capabilities, which are essential for modern traders, are not clearly documented.

User reviews consistently report negative trading experiences. However, specific technical issues are not detailed in available sources. This zeno markets review finds that while some trading conditions may appear competitive on paper, the overall trading experience likely falls short of professional standards. User feedback and the broker's low industry ratings support this conclusion.

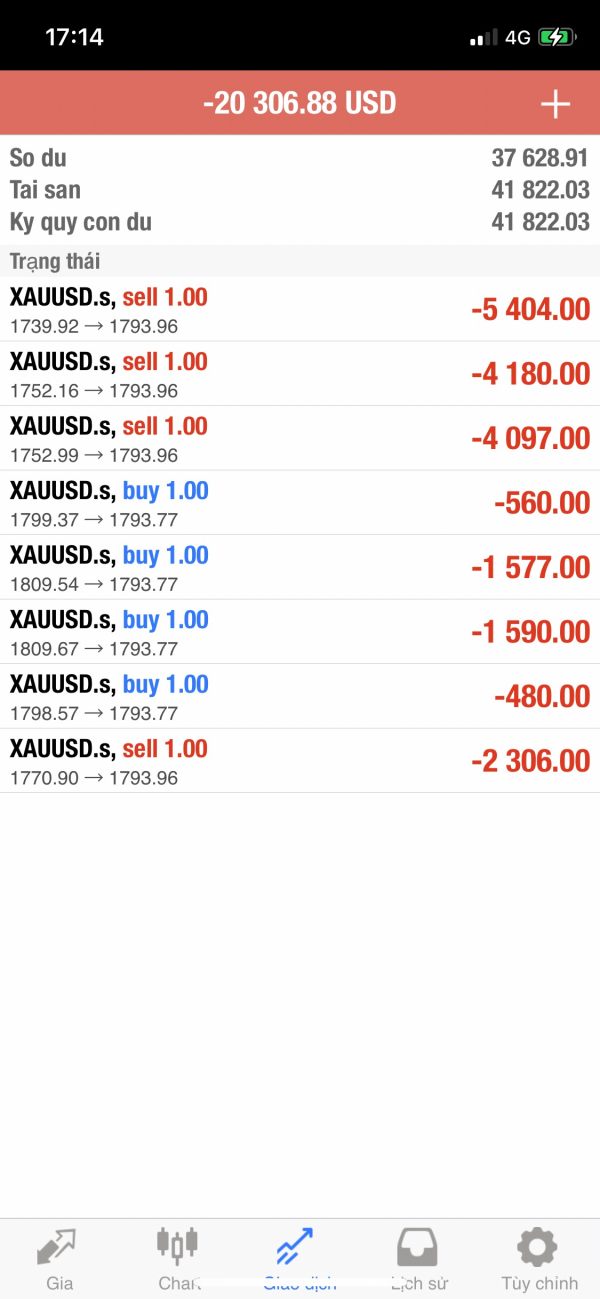

Trust and Safety Analysis

Trust and safety concerns represent the most critical issues identified in this evaluation. Multiple red flags suggest that Zeno Markets may not provide adequate protection for client funds and interests. The broker's registration in Saint Vincent and the Grenadines offers minimal regulatory oversight compared to major financial jurisdictions.

The absence of specific regulatory authority supervision means that standard investor protections may not be in place or adequately enforced. These protections include segregated client accounts, deposit insurance, and regular financial audits. This regulatory gap creates significant risks for client fund security.

Company transparency issues are evident in the lack of detailed information about management, operational history, and business practices. Reputable brokers typically provide comprehensive information about their leadership team, regulatory compliance, and operational procedures. This transparency helps build trust with potential clients.

The FxGecko rating of 2.02/10 and reports of potential fraudulent activities create serious concerns about the broker's reliability and integrity. Third-party evaluations consistently flag Zeno Markets as high-risk. Multiple sources suggest that traders should exercise extreme caution or avoid this broker entirely.

User Experience Analysis

User experience with Zeno Markets appears consistently poor based on available feedback and third-party assessments. Multiple indicators suggest widespread client dissatisfaction. The overall user satisfaction ratings place this broker among the lowest-rated providers in the industry.

Interface design and usability information is not available in public sources. This makes it difficult to assess whether the broker provides an intuitive and efficient user experience. Registration and account verification processes are not clearly documented, potentially creating obstacles for new clients.

The funding experience remains unclear due to limited information about available payment methods, processing times, and associated fees. This includes deposit and withdrawal procedures that are essential for account management. This uncertainty creates additional friction for clients trying to manage their trading accounts effectively.

Common user complaints appear to center around service quality, support responsiveness, and overall reliability. However, specific details are limited in available sources. The consistently negative feedback suggests systemic issues with the broker's operations rather than isolated problems.

The user profile best suited for this broker appears limited to high-risk tolerance traders who prioritize potentially competitive trading conditions over regulatory protection and service quality. However, even risk-tolerant traders should carefully consider the significant concerns identified in this evaluation.

Conclusion

This comprehensive zeno markets review reveals significant concerns that substantially outweigh any potential benefits offered by this offshore broker. The combination of poor user ratings, lack of regulatory oversight, limited transparency, and reports of potential fraudulent activities creates a high-risk environment. This environment is unsuitable for most traders seeking reliable forex services.

Zeno Markets advertises competitive features such as high leverage up to 1:500 and tight spreads starting from 0 pips. However, these benefits are overshadowed by fundamental trust and reliability issues. The broker's registration in Saint Vincent and the Grenadines provides minimal investor protection compared to properly regulated alternatives.

The consistently negative user feedback reflects the FxGecko rating of 2.02/10 and suggests widespread client dissatisfaction. This dissatisfaction spans multiple aspects of the broker's services. From customer support to trading experience, the available evidence points to systematic deficiencies that create significant risks for potential clients.

Traders seeking a reliable forex broker have numerous better-regulated alternatives available. These alternatives offer similar or superior trading conditions with proper oversight and investor protection. The risks associated with Zeno Markets appear to far exceed any potential benefits, making this broker unsuitable for recommendation to retail or professional traders.