Is Zeno Markets safe?

Business

License

Is Zeno Markets Safe or Scam?

Introduction

Zeno Markets is a forex broker that positions itself as a global online trading provider, offering a variety of financial instruments including forex, commodities, indices, and cryptocurrencies. Established in 2011 and registered in Saint Vincent and the Grenadines, Zeno Markets claims to provide competitive trading conditions with high leverage options. However, the lack of regulatory oversight raises significant concerns for potential traders.

As the forex market continues to grow, it is essential for traders to exercise caution when choosing a broker. The potential for scams and fraudulent activities in the trading sector necessitates a thorough evaluation of brokers before committing funds. This article aims to investigate whether Zeno Markets is a safe trading option or if it exhibits characteristics of a scam. Our assessment is based on an analysis of regulatory status, company background, trading conditions, customer feedback, and overall risk factors associated with the broker.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy and safety. Zeno Markets claims to operate under the supervision of the Saint Vincent and the Grenadines Financial Services Authority (SVG FSA). However, it is important to note that the SVG FSA does not regulate forex brokers, which significantly undermines the credibility of Zeno Markets.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | 26368 | Saint Vincent and the Grenadines | Unverified |

The absence of a valid regulatory license means that Zeno Markets lacks the necessary oversight that protects traders from potential fraud. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) impose strict guidelines that ensure brokers operate fairly and transparently. Without such regulation, traders face heightened risks, including the potential loss of funds without any recourse.

Company Background Investigation

Zeno Markets Ltd. was founded in 2011 and operates out of Saint Vincent and the Grenadines. The company claims to have a management team with extensive experience in the financial markets; however, detailed information about the team is scarce. Transparency regarding ownership and operational history is vital for assessing a broker's reliability.

The companys website provides limited information about its leadership and operational structure, which raises concerns about its transparency. In an industry where trust is paramount, a lack of clear communication can be a red flag for potential investors. Furthermore, the use of a privacy service to hide the identity of the website owner further diminishes the broker's credibility.

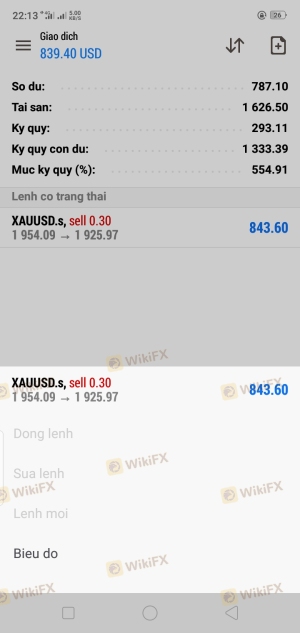

Trading Conditions Analysis

Zeno Markets offers various trading conditions, but the absence of regulation raises questions about the fairness and transparency of these terms. The broker claims to provide competitive spreads and leverage, but potential traders should be cautious.

| Fee Type | Zeno Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.4 pips | 1.0 - 1.5 pips |

| Commission Model | Varies | $0 - $7 per lot |

| Overnight Interest Range | Not disclosed | $1 - $5 |

The spread on major currency pairs starts at 1.4 pips, which is relatively competitive compared to industry standards. However, the commission structure varies significantly between account types, and the lack of clarity regarding overnight interest rates is concerning. Traders should be wary of hidden fees that could impact their profitability.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. Zeno Markets claims to have measures in place for fund protection; however, without regulatory oversight, the effectiveness of these measures is questionable.

The broker does not provide clear information about fund segregation or investor protection policies. In regulated environments, client funds are typically held in segregated accounts, ensuring they are protected in the event of the broker's insolvency. The absence of such assurances with Zeno Markets raises significant concerns about the safety of deposited funds.

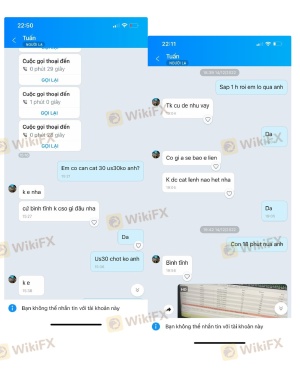

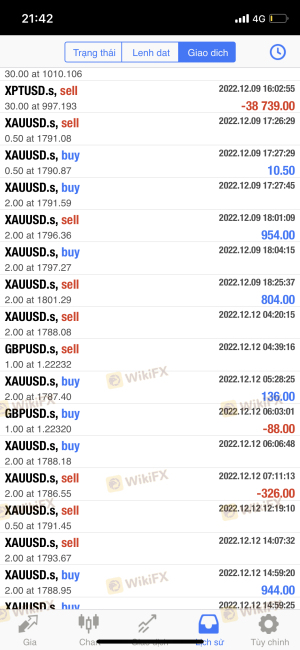

Customer Experience and Complaints

A review of customer feedback reveals a mix of experiences, with a notable number of complaints regarding withdrawal issues and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Average |

Many users have reported difficulties when attempting to withdraw funds, which is a common issue among unregulated brokers. Additionally, the quality of customer support has been criticized, with many users expressing frustration over delayed responses and inadequate assistance.

One notable case involved a user who was unable to withdraw their funds despite multiple requests, leading to allegations of the broker being a scam. Such patterns of complaints are concerning and warrant caution for potential investors.

Platform and Trade Execution

Zeno Markets utilizes the popular MetaTrader 5 (MT5) platform for trading, which is known for its user-friendly interface and advanced trading tools. However, the platform's reliability and execution quality are essential factors to consider.

While MT5 is generally regarded as a robust trading platform, there have been reports of slippage and execution delays, which can significantly impact trading performance. Traders should be aware of these potential issues, as they can lead to unexpected losses, especially in volatile market conditions.

Risk Assessment

Using Zeno Markets presents several risks that traders should be aware of before investing.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight. |

| Withdrawal Risk | High | Frequent complaints about difficulty withdrawing funds. |

| Transparency Risk | Medium | Limited information about company operations and management. |

To mitigate these risks, traders should conduct thorough research and consider using brokers that are regulated by reputable authorities. Additionally, diversifying investments across multiple platforms can help reduce exposure to any single broker's risks.

Conclusion and Recommendations

Based on the evidence gathered, Zeno Markets appears to exhibit several characteristics commonly associated with unregulated and potentially fraudulent brokers. The lack of a valid regulatory license, combined with numerous complaints regarding withdrawals and customer support, raises significant red flags.

For traders considering Zeno Markets, it is advisable to exercise extreme caution. If you are looking for a reliable trading experience, consider reputable alternatives such as brokers regulated by the FCA or ASIC, which offer enhanced security and transparency. In summary, the question, "Is Zeno Markets safe?" leans towards a cautious "no," and potential investors should be wary of the risks associated with trading through this broker.

Is Zeno Markets a scam, or is it legit?

The latest exposure and evaluation content of Zeno Markets brokers.

Zeno Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Zeno Markets latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.